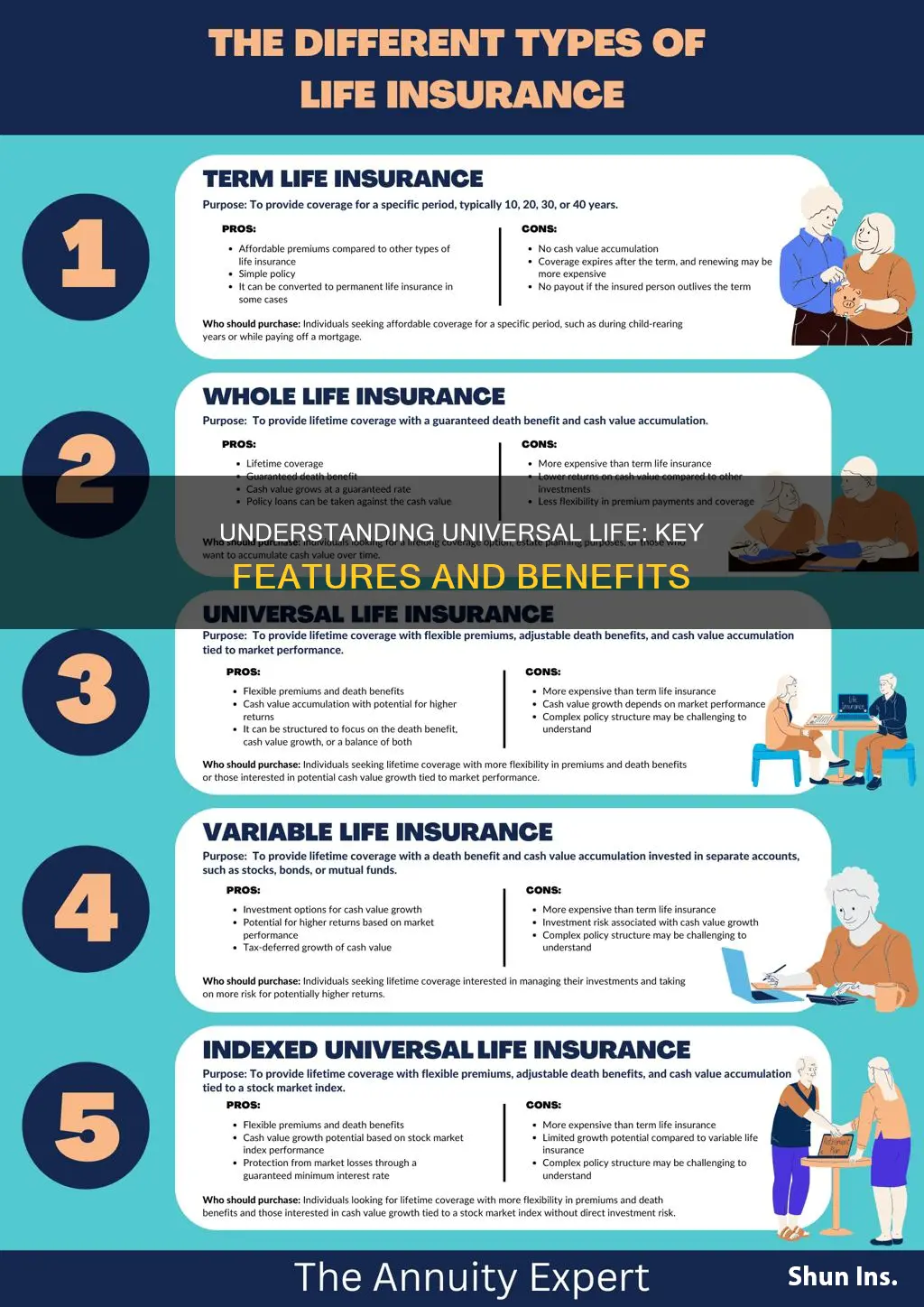

Universal life insurance is a type of permanent life insurance that offers a unique blend of flexibility and long-term coverage. One of its key characteristics is the ability to customize the policy, allowing policyholders to adjust their premiums and death benefits over time. This adaptability is a significant advantage, as it enables individuals to tailor their insurance to their changing financial needs and goals. Unlike traditional term life insurance, universal life insurance provides a guaranteed death benefit and a cash value accumulation, which can be used for various purposes, such as loaning against or withdrawing funds. This feature makes universal life insurance a versatile and attractive option for those seeking both financial security and the potential for long-term wealth accumulation.

What You'll Learn

- Affordability: Universal life is cost-effective, offering low premiums and high coverage

- Flexibility: Policyholders can adjust death benefits and premiums to fit their needs

- Longevity: It provides coverage for a longer period, ensuring financial security throughout life

- Investment Component: The policy includes an investment account, growing cash value over time

- Guaranteed Death Benefit: Universal life ensures a fixed payout upon the insured's death

Affordability: Universal life is cost-effective, offering low premiums and high coverage

Universal life insurance is a type of permanent life insurance that offers a unique blend of flexibility and affordability. One of its key characteristics is its cost-effectiveness, making it an attractive option for those seeking long-term financial protection without breaking the bank.

