Auto insurance companies are allowed to discriminate based on certain factors, such as age, gender, and location. While racial discrimination is illegal, systemic racism and other forms of discrimination persist in the industry, with people from minority groups, low-income individuals, young and senior drivers, and those without a college degree being negatively impacted by high car insurance premiums. This has led to calls for reform and the proposal of bills aimed at reducing discriminatory practices in the auto insurance industry.

| Characteristics | Values |

|---|---|

| Age | Drivers under 25 and over 70 pay higher rates than other age groups. |

| Race | Members of minority groups pay 30% or more in insurance premiums than those in predominantly white neighborhoods. |

| Gender | Some studies are finding single women pay more than single men for car insurance. |

| Location | Urban areas have higher insurance premiums. |

| Education | Drivers without a college degree pay at least 10% higher insurance rates. |

| Occupation | Blue-collar and lower-paying jobs are quoted higher insurance premiums. |

| Housing status | People experiencing homelessness may have a negative impact on their insurance premiums. |

What You'll Learn

Auto insurance companies can discriminate based on age and disability

In addition to age, auto insurance companies can also consider disability status when setting rates. While physical and mental disabilities are prohibited factors in determining insurance rates, the make and model of a vehicle, driving habits, and location can indirectly impact the premiums for individuals with disabilities. For example, individuals who require specialized vehicles or adaptations due to their disability may face higher insurance costs if their vehicles are classified as higher-risk or fall into certain make and model categories.

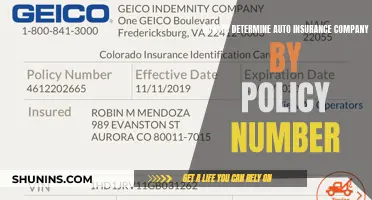

It is important to note that insurance companies are allowed to use risk factors that impact everyone equally and are directly related to car insurance. These factors include driving records, experience, location (zip code), and vehicle characteristics. By assessing these factors, insurance companies can calculate quotes and provide coverage based on statistical risks.

However, it is essential to recognize that discrimination in auto insurance pricing goes beyond age and disability. Systemic racism, income levels, gender, occupation, and other factors also contribute to price discrimination. Efforts are being made to address these issues, with legislators introducing bills, such as the Prohibit Auto Insurance Discrimination Act, to combat unfair practices and reduce discrimination in the auto insurance industry.

The Unseen Impact: Accidents' Lasting Mark on Auto Insurance

You may want to see also

They cannot discriminate based on race or religion

Auto insurance companies are not allowed to discriminate based on race or religion. This is considered unfair discrimination and is illegal under insurance law. Federal law prohibits the use of unfair discrimination that targets certain protected classes, including race, national origin, sex, or religion.

While insurance companies can use certain factors to determine rates and whether to offer coverage, such as age, gender, driving record, and location, they cannot use race or religion as a factor in their decision-making. Doing so would be a form of racial discrimination, which is prohibited by law.

In the United States, the National Association of Insurance Commissioners (NAIC) is the standard-setting organization for the insurance industry. Following the George Floyd protests in 2020, the NAIC held a special session on race to address the connection between insurance and racial discrimination. While overt racial discrimination has become less common, forms of discrimination, especially in the use of big data, persist in the industry.

Some states have also taken steps to address discrimination in insurance. For example, Massachusetts forbids the consideration of gender and credit score when determining car insurance rates, while New York, Michigan, and Maryland consider the use of credit scores in setting insurance rates as a form of legal discrimination.

It's important to note that insurance companies are allowed to use risk factors that impact everyone equally and are directly related to car insurance when determining rates and coverage. However, race and religion cannot be used as risk factors and are protected from discrimination.

Underinsured Motorist Coverage: What It Means for Your Auto Insurance

You may want to see also

Gender and credit score have been used to discriminate

Gender and credit score have been used as factors in determining insurance rates, but several US states have taken steps to ban their use in risk assessments for insurance premiums. In the case of gender, young men under 25 are more likely to get into car accidents than women of the same age, resulting in lower auto insurance premiums for young women. However, this advantage disappears around age 25, and the discrepancy even moves in favour of men when comparing insurance premiums for older people.

Critics of gender-based pricing in auto policies point to inconsistencies in how gender is factored into rates as a reason for its removal. For example, a study found that being a woman driver in Tampa, Florida, resulted in rates 29% higher than those for men, while a quote for the same woman driver in Oklahoma City was only 3% higher than for male drivers.

Regarding credit scores, low credit scores are more likely to target people of colour who have been historically impacted by wealth-based policies. Some states, such as Massachusetts, forbid the consideration of credit scores when determining insurance rates.

Printing MetLife Auto Insurance Card: A Step-by-Step Guide

You may want to see also

Racial discrimination is illegal under insurance law

While insurance companies are allowed to discriminate based on certain factors, racial discrimination is illegal under insurance law. This means that insurance companies cannot use race as a factor when determining rates or coverage. However, racial discrimination in the insurance industry has been a persistent issue, with people from minority groups paying disproportionately high rates.

In the context of auto insurance, studies have shown that drivers in minority communities pay significantly higher rates compared to ZIP codes with predominantly white residents. This is despite the fact that insurance companies do not explicitly use race as a factor in their calculations. Instead, they rely on other factors such as ZIP code, education level, credit score, and occupation, which can indirectly lead to higher rates for minority groups.

To address this issue, state and federal lawmakers have been working to implement reforms. For example, the Prohibit Auto Insurance Discrimination Act (PAID Act) and the Preventing Credit Score Discrimination in Auto Insurance Act were introduced in the U.S. House of Representatives to combat car insurance price discrimination. Additionally, the National Association of Insurance Commissioners (NAIC) has been advocating for state laws that prohibit subjective discriminatory practices, and some states have already taken steps to ban the use of certain factors, such as gender and credit score, in risk assessments for insurance premiums.

While progress is being made, there is still work to be done to ensure that racial discrimination is eliminated from the insurance industry and that everyone has equal access to insurance coverage.

Autonomous Cars: Insurance Impact and the Future of Driving

You may want to see also

Discrimination persists in the use of big data

While overt racial discrimination in the insurance industry has become less common, forms of discrimination persist, especially in the use of big data. In 2017, an investigation by Consumer Reports and ProPublica revealed that practices like redlining persist in subtle forms in the auto insurance industry. The investigation found disparate auto insurance prices in California, Illinois, Missouri, and Texas that could not be explained by differences in risk, suggesting a "subtler form of redlining".

In 2020, the Consumer Federation of America (CFA) reported that most auto insurance companies were using non-driving factors that affected the rates of drivers with certain characteristics. The CFA argued that insurance companies' pricing tools use proxies for race, making auto insurance more expensive for Black Americans.

The use of big data and algorithms in insurance underwriting has raised concerns about discrimination. Algorithms can contribute to discrimination by promoting or extending bias. Regulatory proposals have been put forward to address this issue, such as the 2020 Data Accountability and Transparency Act, which would have created a federal agency to protect privacy and ban the use of personal data to discriminate against protected classes.

At the state level, restrictions on the use of algorithmic practices in insurance underwriting also exist. For example, New York prevents insurers from using algorithms that would have a disparate impact on protected classes. However, it is complicated by the fact that insurers in the state cannot collect information on legally protected classes, making it challenging to determine the effects of algorithms.

To address discrimination in the use of big data, the National Association of Insurance Commissioners (NAIC) members recommended increasing minority representation in the industry, educating consumers, and regulating big data to ensure transparency, protect privacy, and deter discrimination.

Texas Auto Insurance: Minimum Requirements You Need to Know

You may want to see also