Adjustable compensation life insurance is a valuable financial tool that offers individuals a unique level of flexibility and control over their insurance coverage. Unlike traditional life insurance, where the death benefit is fixed, adjustable compensation life insurance allows policyholders to adjust the death benefit amount over time, providing a dynamic approach to financial planning. This feature is particularly beneficial for those who want to ensure their loved ones are adequately protected as their financial situation evolves. With adjustable compensation life insurance, individuals can start with a higher death benefit during their earning years and gradually reduce it as they build a substantial financial cushion, ensuring that the insurance remains relevant and cost-effective throughout their lives. This adaptability makes it an excellent choice for those seeking a long-term financial strategy that can adapt to changing circumstances.

What You'll Learn

- Flexibility: Adjusts coverage to match changing financial needs and life stages

- Cost-Effectiveness: Offers more affordable premiums compared to fixed-term policies

- Long-Term Security: Provides lifelong coverage, ensuring protection throughout life

- Peace of Mind: Eliminates the stress of re-evaluating coverage annually

- Customizable: Tailored to individual circumstances, offering personalized protection

Flexibility: Adjusts coverage to match changing financial needs and life stages

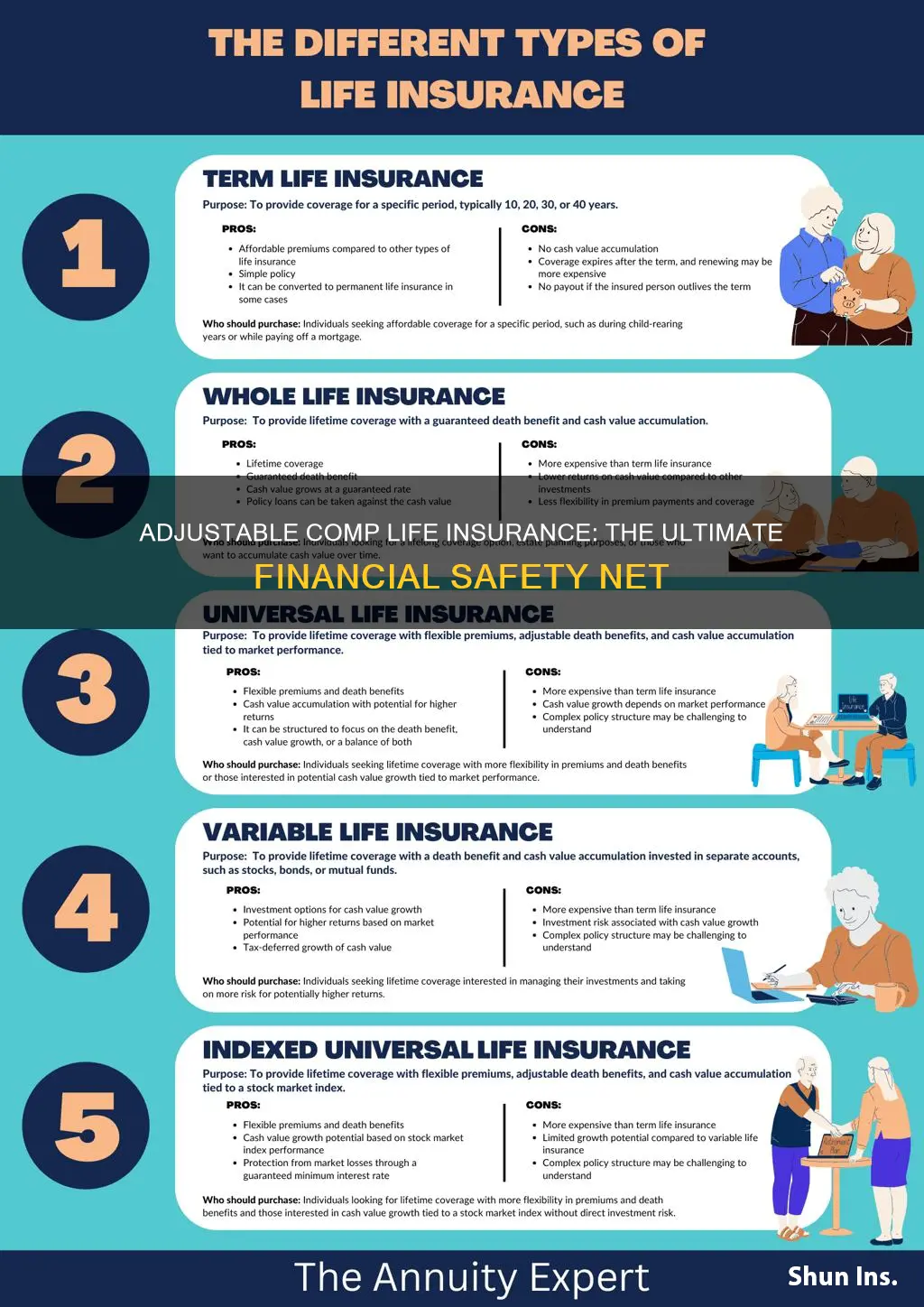

Adjustable or variable life insurance offers a unique advantage in its flexibility, allowing policyholders to adapt their coverage as their financial circumstances and life goals evolve. This adaptability is a significant benefit, especially for those who want to ensure their insurance remains relevant and effective throughout their lives. As individuals progress through different life stages, their financial needs and priorities change. For instance, a young professional starting their career might prioritize comprehensive coverage to protect their family in the event of an unexpected death. However, as they advance in their career, get married, and start a family, their financial obligations and long-term goals expand. This is where adjustable life insurance shines; it provides the option to increase or decrease coverage as needed, ensuring that the policy remains aligned with the policyholder's current financial situation and future aspirations.

The flexibility of adjustable life insurance is particularly valuable during significant life events. For example, when a person gets married, they might want to review and potentially increase their insurance coverage to reflect the added responsibility of supporting a spouse and family. Similarly, when a family welcomes a new child, the policyholder may consider adjusting the coverage to account for the increased financial burden and the long-term security needs of the growing family. This adaptability ensures that the insurance policy remains a reliable and relevant part of the overall financial plan.

