Industrial life insurance is a specialized form of life insurance designed to protect the financial interests of businesses and their employees. It provides coverage for the loss of income or death of a key employee, ensuring the continuity of operations and providing financial security to the business and its workforce. This type of insurance is tailored to the unique needs of industrial and manufacturing sectors, offering comprehensive protection against various risks associated with the industry, such as sudden workforce disruptions, natural disasters, or other unforeseen events. By providing financial support to businesses during challenging times, industrial life insurance plays a crucial role in maintaining the stability and resilience of these organizations.

What You'll Learn

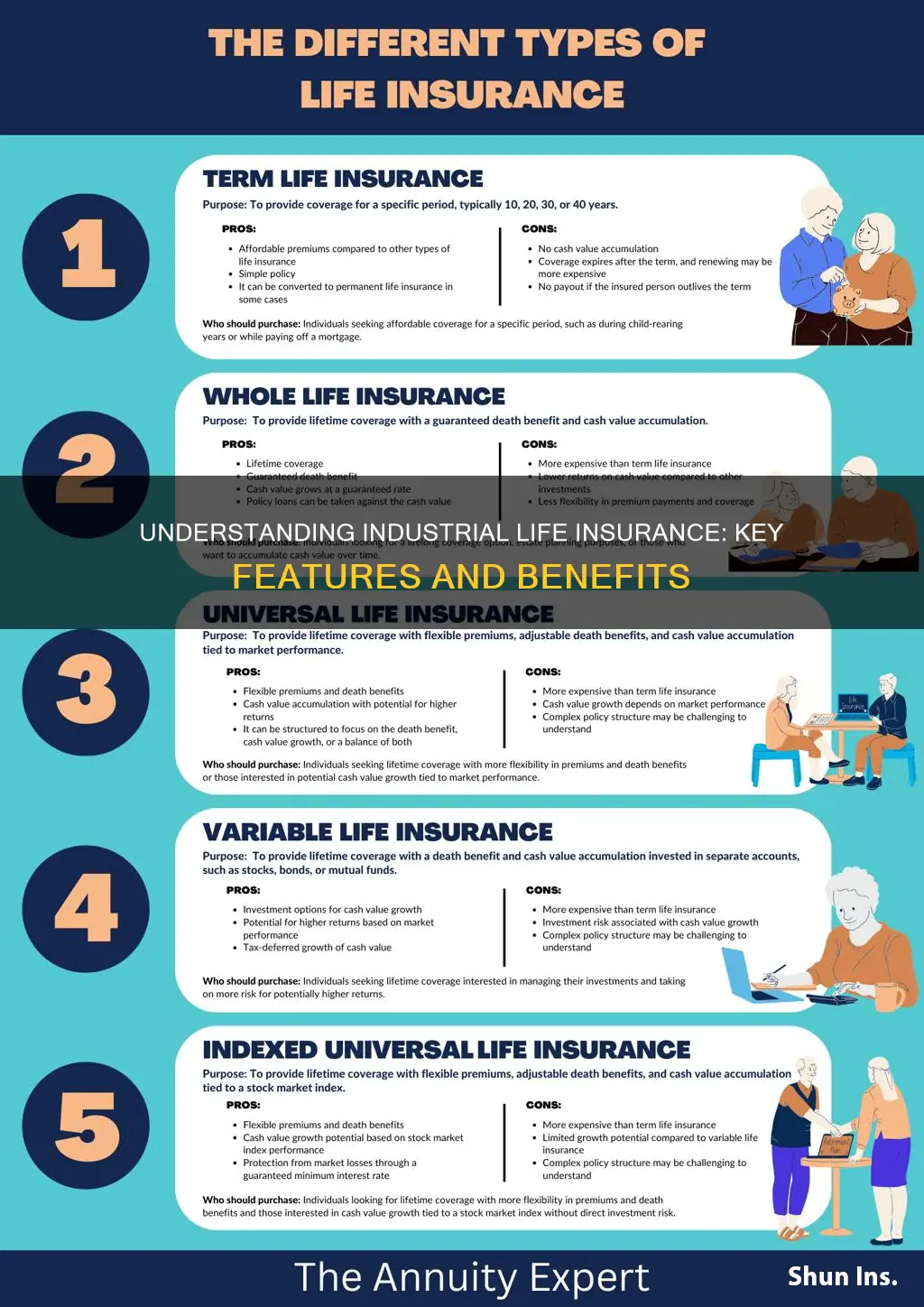

- Definition: Industrial life insurance provides coverage for employees in high-risk jobs, ensuring financial security for their families

- Benefits: It offers financial protection, covering death, disability, and critical illness, tailored to specific industries

- Risk Assessment: Employers assess employee risks to determine appropriate coverage, considering job hazards and industry norms

- Customization: Policies can be tailored to industry-specific needs, offering specialized benefits and exclusions

- Claims Process: Efficient claims handling ensures prompt financial support for beneficiaries, streamlining the process for industrial life insurance

Definition: Industrial life insurance provides coverage for employees in high-risk jobs, ensuring financial security for their families

Industrial life insurance is a specialized form of coverage designed to protect the financial well-being of employees in high-risk occupations. This type of insurance is tailored to address the unique challenges and risks associated with certain professions, offering a safety net for both the individual and their family. The primary purpose is to provide financial security and peace of mind to those in jobs that may expose them to a higher level of danger or uncertainty.

When an individual takes on a high-risk job, such as working in construction, mining, or emergency services, they are more susceptible to accidents, injuries, or even fatalities. Industrial life insurance steps in to mitigate the potential financial impact of these risks. It ensures that the employee's family is financially protected in the event of their untimely demise or permanent disability. This coverage typically includes a death benefit, which is a lump sum payment made to the beneficiary(ies) upon the insured's passing. The amount can vary depending on the policy, but it is often substantial, providing a significant financial cushion for the family.

