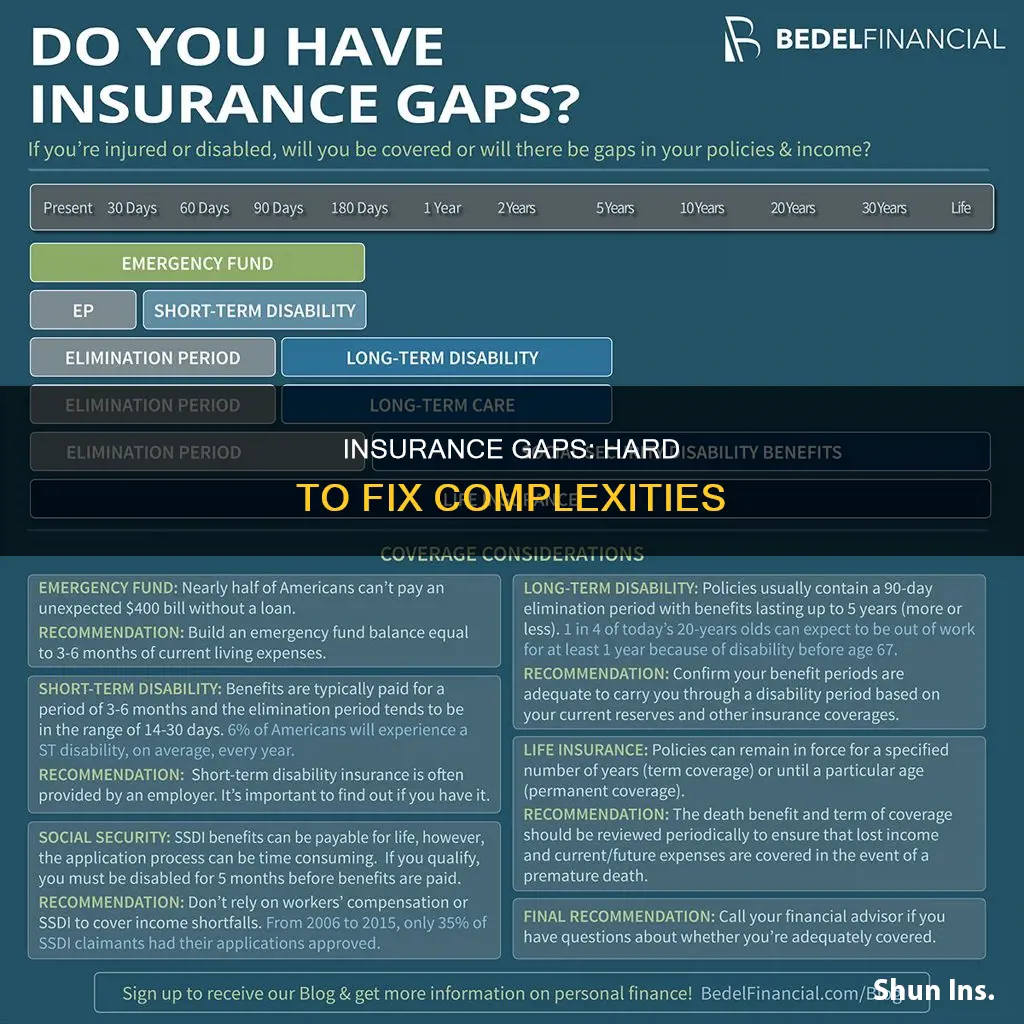

Gaps in insurance coverage can have serious consequences for individuals, especially those with chronic conditions and low incomes. When individuals lose health insurance, even briefly, their access to care is negatively impacted. They are less likely to have a usual source of care, are more likely to lack confidence in obtaining care, and are more likely to have unmet needs. This results in a decrease in the use of preventative services and an increased chance of incurring medical debt. Additionally, gaps in coverage can lead to a decline in overall health or the development of new physical difficulties.

