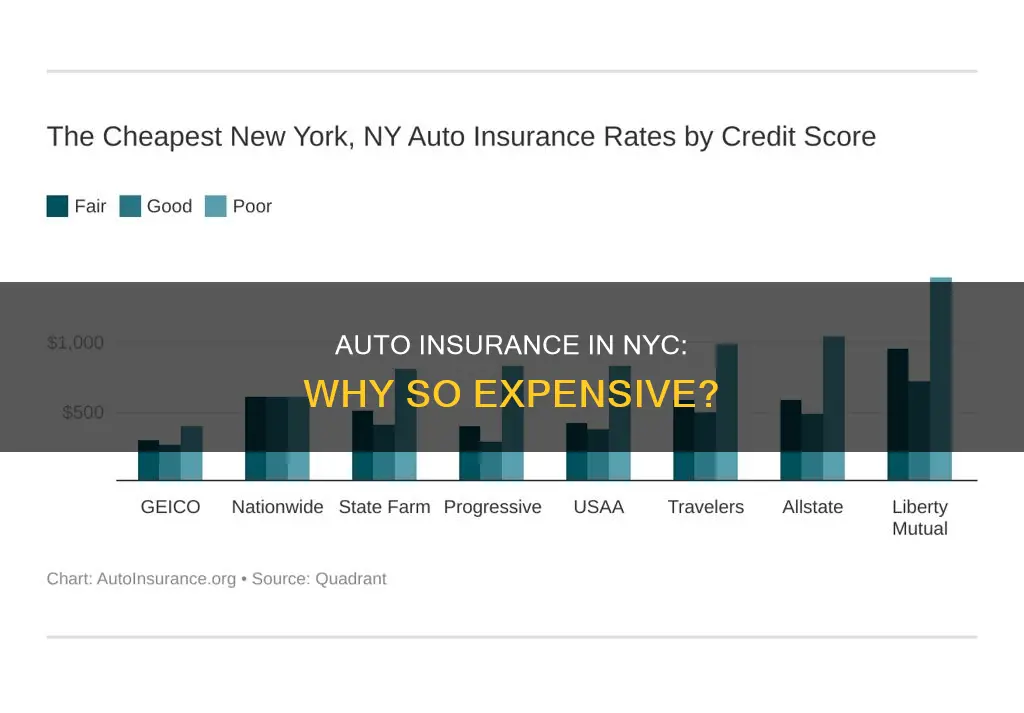

New York has some of the most expensive car insurance costs in the US, with only Michigan surpassing it. The average cost of car insurance in New York is $3,443, more than double the national average of $1,424. There are several factors that contribute to this, including high healthcare costs, additional insurance requirements, severe weather risks, and a higher risk of theft or vandalism.

New York is a no-fault state, which means that drivers must file a claim with their insurance provider after an accident, regardless of who is at fault. This also means that additional insurance coverages, such as personal injury protection (PIP), are required, increasing the overall cost of insurance for drivers in the state.

The high cost of car insurance in New York has been a growing concern for residents, with rates continuing to rise year after year.

| Characteristics | Values |

|---|---|

| Average Cost of Car Insurance in New York | $3,757 per year for full coverage; $1,553 per year for minimum coverage |

| Average Cost of Car Insurance in the U.S. | $2,348 for full coverage; $639 for minimum coverage |

| Average Monthly Cost of Car Insurance in New York | $313 for full coverage; $129 for minimum coverage |

| Average Cost of Car Insurance in New York City | $7,488 per year |

| Cheapest Car Insurance in New York | Progressive, American Family, USAA, Geico, and Erie Insurance |

| No-Fault Insurance Laws | Personal injury protection (PIP) coverage is required, which increases insurance costs |

| High Medical Bills | Insurance companies pay for medical bills regardless of who caused the accident |

| Personal Health Insurance Restriction | Health insurance cannot be used after a car accident; auto insurance must be used first |

| Winter Weather | Cold winters with snow and ice increase the likelihood of car accidents |

| High Risk of Theft or Vandalism | New York had the ninth-highest rate of car thefts in the U.S. in 2022 |

What You'll Learn

No-fault insurance laws

New York is a no-fault state, meaning that after a car accident, you file a claim with your own insurance provider, regardless of who is at fault. No-fault insurance laws require every motor vehicle to provide personal injury protection coverage, so that injured parties receive benefits regardless of who caused the accident. This coverage includes medical expenses, lost earnings, and other reasonable expenses, such as prescriptions, travel expenses, and household help.

Under New York's no-fault insurance laws, your own car insurance coverage (specifically, your "personal injury protection" or PIP coverage) pays for medical treatment and other out-of-pocket losses incurred by anyone covered under the policy, up to coverage limits, regardless of who caused the accident. This includes the vehicle owner/policyholder, anyone else driving the vehicle with permission, any passengers in the vehicle, and any pedestrians or bicyclists hit by the vehicle.

The no-fault benefits are limited in most cases to $50,000 unless additional benefits are purchased. After the insurance company has paid out the full $50,000 of benefits, they will pay no more. An injured person can then submit any remaining unpaid bills to their private health insurance.

To collect no-fault benefits, a claim must be filed within 30 days of the accident. The claim should be filed with the insurance company of the vehicle the victim was an occupant of, or with the insurance company of the vehicle that struck the victim if they are a pedestrian. If the vehicle involved is uninsured, a no-fault claim should be filed with the injured person's vehicle insurance company, as well as with the auto insurance company of any family member in their household.

