Choosing the right life insurance can be a daunting task, as it's a significant financial decision that impacts your loved ones' future. The market offers various types of life insurance, each with unique features and benefits. Term life insurance provides coverage for a specific period, offering a straightforward and cost-effective solution for those seeking temporary protection. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage and an investment component, making it a more complex but potentially rewarding choice. Understanding your financial goals, family needs, and long-term plans is crucial to selecting the insurance that best suits your circumstances.

What You'll Learn

- Assess Your Needs: Consider your financial goals, dependents, and potential risks

- Understand Policy Types: Explore term, whole life, and universal life insurance

- Compare Premiums: Evaluate costs based on coverage amount and duration

- Review Policy Features: Look for riders, cash value, and investment options

- Consult a Professional: Seek advice from a financial advisor for personalized guidance

Assess Your Needs: Consider your financial goals, dependents, and potential risks

When evaluating your life insurance options, it's crucial to assess your unique needs and circumstances. This involves a thoughtful examination of your financial goals, the presence of dependents, and the potential risks you may face. Here's a guide to help you navigate this process:

Financial Goals: Start by defining your short-term and long-term financial objectives. Consider your income, savings, and any upcoming major expenses. For instance, if you have a substantial mortgage or plan to send a child to college in the next few years, you might need a policy that can cover these costs in the event of your passing. Additionally, think about your retirement plans. Do you have a comfortable nest egg set aside, or will your beneficiaries need to cover your expenses during their working years? Understanding your financial goals will help determine the coverage amount you require.

Dependents: The presence of dependents is a significant factor in life insurance planning. If you have a spouse, children, or other family members who rely on your income, life insurance can provide financial security for them. Calculate the potential financial impact of your death on your dependents. Consider their daily living expenses, education costs, and any other financial commitments they might have. The life insurance policy should aim to replace the income you would have provided to support your dependents until they can become financially independent.

Potential Risks: Life is full of uncertainties, and it's essential to identify the risks that could impact your financial stability. Common risks include health issues, accidents, disabilities, and unexpected job losses. Evaluate your health and lifestyle choices. Are you a non-smoker with a healthy diet and regular exercise routine? Or do you have a history of chronic illnesses or engage in high-risk activities? These factors can influence the cost and availability of certain life insurance policies. Additionally, consider the potential risks associated with your career. For example, a high-risk profession or a job with a high level of stress might impact your insurance premiums.

Assessing these aspects will enable you to make informed decisions about the type and amount of life insurance coverage you need. It's a personalized process, and consulting with a financial advisor can provide valuable insights tailored to your specific situation. Remember, the goal is to ensure that your loved ones are protected financially, and a well-assessed plan will help you achieve that peace of mind.

Selling Life Insurance at 33: Is It Possible?

You may want to see also

Understand Policy Types: Explore term, whole life, and universal life insurance

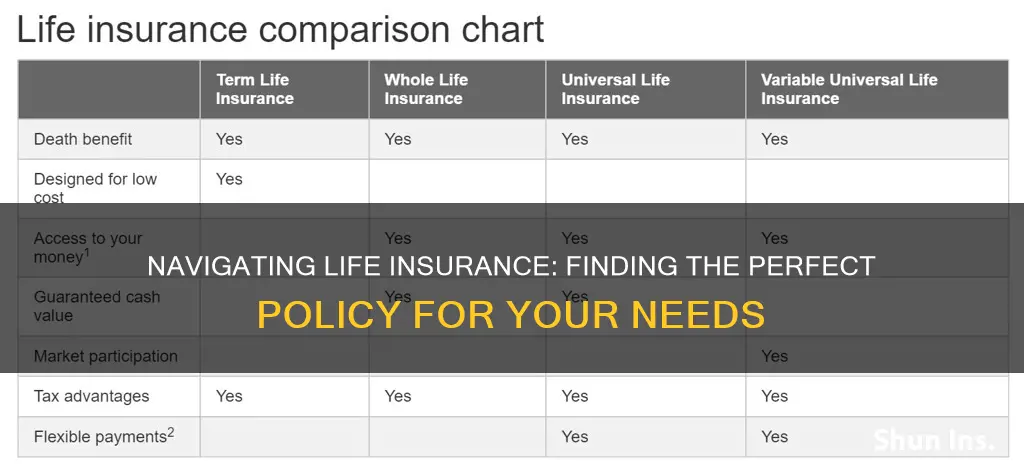

When considering life insurance, it's crucial to understand the different policy types available to ensure you choose the right coverage for your needs. Here's an overview of the three primary types of life insurance: term, whole life, and universal life.

