Life insurance is a crucial aspect of financial planning, and understanding when to review and potentially adjust your coverage is essential. Life Insurance Month, typically observed in October, serves as an annual reminder to assess your life insurance needs and ensure your policy aligns with your current circumstances. This dedicated month encourages individuals to evaluate their financial situation, consider changes in their life, and make informed decisions about their insurance coverage. It's a time to reflect on the evolving nature of life and the importance of having adequate protection for yourself and your loved ones.

What You'll Learn

- Life Insurance Awareness Month Benefits: Highlight the advantages of life insurance for financial security

- Month-Long Life Insurance Discounts: Promote special offers and discounts during the month

- Life Insurance Month Events: Organize workshops, webinars, and community events to educate the public

- Life Insurance Month Statistics: Share data on the importance of life insurance

- Month-Long Life Insurance Support: Offer guidance and resources for those seeking life insurance coverage

Life Insurance Awareness Month Benefits: Highlight the advantages of life insurance for financial security

Life Insurance Awareness Month is an annual event dedicated to educating the public about the importance of life insurance and its numerous benefits. This month-long initiative serves as a reminder that life insurance is not just a product but a vital tool for achieving financial security and peace of mind. By highlighting its advantages, we can encourage more individuals to consider this essential coverage.

One of the primary benefits of life insurance is its ability to provide financial protection for your loved ones. In the event of your passing, a life insurance policy ensures that your family receives a tax-free death benefit. This financial support can help cover various expenses, such as mortgage payments, children's education, daily living costs, and even funeral arrangements. Knowing that your family will be financially secure in your absence can offer immense comfort and peace of mind.

Moreover, life insurance offers a sense of financial stability and control. It allows you to plan for the future and make decisions that align with your values and goals. With life insurance, you can choose the policy type, coverage amount, and payment options that best suit your needs. Term life insurance, for instance, provides coverage for a specific period, ensuring that your family is protected during the years when they may need it most. On the other hand, whole life insurance offers lifelong coverage and a cash value component, allowing your money to grow over time.

The advantages of life insurance extend beyond financial security. It also provides an opportunity to plan for your own future. Many life insurance policies offer investment components, allowing you to grow your money and potentially earn a return. This feature can be particularly beneficial for those seeking to build wealth or save for retirement. Additionally, life insurance can be a valuable tool for business owners, as it can provide liquidity for the business or be used to secure loans, ensuring the continuity of operations.

In conclusion, Life Insurance Awareness Month is an excellent opportunity to emphasize the numerous benefits of life insurance. It is a powerful tool that offers financial protection, peace of mind, and the ability to plan for the future. By understanding the advantages, individuals can make informed decisions about their insurance needs, ensuring that their loved ones are cared for and their financial goals are met. This month-long initiative encourages people to take control of their financial security and make life insurance an integral part of their overall financial strategy.

Life Insurance Proceeds: Form 3520 Requirements

You may want to see also

Month-Long Life Insurance Discounts: Promote special offers and discounts during the month

The concept of a 'Life Insurance Month' is an excellent strategy to promote awareness and sales for insurance companies. By dedicating a specific month to life insurance, you can create a focused marketing campaign that educates and engages potential customers. This approach allows for a comprehensive and consistent message to be conveyed, ensuring that the benefits of life insurance reach a wider audience. Here's how you can utilize this month-long period to offer special discounts and promotions:

Engage Customers with Exclusive Offers: During this designated month, consider launching a series of exclusive discounts and promotions. For instance, you could offer a 10% discount on all new life insurance policies for the entire month. This incentive will attract customers who are keen on securing their future and the future of their loved ones. Additionally, you can provide limited-time offers, such as a bonus coverage period for free with certain policy purchases, encouraging customers to make decisions promptly.

Educational Workshops and Webinars: Organize a series of online or in-person workshops and webinars to educate the public about life insurance. These sessions can cover various topics, including the importance of life insurance, different policy types, and how to choose the right coverage. By providing valuable information, you establish your company as an expert in the field, building trust and confidence among potential clients. You can also offer exclusive discounts to attendees during the Life Insurance Month, encouraging sign-ups.

Social Media Campaigns: Leverage the power of social media to create a buzz around your Life Insurance Month. Launch creative campaigns with catchy hashtags to engage your audience. For example, you could run a photo contest where participants share their reasons for having life insurance, with the winner receiving a special discount. Social media platforms also allow for targeted advertising, enabling you to reach specific demographics and offer personalized discounts accordingly.

