Many individuals purchase life insurance contracts as a means of financial protection and security for themselves and their loved ones. Life insurance provides a safety net by offering financial benefits in the event of the insured's death, ensuring that dependents can maintain their standard of living and cover essential expenses. It is a way to mitigate the financial impact of unexpected life events and provide peace of mind, knowing that one's family is protected. The decision to buy life insurance is often driven by the desire to secure the future and create a financial safety net for those who depend on the policyholder.

What You'll Learn

- Financial Security: Individuals buy life insurance to protect their loved ones and ensure financial stability in the event of their death

- Debt Management: Life insurance can help cover debts and loans, providing peace of mind and financial relief

- Income Replacement: It offers a regular income stream to replace lost wages, supporting family members and dependents

- Long-Term Care: Policies can cover long-term care costs, ensuring individuals receive necessary support and comfort in their later years

- Legacy Planning: Life insurance allows individuals to leave a financial legacy, providing for future generations and charitable causes

Financial Security: Individuals buy life insurance to protect their loved ones and ensure financial stability in the event of their death

Life insurance is a crucial financial tool that provides individuals with a sense of security and peace of mind, especially when it comes to protecting their loved ones and ensuring financial stability. The primary reason many people purchase life insurance is to safeguard their family's financial well-being in the event of their untimely demise. When an individual passes away, the impact can be devastating for those who depend on their income, especially if they are the primary breadwinner. Life insurance steps in to fill this void, providing a financial safety net that can help cover essential expenses and maintain the standard of living for the surviving family members.

Financial security is a key motivator for buying life insurance. It ensures that the family's long-term goals and everyday needs are met, even if the primary source of income is no longer available. For instance, life insurance proceeds can be used to pay for mortgage or rent, utility bills, groceries, and other regular expenses, ensuring that the family can continue to live comfortably and avoid financial strain. This is particularly important for families with children, as it guarantees that the children's education, healthcare, and overall well-being are taken care of.

Moreover, life insurance can provide the means to pay for a child's future, such as college tuition or other significant expenses they may face as they grow up. It can also be used to cover funeral and burial costs, which can be substantial and often unexpected. By having a life insurance policy, individuals can ensure that their loved ones are not burdened with these financial responsibilities during an already difficult time.

In addition to covering immediate expenses, life insurance can also be a valuable asset for long-term financial planning. The policyholder can choose to invest a portion of the premium payments in various investment options offered by the insurance company. These investments can grow over time, providing a tax-advantaged way to build wealth. Upon the insured individual's death, the accumulated value of the policy can be passed on as a tax-free inheritance to beneficiaries, ensuring that the family's financial future is secure.

In summary, life insurance is a powerful tool for individuals to provide financial security and protect their loved ones. It offers a practical solution to ensure that the family's financial obligations are met and that their long-term goals remain on track, even in the face of tragedy. By understanding the importance of life insurance, individuals can make informed decisions to safeguard their family's future.

Pension Retiree Life Insurance: Can You Expect an Increase?

You may want to see also

Debt Management: Life insurance can help cover debts and loans, providing peace of mind and financial relief

Life insurance is a powerful financial tool that can offer significant benefits, especially when it comes to managing and covering debts and loans. For many individuals, purchasing a life insurance contract is a strategic decision that provides a safety net and peace of mind. Here's how life insurance can be a valuable asset in debt management:

Protecting Assets and Liabilities: When an individual takes out a life insurance policy, they essentially create a financial safety net for their loved ones and themselves. The primary purpose of life insurance is to provide financial security during the insured's lifetime. In the event of the insured's death, the death benefit or payout is paid out to the designated beneficiaries. This financial support can be crucial for covering various debts and loans, ensuring that the financial obligations are met even if the primary breadwinner is no longer present. By having this coverage, individuals can protect their assets and prevent the burden of debt from falling solely on their surviving family members.

Covering Debts and Loans: One of the most compelling reasons for purchasing life insurance is to manage and cover debts. Many people have financial obligations such as mortgages, car loans, student loans, or credit card debts. In the unfortunate event of their passing, these debts can become a significant burden for their loved ones. Life insurance proceeds can be used to pay off these debts, ensuring that the financial obligations are settled promptly. This not only prevents the surviving family from facing financial hardship but also protects their creditworthiness and overall financial stability. For example, if a family has a substantial mortgage, the life insurance payout can be used to clear the debt, leaving the family's home free and clear of any remaining liabilities.