Term Life Insurance: This is a straightforward and affordable type of coverage that provides protection for a specified period, typically 10, 20, or 30 years. It is ideal for individuals who want temporary coverage to secure their family's financial future during a specific life stage, such as when they have young children or a mortgage. Term life insurance offers a fixed death benefit if the insured person passes away during the policy term. It is a cost-effective option as it doesn't accumulate cash value, making it a pure insurance product. After the term ends, policyholders can choose to renew the policy or purchase a new one, but premiums may increase with age.

Whole Life Insurance: In contrast to term life, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a cash value component that grows over time. The premiums for whole life insurance are typically higher than term life due to the long-term commitment. With whole life, the policyholder builds up cash value, which can be borrowed against or withdrawn, providing financial flexibility. This type of policy is suitable for those seeking long-term financial security and the peace of mind that comes with knowing their loved ones will be financially protected indefinitely.

Universal Life Insurance: This policy offers flexibility and adaptability, allowing policyholders to adjust their coverage and premiums over time. Universal life insurance provides permanent coverage and includes a cash value component that can grow tax-deferred. Policyholders can choose to pay fixed premiums or variable premiums, allowing for potential investment growth. One of the advantages of universal life is the ability to increase or decrease the death benefit and adjust the premium payments as your financial situation changes. This type of insurance is well-suited for individuals who want a customizable policy and the potential for long-term investment growth.

Understanding these policy types is essential in making an informed decision about life insurance. Each type has its advantages and considerations, and the right choice depends on your specific circumstances, financial goals, and the level of coverage you require. It's recommended to consult with a financial advisor or insurance professional to determine the best fit for your individual needs.

Life Insurance Proceeds: Separate Property or Not?

You may want to see also

Compare Premiums: Evaluate costs based on coverage amount and duration

When considering life insurance, one of the most crucial aspects to evaluate is the cost, especially when comparing different policies. The premium you pay directly impacts your financial planning and the overall value you receive from the insurance. Here's a detailed guide on how to compare premiums based on coverage amount and duration:

Understand Your Needs: Before diving into the comparison, it's essential to identify your specific needs. Determine the coverage amount you require, which is typically based on your financial obligations and goals. For instance, if you have a mortgage, children's education expenses, or a substantial amount of debt, you might need a higher coverage amount. Consider your life stage, health, and any existing financial resources that could provide a safety net.

Coverage Amount: The coverage amount is the financial benefit paid out upon your death. It's a critical factor in premium calculation. Generally, higher coverage amounts result in higher premiums. Insurance companies use complex algorithms to determine rates, taking into account factors like age, health, lifestyle, and the likelihood of claiming the policy. When comparing policies, ensure you're comparing similar coverage amounts to make an accurate assessment.

Duration of Coverage: Life insurance policies can be term life (for a specified period) or permanent (with no expiration date). Term life insurance is often more affordable, especially for younger individuals, as it provides coverage for a defined period. On the other hand, permanent life insurance, which includes features like cash value accumulation, can be more expensive but offers lifelong coverage. When evaluating premiums, consider the duration of the policy and how it aligns with your long-term financial goals.

Compare Quotes: Obtain quotes from multiple insurance providers for the coverage amount and duration you've determined. Request quotes for both term and permanent life insurance to understand the price difference. Ensure that the quotes include all relevant details, such as the policy's features, rider options, and any additional benefits. Comparing quotes will help you identify the most cost-effective options without compromising on essential coverage.

Review Policy Details: When comparing premiums, don't solely focus on the price. Examine the policy details, including the types of coverage, exclusions, and any additional fees. Some policies might offer lower premiums but have higher fees or less favorable terms. Understand the policy's terms and conditions to ensure you're making an informed decision. Additionally, consider the financial strength and reputation of the insurance company to ensure they can honor their commitments.

By carefully evaluating coverage amounts and durations, you can make a well-informed decision when choosing life insurance. Remember, while comparing premiums is essential, it should be done alongside a comprehensive understanding of the policy's features and your personal financial situation. This approach will help you select the right life insurance that provides adequate protection at a reasonable cost.

Whole Life Insurance Cancellation: What to Expect and Prepare For

You may want to see also

Review Policy Features: Look for riders, cash value, and investment options

When evaluating different life insurance policies, it's crucial to delve into the specific features and benefits they offer. One of the key aspects to review is the policy's riders, which are additional benefits that can enhance your coverage. Riders provide extra protection and flexibility, allowing you to customize your policy to better suit your needs. For instance, a waiver of premium rider ensures that your premiums are waived if you become disabled, providing financial relief during challenging times. Similarly, a guaranteed death benefit rider guarantees a specific payout amount, offering certainty and peace of mind. These riders can significantly impact the overall value and adaptability of your life insurance policy.

Another essential feature to consider is the cash value component. Not all life insurance policies include cash value, but it is a valuable aspect to look for. Cash value accumulates over time and can be borrowed against or withdrawn, providing financial flexibility. This feature is particularly beneficial for long-term financial planning, as it allows you to build a savings component within your insurance policy. With cash value, you can potentially access funds for various purposes, such as funding education expenses, starting a business, or even supplementing retirement income. It's a feature that adds long-term financial security and potential growth to your insurance plan.

