Many people are curious about the expiration dates on their whole life insurance policies. Understanding why these dates exist is essential for making informed financial decisions. In this paragraph, we will explore the reasons behind the expiration of whole life insurance policies, including the factors that influence their longevity and the benefits of having a defined end date.

| Characteristics | Values |

|---|---|

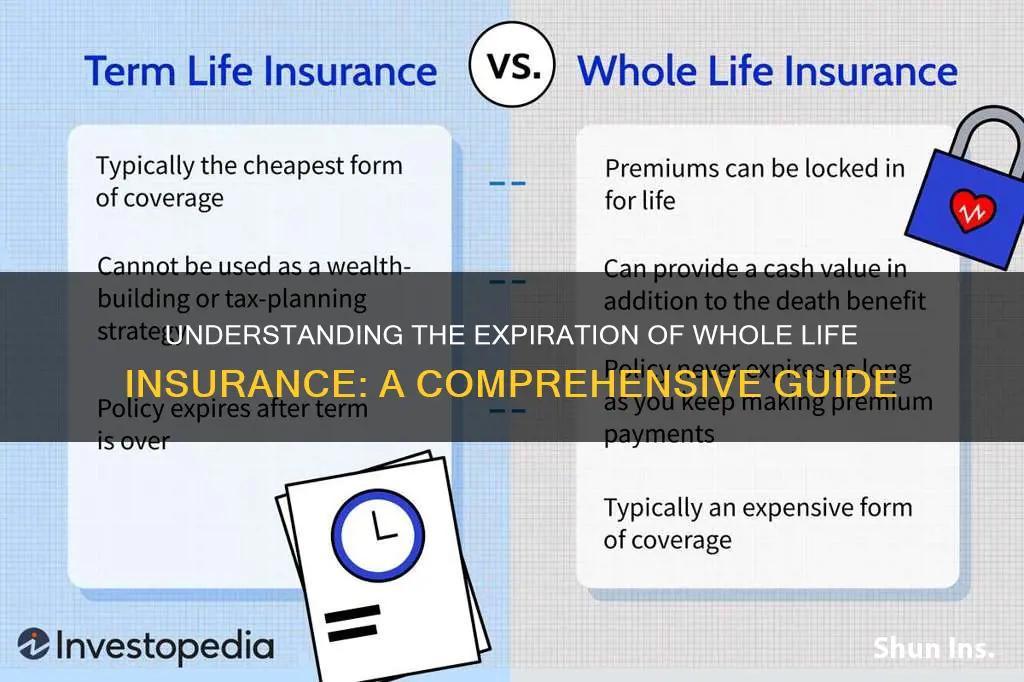

| Maturity and Financial Goals | Whole life insurance policies typically have a maturity date, which is the point at which the policy is fully paid out. This date is often aligned with the insured individual's retirement or financial goals, ensuring that the policyholder has a guaranteed payout at a specific time. |

| Long-Term Financial Planning | The expiration date encourages policyholders to plan for the long term. It provides an incentive to review and adjust the policy as life circumstances change, ensuring that the insurance remains relevant and beneficial. |

| Investment Component | Many whole life insurance policies include an investment component, where a portion of the premiums is invested in various assets. The expiration date allows the policy to mature, providing the opportunity for these investments to grow and potentially offer higher returns over time. |

| Guaranteed Payouts | The policy's expiration date guarantees that the beneficiaries will receive the death benefit amount as specified in the policy. This provides financial security and peace of mind to the insured and their loved ones. |

| Regulatory Compliance | Insurance companies must adhere to regulatory guidelines, which often include a maximum age or term for insurance policies. The expiration date ensures compliance with these regulations, protecting both the insurer and the policyholder. |

| Policy Review and Adjustment | As individuals age, their insurance needs may change. The expiration date prompts policyholders to review their coverage, adjust the policy if necessary, and potentially convert it to a different type of insurance if required. |

| Tax Advantages | Whole life insurance policies offer tax advantages, and the expiration date ensures that these benefits are utilized effectively. It allows for the potential accumulation of cash value, which can be borrowed against or withdrawn tax-free. |

What You'll Learn

- Legal and Regulatory Compliance: Insurance companies must adhere to laws and regulations regarding policy durations

- Risk Management: Expiry dates help manage risk and ensure policyholders are protected when needed

- Financial Planning: Life insurance policies often have limits to ensure financial security for beneficiaries

- Customer Satisfaction: Regular reviews and renewals can enhance customer experience and trust

- Market Trends: Industry standards and market demands influence policy durations and renewal processes

Legal and Regulatory Compliance: Insurance companies must adhere to laws and regulations regarding policy durations

The concept of an expiration date on a whole life insurance policy is primarily driven by legal and regulatory requirements that insurance companies must follow. These regulations are in place to protect both the policyholder and the insurance company, ensuring fair practices and maintaining the integrity of the insurance market. Understanding these compliance aspects is crucial for policyholders to make informed decisions about their insurance coverage.

