Life insurance is a financial product that provides financial protection to your loved ones in the event of your death. It is a contract between the policyholder and the insurance company, where the policyholder agrees to pay regular premiums in exchange for a death benefit paid out to their beneficiaries when they pass away. While life insurance is an important form of financial protection, you may be wondering if your policy is protected if the insurance company goes out of business. This is where the topic of FDIC insurance comes into play. So, is life insurance FDIC-insured?

| Characteristics | Values |

|---|---|

| Are life insurance policies FDIC-insured? | No |

| Who protects consumers in the event that a life insurance company declares bankruptcy? | State governments and state insurance regulators |

| What happens if a life insurance company goes out of business? | State insurance regulators will first try to transfer the policy to a stable insurance fund. If that's not possible, they will keep the policy active through the state's central guaranty fund. |

| What is another strategy that allows insurance companies to mitigate the risk of potential losses if a business failure occurs? | Reinsurance |

| What is reinsurance? | Insurance companies purchase insurance policies from other insurers, which allows them to spread out risk. |

What You'll Learn

Life insurance policies are not covered by FDIC insurance

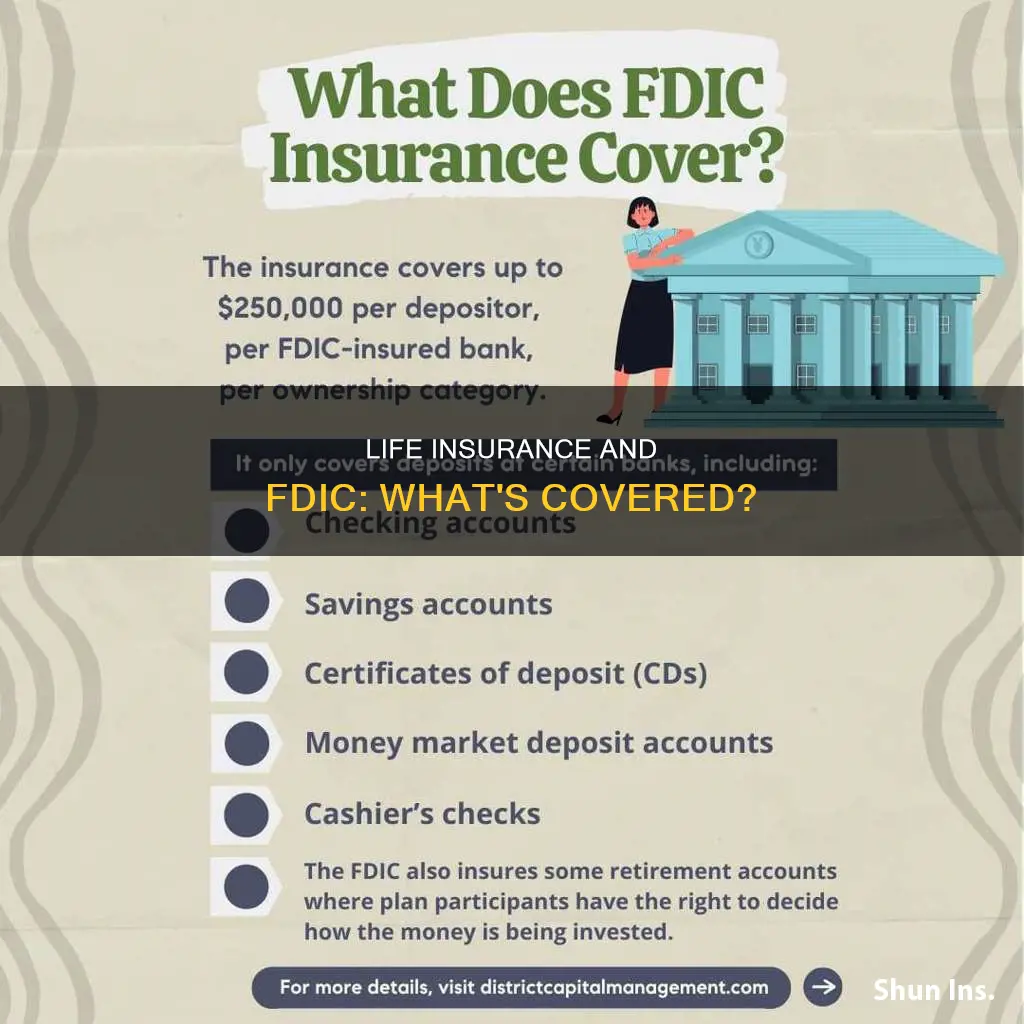

FDIC deposit insurance only covers certain deposit products, such as checking and savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). It is important to note that FDIC insurance does not cover investments, even if they were purchased at an insured bank.

Life insurance policies are specifically listed as one of the financial products that are not covered by FDIC insurance. Therefore, if a life insurance company goes out of business, policyholders are protected by state governments and state insurance regulators, who monitor the financial well-being of life insurance companies.

In summary, life insurance policies are not covered by FDIC insurance, and protection for policyholders in the event of a life insurance company failure falls under the jurisdiction of state governments and their insurance regulators.

Whole Life Insurance: Taking Dividends, Good or Bad?