Moreover, adjustable life insurance allows individuals to take advantage of market fluctuations and changing interest rates. The investment component of this type of insurance provides an opportunity to grow the policy's cash value over time, which can be used to increase coverage or provide additional financial benefits. As the market rises, the policyholder can potentially increase their coverage without the need for a medical examination, ensuring that their insurance keeps pace with their financial growth.

In summary, the flexibility of adjustable life insurance is a powerful feature that enables individuals to stay in control of their financial security. By allowing adjustments to coverage, it ensures that the insurance policy remains a dynamic and relevant part of one's financial strategy, catering to the ever-changing demands of life. This adaptability is a key reason why adjustable life insurance is considered a valuable and modern approach to life insurance, offering both protection and the potential for financial growth.

Credit Score Impact on Life Insurance: What's the Link?

You may want to see also

Cost-Effectiveness: Offers more affordable premiums compared to fixed-term policies

Adjustable compensation life insurance, often referred to as adjustable-term life insurance, offers a unique and cost-effective solution for individuals seeking long-term financial protection. One of its most significant advantages is the potential for lower premiums compared to traditional fixed-term life insurance policies. This cost-effectiveness is particularly appealing to those who want comprehensive coverage without breaking the bank.

The primary reason for the affordability of adjustable-term life insurance lies in its flexibility. Unlike fixed-term policies, which offer coverage for a predetermined period (e.g., 10, 20, or 30 years), adjustable-term policies are designed to adapt to the policyholder's changing needs. This adaptability allows insurance providers to offer more competitive rates. For instance, if a policyholder's financial situation improves or their risk profile changes, they can adjust the policy to extend the term or increase the coverage amount, ensuring that the insurance remains relevant and cost-efficient over time.

In a fixed-term policy, the premium is calculated based on the assumption that the coverage will be needed for the entire specified period. If the insured individual outlives the policy term, the coverage ends, and the premiums paid are not refunded. This structure can result in higher overall costs for the policyholder, especially if they require long-term coverage. In contrast, adjustable-term life insurance allows policyholders to pay for the exact amount of coverage they need for the duration they require it, making it a more economical choice.

The cost-effectiveness of adjustable-term life insurance is further enhanced by the ability to customize the policy. Policyholders can choose the coverage amount, term length, and other features to suit their specific circumstances. This customization ensures that the insurance is tailored to individual needs, reducing the likelihood of overpaying for unnecessary coverage. As a result, individuals can benefit from lower premiums without compromising on the level of protection they desire.