In the context of car insurance, gaps can occur when the current value of a vehicle is less than the balance of a loan or lease. This is known as being upside down on your loan. Gap insurance, or guaranteed auto protection, is an optional coverage that can help bridge this gap and protect individuals from financial losses. It reimburses car owners when the payment for a total loss is less than the outstanding loan or lease balance.

| Characteristics | Values |

|---|---|

| Difficulty | Degradation in access to care |

| Loss of financial protection | |

| Increased chance of incurring medical debt | |

| Negative impact on overall health | |

| Loss of confidence in ability to obtain care | |

| Unmet needs for care or pharmaceuticals | |

| Decreased use of preventative services | |

| Gaps in insurance coverage | Financial burden |

| Inability to replace vehicle | |

| Inability to cover remaining loan balance |

What You'll Learn

Gaps in health insurance coverage can cause a degradation in access to care

People with health insurance coverage gaps are three times more likely to report not seeing a physician due to cost, relative to the fully insured. This results in a loss of access to care, including a decrease in the use of preventative services such as mammography, Pap tests, cholesterol checks, flu vaccination, and prostate and breast cancer screenings.

The lack of consistent healthcare access contributes to delayed diagnoses and treatment, which, in turn, lead to worse health outcomes and continued infection transmission. For example, individuals with chronic conditions and low incomes suffer the greatest harm without coverage.

In addition, gaps in health insurance coverage can lead to increased medical debt, as those with disrupted coverage are less likely to have a primary care visit and more likely to incur medical debt compared to those with continuous insurance coverage.

Gap Insurance: Protecting Your Car Finance

You may want to see also

Gaps can lead to a loss of access to preventative services

Gaps in insurance coverage can lead to a loss of access to preventative services, which can have detrimental effects on health outcomes. Preventative services are crucial for reducing suffering, death, and the financial burden of disease. However, many people in the United States face barriers to accessing quality preventative care due to insurance gaps.

One of the largest barriers to healthcare access is inadequate health insurance coverage. This contributes to disparities in health outcomes, as those with lower incomes are often uninsured or underinsured. Uninsured adults are less likely to receive preventive services for chronic conditions such as diabetes, cancer, and cardiovascular disease. Similarly, children without health insurance coverage may not receive appropriate treatment for conditions like asthma or critical preventive services such as dental care, immunizations, and well-child visits.

Insurance gaps can also lead to delays or foregone needed care due to out-of-pocket medical costs. Even when insurance coverage is present, high out-of-pocket expenses can deter individuals from seeking preventative services. This can result in undetected or untreated health issues, potentially leading to more severe and costly health problems over time.

Additionally, certain demographic groups are disproportionately affected by insurance gaps. For example, racial and ethnic minorities, low-income individuals, and vulnerable populations such as cancer survivors, immigrants, and refugees face greater challenges in accessing preventative care due to insurance gaps. These disparities contribute to higher rates of chronic diseases, higher morbidity and mortality rates, and inferior health outcomes within these communities.

The lack of a diverse healthcare force that reflects the diversity of the American public further exacerbates these issues. It can lead to communication issues, cultural barriers, and mistrust between providers and patients, making it more difficult for individuals from underrepresented groups to access and utilise preventative services.

In conclusion, insurance gaps can create significant obstacles to accessing preventative services, which are essential for maintaining good health and reducing the burden of disease. Addressing these gaps is crucial for ensuring equitable access to healthcare and improving health outcomes, especially for vulnerable and underrepresented communities.

Insurance Revoked: DMV Notified?

You may want to see also

Gaps can cause an increase in medical debt

Gaps in insurance coverage can cause an increase in medical debt. In the first quarter of 2023, household debt in America rose to $17.05 trillion, with medical debt being one of the types of debt held by many Americans. While health insurance is intended to protect patients from unaffordable healthcare costs, gaps in coverage leave individuals financially vulnerable when seeking medical care. These gaps include inadequate enrollment in comprehensive healthcare coverage, high-deductible health plans, and skinny health plans.

High-deductible plans are designed to increase patients' financial exposure through high cost-sharing in exchange for lower monthly premiums. Many individuals enrolled in these plans cannot afford the cost-sharing required by their health plan. A recent Federal Reserve report found that 37% of adults would not be able to afford a $400 emergency, an amount that is $1,000 less than the average general annual deductible for single, employer-sponsored coverage. High-deductible plans contribute to medical debt as individuals struggle to pay their medical bills.

Skinny health plans, or short-term limited-duration health plans, cover fewer benefits and include little to no consumer protections. These plans often lead to surprise gaps in coverage, leaving patients responsible for their entire medical bill without any help from their health plan. As a result, patients with skinny health plans may accumulate significant medical debt, especially for critical services such as emergency medical and oncology care.

