Life insurance is an important investment, but it doesn't have to be a costly one. The cheapest type of life insurance is generally term life insurance, which provides coverage for a specific period, such as 10, 20, or 30 years. The cost of whole life insurance, which has no time limit, can be significantly higher. The rates vary based on factors like age, gender, health, and lifestyle choices such as smoking. Pacific Life, State Farm, and Colonial Penn are known for offering affordable rates, with Colonial Penn specializing in guaranteed acceptance whole life insurance coverage. Additionally, employer-provided life insurance can be a low-cost or no-cost option, although it may have lower coverage limits. To find the best rates, it's recommended to compare quotes from multiple insurers and consider factors beyond price, such as financial strength and customer satisfaction.

| Characteristics | Values |

|---|---|

| Cheapest Life Insurance Companies | Symetra, Corebridge Financial, Pacific Life, Penn Mutual, Protective, Nationwide, State Farm, Ladder, Amica, Ethos |

| Cheapest Type of Life Insurance | Term life insurance |

| Factors Affecting Life Insurance Cost | Type of insurance, age, gender, health, medical history, smoking status, coverage amount, etc. |

| Average Cost of Life Insurance | $40-$55 per month, $26 per month according to a NerdWallet analysis |

What You'll Learn

Term life insurance is the cheapest option

Life insurance is an important investment, but it doesn't have to be a costly one. Term life insurance is the cheapest option on the market, with the cost of whole life insurance being significantly higher. Term life insurance is a great option for those looking for a straightforward, affordable policy. It offers a set coverage amount over a specific period, usually ranging from 10 to 40 years.

There are several companies that offer competitive rates for term life insurance. For example, Ladder Life provides term policies of up to $8 million in coverage, and you may not need a medical exam for policies up to $3 million. They also offer a unique “laddering” tool that allows you to adjust your coverage as needed. Pacific Life is another company that offers term life insurance, as well as universal and permanent policies. They allow you to convert your term policy into a permanent one within a certain timeframe without a medical exam if you're under 70.

When considering term life insurance, it's important to shop around and get quotes from multiple insurers to ensure you're getting the best coverage at the most affordable price. Additionally, consider your health, age, and any medical conditions, as these factors can impact your rates. For example, smokers typically pay more due to the health risks associated with tobacco use.

While term life insurance is the cheapest option, it's important to remember that it doesn't build cash value and isn't permanent. If you're seeking lifelong coverage or an investment opportunity, you may want to consider other options, such as whole or universal life insurance. However, for those looking for basic financial protection for their loved ones, term life insurance is a cost-effective solution.

Life Insurance: ERS Cost and Coverage Explained

You may want to see also

Whole life insurance is more expensive

Term life insurance is the cheapest type of life insurance policy. The cost of whole life insurance can be significantly higher. Smokers, for example, will pay more for life insurance because of the health risks associated with tobacco use.

Whole life insurance premiums can range from five to 15 times more expensive than term life premiums. This is because whole life insurance includes a cash value account. A portion of your monthly premiums are deposited into your cash value account, and the amount grows tax-deferred over time. You can borrow against your balance, withdraw the funds or exchange the cash value to increase the death benefit amount.

Whole life insurance is designed to last your whole life. This, coupled with the potential to accumulate cash value over time, is generally what makes whole life more expensive than other types of life insurance. When you pay your whole life premiums, part of your payment goes toward insurance costs, while another portion goes into a cash value component of your policy that begins growing at an established interest rate.

Health and Life Insurance: Licensing Requirements and Benefits

You may want to see also

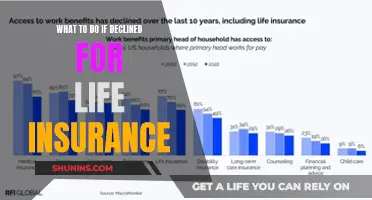

Free life insurance from your employer

Life insurance can be an expensive investment, but it doesn't have to be. Term life insurance is the cheapest type of life insurance policy, and your employer may provide this for free.

