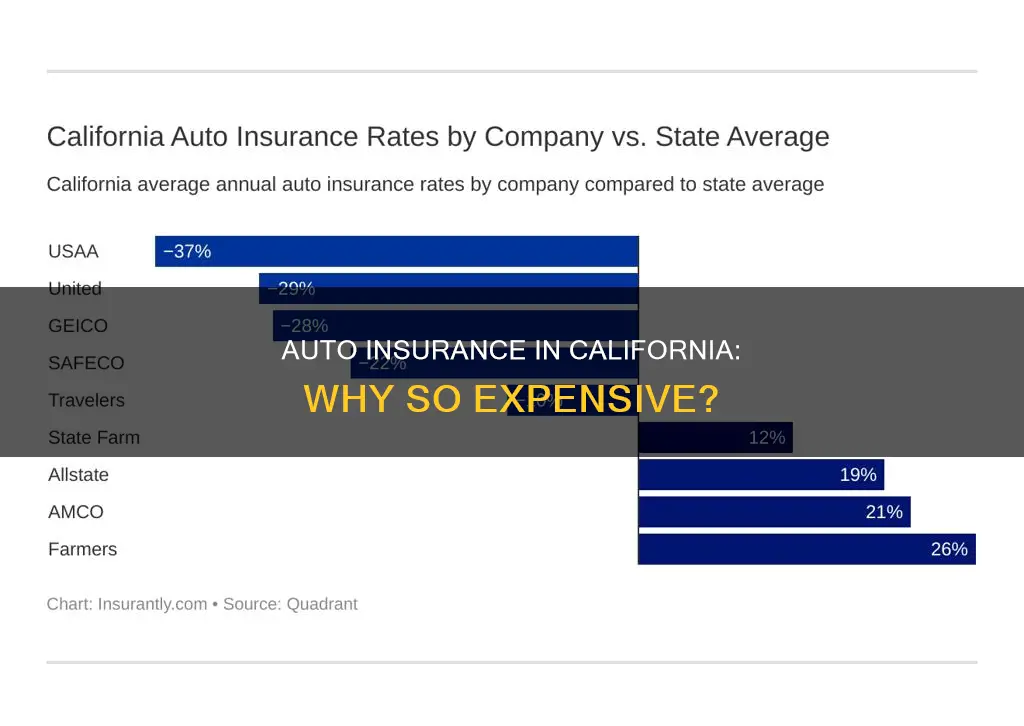

California is known for its high car insurance rates, with drivers paying about $1,429 per year on average. The state's dense population, high healthcare costs, costly auto repairs, and severe weather risks all contribute to the high insurance premiums. California's heavily-trafficked roads, with nearly 40 million residents, result in more accidents and insurance claims. The state's healthcare costs are among the highest in the country, with medical bills from car accidents adding to the expense. Auto repairs are also more expensive due to the advanced technology in modern vehicles. Additionally, California's frequent wildfires, droughts, floods, and earthquakes result in total loss of vehicles, leading to higher insurance payouts. These factors make it challenging for Californians to find affordable auto insurance, and the problem is expected to persist in the coming years.

| Characteristics | Values |

|---|---|

| Number of licensed drivers | 27 million |

| Accident costs | Thousands of dollars |

| Technology in cars | Expensive to repair |

| Inflation | Yes |

| Frequency of accidents | Almost double what it was prior to the pandemic |

| Insurance premium increases | 30% (Allstate), 21% (State Farm), 62% (Root Insurance), 65% (Geico) |

| Population | 40 million |

| Healthcare costs | High |

| Auto repair costs | High |

| Natural disasters | Wildfires, droughts, floods, earthquakes |

| Theft and vandalism | High in densely-populated urban areas |

| Uninsured motorists | 17% |

What You'll Learn

California's high healthcare costs

The high healthcare costs in California are driven by several factors. Firstly, the state has a large population, with nearly 40 million residents, many of whom live in densely-packed cities like Los Angeles, San Francisco, and San Diego. This high population density increases the risk of accidents and contributes to more frequent insurance claims. Secondly, California experiences severe weather events and natural disasters, such as wildfires, droughts, floods, and earthquakes, which can result in costly damage to vehicles. Insurers must factor in these risks when setting insurance rates.

Additionally, the cost of auto repairs in California is higher than in other states. According to CarMD, California drivers pay the highest car repair costs in the country, with an average cost of $410.73 to address a check engine light as of 2020. This increases the financial burden on insurers, who need to reimburse policyholders for these repairs.

The combination of high healthcare costs, expensive auto repairs, and the frequency of accidents and natural disasters in California significantly contributes to the elevated insurance premiums in the state. These factors ultimately result in higher costs for consumers, making it crucial for drivers to shop around and compare quotes to find the best rates.

Auto Liability Insurance Coverage in California: What's Included?

You may want to see also

Costly auto repairs

California has some of the highest car repair costs in the nation. The average cost of a check engine-related car repair in California was $390.37 in 2012, which was the second-highest in the United States. By 2023, car repair costs had increased by almost 20% across the United States, with repairs costing consumers $500 to $600 per visit, and sometimes "much higher".

There are several reasons for the high and rising cost of auto repairs in California. One significant factor is the prevalence of advanced technology in modern vehicles. Cars today are filled with expensive technology, such as advanced driver-assistance systems (auto emergency braking, lane-keeping assist, and cross-traffic alert systems), electronic sensors, cameras, and LiDAR. When these high-tech parts are damaged in accidents, repairs are much more costly. Technicians need specialised training to work on these vehicles, and the repairs themselves require more precision and time. For example, the thickness of paint on a repaired car bumper must be "just right" for sensors to function properly.