Insurance policies, including whole life insurance, are subject to various laws and regulations that dictate their structure, terms, and validity. One of the key reasons for these rules is to prevent insurance companies from offering policies with indefinite coverage, which could potentially lead to financial instability for the insurer. By setting an expiration date, insurance providers are required to periodically review and adjust their policies, ensuring they remain financially sound and capable of fulfilling their obligations to policyholders. This periodic review process is essential for risk management and helps insurance companies stay compliant with regulatory bodies.

Regulatory bodies, such as insurance commissions or financial authorities, often set guidelines for policy durations to maintain market stability. These guidelines may vary by jurisdiction and can include specific requirements for policy renewal, adjustments, and termination. For instance, some regions may mandate that whole life insurance policies be renewable annually, allowing policyholders to continue coverage as long as they meet certain criteria. During the renewal process, insurance companies can reassess the policy's terms, premiums, and coverage amounts, ensuring they remain appropriate and fair for both parties.

Adhering to legal and regulatory compliance is essential for insurance companies to maintain their licenses and operate within the boundaries of the law. Failure to comply with policy duration regulations can result in severe consequences, including fines, license revocation, or even criminal charges. Insurance providers must stay updated on relevant laws and industry standards to ensure their policies are structured correctly and remain compliant over time. This includes providing clear and transparent information to policyholders about the policy's duration, renewal options, and any changes that may occur during the policy's lifetime.

In summary, the expiration date on a whole life insurance policy is a critical aspect of legal and regulatory compliance. It ensures that insurance companies operate within the boundaries of the law, manage risks effectively, and provide fair and transparent policies to their customers. Policyholders should be aware of these compliance measures to understand their rights and the terms of their insurance coverage. Staying informed about the regulatory environment can help individuals make better decisions regarding their insurance needs and ensure they receive the appropriate level of protection.

Gerber Life Insurance: Calculating Your Cash Value

You may want to see also

Risk Management: Expiry dates help manage risk and ensure policyholders are protected when needed

The concept of an expiry date on a whole life insurance policy is an essential aspect of risk management, ensuring that policyholders are adequately protected when they need it the most. This feature is a critical component of insurance, as it provides a safety net for individuals and their families, offering financial security during unforeseen circumstances. Here's how expiry dates contribute to effective risk management:

Long-Term Financial Security: Whole life insurance is designed to provide coverage for a lifetime, offering a sense of financial security to policyholders. However, the insurance industry operates in a dynamic environment, where risks and circumstances can change over time. By setting an expiry date, insurance companies can adapt to these changes and ensure that the policy remains relevant and beneficial to the policyholder. This adaptability is crucial, as it allows the insurance provider to adjust the policy's coverage and premiums as the policyholder's needs and risks evolve.

Risk Assessment and Management: Insurance policies, including whole life insurance, are underpinned by a thorough risk assessment process. Expiry dates facilitate this process by providing a structured framework. As the policy ages, the insurance company can periodically review and reassess the policyholder's risks. This regular evaluation ensures that the policy remains aligned with the policyholder's current circumstances, allowing for necessary adjustments to the coverage. For instance, if a policyholder's health improves significantly, the insurance company can adjust the policy to reflect the reduced risk, potentially offering more competitive rates.

Policy Flexibility and Customization: The presence of an expiry date enables insurance companies to offer flexible and customized policies. Policyholders can choose to extend their coverage beyond the initial term, ensuring a continuous safety net. This flexibility is particularly valuable for individuals who want long-term protection and are willing to invest in a policy that will adapt to their changing needs. Additionally, insurance providers can offer various policy options, allowing customers to select the most suitable coverage period, ensuring they are protected when it matters the most.