Collaborate with Influencers: Partnering with influencers or celebrities in the finance and lifestyle space can significantly boost your campaign's reach. Invite them to share their experiences and the importance of life insurance with their followers. Their endorsement can attract attention and create a sense of urgency, encouraging people to take advantage of the month-long discounts.

Email Marketing Strategy: Develop a targeted email marketing campaign to reach existing and potential customers. Send personalized emails highlighting the benefits of life insurance and the special offers available during this month. Include clear calls to action, such as "Secure Your Future Now" or "Don't Miss Out on Our Exclusive Discounts." This direct approach ensures that your message reaches the intended audience effectively.

By implementing these strategies, you can make the most of the designated Life Insurance Month, attracting new customers and providing valuable discounts. It's an opportunity to educate, engage, and ultimately, increase sales while fostering a positive perception of life insurance among the general public.

Depression's Impact: Higher Life Insurance Premiums

You may want to see also

Life Insurance Month Events: Organize workshops, webinars, and community events to educate the public

Life Insurance Awareness Month is an annual event dedicated to educating the public about the importance of life insurance and its role in financial planning. This month-long initiative is a great opportunity for insurance professionals, financial advisors, and community organizations to come together and raise awareness about the benefits of life insurance. Here's a guide on how to make the most of Life Insurance Month and engage your community:

Workshops and Seminars: Organize interactive workshops and seminars to provide valuable insights to the public. These events can be held in various locations such as community centers, libraries, or even online. Invite experienced financial advisors or insurance agents to lead these sessions. Topics can include the basics of life insurance, different types of policies available, and how to choose the right coverage for individual needs. Make the workshops engaging by incorporating interactive activities, Q&A sessions, and real-life case studies to illustrate the impact of life insurance.

Webinars and Online Events: In today's digital age, webinars and online events are powerful tools to reach a wide audience. Host live webinars during Life Insurance Month to discuss relevant topics and answer common questions. You can cover subjects like the financial impact of premature death, the role of life insurance in estate planning, or how to navigate the insurance market. Promote these webinars through social media, email campaigns, and community partnerships to attract a diverse audience.

Community Outreach Programs: Engage with local communities by organizing community events and outreach programs. Set up booths or information stands in public areas, shopping malls, or community fairs. Provide free consultations and offer personalized advice to individuals and families. You can also collaborate with local schools, churches, or community groups to host joint events, such as a financial literacy workshop series or a life insurance awareness campaign. By bringing the message directly to the community, you can create a more personal connection and encourage people to take action.

During Life Insurance Month, it's essential to provide practical resources and tools to the public. Create informative brochures, checklists, or online guides that outline the key considerations when purchasing life insurance. Offer calculators or quizzes to help individuals assess their needs and understand the potential financial impact. Additionally, provide a list of reputable insurance providers and offer guidance on how to compare policies and choose the best fit.

By organizing workshops, webinars, and community events, you can actively participate in Life Insurance Month and contribute to a more financially secure society. These initiatives help educate the public, dispel myths, and empower individuals to make informed decisions about their future. Remember to promote your events through various channels and collaborate with local partners to maximize reach and engagement.

AIA Life Insurance: Is It Worth the Hype?

You may want to see also

Life Insurance Month Statistics: Share data on the importance of life insurance

Life Insurance Month is an annual event that aims to raise awareness about the significance of life insurance and its impact on individuals and families. This month-long celebration, typically held in October, serves as a crucial reminder of the importance of financial planning and the role life insurance plays in providing security and peace of mind. Here are some key statistics and facts that highlight the importance of life insurance:

- Financial Security: Life insurance is a vital tool for ensuring financial security for one's loved ones. According to a survey by LIMRA (Life and Health Insurance Marketing and Research Association), 72% of respondents believe that life insurance is essential for providing financial protection to their families. This statistic emphasizes the need for individuals to consider life insurance as a fundamental part of their long-term financial strategy.

- Coverage Gaps: Many families underestimate the coverage they need, leading to potential gaps in financial protection. A study by the Genworth Financial Agency Survey revealed that 63% of adults in the United States do not have enough life insurance to cover their family's annual living expenses for three years. This gap can have severe consequences, as it may leave dependents struggling financially in the event of the insured individual's passing.