Moreover, this insurance goes beyond just death coverage. It often includes permanent disability benefits, which can be crucial for employees who suffer long-term injuries or illnesses that render them unable to work. In such cases, the insurance company provides regular income to the policyholder, ensuring they can maintain their standard of living and cover essential expenses during their recovery or rehabilitation period.

The key aspect of industrial life insurance is its focus on the specific needs of high-risk employees. It recognizes that these individuals often face a higher likelihood of adverse events and aims to provide comprehensive protection. By offering both death and disability benefits, the insurance ensures that the family's financial stability is safeguarded, even in the face of unforeseen circumstances. This type of coverage is particularly valuable for those in dangerous professions, as it provides a sense of security and allows employees to focus on their work without constant worry about their family's financial future.

In summary, industrial life insurance is a specialized financial product designed to cater to the unique risks faced by employees in high-risk jobs. It provides a safety net for both the individual and their family, ensuring financial security and peace of mind. With its tailored benefits, this insurance plays a vital role in protecting the livelihoods of those who dedicate their careers to challenging and potentially hazardous occupations.

Life Insurance Awareness: Celebrating Financial Security Every Month

You may want to see also

Benefits: It offers financial protection, covering death, disability, and critical illness, tailored to specific industries

Industrial life insurance is a specialized form of coverage designed to protect employees and their families in high-risk occupations or industries. It provides a comprehensive safety net, ensuring financial security in the face of unforeseen circumstances. This type of insurance is tailored to the unique demands and challenges of specific industries, offering a range of benefits that are crucial for workers and their dependents.

One of the primary advantages of industrial life insurance is its ability to provide financial protection. It covers various aspects of life, including death, disability, and critical illness. In the event of an employee's passing, the policy ensures that their loved ones are financially secure, with a lump sum payment providing a safety net for funeral expenses and ongoing living costs. This financial support can be a significant relief during a difficult time, allowing families to focus on grieving and adjusting to life without the primary breadwinner.