You may want to see also

FDIC insurance covers deposit accounts

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects bank depositors against the loss of their insured deposits in the event that an FDIC-insured bank or savings association fails. FDIC insurance covers deposit accounts, including checking accounts, savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). Coverage is automatic when you open one of these types of accounts at an FDIC-insured bank, and there is no need to apply for FDIC insurance.

The FDIC does not cover all financial products offered by banks. Investment products that are not deposits, such as mutual funds, annuities, life insurance policies, stocks, bonds municipal securities, and safe deposit boxes or their contents, are not covered by FDIC insurance.

The standard deposit insurance amount is $250,000 per depositor, per FDIC-insured bank, per ownership category. This means that if you have multiple accounts at the same bank, the total amount in all of your accounts is insured up to $250,000. However, if you have accounts in different ownership categories, each category is insured separately, up to $250,000. For example, if you have a single account and a joint account at the same bank, each account is insured for up to $250,000, giving you a total coverage of $500,000.

To determine if a bank is FDIC-insured, you can ask a bank representative, look for the FDIC sign at your bank, or use the FDIC's BankFind tool on their official website.

Children's Life Insurance: Who Gets the Money?

You may want to see also

FDIC insurance is automatic for deposit accounts

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects bank depositors against the loss of their insured deposits in the event that an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the United States government.

FDIC deposit insurance is automatic for any deposit account opened at an FDIC-insured bank. This includes traditional deposit accounts like Money Market Deposit Accounts (MMDAs) and Certificates of Deposit (CDs). Coverage is also extended to prepaid cards if certain requirements are met.

Deposit insurance is calculated dollar-for-dollar, including principal and any accrued interest through the date of default. For example, if a customer had a CD account in her name with a principal balance of $195,000 and $3,000 in accrued interest, the full $198,000 would be insured.

The standard deposit insurance amount is $250,000 per depositor, per FDIC-insured bank, per ownership category. This means that deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank. For example, a revocable trust account with one owner naming three unique beneficiaries can be insured up to $750,000.

It is important to note that FDIC insurance only covers deposit accounts and does not cover investment products such as life insurance policies, municipal securities, or safe deposit boxes and their contents.

Life Insurance: Key Considerations for Smart Choices

You may want to see also

FDIC insurance covers up to $250,000 per depositor

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects bank depositors against the loss of their insured deposits in the event that an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the United States government.

FDIC deposit insurance covers bank customers in the event that an FDIC-insured depository institution fails. Bank customers don’t need to purchase deposit insurance; it is automatic for any deposit account opened at an FDIC-insured bank. Deposits are insured up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.

Deposit insurance is calculated dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's closing, up to the insurance limit. For example, if a customer had a CD account in her name alone with a principal balance of $195,000 and $3,000 in accrued interest, the full $198,000 would be insured.

The FDIC provides separate insurance coverage for funds depositors may have in different categories of legal ownership. The FDIC refers to these different categories as “ownership categories”. This means that a bank customer who has multiple accounts may qualify for more than $250,000 in insurance coverage if the customer’s funds are deposited in different ownership categories and the requirements for each ownership category are met.

The FDIC does not insure all financial products at a bank. FDIC deposit insurance only covers certain deposit products, such as checking and savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). Investment products that are not deposits, such as mutual funds, annuities, life insurance policies, and stocks and bonds, are not covered by FDIC deposit insurance.

Life Insurance and Suicide: What Does KY Cover?

You may want to see also

State governments protect consumers if a life insurance company declares bankruptcy

Life insurance policies are not insured by the Federal Deposit Insurance Corporation (FDIC). However, consumers are protected by state governments if a life insurance company declares bankruptcy. State insurance regulators monitor the financial health of insurance companies licensed to operate within their respective states and are responsible for safeguarding consumers in the event of a life insurance company failure.

- Statutory Reserves: Life insurance companies are legally required to maintain cash reserves to cover policyholder death benefits in the event of business failure. The minimum reserve requirement typically ranges from 8% to 12% of the insurer's total revenue, but the exact amount varies by state and risk.

- Reinsurance Requirements: Life insurance companies purchase reinsurance policies from other insurers to spread the risk of potential losses. Reinsurance ensures that claims and death benefits are paid out even if the original insurer goes bankrupt.

- Guaranty Associations: Guaranty associations, such as the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA), provide additional protection. Membership in these associations is mandatory for life insurance companies. If an insurer becomes insolvent, the guaranty association steps in to guarantee the payment of benefits, manage liquidated assets, and transfer coverage for living policyholders to another insurer.

While life insurance company bankruptcies are rare, these safeguards ensure that policyholders and beneficiaries remain protected even in the event of a company failure.

Life Insurance: Can It Fail or Not?

You may want to see also

Frequently asked questions

No, life insurance policies are not covered by FDIC insurance.

FDIC insurance is a type of deposit insurance that protects bank customers in the event that an FDIC-insured bank fails.

FDIC insurance is backed by the full faith and credit of the US government. It covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest, up to a certain limit.

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

You can use the FDIC's BankFind tool on its website, ask a bank representative, or look for the FDIC sign at your bank.