- Longevity and Health: Life expectancy has been increasing, and with it, the need for comprehensive life insurance. The Social Security Administration reports that the average life expectancy at birth in the United States was 77.5 years in 2019. As individuals live longer, the importance of having adequate life insurance coverage becomes even more critical to ensure financial stability during retirement and beyond.

- Peace of Mind: Beyond financial security, life insurance provides peace of mind. It allows individuals to focus on living their lives to the fullest, knowing that their loved ones will be taken care of in the event of their passing. A survey by the Life Happens Media Group found that 87% of respondents who have life insurance feel more confident about their financial future. This statistic highlights the emotional and psychological benefits of having life insurance.

- Awareness and Education: Life Insurance Month serves as an educational platform to inform the public about the various types of life insurance policies available and how to choose the right coverage. It encourages people to assess their needs, understand the different coverage options, and make informed decisions. By promoting awareness, this month-long event helps individuals take control of their financial future and protect their loved ones.

In summary, Life Insurance Month is a critical initiative to educate and remind individuals about the importance of life insurance. The provided statistics emphasize the financial security, coverage gaps, longevity considerations, peace of mind, and educational aspects associated with life insurance. By sharing these insights, the event encourages people to take proactive steps in securing their financial future and ensuring the well-being of their families.

Gvul Life Insurance: A Comprehensive Guide to Understanding Your Coverage

You may want to see also

Month-Long Life Insurance Support: Offer guidance and resources for those seeking life insurance coverage

Life insurance is a crucial aspect of financial planning, and understanding the process can be a daunting task. Many individuals feel overwhelmed when considering life insurance, especially if they are new to the concept. To address this, a month-long support program can be an excellent initiative to guide and assist those interested in securing life insurance coverage. This comprehensive approach ensures that individuals receive the necessary information and resources to make informed decisions.