Providing Financial Relief and Peace of Mind: Managing debt can be stressful, and life insurance offers a sense of security and relief. Knowing that debts are covered in the event of one's passing can significantly reduce anxiety and worry. This peace of mind allows individuals to focus on their current financial goals, plan for the future, and make informed decisions without the constant fear of financial burdens. Additionally, life insurance can provide the necessary funds to cover immediate expenses, such as funeral costs or outstanding medical bills, ensuring that the family's finances are not further strained during a difficult time.

Long-Term Financial Planning: Life insurance is a valuable component of long-term financial planning. It allows individuals to secure their family's financial future by ensuring that debts are managed effectively. By incorporating life insurance into their financial strategy, individuals can create a comprehensive plan that includes debt coverage, estate planning, and wealth preservation. This approach enables them to build a secure financial foundation, knowing that their loved ones will be protected even in their absence.

In summary, life insurance is a practical and thoughtful approach to debt management. It empowers individuals to take control of their financial future and provide a safety net for their families. By covering debts and loans, life insurance offers peace of mind, financial security, and the ability to leave a lasting legacy for loved ones. It is a wise investment that demonstrates foresight and a commitment to the well-being of one's family.

Understanding Life Insurance: Face Amount Explained

You may want to see also

Income Replacement: It offers a regular income stream to replace lost wages, supporting family members and dependents

Income replacement is a critical aspect of life insurance, and it is one of the primary reasons why individuals purchase life insurance contracts. When a person buys life insurance, they are essentially securing a financial safety net for their loved ones in the event of their untimely death. The primary purpose of this financial security is to ensure that the family can maintain their standard of living and cover essential expenses even if the primary breadwinner is no longer present.

Life insurance provides a regular income stream that can replace the lost wages of the deceased individual. This income is designed to mimic the financial contributions the person would have made to the family if they were still alive. For example, if a family's primary income earner passes away, the life insurance policy can provide a steady payment to cover daily living expenses, mortgage or rent payments, utility bills, and other regular costs. This financial support is crucial, especially in the initial years following the loss, as it prevents the family from falling into financial hardship and debt.

The income replacement benefit is particularly vital for families with dependents, such as children or elderly parents who rely on the financial support of the primary earner. It ensures that these dependents can continue to have their needs met, including education, healthcare, and other essential services. By providing a consistent income, life insurance allows the family to maintain their lifestyle and avoid making significant financial sacrifices that could have long-term consequences.

Moreover, income replacement through life insurance can help prevent the family from having to make drastic lifestyle changes or rely on other sources of income, which may not be as stable or reliable. It provides a sense of financial security and peace of mind, knowing that the family's financial future is at least partially protected. This aspect of life insurance is often overlooked, but it can significantly impact the overall well-being and stability of a family during challenging times.

In summary, income replacement is a powerful feature of life insurance that ensures financial stability and security for loved ones. It allows families to maintain their standard of living, cover essential expenses, and provide for their dependents, even when the primary income earner is no longer present. Understanding this benefit is essential for individuals to make informed decisions about life insurance and ensure their families are protected.

Life Insurance: AM Life Malaysia's Ultimate Guide

You may want to see also

Long-Term Care: Policies can cover long-term care costs, ensuring individuals receive necessary support and comfort in their later years

Long-term care is an essential aspect of financial planning, especially for individuals who want to ensure their comfort and well-being during their later years. As people age, they may require assistance with daily activities, such as bathing, dressing, and eating, which can be provided by long-term care facilities or in-home caregivers. The costs associated with long-term care can be substantial and often pose a significant financial burden on individuals and their families. This is where long-term care insurance comes into play as a valuable tool to mitigate these expenses.

Long-term care insurance policies are designed to provide financial protection and peace of mind to individuals. These policies offer coverage for the costs associated with long-term care services, ensuring that individuals can access the necessary support they need. When purchasing a long-term care policy, individuals can choose from various coverage options tailored to their specific requirements. This flexibility allows them to customize the policy to fit their budget and desired level of care.

