The Affordable Care Act, commonly known as Obamacare, was signed into law in 2010 by President Barack Obama. This act brought about a significant transformation of the US healthcare system. One of the key provisions of Obamacare was the individual mandate, which required most Americans to obtain and maintain health insurance coverage. To encourage compliance, the law initially included tax penalties for those without insurance, known as the individual mandate penalty or Obamacare penalty. However, as of 2019, these federal penalties have been eliminated, and there is no longer a federal fine for not having health insurance. Despite this, some states, including Massachusetts, New Jersey, California, and Rhode Island, have implemented their own coverage mandates and may apply state tax penalties for residents who lack health coverage. These state-level penalties vary but generally follow the structure of the former federal penalty. While the fines are no longer in place, it is still essential and advisable to have health insurance to ensure access to affordable healthcare when needed.

| Characteristics | Values |

|---|---|

| Year of Obamacare's inception | 2010 |

| Year Obamacare fine was repealed | 2019 |

| Current status of Obamacare fine | No longer in effect on a federal level |

| States that still implement Obamacare fine | New Jersey, Vermont, the District of Columbia, California, Rhode Island, and Massachusetts |

| Year the fine was reduced to $0 | 2018 |

What You'll Learn

Obamacare fines are no longer federal policy

History of Obamacare

Obamacare, officially known as the Affordable Care Act (ACA), was signed into law in 2010 by President Barack Obama. This act brought about a significant transformation of the US healthcare system. The law mandated that all US citizens have health insurance coverage and imposed tax penalties on those without coverage for the entire year or part of it.

Obamacare's Individual Mandate

The individual mandate was a crucial provision within the ACA. It required most Americans to obtain and maintain health insurance coverage. The aim was to increase the number of insured individuals and create a balanced risk pool, thereby controlling healthcare costs and ensuring universal access to healthcare.

Obamacare Tax Penalties

The Obamacare tax penalties were federal fines that individuals had to pay if they lacked health insurance coverage. These penalties were assessed and collected by the IRS during tax filings. However, certain exemptions applied, and not everyone had to pay these fines.

Changes to Obamacare Penalties

Over time, the Affordable Care Act has undergone significant changes, impacting the healthcare coverage and tax obligations of individuals and businesses. One notable change was the repeal of the individual mandate penalty.

Repeal of the Individual Mandate Penalty

In 2017, President Donald Trump signed the Tax Cuts and Jobs Act, which eliminated the tax penalty associated with the ACA's individual mandate. As a result, starting in 2019, Obamacare tax penalties are no longer enforced at the federal level. This means that individuals who do not have health insurance will not face federal tax consequences.

State-Level Mandates and Penalties

While the federal mandate penalty has been repealed, it is important to note that some states have implemented their own mandates and penalties. As of 2024, states such as Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia impose financial penalties on residents who do not have health insurance and are not eligible for an exemption. These penalties are collected through state tax returns.

Importance of Health Insurance

Despite the repeal of the federal mandate penalty, it is still advisable to maintain health insurance coverage. Lack of insurance can make healthcare unaffordable or inaccessible in the event of a serious illness. Additionally, enrolling outside of open enrollment periods is typically only possible if individuals have a qualifying event, further emphasizing the importance of continuous coverage.

Citations: Multiple Items, One Fine?

You may want to see also

Some states still impose fines

As of 2024, tax penalties for Obamacare have been largely cancelled. However, some states still require residents to pay a fee if they don't have health insurance. These include Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia.

Massachusetts has imposed an individual mandate and penalty since 2006. The state started assessing the penalty again in 2019. The penalty in Massachusetts is calculated as 50% of the cost of the lowest-cost plan that the person could have purchased. There is no penalty if your income is up to 150% of the poverty level. If your income is between 150.1% and 300% of the poverty level, your penalty is 50% of the premium for the lowest-cost ConnectorCare plan. If your income is over 300% of the poverty level, your penalty is 50% of the cost of the lowest-cost bronze plan available through the Massachusetts Health Connector.

New Jersey implemented an individual mandate and penalty in 2019. The maximum penalty is based on the average cost of a bronze plan in the state. The revenue generated from the penalty is used to fund the state's reinsurance program.

The District of Columbia approved an individual mandate and penalty in 2018, which came into effect in 2019. The maximum penalty is based on the average cost of a bronze plan in the district. The revenue from the penalty is used for outreach and enrollment assistance, as well as programs that improve the availability and affordability of coverage.

California has an individual mandate and penalty since 2020. The revenue from the state's individual mandate is used to help cover the cost of the state's new premium subsidies, which extend to higher income levels than the ACA's premium subsidies.

Rhode Island has an individual mandate and penalty since 2020. The revenue collected from the penalty is used to fund the state's reinsurance program.

Vermont enacted legislation to create an individual mandate in 2020, but there is no penalty for non-compliance. Instead, the state focuses on using the mandate as a platform to educate residents about the importance of having health insurance and guide them towards available programs and subsidies.

Choosing the Right Term Insurance Horizon: Navigating the Optimal Tenure for Peace of Mind

You may want to see also

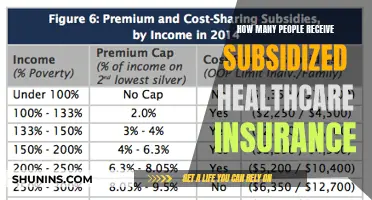

Fines are based on income

As of 2024, tax penalties for Obamacare have been largely cancelled. However, some states in the US still require residents to pay a fee if they don't have health insurance. These states include Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia.

