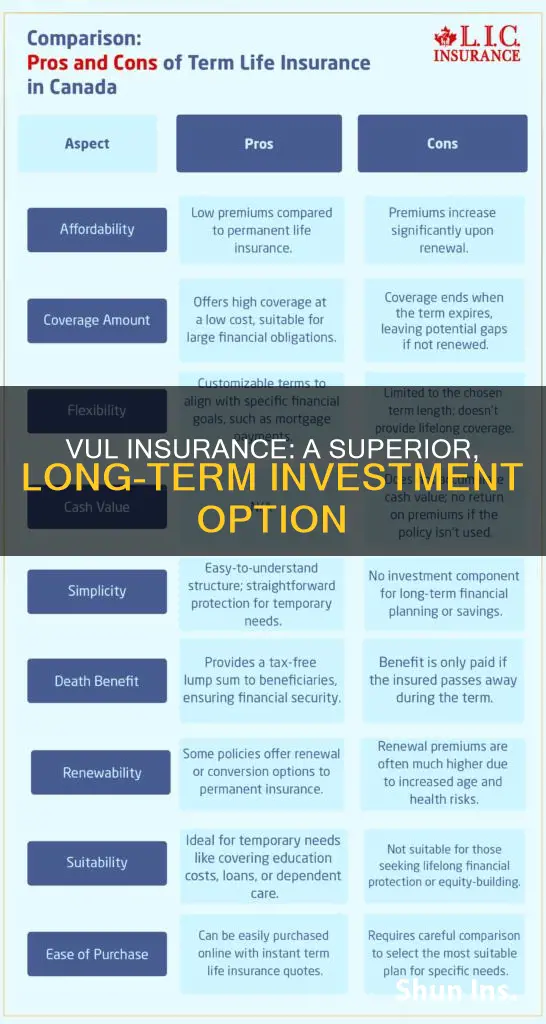

Variable Universal Life (VUL) insurance is a type of permanent life insurance that combines a death benefit with a savings component, known as cash value. Unlike term life insurance, which is temporary and has lower premiums, VUL offers increased flexibility, allowing policyholders to adjust their premiums and death benefits according to their financial needs. The cash value in a VUL policy can be invested in market options, providing the potential for higher returns but also carrying the risk of losses. While VUL provides opportunities for growth and customization, it is a complex product with various fees and potential tax implications. Therefore, careful consideration of financial goals, risk tolerance, and investment knowledge is crucial before choosing VUL over term life insurance.

What You'll Learn

VUL offers flexible premiums and death benefits

Variable Universal Life (VUL) insurance is a complex product that combines life insurance with investment options, offering flexibility and growth potential. It is a permanent life insurance policy that offers a death benefit and investment options.

VUL policies allow policyholders to adjust premiums and death benefits to fit their changing financial needs. This means that if your income varies, you can adjust the death benefit up or down, as well as the premiums, within certain limits. You can also choose between a fixed death benefit and a variable one. A fixed death benefit will pay out a specific dollar amount to your beneficiaries, while a variable death benefit may increase or decrease based on the cash value amount.

VUL policies also allow you to invest the cash value in the market via subaccounts, which can lead to higher returns but also involves market performance risks. The cash value accumulated in your VUL policy can be used to supplement your retirement income. You can access this cash value through withdrawals or loans, providing additional funds to support your lifestyle during retirement.

It is important to carefully assess the risks and understand the terms and conditions of a VUL policy before purchasing it. The fees and costs associated with the subaccounts can impact the growth of your cash value, and there may be limits on the number of annual cash value transfers you can make. Additionally, insufficient funding could cause the policy to lapse, while overfunding can have tax implications.

Rheumatoid Arthritis: Life Insurance Rates and Their Impact

You may want to see also

VUL offers a cash value account

Variable Universal Life (VUL) insurance offers a cash value account that you can access while you are still alive. This is a significant advantage over term life insurance, which does not build cash value. With VUL, you have the flexibility to invest the cash value in market options, such as stocks, bonds, money market securities, ETFs, and mutual funds, potentially leading to higher returns. However, it's important to note that these investments come with risks, and the return is not guaranteed.

The cash value account in VUL insurance provides you with control over how to invest your money. You can choose from various sub-account options, ranging from conservative to aggressive strategies, depending on your risk tolerance and investment objectives. This customization allows you to align your investments with your financial goals and market outlook. Additionally, you have the option to adjust the amount and frequency of premium payments to fit your budget and financial needs.

The growth potential of the cash value account in VUL insurance is a key benefit. Unlike traditional life insurance with fixed returns, VUL offers the opportunity for significantly higher gains by investing in market-based instruments. Over time, this can help you meet future financial needs and achieve your long-term goals. The growth of your cash value is also tax-deferred, providing additional financial planning advantages.

It's important to carefully consider the risks associated with investing your cash value. While VUL offers the potential for higher returns, there is also the possibility of losses. The performance of your investments will impact the growth of your cash value, and underperforming investments can lead to higher premiums. Therefore, it is crucial to evaluate your financial stability, risk tolerance, and investment knowledge before choosing a VUL policy.

The cash value account in VUL insurance provides flexibility, growth potential, and control over your investments. However, it is important to carefully assess the risks and complexities involved before purchasing a VUL policy to ensure it aligns with your financial goals and comfort level.

Steroid Testing: Life Insurance's Dark Secret

You may want to see also

VUL offers investment options

Variable Universal Life (VUL) insurance is a type of permanent life insurance policy that combines a death benefit with a savings component, called cash value. It is built like a traditional universal life insurance policy but lets you invest the cash value in the market via subaccounts.