Disability coverage is another critical component. It compensates employees who become unable to work due to injury or illness. This benefit replaces a portion of their income, helping them maintain their standard of living and cover essential expenses while they recover. The financial support can be a lifeline, ensuring that workers can afford medical treatments, rehabilitation, and daily living costs without incurring significant debt.

Furthermore, industrial life insurance often includes coverage for critical illnesses. This benefit provides financial assistance when an employee is diagnosed with a severe medical condition that may impact their ability to work. The policy can cover medical expenses, ongoing treatments, and even provide a lump sum payment to help with the financial burden of such illnesses. This aspect of insurance is particularly valuable in industries where certain health risks are prevalent, ensuring that workers receive the necessary support to manage their health effectively.

The customization of industrial life insurance is a key feature, as it is tailored to the specific needs of different industries. For example, construction workers may require higher coverage for their physical labor, while pilots might need extended benefits for their unique career risks. This customization ensures that the insurance policy is relevant and valuable to the workforce, providing a sense of security and peace of mind.

Military Life Insurance: Who Qualifies and How to Apply

You may want to see also

Risk Assessment: Employers assess employee risks to determine appropriate coverage, considering job hazards and industry norms

When it comes to industrial life insurance, employers play a crucial role in assessing the risks associated with their workforce to ensure adequate coverage. This process involves a comprehensive risk assessment, which is a critical step in determining the appropriate insurance policies for employees. The primary goal is to identify potential hazards and risks that employees may face in their respective roles and industries.

Employers should start by evaluating the nature of the work and the potential dangers present in each job sector. For instance, construction sites involve physical labor, heavy machinery, and high-risk activities, making it essential to assess the likelihood and impact of accidents or injuries. Similarly, jobs in manufacturing or mining expose workers to hazardous materials, extreme conditions, and potential machinery malfunctions. By understanding the specific risks, employers can tailor their insurance plans accordingly.

The assessment should consider various factors, including the frequency and severity of potential accidents, the likelihood of occupational diseases, and the industry-specific risks. For example, in high-risk industries like oil and gas or aviation, the focus might be on comprehensive coverage for severe injuries or fatalities. In contrast, office-based jobs may require more emphasis on health insurance and coverage for work-related stress or mental health issues. Industry norms and standards also play a vital role in this evaluation, as they provide a benchmark for acceptable risk levels and help employers set appropriate coverage limits.

During the risk assessment, employers should gather data and statistics related to workplace accidents, illnesses, and industry-specific hazards. This information can be obtained from various sources, including government reports, industry associations, and internal records. By analyzing this data, employers can identify trends, common risk factors, and areas where additional training or safety measures are required. This proactive approach ensures that the insurance coverage is not only adequate but also aligned with the unique challenges of each industry.

Once the risks are assessed, employers can work with insurance providers to design customized policies. This may involve selecting appropriate coverage types, such as life insurance, disability insurance, or critical illness coverage, based on the identified risks. Additionally, employers can negotiate terms and benefits that best suit their workforce and industry. By taking a proactive stance in risk assessment, employers can provide their employees with the necessary protection, ensuring a safer work environment and peace of mind for both parties.

Canceling Great West Life Insurance: A Step-by-Step Guide

You may want to see also

Customization: Policies can be tailored to industry-specific needs, offering specialized benefits and exclusions

Industrial life insurance is a specialized form of coverage designed to protect employees and their families in the event of death or critical illness. One of its key strengths is the ability to customize policies to meet the unique needs of different industries. This customization ensures that the insurance provides relevant and valuable benefits while excluding industry-specific risks.

When tailoring industrial life insurance, insurers consider the specific risks and challenges associated with various sectors. For instance, construction workers face higher risks of accidents and injuries, so policies for this industry might include enhanced coverage for accidental death and dismemberment. Similarly, insurance for the healthcare sector could offer benefits tailored to the high-stress environment and potential exposure to infectious diseases.

