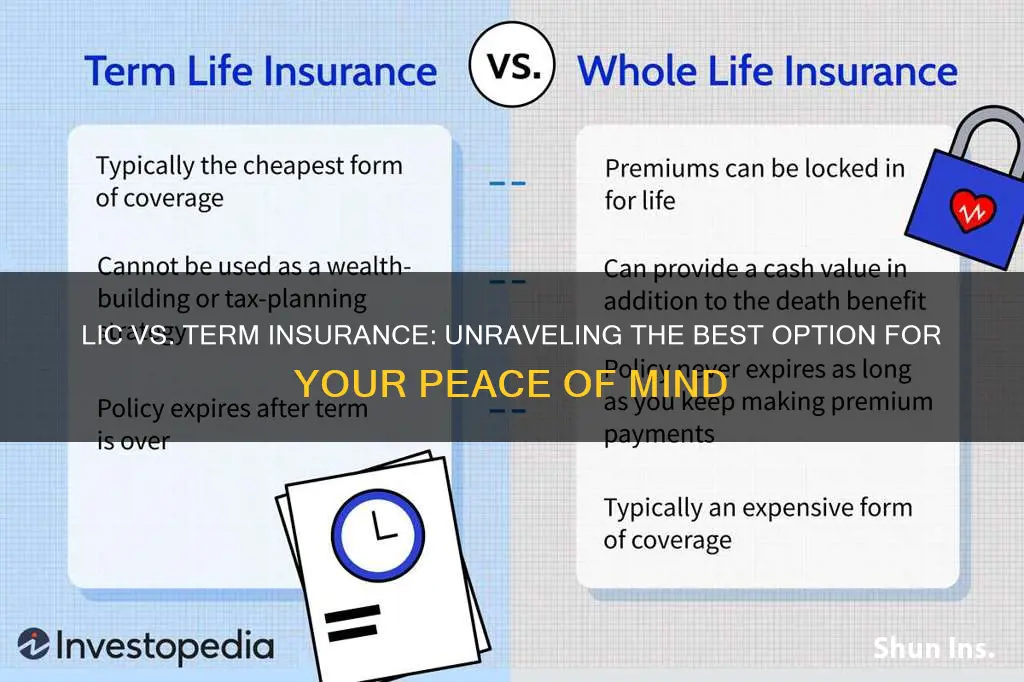

Term insurance and LIC (Life Insurance Corporation) are two of the most common types of life insurance. Term insurance is a more affordable option that provides coverage for a specific period, usually up to 10 years, and can be renewed for additional periods. It is a type of life insurance that pays out a sum of money to a beneficiary if the insured person dies during the policy tenure. On the other hand, LIC offers lifelong coverage and combines insurance with savings and investment components, offering both death and maturity benefits. LIC policies are more expensive than term insurance plans, with premiums that are typically higher. However, LIC policies also provide additional benefits, such as the ability to borrow against the policy or withdraw funds for other financial needs. When choosing between term insurance and LIC, individuals should consider their specific financial goals, circumstances, and budget.

What You'll Learn

Term insurance is more affordable than life insurance

Term insurance is a pure life insurance product that provides compensation to the family or nominee only in the event of the insured person's death. There is no savings component in term plans, so they are designed only to offer death benefits and no survival benefits. Term plans provide substantial coverage at low premium prices. For example, one can easily obtain life insurance of INR 1 crore by paying a premium of a few thousand rupees.

Term insurance plans are also flexible in terms of surrendering the policy. To surrender a term insurance policy, the insured person simply needs to stop paying the premium, and then their policy coverage and benefits will terminate.

Term life insurance is also straightforward and easier to understand than permanent policies. It is often the most affordable life insurance because it is temporary and has no cash value.

Term insurance is ideal for people who want substantial coverage at a low cost and those who cannot afford the much higher monthly premiums associated with whole life insurance.

Long-Term Security: Exploring the Benefits of 20-Year Term Life Insurance Plans

You may want to see also

Term insurance provides coverage for a specific period

Term insurance is a type of life insurance that provides coverage for a specific period, typically up to 10 years, and can be renewed for additional periods. It is a cost-effective way to provide a lump sum to your dependents if something happens to you. Term insurance is ideal for those who cannot afford the much higher monthly premiums associated with whole life insurance.

Term insurance is a good option for people who want substantial coverage at a low cost. It is also a good choice for those who need protection for a temporary time or a specific need. For example, parents can obtain substantial coverage for a low cost to protect their family in the event of their untimely death.

Term insurance plans are highly flexible. They can be easily renewed and converted to another type of insurance, such as an endowment plan, by paying the necessary premiums. However, term insurance does not offer any maturity benefits. If the insured person survives the policy term, no maturity benefit will be paid.