In addition to the increased complexity and cost of repairing modern vehicles, there is also a shortage of certain components, such as microchips, due to ongoing supply chain issues. These supply chain problems have also impacted the availability of new cars, leading to an increase in the average age of vehicles on the road. Older cars are more likely to require major repairs, further contributing to the costliness of auto repairs.

The high cost of real estate in California also contributes to the expense of car repairs. Repair shops and dealerships must deal with higher overhead costs compared to those in other states. Furthermore, California's poor road conditions and the state's car-dependent culture, which results in longer commutes and more wear and tear on vehicles, also play a role in the high cost of auto repairs.

Auto Insurance in Ohio: What's the Cost?

You may want to see also

Severe weather risks

California is susceptible to severe weather events, including tropical rainstorms, flooding, and wildfires. These weather events pose significant risks to property and lives, and their impacts are felt throughout the state.

The state's unique geography, with its numerous mountains and hills, makes it particularly vulnerable to flooding. Even a few inches of rain can cause significant flooding, and the rapid runoff can lead to destructive events such as flash floods, debris flows, mudslides, and hillside slippages. These events not only endanger lives but also cause extensive property damage, including to vehicles and infrastructure. Motorists may find themselves stranded on flooded roads or unable to commute due to blocked routes.

Additionally, California faces the constant threat of wildfires, which have become increasingly frequent and intense due to climate change. The state has experienced several destructive and deadly wildfires in recent years, leading to skyrocketing fire insurance premiums that many homeowners struggle to afford. The increased wildfire risks have also caused some of the biggest insurers to pull out of California, further exacerbating the situation.

The severe weather risks in California contribute to the high cost of auto insurance in the state. Insurers factor in the potential for weather-related claims when setting premiums, and the frequent occurrence of extreme weather events drives up these costs. The impact of climate change on insurance costs cannot be overstated, as carriers assess the number of weather-related claims made in an area when determining premiums.

To mitigate the financial burden of severe weather risks, Californians can take proactive measures such as shopping around for better rates, adding comprehensive coverage to their policies, and taking steps to protect their vehicles during storms and floods. However, the underlying issue of extreme weather events in the state underscores the importance of addressing climate change and adapting to its ongoing impacts.

Insuring a Vehicle: Ownership Flexibility

You may want to see also

High risk of theft or vandalism

California has witnessed a surge in vehicle thefts, with over 44,000 car thefts reported in the first half of 2023, making it the state with the highest number of vehicle thefts in the country. This rise in car thefts and vehicle-related crimes has contributed to the increase in auto insurance premiums in the state.

The risk of theft or vandalism is a significant factor in determining auto insurance rates. If you live in an area with a high incidence of car thefts and vandalism, insurers will consider you a higher risk, which will likely lead to higher premiums. The make and model of your vehicle also play a role, as some cars are more attractive to thieves, and insurers may adjust rates based on the theft risk associated with specific models.

To mitigate potential rate increases due to theft or vandalism, there are several preventive measures you can take. These include installing anti-theft devices, parking in secure and well-lit areas, using steering wheel locks, and following recommended safety practices. Additionally, consider adding comprehensive coverage to your policy, which will protect you financially in the event of theft or vandalism. Comprehensive coverage is optional but highly recommended, as it covers theft, vandalism, animal damage, falling objects, broken glass, and weather damage.

While basic auto insurance coverage is mandatory, it does not typically cover theft or vandalism. Therefore, it is essential to review your policy and understand the extent of your coverage. By taking proactive steps and choosing the right insurance coverage, you can better protect yourself and your vehicle from the financial impact of theft or vandalism.

Gap Insurance vs. Extended Warranty: What's the Difference?

You may want to see also

Population density

California has more than 27 million licensed drivers, many of whom are facing higher insurance premiums. Population density is a key factor in determining insurance rates. Insurers use your address and ZIP code to set premiums because crime rates, population density, claims volume and frequency, and road conditions vary by region and city.

Living in a densely populated area can lead to higher car insurance premiums. This is because accidents are more likely to happen in these areas since more vehicles are on the road. Packing lots of people into one area increases the chance of traffic congestion and car accidents. Car insurance companies use this data to charge higher premiums in metropolitan areas.

Insurers also consider the type and frequency of claims filed in an area when calculating rates, plus the parts and labor costs to fix your vehicle. If you live in an area with a high claims frequency and average expenses, you’ll probably pay higher car insurance costs.

Vehicle crimes, like theft and vandalism, also factor into how much you pay based on your address, as these crimes drive up claim costs. People reported over one million thefts across the country in 2023, according to the National Insurance Crime Bureau. California, Texas, Florida, and Washington saw the highest car theft rates for the year.

California also has the most drivers out of all the states, with about 27 million licensed drivers in 2021, 9 million more than the next state, Texas.

Navy Federal Auto Loan Insurance Requirements: Full Coverage or Bust?

You may want to see also

Frequently asked questions

California has a large population of over 27 million licensed drivers, many of whom live in densely-packed cities. This means more accidents and more insurance claims. California also has a less robust public transportation system compared to other states, so most residents rely on cars. California's insurance companies must also deal with high healthcare costs, costly auto repairs, and severe weather risks, all of which contribute to higher premiums.

California's insurance department can help lower costs by approving rate increase requests from insurance companies. The department hasn't approved any rate increases for more than two years due to the pandemic, which has contributed to the current high costs. Going forward, approving some of the 80 requests currently under review may help ease the situation.

Drivers can shop around for the best rates, bundle their coverage, and ask about discounts. They can also consider raising their deductible, which will lower their premium but result in higher out-of-pocket expenses in the event of an accident.