The affordability of universal life insurance stems from its low premiums. Unlike some other forms of life insurance, such as term life, which may have higher initial costs, universal life policies typically start with lower monthly or annual premiums. This is particularly beneficial for individuals who want to maximize their coverage without incurring excessive expenses. Over time, as the policy grows, the premiums may increase, but they are generally more stable and predictable compared to other insurance products.

The low premium structure is made possible by the way universal life insurance works. It combines a death benefit with an investment component. Policyholders can allocate a portion of their premium payments to a cash value account, which grows over time through interest and investment returns. This accumulation of cash value allows the policy to build a substantial reserve, providing a financial cushion. As a result, the insurance company can offer lower premiums in the early years, ensuring that the policy remains affordable for a longer period.

Furthermore, universal life insurance provides high coverage amounts, which further enhances its affordability. Policyholders can choose the level of coverage they desire, and the policy's cash value can be used to increase the death benefit if needed. This flexibility enables individuals to tailor their coverage to their specific financial goals and risk tolerance. With high coverage, policyholders can ensure that their loved ones are financially protected in the event of their passing, all while maintaining a manageable premium cost.

In summary, universal life insurance stands out for its affordability, offering low premiums and high coverage. This combination of cost-effectiveness and comprehensive protection makes it an excellent choice for individuals seeking a long-term financial safety net without compromising their budget. By understanding and appreciating this key characteristic, individuals can make informed decisions about their insurance needs and find a suitable solution that aligns with their financial objectives.

Life Insurance Settlements: Taxable Income or Tax-Free Windfall?

You may want to see also

Flexibility: Policyholders can adjust death benefits and premiums to fit their needs

Universal life insurance offers a unique advantage to policyholders in the form of flexibility, allowing them to customize their insurance policies to align with their evolving financial goals and circumstances. This adaptability is a key characteristic that sets universal life insurance apart from other types of permanent life insurance.

One of the primary ways policyholders can exercise this flexibility is by adjusting the death benefit, which is the amount paid out upon the insured's death. Universal life insurance policies typically provide a flexible death benefit, enabling policyholders to increase or decrease this amount over time. This feature is particularly useful for individuals who want to ensure their loved ones are adequately protected during their working years but may also want to adjust the coverage as their financial situation changes. For example, a policyholder might start with a higher death benefit to cover immediate family expenses and then gradually reduce it as the children become financially independent.

In addition to adjusting the death benefit, policyholders can also modify their premiums. Universal life insurance allows for premium flexibility, meaning policyholders can choose to pay higher premiums during their earning years when they have a higher income and can afford it. This approach can build up a substantial cash value in the policy, which can be borrowed against or withdrawn tax-free. As the policyholder's financial situation improves, they can opt to pay lower premiums, ensuring that the policy remains affordable even if their income fluctuates.

The flexibility in universal life insurance empowers individuals to make informed decisions about their insurance coverage. It allows them to tailor the policy to their specific needs, ensuring that the death benefit and premium payments are appropriate for their current and future financial goals. This adaptability is especially valuable for those who want to maintain control over their insurance decisions and adapt to life changes without incurring penalties or additional costs.

Furthermore, the flexibility of universal life insurance encourages long-term financial planning. Policyholders can use the cash value built up in the policy to invest in various financial instruments, providing an opportunity to grow their money over time. This investment aspect, combined with the flexibility to adjust death benefits and premiums, makes universal life insurance a versatile tool for comprehensive financial planning.

How to Evaluate Your Life Insurance Premium

You may want to see also

Longevity: It provides coverage for a longer period, ensuring financial security throughout life

Universal life insurance is a unique and versatile insurance product that offers a key advantage: longevity. This type of insurance is designed to provide coverage for an individual's entire life, ensuring financial security and peace of mind. Unlike traditional term life insurance, which offers coverage for a specific period, universal life insurance adapts to the insured's needs over time.

The concept of longevity in universal life insurance is a cornerstone of its appeal. It means that the insurance policy remains in force for the entire life of the insured individual. This is particularly important as it provides long-term financial protection, which is often lacking in other insurance forms. With universal life, the coverage grows and adapts as the insured person ages, ensuring that the financial security is maintained throughout their lifetime.

One of the key benefits of this longevity feature is the flexibility it offers. Policyholders can choose to increase or decrease the death benefit amount as their financial goals and circumstances change. This adaptability is a significant advantage, especially for those who want to ensure their loved ones are financially protected, regardless of future economic shifts. Over time, the cash value of the policy also accumulates, providing an additional financial asset that can be borrowed against or withdrawn, further enhancing the policyholder's financial flexibility.

Moreover, the longevity aspect of universal life insurance encourages a long-term financial planning mindset. It prompts individuals to consider their financial future and make informed decisions about their insurance needs. By providing coverage for a longer period, it allows policyholders to build a substantial cash value, which can be used for various financial goals, such as retirement planning, education funds, or even starting a business.