Term insurance is also more affordable than whole life insurance, particularly in the early policy durations. The premiums are based on the insured's age, health, and life expectancy. Term insurance policies also have lower premiums because they do not accumulate any cash value.

Overall, term insurance provides coverage for a specific period, making it a good option for those who want flexible and affordable protection for their loved ones.

The Intricacies of Experience Rating: Unraveling Insurance's Impact on Businesses

You may want to see also

Life insurance provides death, maturity, and survival benefits

Life insurance is a contract between you and an insurance company that pays out a guaranteed sum of money when you die. There are two main types of life insurance: term insurance and whole life insurance. Term insurance is more affordable but only covers a specific period, whereas whole life insurance is more expensive but provides lifelong coverage.

Term insurance plans are one of the most popular insurance products in India. They provide coverage for a specific period, usually up to 10 years, and can be renewed for additional periods. The primary advantage of term insurance is risk coverage, as it provides a financial safety net for your family in case of your untimely death. Term insurance plans also often cover expenses for hospitalization and treatment of critical illnesses. Additionally, some plans offer guaranteed income, providing a fixed sum to the insured or their nominee at regular intervals. Term insurance plans can also help inculcate a savings culture, as subscribers can accumulate wealth over time. Furthermore, term insurance plans offer tax benefits under section 80C of the Income Tax Act, 1961.

Life insurance, on the other hand, provides death, maturity, and survival benefits. It helps you create wealth and protect your family for the entire policy term. Life insurance plans can also help you build a financial cushion for yourself and your dependents, providing financial security in case of unexpected death or survival until the end of the policy term. The premiums for life insurance are typically higher than those for term insurance since they cover the whole life. However, life insurance plans offer the advantage of bonus additions, which can increase the total payout.

In summary, term insurance is more affordable and provides coverage for a specific period, making it ideal for those seeking financial protection without a long-term commitment. On the other hand, life insurance offers more comprehensive coverage, including death, maturity, and survival benefits, but at a higher cost.

Understanding Fidelity Insurance: Protecting Your Finances Simply and Effectively

You may want to see also

Term insurance does not offer maturity benefits

Term insurance is a type of life insurance that provides coverage for a specific period, usually up to 10 years, and can be renewed for additional periods. It is a more affordable option compared to whole life insurance and is designed to offer financial protection in case of an unexpected death. While term insurance provides coverage for a chosen period, life insurance covers the policyholder for their entire lifetime.

However, there are some term insurance plans that offer a return of premiums, where the policyholder can get back the premiums they have paid if they survive the policy term. These plans provide an additional benefit on top of the pure protection offered by traditional term insurance. By choosing a term plan with a return of premium option, policyholders can ensure that their premiums are not wasted if they outlive the policy.

In summary, while term insurance does not typically offer maturity benefits, there are term plans available that provide a return of premiums, offering an additional layer of financial protection.

Understanding the Islamic Perspective on Term Insurance: Halal or Haram?

You may want to see also

Term insurance premiums are based on the insured's age, health, and sum assured

- Age: Younger individuals typically pay lower premiums because they are less likely to get sick and have a longer life expectancy.

- Health: The insured's health status and medical history can impact the premium. Pre-existing health conditions or serious illnesses may result in higher premiums.

- Lifestyle: Risky activities, smoking, and drinking can increase the premium due to higher health risks.

- Gender: Women tend to have lower premiums than men because they generally have longer life expectancies.

- Policy Value: The higher the policy's value or sum assured, the higher the premium will be.

- Company Factors: The insurance company's business expenses, investment earnings, and mortality rates also influence the premium amount.

It's important to note that term insurance premiums are generally lower than other types of insurance because they only provide coverage for a specific period and do not accumulate cash value. Term insurance is designed to provide financial protection to the insured's family in the event of their untimely death.

Understanding Family Term Insurance: Protecting Your Loved Ones

You may want to see also

Frequently asked questions

LIC is a type of life insurance that provides coverage for the entirety of the policyholder's life, whereas term insurance provides coverage for a specific period, usually up to 10 years, which can be renewed.

LIC offers both death and maturity benefits, while term insurance only offers death benefits. LIC policies also often include bonuses and additional benefits, which are not usually included in term insurance plans.

LIC plans typically have higher premiums than term insurance plans due to the longer coverage period and additional benefits. Term insurance plans are designed to be more affordable and offer lower premiums.

LIC plans offer the opportunity to build an investment corpus as a portion of the premium is invested. Term insurance plans do not have this feature and only provide death benefits, making LIC a better choice for those seeking to grow their wealth.