The amount of the fine depends on the income of the person being fined. In Massachusetts, if your income is up to 150% of the poverty line, you are not fined. If your income is between 150.1% and 300% of the poverty line, your fine is 50% of the premium for the lowest-cost ConnectorCare plan. If your income is over 300% of the poverty line, your fine is 50% of the cost of the lowest-cost bronze plan available through the Massachusetts Health Connector.

In New Jersey, the maximum fine is based on the average cost of a bronze plan in the state. In the District of Columbia, the fine is calculated based on a percentage of household income or a per-person fee, whichever is higher. In California, the fine is either a flat amount per family member or a percentage of the household income over the state tax filing threshold. In Rhode Island, the fine is calculated as either a percentage of income or a flat fee per person in the household.

Insurance Consultants: Who Qualifies?

You may want to see also

Exemptions are available

As of 2024, tax penalties for the Affordable Care Act (also known as Obamacare) have been largely cancelled. However, some states still require residents to pay a fee if they don't have health insurance. These states include Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia. Vermont also requires residents to maintain health coverage and report their coverage status on state tax returns, but does not impose a financial penalty for being uninsured.

The exemptions available vary from state to state, but generally follow the exemption criteria used for the federal government's individual mandate. Here are the exemptions available in each state:

Massachusetts

Massachusetts has had an individual mandate since 2006. There is no penalty if your income is up to 150% of the poverty level. If your income is between 150.1 and 300% of the poverty level, your penalty is 50% of the premium for the lowest-cost ConnectorCare plan. If your income is over 300% of the poverty level, your penalty is 50% of the cost of the lowest-cost bronze plan available through the Massachusetts Health Connector. Exemptions are available for those with income levels below a certain threshold.

New Jersey

New Jersey has an individual mandate with a penalty modelled on the ACA's penalty. The maximum penalty is based on the average cost of a bronze plan in the state. Exemptions are available for those with qualifying health insurance coverage.

The District of Columbia

The District of Columbia has an individual mandate with a penalty also modelled on the ACA's penalty. The maximum penalty is based on the average cost of a bronze plan in DC. Exemptions are available for residents without coverage.

California

California has an individual mandate as of 2020, with a penalty similar to the ACA's penalty. Exemptions are available, but the specific criteria are not mentioned.

Rhode Island

Rhode Island has an individual mandate as of 2020, with a penalty similar to the federal framework. The penalty is calculated as either a percentage of income or a flat fee per person in the household. Exemptions are available, but the specific criteria are not mentioned.

Vermont

Vermont has an individual mandate but does not impose financial penalties for non-compliance. Instead, the state focuses on educating residents about the importance of having health insurance and guiding them towards available programs and subsidies. Exemptions are available, but the specific criteria are not mentioned.

Insurance Claims: Why Admit Fault?

You may want to see also

Fines were unpopular

The individual mandate, which required most Americans to obtain and maintain health insurance coverage, was an unpopular aspect of Obamacare. The mandate was included in the Affordable Care Act (ACA) to increase the number of people with insurance and create a more balanced risk pool, ultimately helping to control healthcare costs and ensure access to care for all. However, many people viewed the mandate and its associated penalties as a form of government overreach.

The individual mandate penalty, often referred to as the "Obamacare penalty," was a federal penalty collected by the IRS on tax returns. This penalty was reduced to $0 after 2018, meaning there is no longer a federal penalty for being uninsured. However, some states have implemented their own coverage mandates and may apply state tax penalties for those without health insurance. As of 2024, these states include Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia.

The Obamacare penalty was never popular, and it was often criticised as an unfair burden on individuals and families who could not afford health insurance. Additionally, there were concerns that the penalty did not effectively encourage healthy people to join insurance pools, as intended. Instead, it was argued that healthy individuals might still choose to pay the penalty rather than purchase insurance, resulting in higher premiums for those who maintained coverage.

The elimination of the individual mandate penalty in 2019 contributed to slightly higher individual market premiums for that year. This increase was due to insurers expecting healthy individuals to be more likely to drop their coverage after the penalty was removed, while sick people would be more likely to retain their insurance. However, the impact of the penalty's elimination on premiums was mitigated by the ACA's premium subsidies, which kept coverage affordable for most enrollees.

While the individual mandate itself still exists, there is no longer a financial consequence for non-compliance at the federal level. This change was a result of the Tax Cuts and Jobs Act, signed into law by President Donald Trump in 2017, which repealed the tax penalty mandate from the ACA. Despite the elimination of the federal penalty, maintaining continuous health insurance coverage is still in an individual's best interest, as it ensures access to affordable healthcare in the event of a serious illness or injury.

Informing Exes: Insurance Update Protocols

You may want to see also

Frequently asked questions

Obamacare, or the Affordable Care Act, was signed into law in 2010 by President Barack Obama. It required everyone in the United States to have health insurance coverage. The idea was to increase the number of people with access to healthcare and insurance, as well as to lower the cost of health coverage for those with lower incomes.

As of 2024, tax penalties for Obamacare have been largely cancelled. However, some states, including Massachusetts, New Jersey, California, Rhode Island, and the District of Columbia, still impose financial penalties on residents who do not have health insurance.

The fine for not having health insurance depends on your income status and the state in which you live. For example, in Massachusetts, if your income is up to 150% of the poverty line, you are exempt from the fine. If your income is between 150.1% and 300% of the poverty line, your fine is 50% of the premium for the lowest-cost ConnectorCare plan. If your income is over 300% of the poverty line, your fine is 50% of the cost of the lowest-cost bronze plan available.

Even if there is no fine for being uninsured in your state, it is still wise to have health insurance. Without coverage, healthcare for a serious illness could be unaffordable or inaccessible.