Life insurance valuation is a critical process that determines the financial worth of a life insurance policy. It involves assessing the policy's value based on various factors, such as the insured individual's age, health, and lifestyle, as well as the policy's terms and conditions. This process is essential for ensuring that the policyholder and the insurance company have a clear understanding of the policy's value and the potential benefits or obligations associated with it. The valuation helps in making informed decisions regarding policy adjustments, settlements, or transfers, and it plays a significant role in maintaining the integrity and fairness of the life insurance system.

What You'll Learn

- Premiums and Premiums Calculation: Determining insurance premiums involves assessing risk and setting rates

- Policy Liabilities: Understanding the financial obligations tied to insurance policies is crucial

- Investment Components: Life insurance companies invest premiums, impacting policy value and returns

- Death Benefits: The payout upon a policyholder's death is a key valuation factor

- Regulatory Compliance: Adherence to insurance regulations is essential for accurate valuation practices

Premiums and Premiums Calculation: Determining insurance premiums involves assessing risk and setting rates

The process of determining insurance premiums for life insurance policies is a complex task that requires a thorough understanding of risk assessment and actuarial science. When calculating premiums, insurers aim to ensure that the rates they set are sufficient to cover potential claims and administrative costs while also being competitive in the market. This involves a meticulous analysis of various factors that influence the risk associated with insuring an individual's life.

One of the primary considerations is the insured's age and health status. Younger individuals generally have lower premiums as they are statistically less likely to require a payout during the policy term. Conversely, older individuals may face higher premiums due to the increased risk of mortality and potential health issues. Medical history plays a crucial role here; insurers may request detailed health information, including any pre-existing conditions, to assess the likelihood of future claims. For instance, a person with a history of chronic illnesses or smoking habits might be considered a higher-risk case, leading to elevated premium rates.

Another critical factor is the insured's lifestyle and habits. Factors such as smoking, excessive alcohol consumption, dangerous hobbies, or occupations with higher risk profiles can significantly impact premium calculations. Insurers often use statistical models to determine the impact of these factors on longevity and claim likelihood. For example, a non-smoker with a sedentary lifestyle may be offered lower premiums compared to a smoker with an active, adventurous lifestyle.

Additionally, the type of life insurance policy and its coverage amount are essential considerations. Term life insurance, which provides coverage for a specified period, typically has lower premiums compared to whole life insurance, which offers lifelong coverage. The coverage amount, or death benefit, also plays a role; a higher death benefit will generally result in higher premiums as the insurer takes on a more significant financial risk.

Calculating premiums also involves considering demographic factors such as gender, occupation, and marital status. Statistical data often shows that certain occupations, like high-risk jobs, may increase the likelihood of premature death, thus affecting premium rates. Marital status can also be a factor, as married individuals may have different risk profiles compared to single individuals.

In summary, determining insurance premiums for life insurance policies requires a comprehensive assessment of various risk factors. Insurers use a combination of statistical models, medical information, lifestyle assessments, and demographic data to calculate rates that ensure the financial stability of the insurance company while providing adequate coverage for the policyholder. This intricate process ensures that the premiums collected are sufficient to meet the potential financial obligations associated with the policy.

Understanding Comdex Ratings: North American Life Insurance Explained

You may want to see also

Policy Liabilities: Understanding the financial obligations tied to insurance policies is crucial

Understanding the financial obligations associated with insurance policies is a critical aspect of life insurance valuation. These obligations, often referred to as policy liabilities, encompass various financial commitments that insurance companies make to policyholders. When evaluating a life insurance policy, it is essential to consider these liabilities to determine the true value and financial health of the policy.

One key aspect of policy liabilities is the death benefit, which is the primary financial obligation of the insurance company. This benefit is typically a fixed amount agreed upon in the policy contract, and it is paid out to the designated beneficiaries upon the insured individual's death. The death benefit is a significant liability for the insurer, as it represents a guaranteed payment to be made under specific conditions. The valuation of a life insurance policy often revolves around assessing the present value of this future payment, taking into account factors such as interest rates, policyholder's age, and mortality rates.

In addition to the death benefit, policy liabilities also include other financial commitments made by the insurance company. These may include policyholder dividends, which are distributions of the insurer's profits to policyholders, and policyholder withdrawals, which allow policyholders to access a portion of their policy's cash value. These liabilities are particularly relevant in whole life insurance policies, where policyholders have the option to borrow against or withdraw funds from the policy's cash value. Understanding these liabilities is crucial for accurately valuing the policy and assessing its financial impact on the policyholder.