The benefits of long-term care insurance are numerous. Firstly, it provides financial security by covering the often-high costs of long-term care services. Without such insurance, individuals and their families might have to rely on their savings, assets, or even public assistance programs, which may not adequately cover the expenses. Secondly, it offers peace of mind, knowing that one's future care needs are financially protected. This reassurance can be particularly valuable for individuals and their loved ones, allowing them to focus on enjoying their later years rather than worrying about financial burdens.

Moreover, long-term care insurance policies often include features that enhance their value. For instance, some policies offer inflation-adjusted benefits, ensuring that the coverage amount increases over time to keep up with rising care costs. Additionally, certain policies provide coverage for a wide range of services, including skilled nursing care, assisted living, and even in-home care, ensuring comprehensive support. By carefully reviewing and selecting the right policy, individuals can ensure they receive the necessary care and comfort they deserve in their later years.

In summary, long-term care insurance is a crucial component of life insurance contracts, offering financial protection and peace of mind. It enables individuals to plan for their future care needs, ensuring they can access the support and comfort they require during their later years. With the right policy, individuals can safeguard their financial well-being and focus on enjoying their retirement years to the fullest.

Term vs. Full Life Insurance: Which is Right for You?

You may want to see also

Legacy Planning: Life insurance allows individuals to leave a financial legacy, providing for future generations and charitable causes

Life insurance is a powerful tool for legacy planning, offering a way to ensure your financial legacy endures and benefits those you care about. When individuals purchase life insurance contracts, they are essentially creating a financial safety net that can be used to provide for their loved ones and support charitable causes they hold dear. This aspect of life insurance is often overlooked, but it is a crucial part of comprehensive financial planning.

The primary purpose of life insurance is to provide financial security for your family and dependents. In the event of your passing, the death benefit from your life insurance policy can be used to cover immediate expenses, such as funeral costs and outstanding debts, ensuring your loved ones are not burdened with financial strain during a difficult time. However, the benefits of life insurance extend far beyond these immediate needs.

Legacy planning with life insurance allows you to leave a lasting impact on your family's future. You can use the death benefit to fund your children's education, ensuring they have the resources to pursue their dreams and build successful lives. For parents, this can be a way to provide for their children's long-term financial well-being, even after they are gone. Additionally, life insurance can be a valuable tool for grandparents who want to ensure their grandchildren's needs are met, especially if they wish to contribute to their education or provide a financial cushion for their future.

Furthermore, life insurance can be an effective way to support charitable causes and missions that are important to you. Many individuals choose to designate a portion of their death benefit to charitable organizations or set up trust funds that benefit specific causes. This allows you to contribute to the greater good while also ensuring your family's financial security. By incorporating charitable giving into your legacy plan, you can make a meaningful impact on the world and leave a positive, lasting impression.

In summary, life insurance is not just about providing financial security for your loved ones; it is also a powerful tool for legacy planning. By purchasing life insurance contracts, individuals can ensure their financial legacy endures, providing for future generations and the causes they hold dear. This aspect of life insurance is a testament to its versatility and importance in comprehensive financial planning.

Understanding Life Insurance Rebates and Their Benefits

You may want to see also

Frequently asked questions

Life insurance provides financial protection and peace of mind for individuals and their families. It ensures that loved ones are taken care of in the event of the policyholder's death, covering expenses such as funeral costs, outstanding debts, mortgage payments, or daily living expenses. The primary goal is to secure the financial future of dependents and loved ones, even when the primary earner is no longer around.

Life insurance is a valuable tool for long-term financial planning. It allows individuals to secure their family's financial future by providing a lump sum payment (death benefit) to beneficiaries. This benefit can be used to cover various financial goals, such as paying for children's education, starting a business, or ensuring a comfortable retirement for the spouse. Additionally, certain types of life insurance policies also offer investment components, allowing policyholders to grow their money over time.