Many employers offer life insurance as a workplace perk, sometimes referred to as "basic group life". This is often a type of term life insurance, and it can be an excellent addition to an employee benefits package. The coverage amounts are typically capped at low amounts, such as one to two times your annual salary, or a flat sum of $20,000. Some companies may offer plans that pay out two or three times your salary. Basic employer-provided life insurance is usually low-cost or free, and you may be able to buy additional coverage at low rates. However, if you leave your job, you will likely lose this benefit. You might be able to convert your group policy to an individual policy, but this could be significantly more expensive.

The coverage provided by your employer may not be enough to meet your needs. If you have dependents or financial obligations, a group life insurance policy could leave you underinsured. If you are healthy and a non-smoker, buying a stand-alone policy might be cheaper than taking coverage from your employer. If you are young and healthy, you will likely be able to find a better rate elsewhere. You can also purchase other life insurance policies, such as an individual term life policy or a permanent life policy.

Prudential Life Insurance: Is It Worth the Hype?

You may want to see also

Critical illness and disability riders

When it comes to life insurance, term life insurance is generally the cheapest type of policy. However, it's important to consider other factors besides cost when choosing a life insurance policy, such as the company's history, reputation for customer service, and financial stability. Additionally, there are various riders or add-ons that can be included in a life insurance policy to enhance coverage.

Critical illness riders can be purchased separately or added to an existing life insurance policy. When added to a life insurance policy, they are known as accelerated benefit riders, which allow policyholders to access death benefits while they are still alive under certain conditions. These riders typically pay benefits on top of the traditional death benefit and cash value if the policyholder has a critical illness, chronic illness, or requires long-term care. The payout for these riders can range from 25% to 100% of the death benefit, and it can be received as a lump sum or through periodic payments, depending on the policy.

Disability riders, also known as waiver of premium riders, waive insurance premium payments if the policyholder becomes disabled or physically impaired and is unable to work. To qualify for this waiver, the policyholder may need to meet specific health and age requirements and may need to be disabled for a certain period, such as six consecutive months. This type of rider helps maintain the life insurance policy by redirecting funds to critical needs and ensuring the policyholder's financial stability during a challenging time.

When considering critical illness and disability riders, it's important to carefully review the policy's stipulations, exclusions, and restrictions. These riders may not cover all types of illnesses, and there may be specific circumstances under which benefits are paid out. Additionally, they may not be available in all states, and certain pre-existing conditions or physical impairments may disqualify an individual from obtaining these riders.

Raymond James: Life Insurance Policies and Plans

You may want to see also

Lower your rate with a healthy lifestyle

Term life insurance is the cheapest type of life insurance policy. However, there are several factors that affect the cost of your life insurance premiums. Some of these factors are beyond your control, such as your age, gender, and family medical history. The younger you are, the lower your payments. Women generally pay lower premiums than men because they tend to live longer.

However, you can take steps to lower your life insurance premium by making lifestyle changes and improving your health. If you are a smoker, you may pay more than twice as much as non-smokers for comparable coverage. Even occasional smoking or the use of nicotine products such as e-cigarettes, pipes, chewing tobacco, or vaping can push you into the "smoker" category. If you are otherwise healthy, with good blood pressure, weight, and cholesterol levels, you may be able to get a lower rate.

Participating in high-risk activities can also increase your life insurance premiums. These include hobbies such as mountain climbing, horseback riding, motorcycle riding, flying an airplane, scuba diving, skydiving, and piloting a plane. If you reduce your participation in these activities, you may be able to get a lower rate.

In addition to lifestyle changes, you can also lower your life insurance premium by choosing a policy that requires a medical exam. This allows the company to assess your risk and offer you a lower rate if you are in good health. It is also a good idea to shop around and get quotes from multiple insurers to find the best coverage at the most affordable price.

Whole Life Insurance: A Doctor's Smart Investment Strategy

You may want to see also

Frequently asked questions

Term life insurance is the cheapest type of life insurance. However, it only provides coverage for a specific period of time.

Colonial Penn, Pacific Life, and State Farm are some companies that offer affordable life insurance.

Shop around and get quotes from multiple insurers to ensure you're getting the best coverage for the best price.

Age, gender, health, and lifestyle choices such as smoking or engaging in high-risk activities can all impact the cost of life insurance.

Yes, one of the least expensive options for life insurance is through your employer's group life insurance plan. However, coverage limits may be low, and you may lose the benefit if you leave the company.