In summary, the key characteristic of universal life insurance is its ability to provide coverage for a longer period, ensuring financial security and adaptability. This longevity feature sets it apart from other insurance types, offering policyholders a comprehensive and flexible solution for their financial protection needs throughout their lives. Understanding this aspect is crucial for anyone considering long-term financial planning and insurance coverage.

Lying About Smoking: Life Insurance Policy Risks and Consequences

You may want to see also

Investment Component: The policy includes an investment account, growing cash value over time

Universal life insurance is a type of permanent life insurance that offers a unique combination of insurance coverage and investment opportunities. One of its key characteristics is the inclusion of an investment component, which allows policyholders to grow their cash value over time. This feature is a significant advantage for those seeking both insurance protection and a way to potentially increase their wealth.

The investment account within a universal life policy is designed to accumulate cash value, which can be used for various purposes. As the policyholder, you have the flexibility to allocate a portion of your premium payments to the investment account, where they can earn interest and grow. This investment aspect is a crucial differentiator from traditional term life insurance, as it provides a long-term financial strategy. Over time, the cash value in the investment account can accumulate and be used to increase the death benefit of the policy, ensuring that your loved ones receive a higher payout if something happens to you.

The beauty of this investment component is its adaptability. Policyholders can adjust their investment strategy based on their financial goals and market conditions. They can choose from various investment options offered by the insurance company, such as fixed, variable, or index-based investments. This flexibility allows individuals to tailor their policy to their risk tolerance and financial objectives. For instance, those who prefer a more conservative approach might opt for fixed investments, while others seeking higher potential returns could explore variable or index-based options.

As the policyholder, you also have the freedom to make additional payments, known as "extra payments," into the investment account. These payments can accelerate the growth of your cash value, providing a boost to your overall financial strategy. By making these extra contributions, you can potentially increase the value of your policy more rapidly, ensuring that your investment and insurance goals are met more quickly.

In summary, the investment account in universal life insurance is a powerful tool for growing your wealth while providing essential life coverage. It offers policyholders the opportunity to actively manage their finances, adapt to changing market conditions, and potentially increase the value of their policy over time. This characteristic sets universal life insurance apart, making it an attractive choice for those seeking a comprehensive financial solution.

Getting an Oklahoma Life Insurance License: A Guide

You may want to see also

Guaranteed Death Benefit: Universal life ensures a fixed payout upon the insured's death

Universal life insurance is a type of permanent life insurance that offers a unique and flexible approach to coverage. One of its key characteristics is the Guaranteed Death Benefit, which is a fundamental aspect that sets it apart from other life insurance policies. This feature ensures that the insured individual's beneficiaries will receive a predetermined amount of money upon their death, providing financial security and peace of mind.

The Guaranteed Death Benefit is a fixed amount that the insurance company promises to pay out when the insured person passes away. This benefit is typically set at the time of purchasing the policy and remains constant throughout the life of the policy. It is a critical component of universal life insurance as it guarantees a specific financial outcome, offering protection and assurance to the policyholder and their loved ones.

When an individual purchases a universal life insurance policy, they have the option to choose the amount of the Guaranteed Death Benefit. This choice allows policyholders to customize their coverage according to their specific needs and financial goals. By selecting an appropriate death benefit, individuals can ensure that their family or beneficiaries are financially protected in the event of their passing.

This feature of universal life insurance provides several advantages. Firstly, it offers flexibility, as policyholders can adjust the death benefit over time to reflect changing circumstances or financial goals. Secondly, it provides a sense of security, knowing that the insured individual's family will receive a specified amount, regardless of market fluctuations or other insurance policy variations. Moreover, the Guaranteed Death Benefit ensures that the insurance policy remains a valuable asset, even if other aspects of the policy, such as cash value accumulation, may vary.

In summary, the Guaranteed Death Benefit is a defining feature of universal life insurance, offering a fixed and assured payout upon the insured's death. This characteristic provides financial security, flexibility, and peace of mind to policyholders, making it an attractive option for those seeking long-term life insurance coverage. Understanding this key aspect is essential for individuals considering universal life insurance as a means to protect their loved ones and secure their financial future.

Life Insurance: Sickness, Coverage, and Your Options

You may want to see also

Frequently asked questions

Universal Life Insurance offers permanent coverage with a flexible premium, allowing policyholders to adjust the amount paid into the policy. It provides a death benefit and a cash value account, which can accumulate cash over time. This type of insurance is more expensive than term life but offers greater flexibility and the potential for investment growth.

The cash value is a significant feature of Universal Life, where a portion of the premium payments goes into an investment account. This account grows tax-deferred, and the policyholder can borrow against this cash value or withdraw it (subject to certain conditions). The cash value can be used to pay premiums, providing an alternative to paying out-of-pocket, and it also ensures the policy remains in force even if the premium payments decrease.

Yes, one of the key advantages of Universal Life Insurance is its convertibility. Policyholders can often convert their Universal Life policy to a whole life insurance policy at a later date, typically without a medical examination. This conversion option provides policyholders with the security of a permanent life insurance policy while retaining the flexibility of Universal Life during the initial years.