In summary, adjustable-term life insurance is a cost-efficient option for those seeking long-term financial security. Its flexibility, adaptability, and customization options allow policyholders to manage their insurance costs effectively. By offering more affordable premiums and the ability to adjust coverage as needed, this type of insurance provides a practical and financially responsible choice for individuals and families.

Understanding Guaranteed Issue Life Insurance: A Comprehensive Guide

You may want to see also

Long-Term Security: Provides lifelong coverage, ensuring protection throughout life

Adjustable compensation life insurance is a valuable financial tool that offers long-term security and peace of mind. This type of insurance provides lifelong coverage, ensuring that individuals and their families are protected throughout their lives. Here's why it is a good choice for long-term financial planning:

Lifelong Protection: One of the key advantages of adjustable compensation life insurance is its ability to offer coverage for a lifetime. Unlike term life insurance, which provides coverage for a specific period, this policy remains in force as long as the policyholder is alive. This means that the insured individual and their beneficiaries will receive death benefits regardless of when the policyholder passes away, ensuring a consistent level of financial security. For example, if someone purchases this insurance at age 30 and passes away at age 70, the beneficiaries will receive the death benefit, providing financial support during a critical period.

Flexibility and Adjustments: As the name suggests, this insurance policy allows for adjustments over time. Policyholders can typically increase or decrease the death benefit amount based on their changing needs and financial circumstances. This flexibility is particularly beneficial as it ensures that the insurance remains relevant and adequate as an individual's life changes. For instance, a young professional might start with a lower death benefit and gradually increase it as their income and financial responsibilities grow. This adaptability is a significant advantage, allowing individuals to optimize their coverage without the need for a complete policy overhaul.

Financial Security for Dependents: For those with dependents, such as children or a spouse, adjustable compensation life insurance provides an essential safety net. The death benefit can be structured to provide long-term financial support for these dependents, ensuring their well-being even if the primary breadwinner is no longer present. This aspect is crucial for families, as it allows them to maintain their standard of living and cover essential expenses, such as education costs, mortgage payments, or daily living expenses, for an extended period.

Peace of Mind: Knowing that you have lifelong coverage can significantly reduce financial stress and provide peace of mind. This type of insurance ensures that your loved ones are protected, even in the event of your untimely passing. It allows individuals to focus on their current responsibilities and enjoy their lives without constantly worrying about financial security. With adjustable compensation life insurance, you can rest assured that your family's financial future is protected, providing a sense of security that is invaluable.

In summary, adjustable compensation life insurance offers a comprehensive solution for long-term financial security. Its lifelong coverage, flexibility, and ability to provide for dependents make it an excellent choice for individuals seeking to protect their loved ones and ensure financial stability over the long term. By investing in this type of insurance, people can gain peace of mind and build a robust financial safety net for themselves and their families.

Life Insurance: Leaving VA, What's Next?

You may want to see also

Peace of Mind: Eliminates the stress of re-evaluating coverage annually

Adjustable compensation life insurance offers a unique advantage that can significantly reduce financial stress and provide peace of mind for policyholders. One of the most appealing aspects of this type of insurance is the elimination of the annual review and adjustment process. Unlike traditional term life insurance, where coverage needs to be reassessed and potentially increased or decreased each year, adjustable compensation life insurance provides a dynamic and flexible solution.

With adjustable compensation life insurance, policyholders can rest assured that their coverage will automatically adjust based on their changing circumstances. This means no more worrying about whether your insurance policy is adequate or if you're over or under-insured. The policy adapts to your life's evolving needs, ensuring that you always have the right level of protection without the hassle and stress of frequent re-evaluations. This feature is particularly beneficial for those who prefer a more hands-off approach to insurance management, allowing them to focus on other aspects of their lives without the constant worry of insurance coverage.

The elimination of annual reviews also means no more unexpected premium increases or the hassle of shopping around for a new policy. Many insurance companies use various factors, such as age, health, and lifestyle, to determine premium rates. Over time, these factors can change, leading to significant fluctuations in insurance costs. With adjustable compensation life insurance, these adjustments are made seamlessly, ensuring that your premiums remain fair and aligned with your current circumstances. This predictability in pricing can provide long-term financial stability and peace of mind.