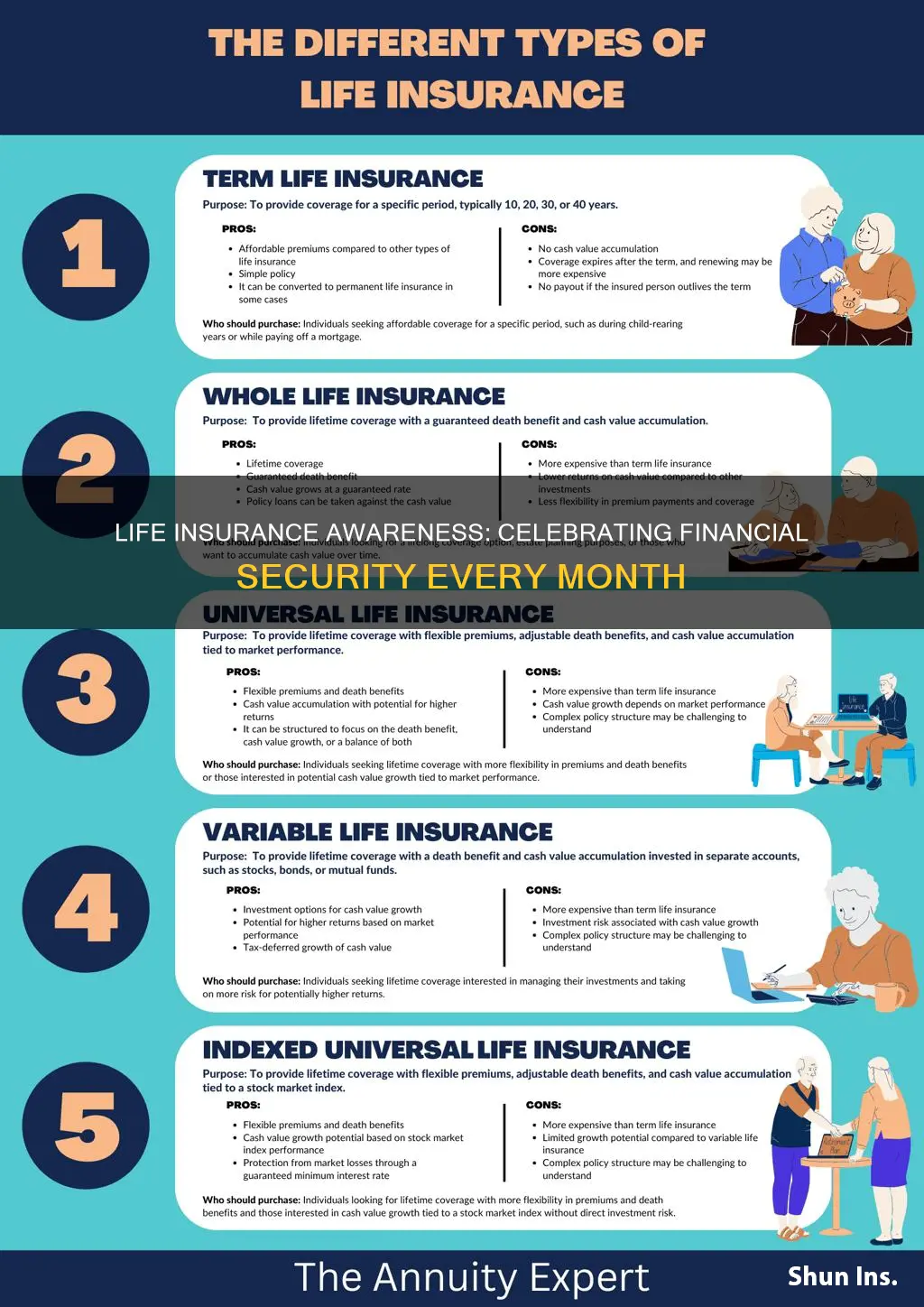

The first step in this support journey is to educate potential policyholders about the various types of life insurance available. Term life insurance, whole life insurance, and universal life insurance are just a few examples. Each type has unique features and benefits, and understanding these differences is essential. For instance, term life insurance provides coverage for a specified period, offering a straightforward and cost-effective solution for temporary needs. On the other hand, whole life insurance offers lifelong coverage and a cash value component, making it a more permanent financial commitment. By providing detailed explanations and comparisons, the support program can help individuals choose the most suitable option.

During the month-long initiative, it is beneficial to offer resources such as online tutorials, webinars, or interactive workshops. These resources can cover topics like the importance of life insurance, how to determine the right coverage amount, and the application process. For instance, a step-by-step guide on filling out the application form can demystify the process and ensure applicants provide all the necessary information accurately. Additionally, sharing success stories or testimonials from individuals who have recently obtained life insurance can inspire and motivate others to take that crucial step.

Another critical aspect of this support program is to address common concerns and misconceptions about life insurance. Many people might hesitate due to fears of high costs, complex medical exams, or the emotional burden of thinking about their mortality. By providing transparent information and dispelling myths, the support team can alleviate these worries. For example, explaining the various factors that influence premium costs, such as age, health, and lifestyle choices, can make the process more accessible and understandable.

Furthermore, the support program can offer personalized assistance by providing access to insurance advisors or brokers. These professionals can guide individuals through the entire process, ensuring they make the right choices based on their unique circumstances. They can also help with understanding policy details, riders, and any additional benefits offered. By providing this level of support, the program ensures that policyholders feel empowered and confident in their decision-making.

In conclusion, a month-long life insurance support program is an excellent strategy to educate and assist individuals seeking coverage. By offering comprehensive resources, addressing concerns, and providing personalized guidance, this initiative can make life insurance more accessible and beneficial to those in need. It empowers individuals to take control of their financial future and provides peace of mind, knowing that they have made the right choice for their loved ones.

New York Life: Health Insurance Options and Availability

You may want to see also

Frequently asked questions

Life Insurance Month is an annual event dedicated to raising awareness about the importance of life insurance and its role in providing financial security to individuals and their families. It aims to educate people about the various types of life insurance policies, their benefits, and how they can help achieve long-term financial goals.

Life Insurance Month is usually celebrated during the month of October. It is a time when insurance companies, financial advisors, and industry professionals come together to promote the significance of life insurance and offer educational resources to the public.

Life Insurance Month is beneficial for everyone, regardless of age or financial status. It provides an opportunity for individuals to assess their current insurance coverage, understand their needs, and make informed decisions about their future. Whether you are young and starting a family or an older adult planning for retirement, this month-long event offers valuable insights and resources.

Yes, Life Insurance Month often features a range of activities and events, including seminars, workshops, online webinars, and community outreach programs. These events cover topics such as understanding life insurance terms, choosing the right policy, estate planning, and the impact of life insurance on retirement planning. Many insurance companies also offer special promotions and discounts during this month to encourage people to take the first step towards securing their loved ones' financial future.