Auto Insurance: Understanding Corrosion Coverage

You may want to see also

High medical costs

New York has some of the most expensive car insurance costs in the nation, with the average cost of car insurance being $3,443, more than double the national average of $1,424. The average cost of car insurance in New York per year is $3,757 for full coverage and $1,553 for minimum coverage.

The high medical costs in New York are a significant factor contributing to the high cost of auto insurance in the state. Healthcare is expensive across the United States, but costs are even higher in New York. According to a 2017 study conducted by the NYS Health Foundation, New York residents paid the eighth-highest insurance rates in the country.

When healthcare costs are high, insurance companies have to pay out more in claims to cover the cost of treating injuries. As a result, insurance carriers set higher policy premiums to compensate for these higher-than-average healthcare expenses. This means that drivers in New York end up paying higher premiums to cover the cost of potential medical claims arising from car accidents.

In addition to high medical costs, there are other factors that contribute to the high cost of auto insurance in New York. These include the state's no-fault insurance system, which requires additional personal injury protection, the high risk of theft or vandalism, and severe weather conditions that increase the likelihood of accidents and damage.

Switching States: Transferring Auto Insurance from NY

You may want to see also

Extra insurance requirements

New York has some of the most expensive car insurance costs in the US, with the average driver spending $3,433 on coverage annually. The state has more insurance requirements than most other states, which contributes to the high cost of car insurance.

New York is a no-fault state, meaning that drivers must file a claim with their insurance provider after an accident, regardless of who is at fault. No-fault states tend to have additional insurance requirements, such as personal injury protection (PIP) insurance, which increases the overall cost of insurance for drivers.

In New York, drivers are required to have the following minimum insurance coverage:

- $10,000 for property damage per accident

- $25,000 for bodily injury and $50,000 for death per person in an accident

- $50,000 for bodily injury and $100,000 for death for all people in an accident

In addition to the above, New York drivers must also carry PIP and uninsured motorist insurance. These coverage requirements are above what is typically seen in most states, which usually only require some form of liability-only coverage. The number of coverages included in a policy increases the premium, making New York auto insurance more expensive.

While it is possible to find affordable car insurance in New York, drivers must carefully consider their options and compare quotes from different providers. It is also important to understand the state's insurance requirements and ensure that the policy provides the necessary coverage.

American Family Auto Insurance: Is It Worth the Hype?

You may want to see also

Severe weather risks

New York is part of the Mid-Atlantic region, which is at high risk of hurricanes and winter storms. Winter storms, which typically occur between October and April, can make even the safest roads treacherous. Hurricanes, on the other hand, increase the likelihood of flooding, which can result in total losses for vehicles. Both severe accidents and total losses are costly for insurance companies to pay out, so carriers mitigate the financial risks associated with these events by charging higher premiums.

New York's location in the Mid-Atlantic region, where hurricanes and winter storms are common, is a significant factor in the high cost of auto insurance in the state, particularly in New York City. The increased likelihood of severe weather events, such as hurricanes and winter storms, contributes to higher premiums as insurance companies anticipate more costly claims.

Winter storms can make driving conditions hazardous, even for experienced drivers on familiar roads. Hurricanes, on the other hand, bring the risk of flooding, which can result in total losses for vehicles. These severe weather events not only increase the likelihood of accidents but also raise the chances of vehicles being damaged beyond repair.

Insurance companies, in an effort to manage their financial exposure, pass on some of the costs associated with these risks to policyholders. As a result, drivers in New York, especially those in New York City, face higher insurance premiums to account for the increased possibility of severe weather-related incidents.

Full Coverage Auto Insurance: Louisiana's Essential Protection

You may want to see also

High risk of theft or vandalism

New York City has a high risk of theft and vandalism, which is a major factor in the high cost of auto insurance in the city. The city's dense urban areas and high traffic patterns increase the risk of accidents and vehicle crimes.

Theft and vandalism are covered by most homeowner insurance policies, but only up to a certain limit. This means that if the full extent of the loss from a burglary or vandalism incident is not covered, individuals may need to seek legal assistance to protect their rights and receive fair compensation.

Theft and vandalism are prevalent in New York City, with a high number of shoplifting arrests and a significant impact on the city's overall crime rate. The city's high cost of living and income disparities may also contribute to theft and vandalism rates, as some individuals may resort to petty crimes to survive.

New York's vandalism laws categorise vandalism crimes as criminal mischief or criminal tampering, with penalties ranging from misdemeanours to felonies, depending on factors such as the mental state, cost of damage, type of property damaged, and means used to carry out the damage.

The high risk of theft and vandalism in New York City leads to more frequent insurance claims, resulting in higher auto insurance premiums for residents.

Auto Insurance Simplified: Comprehensive Coverage Explained

You may want to see also

Frequently asked questions

The average cost of car insurance in New York is $3,443 per year, more than double the national average of $1,424.

Some factors that contribute to the high cost of auto insurance in NYC include high healthcare costs, additional insurance requirements, severe weather risks, and a higher risk of theft or vandalism.

Auto insurance rates in New York have been increasing over the years. From 2015 to 2021, premiums in the state increased by $485, or 14.2% on average.

To save money on auto insurance in NYC, you can compare rates from different providers, purchase multiple policies from one provider, look for available discounts, use a comparison tool, raise your deductible, or consider pay-per-mile insurance if you don't drive regularly.