Peace of Mind and Financial Planning: Knowing that a whole life insurance policy has an expiry date can provide policyholders with peace of mind. It encourages individuals to plan for the future, ensuring that their financial affairs are in order. With an expiry date in mind, policyholders are more likely to review and update their policies regularly, making necessary changes to reflect their current situation. This proactive approach to insurance management can lead to better financial decisions and a more secure future.

In summary, the inclusion of expiry dates in whole life insurance policies is a strategic move towards effective risk management. It allows insurance companies to adapt to changing circumstances, provides policyholders with long-term financial security, and encourages a proactive approach to insurance management. By understanding the importance of these expiry dates, individuals can make informed decisions about their insurance coverage, ensuring they are protected when it matters the most.

Term Life Insurance: Outliving and Navigating the Next Steps

You may want to see also

Financial Planning: Life insurance policies often have limits to ensure financial security for beneficiaries

Life insurance is a crucial financial tool that provides a safety net for individuals and their loved ones. However, it's important to understand that these policies are not indefinite; they often come with specific terms and conditions, including expiration dates. This might prompt the question: Why do life insurance policies have an expiry date? The answer lies in the very purpose of life insurance—to offer financial security and peace of mind.

Life insurance companies set expiration dates to manage risk effectively. When you purchase a policy, the insurer agrees to provide a financial benefit to the policyholder's beneficiaries upon the insured individual's death. However, this commitment is not unlimited. Insurance policies typically have a defined period during which the coverage is active, after which the policy may lapse or terminate. This is a strategic approach to ensure that the insurance company can fulfill its obligations to beneficiaries without incurring excessive financial risk.

The expiration date is a critical aspect of financial planning, especially for those relying on life insurance as a primary source of financial security. For instance, if you have a family that depends on your income, a life insurance policy with a limited term can provide a specific period of financial protection. This ensures that your family has the necessary financial support during the years when they are most vulnerable, such as when children are growing up or when mortgage payments are due. Understanding the term length of your policy is essential to ensure that you have adequate coverage during the most critical times of your life.

Moreover, life insurance policies often have limits to protect both the insurer and the policyholder. These limits can include a maximum age for coverage, a specific term length, or a cap on the death benefit amount. For example, some policies may only cover the insured individual up to a certain age, after which the coverage ends. This prevents the insurer from taking on an excessive financial burden, especially as the insured person ages and the risk of death increases.

In financial planning, it is crucial to consider these limits when choosing a life insurance policy. By understanding the terms and conditions, you can select a policy that aligns with your specific needs and ensures that your beneficiaries are financially protected. This might involve choosing a longer term policy to cover a more extended period of financial dependency or opting for a higher death benefit to provide more comprehensive coverage.

In summary, the expiration date on a life insurance policy is a strategic feature designed to manage risk and provide financial security. By understanding the limits and terms of your policy, you can make informed decisions about your financial planning, ensuring that your loved ones are protected during the most critical times. It is a vital aspect of comprehensive financial planning that should not be overlooked.

Life Insurance: Sensible or Not?

You may want to see also

Customer Satisfaction: Regular reviews and renewals can enhance customer experience and trust

Regular reviews and renewals are essential components of a comprehensive insurance strategy, and they play a pivotal role in enhancing customer satisfaction and trust. When it comes to whole life insurance, the concept of an expiry date might seem counterintuitive, as it is designed to provide lifelong coverage. However, the inclusion of a review and renewal process is a strategic move by insurance providers to ensure that the policy remains relevant and beneficial to the policyholder throughout their life.

The primary purpose of these reviews and renewals is to assess the changing needs and circumstances of the insured individual. Life is a dynamic journey, and as individuals progress through different stages, their financial goals, health conditions, and risk factors may evolve. For instance, a young adult purchasing whole life insurance might prioritize coverage for a large sum assured, while a middle-aged individual might seek to adjust the policy to align with their retirement goals. By conducting regular reviews, insurance companies can identify these shifts and make necessary adjustments to the policy, ensuring it remains tailored to the customer's best interests.

Renewal processes also serve as an opportunity to educate and engage customers. During the renewal, insurance providers can review the policy's performance, highlight any potential savings or benefits, and provide updated information about the policy's features. This proactive approach empowers customers to make informed decisions about their insurance. For example, an insurer might suggest increasing the sum assured to cover a growing family's needs or offer a discount for maintaining a healthy lifestyle, encouraging policyholders to take an active role in their insurance management.