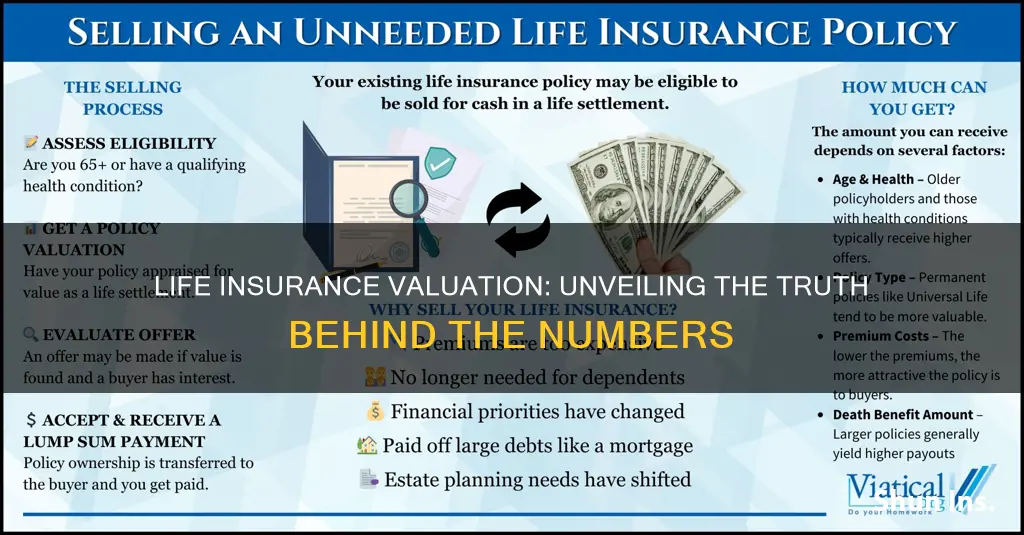

Furthermore, the duration of the policy also plays a role in policy liabilities. Term life insurance policies have a defined period during which the death benefit is guaranteed, while permanent life insurance policies, such as whole life or universal life, offer coverage for the entire life of the insured individual. The valuation of these policies requires considering the long-term financial obligations and the potential for policyholder withdrawals or dividends over an extended period.

In summary, policy liabilities are an essential consideration in life insurance valuation. They encompass the financial obligations of the insurance company, including the death benefit, policyholder dividends, and withdrawals. By understanding these liabilities, insurance companies can accurately assess the value of their policies, manage their financial commitments, and ensure the long-term sustainability of their business. This knowledge is vital for both insurers and policyholders to make informed decisions regarding life insurance products.

Add-on Insurance: Is It the Same as Life Insurance?

You may want to see also

Investment Components: Life insurance companies invest premiums, impacting policy value and returns

Life insurance companies play a crucial role in managing the investments of the premiums collected from policyholders. These investments are a key component of life insurance valuation and significantly impact the overall performance and value of the policies. Here's an overview of the investment aspects related to life insurance:

Investment Strategies: Life insurance companies employ various investment strategies to grow their assets and generate returns. These strategies often include a mix of fixed-income securities, such as bonds and fixed deposits, which provide stable income and a low-risk approach. Additionally, they may invest in a diverse range of equity securities, real estate, and alternative investments to potentially increase returns over the long term. The investment portfolio is carefully constructed to align with the company's risk appetite and financial goals.

Policy Value and Investment Returns: The investment of premiums is directly linked to the policy's value. As life insurance companies invest these funds, they earn returns, which are then used to fund the policy's benefits. Over time, the policy's cash value grows, providing a financial cushion for the policyholder. This growth is influenced by factors such as investment performance, interest rates, and the company's investment management skills. Policyholders can access this accumulated value through various options, such as taking loans, making additional payments, or surrendering the policy.

Impact on Policyholders: The investment component of life insurance offers several advantages to policyholders. Firstly, it provides a means to build wealth over time, allowing individuals to accumulate a substantial amount of money, which can be used for various financial goals. Secondly, the investment returns can contribute to the overall financial security of the policyholder and their beneficiaries. Moreover, life insurance companies often provide policyholders with regular updates on the performance of their investments, ensuring transparency and allowing individuals to make informed decisions regarding their policies.

Risk Management: Effective investment management is crucial for life insurance companies to navigate market risks and ensure the long-term stability of their operations. Diversification is a key strategy to mitigate risks, as it involves spreading investments across various asset classes and sectors. By diversifying, insurance companies can reduce the impact of potential losses in any single investment and maintain a more stable portfolio. Regular risk assessments and adjustments to investment strategies are essential to adapt to changing market conditions.

In summary, the investment of premiums by life insurance companies is a vital aspect of life insurance valuation, impacting policy value, returns, and the overall financial well-being of policyholders. Understanding these investment components is essential for both insurance companies and policyholders to make informed decisions and ensure a secure financial future.

Filing Life Insurance Claims: Tax Implications and Strategies

You may want to see also

Death Benefits: The payout upon a policyholder's death is a key valuation factor

When it comes to life insurance valuation, one of the most critical aspects is the death benefit, which is the financial payout made to the policyholder's beneficiaries upon their passing. This payout is a fundamental element in determining the value and worth of a life insurance policy. The death benefit is a key factor because it represents the financial security and protection that the policy provides to the insured individual's loved ones.