Customization allows for the inclusion of industry-specific benefits. For example, in the manufacturing industry, where machinery accidents are common, insurance policies can provide additional coverage for dismemberment or limb loss. In contrast, policies for the financial sector might emphasize mental health support and critical illness benefits, addressing the high-pressure nature of the job.

Exclusions are also an essential part of customization. Certain industries may have inherent risks that are not covered by standard policies. For instance, insurance for aviation professionals might exclude coverage for death caused by flying, as this is a well-known risk in the industry. By excluding such risks, the policy remains focused on providing relevant protection.

This tailored approach ensures that industrial life insurance is more than just a one-size-fits-all product. It becomes a powerful tool to safeguard employees and their families, offering peace of mind and financial security while addressing the unique challenges and risks of each industry. Customization is a key differentiator, making industrial life insurance a valuable asset for employers and their workforce.

Life Insurance: Understanding the Safe Age for Coverage

You may want to see also

Claims Process: Efficient claims handling ensures prompt financial support for beneficiaries, streamlining the process for industrial life insurance

The claims process for industrial life insurance is designed to be efficient and straightforward, ensuring that beneficiaries receive their financial support promptly. When a policyholder's death is reported, the insurance company initiates a series of steps to validate the claim and disburse the benefits. This process is crucial as it provides financial security to the policyholder's dependents or beneficiaries, offering peace of mind during a challenging time.

The first step involves the insurance company verifying the policyholder's death. This typically requires providing official documentation, such as a death certificate, to the insurance provider. Once the death is confirmed, the insurance company will review the policy to determine the applicable benefits and the eligible beneficiaries. This review is essential to ensure that the claims process adheres to the policy's terms and conditions.

After the policy review, the insurance company will notify the beneficiaries of the claim's status and the next steps. This communication is vital as it informs the beneficiaries about the process and their rights. The company may also request additional information or documentation to support the claim, such as proof of relationship or any relevant medical records.

The efficient handling of claims is a critical aspect of industrial life insurance. It involves prompt action and clear communication between the insurance company, the policyholder's representatives, and the beneficiaries. The goal is to minimize delays and ensure that the financial support reaches the beneficiaries as quickly as possible. Streamlining the process includes quick response times, efficient documentation, and a well-organized system to handle potential complexities.

In summary, the claims process for industrial life insurance is a vital component that ensures financial security for beneficiaries. It requires a meticulous approach, efficient documentation, and clear communication to provide prompt support during challenging times. By following these steps, the insurance company can honor the policyholder's wishes and provide much-needed financial assistance to their loved ones.

Avoid These Phrases When Applying for Life Insurance

You may want to see also

Frequently asked questions

Industrial Life Insurance, also known as group life insurance, is a type of life insurance policy designed for employees of a specific company or industry. It provides financial protection to the policyholders and their beneficiaries in the event of death or permanent disability.

Industrial Life Insurance is typically offered as a benefit to employees by their employers, making it a group policy. It often provides coverage at a lower cost compared to individual plans due to the larger pool of insured individuals. Individual life insurance, on the other hand, is a personal policy tailored to an individual's needs.

Eligibility for Industrial Life Insurance is usually restricted to employees of a particular company or industry. The employer may offer this insurance as part of the employee benefits package, and the coverage can vary based on the company's policies and the employee's role and tenure.

Industrial Life Insurance offers several advantages to employees. It provides financial security to the policyholder's family in case of their untimely death. Additionally, some policies may offer permanent disability coverage, ensuring income replacement if the employee becomes permanently disabled. This type of insurance can be a valuable component of an employee's overall financial well-being.

In some cases, Industrial Life Insurance may be convertible to an individual policy. This option allows employees to continue their coverage even after leaving the company. However, the conversion process and terms may vary, and it is essential to review the policy details and consult with the insurance provider to understand the conversion options available.