Moreover, regular reviews and renewals contribute to building a strong relationship of trust between the insurance company and the customer. When an insurer demonstrates a commitment to staying informed about the policyholder's life changes and proactively adjusts the policy, it fosters a sense of reliability and loyalty. Customers who feel heard and understood are more likely to have a positive experience, leading to increased satisfaction and a higher likelihood of long-term policy retention.

In summary, the inclusion of regular reviews and renewals in whole life insurance policies is a strategic decision that significantly impacts customer satisfaction and trust. It allows for personalized adjustments, educates customers, and strengthens the relationship between the insurer and the policyholder. By embracing this practice, insurance companies can ensure that their products remain relevant and valuable, even as the insured individual's life circumstances evolve over time.

Life Insurance Cancellation: Understanding AIG's Late Policy

You may want to see also

Market Trends: Industry standards and market demands influence policy durations and renewal processes

The concept of a finite duration for whole life insurance policies is a market-driven phenomenon, shaped by industry standards and consumer demands. In the insurance sector, policies are often designed to meet specific needs and expectations, and these can vary widely. Industry standards play a crucial role in determining the typical policy duration, which is often a reflection of the insurer's risk assessment and the desired level of coverage. For instance, a standard whole life insurance policy might offer coverage for a specific number of years, such as 10, 20, or 30 years, with the option to renew or convert it into a permanent policy. This approach allows insurers to manage risk effectively while providing customers with a sense of security and predictability.

Market demands heavily influence the renewal process and policy durations. Consumers often seek insurance products that align with their financial goals and life stages. For example, a young professional might opt for a 10-year term policy to cover a specific period, such as a mortgage or a business venture, after which they plan to reassess their needs. In contrast, an older individual might prefer a longer-term policy, like 20 or 30 years, to ensure long-term financial security. The flexibility to renew or adjust the policy duration at renewal time is essential to meeting these diverse market demands.

Industry standards and market trends have led to the development of various policy structures. Some insurers offer renewable term life insurance, allowing policyholders to extend coverage annually or at predetermined intervals. This approach provides a safety net for those who may require insurance for a limited time but want the option to continue coverage. On the other hand, some companies introduce 'convertible' policies, allowing term life insurance to be converted into permanent coverage without a medical examination, providing policyholders with added flexibility.

The market's dynamic nature also influences the renewal process. Insurers often review policies at renewal time, assessing the policyholder's health, lifestyle, and financial situation. This review can lead to adjustments in premiums or even the termination of the policy if certain criteria are not met. Market trends, such as increasing life expectancy and improved healthcare, may also impact the availability and cost of long-term coverage, influencing the renewal decisions of both insurers and policyholders.

In summary, the expiry date on whole life insurance policies is a result of industry standards and market demands working in tandem. Insurers aim to provide tailored solutions, and the policy duration is a critical aspect of meeting these needs. The renewal process, influenced by market trends and consumer behavior, ensures that insurance coverage remains relevant and adaptable over time, allowing individuals to manage their financial security effectively. Understanding these market dynamics is essential for both insurers and policyholders to make informed decisions regarding insurance coverage.

Canada's Top Life Insurance: Find the Best Fit for You

You may want to see also

Frequently asked questions

Whole life insurance is a permanent policy that provides coverage for the entire life of the insured individual. However, the policy's cash value, which is the investment component of the insurance, is designed to grow over time. The expiration date is typically set at a predetermined age, often 100 years, to ensure that the policy's cash value has had sufficient time to accumulate. At this point, the policy's death benefit is guaranteed, and the cash value can be surrendered for its full value.

Yes, one of the advantages of whole life insurance is that it is a permanent policy, and once the initial term is met, the coverage remains in force for the entire life of the insured. You can continue to pay the premiums and maintain the policy indefinitely. The expiration date is more of a milestone to ensure the policy's integrity and the insurer's ability to guarantee the death benefit.

If you outlive the expiration date, your whole life insurance policy will still be in force, providing lifelong coverage. The policy's death benefit will remain guaranteed, and the cash value will continue to grow. You can continue to pay the premiums and ensure that your beneficiaries receive the death benefit when you pass away.

Yes, having a defined expiration date can provide several benefits. Firstly, it ensures that the policy's cash value is not left unattended for an extended period, allowing the insurer to manage the investment component effectively. Secondly, it provides a clear structure for the policy, making it easier for the insured to understand and manage their coverage. Additionally, the expiration date can serve as a reminder to review and potentially adjust the policy as your needs change over time.