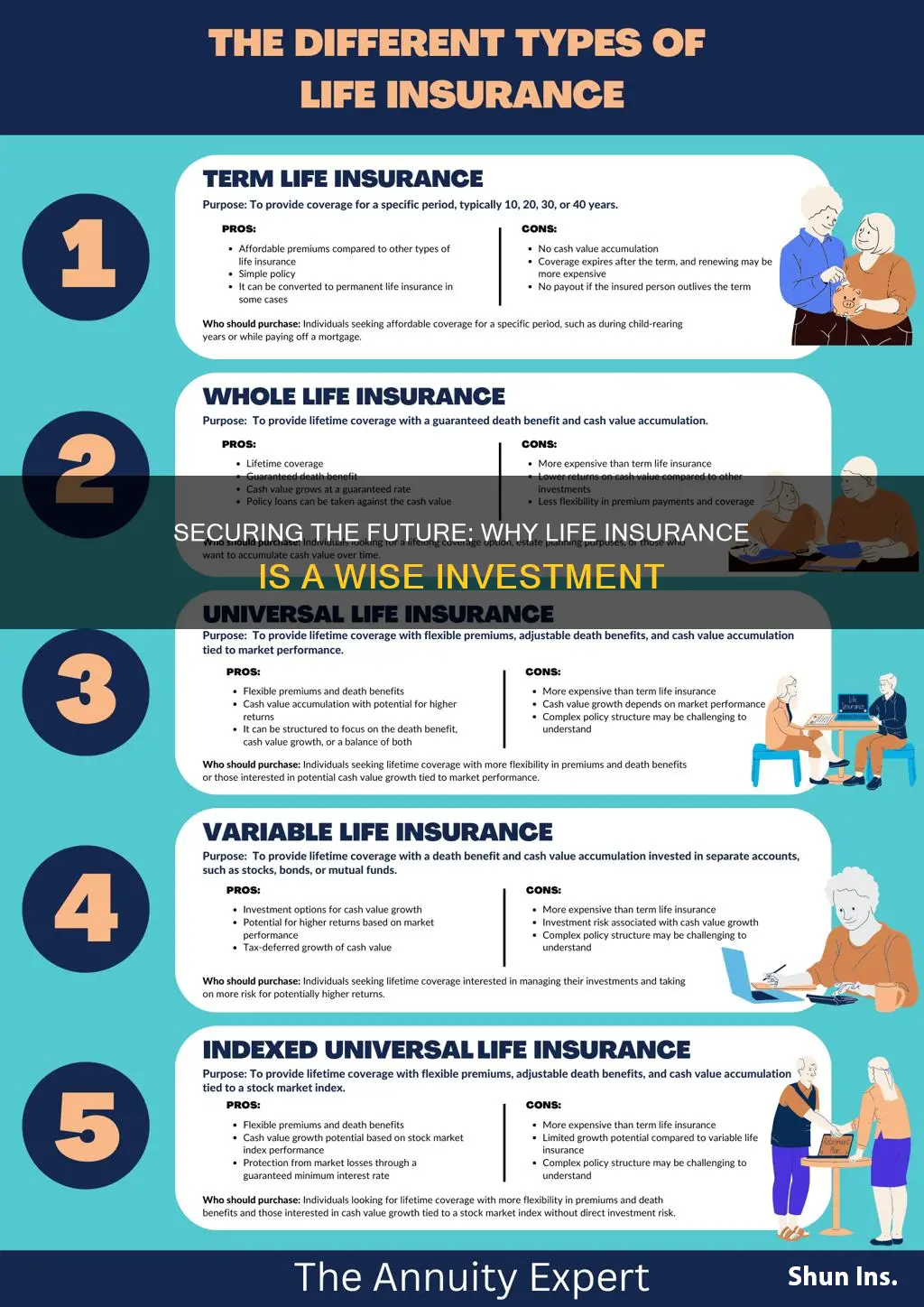

Yes, there are several types of life insurance policies, each with unique features and benefits. The most common types include Term Life Insurance, which provides coverage for a specified period; Permanent Life Insurance, offering lifelong coverage and a cash value component; and Universal Life Insurance, which provides flexible coverage and potential investment options. Individuals can choose the type that best suits their needs, considering factors like coverage duration, financial goals, and risk tolerance.