Additionally, the automatic adjustment feature can be particularly useful for those with complex financial situations or multiple sources of income. It simplifies the management of insurance policies, especially for high-net-worth individuals or those with diverse financial portfolios. By eliminating the need for frequent policy reviews, adjustable compensation life insurance offers a streamlined approach to insurance management, making it an attractive option for those seeking convenience and peace of mind.

In summary, the ability to eliminate the stress of annual re-evaluations is a significant advantage of adjustable compensation life insurance. It provides a dynamic and flexible solution, ensuring that your insurance coverage adapts to your changing life without the hassle of frequent adjustments. This feature, combined with the predictability of pricing, offers a sense of security and peace of mind, allowing individuals to focus on their lives and financial goals without the constant worry of insurance management.

Life Insurance: Private Placement Benefits and Features

You may want to see also

Customizable: Tailored to individual circumstances, offering personalized protection

Adjustable compensation life insurance is a powerful tool that allows individuals to customize their life insurance policies to fit their unique needs and circumstances. This type of insurance offers a level of flexibility that is often lacking in traditional, fixed-term policies, providing a more personalized and comprehensive approach to financial protection.

One of the key advantages of adjustable compensation life insurance is its ability to adapt to an individual's changing life situation. As people's lives progress, their financial obligations and goals evolve. For instance, a young professional might start with a basic insurance plan to cover their mortgage and family expenses. As they advance in their career, they may want to increase the coverage to secure their children's education or to provide a substantial financial cushion for their spouse. With adjustable compensation life insurance, these adjustments can be made easily and promptly, ensuring that the policy remains relevant and effective throughout the policyholder's life.

This customization is particularly beneficial for those with non-traditional lifestyles or complex financial situations. For example, individuals with multiple sources of income, such as freelancers or business owners, can tailor their policy to account for these diverse earnings. They can choose to adjust the compensation amount based on their varying income levels, ensuring that their life insurance remains a stable component of their financial strategy. Similarly, those with significant assets or investments might want to adjust their policy to reflect the value of these holdings, thus providing adequate coverage for potential liabilities.

The personalized nature of adjustable compensation life insurance also extends to the policy's features and benefits. Policyholders can select from a range of options, such as different death benefit options, riders for additional coverage, or even the ability to convert the term life insurance into a permanent policy over time. This level of customization ensures that the insurance plan is not just a one-size-fits-all solution but a carefully crafted financial instrument that aligns with the individual's specific requirements.

In summary, adjustable compensation life insurance is an excellent choice for those seeking a tailored and flexible approach to life insurance. Its ability to adapt to individual circumstances, provide personalized protection, and offer a range of customizable features makes it a powerful tool for managing financial risks and ensuring long-term security. By taking the time to understand and utilize this type of insurance, individuals can make informed decisions that will benefit them and their loved ones in the long run.

Stranger-Originated Life Insurance: Protecting Your Legacy, Ensuring Financial Security

You may want to see also

Frequently asked questions

Adjustable or variable life insurance offers a unique feature that allows policyholders to adjust the death benefit and premiums over time. This flexibility is beneficial as it enables individuals to adapt their insurance coverage to changing financial circumstances and goals. For instance, during the early years of a policy, when the insured individual might have a growing family or business, the adjustable feature can be used to increase the death benefit to ensure adequate financial protection. As the individual's financial situation improves or changes, the policy can be adjusted to reflect these new priorities.

The adjustability of the policy is a key factor in providing long-term financial security. Over time, the insured person may experience various life events such as marriage, the birth of children, career advancements, or business growth. These events can impact the level of insurance coverage needed. With adjustable life insurance, the policyholder can increase the death benefit to match these changing needs, ensuring that the financial protection remains relevant and sufficient. This adaptability is particularly useful for those who want to provide for their loved ones' long-term financial goals, such as education expenses or mortgage payments.

Yes, one of the significant advantages of adjustable life insurance is the freedom to make changes without incurring additional fees or penalties. Unlike traditional fixed-term policies, adjustable life insurance allows for modifications to the death benefit and premiums. This flexibility is especially valuable during the early years of the policy when the insured individual might want to increase coverage to cover significant life events. Additionally, if financial circumstances change and the individual no longer requires the same level of coverage, they can adjust the policy accordingly without facing any financial penalties, providing a more dynamic and responsive insurance solution.