Investment options are also a critical aspect of policy features. Some life insurance companies offer investment accounts linked to your policy, allowing you to invest the cash value portion. These investment options can provide opportunities for growth and potentially higher returns compared to traditional savings accounts. By reviewing the investment choices available, you can align your policy with your financial goals and risk tolerance. This feature enables you to potentially grow your money while also ensuring that your life insurance coverage remains in place. It's a way to maximize the benefits of your policy and make it work harder for your financial future.

When comparing policies, take the time to understand the investment performance history and fees associated with each option. Some investment accounts may have higher fees or different risk profiles, so it's essential to choose options that align with your investment strategy. Additionally, consider the liquidity of the investment options, as this will impact your ability to access funds if needed. By carefully reviewing the investment features, you can make informed decisions and select a policy that provides both insurance protection and potential financial growth.

In summary, when reviewing policy features, don't overlook the importance of riders, cash value, and investment options. These elements significantly contribute to the overall value and adaptability of your life insurance policy. Riders offer additional protection and customization, cash value provides long-term financial security and potential savings, and investment options allow for growth and financial planning. By carefully evaluating these features, you can make an informed decision and choose a life insurance policy that best meets your individual needs and financial objectives.

Calculating Demio for Life Insurance: A Simple Guide

You may want to see also

Consult a Professional: Seek advice from a financial advisor for personalized guidance

When it comes to choosing the right life insurance policy, seeking professional advice is an invaluable step. A financial advisor can provide personalized guidance tailored to your unique circumstances, ensuring you make an informed decision. Here's why consulting a professional is essential:

Financial advisors are experts in assessing an individual's financial situation and goals. They will consider your age, health, income, family status, and long-term objectives. By understanding your specific needs, they can recommend the most suitable life insurance options. For instance, they might suggest term life insurance for temporary coverage or permanent life insurance for long-term financial security. This personalized approach ensures you don't end up with a policy that doesn't align with your requirements.

The insurance market offers a wide array of policies, each with its own features and benefits. From whole life to universal life, term life to variable life, the options can be overwhelming. A financial advisor will simplify this process by explaining the differences and helping you navigate through the choices. They can also provide insights into the various factors that influence premium costs, such as coverage amount, policy duration, and underwriting criteria.

Moreover, advisors can assist in evaluating your risk tolerance and financial capacity. They will help you determine the appropriate level of coverage needed to protect your loved ones and achieve your financial goals. This assessment is crucial, as it ensures you don't over- or under-insure yourself, which could lead to unnecessary expenses or a lack of adequate protection.

Consulting a financial advisor also provides an opportunity to understand the tax implications and regulatory considerations associated with life insurance. They can explain how different policies interact with your tax situation and offer strategies to optimize your overall financial plan. This level of expertise is particularly beneficial in ensuring your life insurance strategy aligns with your long-term financial objectives.

In summary, seeking advice from a financial advisor is a strategic move when deciding on life insurance. Their expertise and personalized approach will guide you through the complexities of the insurance market, ensuring you make a well-informed decision. This consultation can lead to a more secure and tailored financial plan, providing peace of mind for you and your family.

Understanding the Commission Structure for Whole Life Insurance Agents

You may want to see also

Frequently asked questions

Assessing your unique circumstances is crucial. Consider your age, health, financial obligations, and dependents. Younger individuals might opt for term life insurance, offering affordable coverage for a specific period. Conversely, older adults may prefer whole life or universal life insurance, providing lifelong coverage and potential investment components.

Several factors impact life insurance premiums. Age is a significant determinant, with younger individuals typically paying less. Health status plays a vital role; insurers may offer lower rates to healthy individuals with no pre-existing conditions. Additionally, lifestyle choices like smoking, excessive drinking, or dangerous hobbies can affect rates. The amount of coverage and the term length also contribute to the overall cost.

The decision between term life and permanent life insurance depends on your specific goals. Term life insurance provides coverage for a set period, often at lower premiums, making it suitable for temporary needs like mortgage protection or providing for children's education. Permanent life insurance, including whole life and universal life, offers lifelong coverage and potential cash value accumulation, making it ideal for long-term financial planning and wealth building.

Regular policy reviews are essential to ensure your coverage remains appropriate. Life events like marriage, the birth of a child, purchasing a home, or significant financial changes may necessitate adjustments to your policy. It's recommended to review your life insurance annually or whenever your circumstances undergo substantial modifications to guarantee adequate protection.

Yes, individuals with pre-existing health conditions can still obtain life insurance, but the process might be more complex. Insurers may require additional medical exams or offer specialized policies with higher premiums. It's essential to disclose all relevant health information accurately to ensure proper coverage and avoid potential issues during claims.