VUL insurance gives you control over how to invest your cash value. You can pick the subaccounts that best fit your risk tolerance and investment objectives. You can choose from a diverse range of sub-account options varying in asset classes and levels of risk, aligning their choices with their financial objectives and market outlook. This means that investments can be conservative, aggressive, or a mix, depending on the individual’s financial goals.

VUL policies may offer tax-deferred growth and tax-free death benefits to beneficiaries, subject to policy terms and conditions. The growth of your cash value is tax-deferred, and the death benefit is generally paid out income-tax-free to your beneficiaries. These tax advantages can enhance your financial planning strategy and help you achieve your long-term goals.

It is important to carefully assess the risks before purchasing a VUL policy. The return to the cash component is not guaranteed year after year. If your cash value balance is too low, you may need to pay higher premiums to keep your VUL. Your cash value return is not guaranteed, and if your investments perform badly, your cash value will not grow as quickly, and you could even lose money.

Life Insurance: Changing Policies Whenever You Want

You may want to see also

VUL is a permanent life insurance policy

Variable Universal Life (VUL) insurance is a type of permanent life insurance policy that offers lifelong insurance protection and includes a payout to the beneficiary upon the policyholder's death. Unlike term life insurance, which is temporary and offers much lower premiums, VUL provides the added benefit of a savings component, allowing policyholders to invest the cash value in the market. This cash value can be invested in various instruments, such as stocks, bonds, money market securities, and ETFs, potentially leading to higher returns. However, it's important to note that the returns are not guaranteed, and there are associated fees and risks involved.

One of the key advantages of VUL is its flexibility. Policyholders can adjust their premium payment amounts and death benefits to align with their changing financial needs. This flexibility extends to the investment options, allowing individuals to choose from a range of sub-account options with varying asset classes and levels of risk. This customization enables policyholders to tailor their VUL policy to their specific financial goals and risk tolerance.

The growth potential of VUL is another attractive feature. By investing the cash value in market-based instruments, individuals can potentially achieve higher returns compared to traditional life insurance with fixed returns. Over time, this can result in significant growth in cash value, which can be accessed during retirement or used to fund other financial goals. Additionally, the growth of cash value in a VUL policy is typically tax-deferred, providing further financial advantages.

However, it's important to carefully consider the risks associated with VUL. While it offers the potential for higher returns, there is also the possibility of losing money if the investments perform poorly. The complex nature of VUL, with its various fees and investment options, underscores the importance of thoroughly understanding the policy terms and conditions before making a decision. Evaluating one's financial stability, risk tolerance, and investment knowledge is crucial before choosing a VUL policy.

In summary, VUL is a permanent life insurance policy that combines insurance protection with investment opportunities. Its flexibility, growth potential, and tax advantages make it a compelling option for individuals with specific financial goals and a higher risk tolerance. However, the potential risks and complexities of VUL highlight the need for careful consideration and financial planning before selecting this type of policy.

Life Insurance Interest Tax: When Does It Apply?

You may want to see also

VUL offers tax advantages

Variable Universal Life (VUL) insurance offers several tax advantages that can be beneficial to individuals seeking life insurance protection and investment potential. Here are the reasons why VUL offers tax advantages:

Tax-Deferred Growth: VUL insurance provides tax-deferred growth on the cash value of the policy. This means that the growth of your investment is not taxed until you withdraw it. This allows your money to grow without being reduced by taxes, potentially resulting in higher returns over time.

Tax-Free Death Benefits: Typically, the death benefit payout to beneficiaries is generally income tax-free. This ensures that the full amount of the benefit is available to the designated beneficiaries, providing financial security and support when they need it most.

Supplemental Retirement Income: The cash value accumulated in a VUL policy can be accessed during retirement to supplement retirement income. Withdrawals or loans can be taken from the policy, providing additional funds to support retirement needs. While there may be income taxes and penalties on withdrawals, the ability to access tax-deferred savings can still offer financial flexibility during retirement.

Leverage with Death Benefit: VUL insurance combines life insurance with investment options, allowing individuals to leverage the death benefit. The death benefit remains a central feature, providing assurance to beneficiaries. At the same time, the cash value component offers the potential for growth, enabling individuals to seek higher returns than traditional life insurance policies with fixed rates.

Flexibility with Premium Payments: VUL insurance offers flexibility in premium payments, allowing individuals to adjust their payments within certain limits. This flexibility can help individuals manage their finances effectively, especially if their income varies. Proper management of premium payments can also help maintain adequate funding for the death benefit, ensuring that the policy remains active.

It is important to note that while VUL insurance offers tax advantages, it is a complex product with risks and fees associated with its investment options. Individuals should carefully assess their financial goals, risk tolerance, and investment knowledge before choosing VUL insurance.

Living Benefit Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

VUL combines life insurance with investment options, offering flexibility and growth potential. Policyholders can adjust premiums and death benefits to fit changing financial needs.

VUL policies allow for the cash component to be invested in the market via subaccounts to produce greater returns. Almost all VUL policies allow investments in stocks, bonds, money market securities, ETFs, and mutual funds, as well as a guaranteed fixed-interest option.

The growth of your cash value is tax-deferred, and the death benefit is generally paid out income-tax-free to your beneficiaries.

VUL is a complex product with numerous features and options. The return on the cash component is not guaranteed and can vary based on market performance. If your cash value balance is too low, you may need to pay higher premiums to keep your VUL active.