The amount of the death benefit is carefully calculated based on various factors, including the policyholder's age, health, lifestyle, and the chosen coverage amount. Insurers use sophisticated actuarial tables and risk assessments to determine the likelihood of the insured's death and, consequently, the potential payout. This calculation ensures that the insurance company can adequately cover the financial obligations and provide the intended support to the beneficiaries.

In the event of the policyholder's death, the death benefit is paid out according to the terms specified in the policy. This payout can be a lump sum, an annuity, or a combination of both, depending on the policy type and the policyholder's preferences. For instance, a term life insurance policy typically offers a death benefit as a lump sum, while a whole life policy may provide a death benefit as an annuity, ensuring a steady income for the beneficiaries over time.

The death benefit is a crucial consideration for both the policyholder and the insurance company. For the policyholder, it provides peace of mind, knowing that their family or designated beneficiaries will receive financial support in the event of their passing. This support can help cover essential expenses, such as mortgage payments, living costs, education fees, or any other financial responsibilities the policyholder may have left behind.

For the insurance company, the death benefit is a significant liability and a key factor in assessing the financial health and stability of the policy. Insurers must ensure that they have sufficient funds to meet the death benefit obligations, which are often a substantial portion of their liabilities. Therefore, the valuation of life insurance policies heavily relies on accurately estimating and managing these death benefits to ensure the long-term viability of the insurance company.

Life Insurance Agents: License Renewal Frequency Explained

You may want to see also

Regulatory Compliance: Adherence to insurance regulations is essential for accurate valuation practices

Regulatory compliance is a critical aspect of life insurance valuation, ensuring that the valuation practices adhere to the legal and ethical standards set by insurance regulators. These regulations are designed to protect policyholders, maintain market integrity, and promote fair and transparent valuation methods. Here's an overview of why regulatory compliance is essential in this context:

Insurance regulations provide a framework that guides the valuation process, ensuring consistency and fairness. These rules outline specific requirements for assessing the value of life insurance policies, especially those with complex features or unique circumstances. For instance, regulations may dictate how long-term care benefits should be valued or how to account for investment components within the policy. By following these guidelines, insurance companies can ensure that their valuation practices are accurate, reliable, and in compliance with the law.

One of the key benefits of regulatory compliance is the protection it offers to policyholders. Insurance regulations mandate that companies provide transparent and fair valuations, ensuring that policyholders understand the value of their policies. This transparency helps policyholders make informed decisions about their insurance coverage and can be crucial during claim settlements. When companies comply with regulations, they are more likely to provide accurate valuations, reducing the risk of disputes and ensuring a smoother claims process.

Moreover, regulatory compliance fosters market integrity. Insurance regulators set standards to maintain the stability and reliability of the insurance industry. By adhering to these regulations, insurance companies demonstrate their commitment to ethical practices and fair treatment of policyholders. This, in turn, builds trust in the market and encourages policyholders to maintain their coverage. Compliance also helps prevent fraudulent activities and ensures that the industry operates within legal boundaries, benefiting all stakeholders.

In the context of life insurance valuation, regulatory compliance involves staying updated with the latest rules and guidelines. Insurance regulators frequently release new regulations or amendments to existing ones, requiring companies to adapt their valuation practices accordingly. This may include changes in valuation methods, disclosure requirements, or the incorporation of new risk assessment techniques. By keeping up with these updates, insurance professionals can ensure that their valuation practices remain compliant and accurate.

In summary, regulatory compliance is vital for life insurance valuation as it ensures accuracy, fairness, and transparency in the valuation process. It protects policyholders' interests, maintains market integrity, and provides a legal framework for insurance companies to operate within. Staying informed about regulatory changes and adapting valuation practices accordingly is essential for insurance professionals to provide reliable and compliant services.

How 23andMe Impacts Life Insurance Policies and Premiums

You may want to see also

Frequently asked questions

The most common approach to valuing life insurance policies is through the "net level premium" method, which compares the policy's cash value to its death benefit. This method ensures that the policyholder receives a fair value for their insurance.

Life insurance policies should be reviewed and re-evaluated periodically, especially when significant life changes occur, such as marriage, the birth of a child, or a major health issue. It is recommended to reassess policies at least once a year or whenever there are substantial changes in personal circumstances.

Yes, market-based valuation techniques can be employed, particularly for term life insurance policies. These methods consider the current market rates for similar insurance products, taking into account factors like age, health, and term length.

Actuarial science plays a crucial role in life insurance valuation by applying statistical and mathematical models to predict future events and calculate appropriate premiums. Actuaries use data and assumptions to determine the likelihood of policyholders' deaths and the potential costs associated with paying out death benefits.

The investment aspect of life insurance policies can impact their valuation. Policies with an investment component, such as whole life or universal life insurance, have a cash value that grows over time. This cash value can be borrowed against or withdrawn, and its growth rate affects the overall policy value. Regular valuation of the investment performance is essential to ensure accurate policy pricing.