The decision by some states not to expand Medicaid further exacerbates the problem of medical debt. States that chose to broaden their public health insurance for low-income individuals saw a significant decline in total medical debt. In contrast, states that did not expand Medicaid experienced smaller reductions in medical debt, with the gap in amounts owed by high-income and low-income residents widening.

To address the increase in medical debt, it is crucial to ensure that all individuals have access to affordable, comprehensive healthcare coverage with manageable cost-sharing. This includes removing providers from the collection of cost-sharing, restricting the sale of high-deductible plans, prohibiting the sale of skinny health plans, and lowering the maximum out-of-pocket cost limits. By addressing these gaps in insurance coverage, we can help reduce the financial burden of medical debt on individuals.

Vehicle Zones: Insurance Coverage Areas

You may want to see also

Gaps can lead to a decline in overall health

Gaps in health insurance coverage can lead to a decline in overall health. When individuals lose health insurance, even for a short time, they are less likely to have a usual source of care, are more likely to lack confidence in their ability to obtain care, and are more likely to have unmet needs for care or pharmaceuticals.

The literature on the topic suggests that gaps in health insurance coverage lead to a degradation in access to care. Individuals with coverage gaps are less likely to receive preventive health services like mammography, Pap tests, cholesterol checks, flu vaccination, and prostate and breast cancer screenings.

Additionally, the loss of coverage increases the chance of incurring medical debt. Those with disrupted coverage are less likely to have a primary care visit and more likely to have unmet health care needs and medical debt.

The consequences of health insurance coverage gaps are particularly significant for those with chronic conditions and low incomes. Gaps in coverage can lead to a decline in overall health, including mental health.

Furthermore, the household wealth gap can also negatively impact mental health. The relative deprivation experienced by individuals due to income and wealth inequality can significantly affect their health status.

Overall, gaps in health insurance coverage can lead to a decline in overall health, including physical and mental health, particularly for vulnerable populations.

Gap Insurance: DCU's Coverage Options

You may want to see also

Gaps can cause financial losses

Gaps in insurance coverage can lead to significant financial losses, especially when individuals experience unforeseen events or accidents. Here are some ways that gaps can result in financial losses:

Loss of Coverage and Access to Care

Gaps in health insurance coverage can lead to a loss of access to healthcare services. Individuals who experience a lapse in insurance are more likely to face barriers when seeking medical care. They may be less likely to have a usual source of care, feel confident in their ability to obtain treatment, or have their healthcare needs met. This disruption in coverage can result in a decrease in the use of preventative services, such as cancer screenings or immunizations, which are crucial for maintaining overall health.

Increased Medical Debt

The loss of insurance coverage increases the likelihood of incurring medical debt. Individuals with disrupted coverage are more likely to face financial challenges when it comes to paying for healthcare services. They may struggle to keep up with medical bills, leading to a buildup of debt. This can be particularly burdensome for individuals with chronic conditions or low incomes, who may be unable to afford the necessary treatments without adequate insurance coverage.

Negative Impact on Overall Health

Gaps in health insurance coverage can have a direct impact on an individual's health. Research has shown that those with coverage gaps are more likely to experience a major decline in overall health or develop new physical difficulties. This is especially concerning for individuals with pre-existing conditions, as the lack of continuous coverage can exacerbate their health issues.

Vehicle Depreciation and Loan Balance

When purchasing a new vehicle, it is common for individuals to make a small down payment and finance the rest over an extended period. However, this can create a gap between the depreciated value of the car and the outstanding loan balance. In the event of an accident or total loss, standard car insurance may only cover the current market value of the vehicle, leaving individuals with a financial burden to cover the remaining loan amount.

Inadequate Homeowners Insurance

Homeowners insurance policies may not always provide the expected level of coverage in the event of a disaster. Many policies have caps on replacement costs, and there may be exclusions or exceptions for certain types of damage, such as those caused by floods, earthquakes, or hurricanes. Individuals may find themselves underinsured, leading to financial strain when trying to rebuild or repair their homes.

To avoid financial losses due to insurance gaps, it is crucial to regularly review and understand your insurance policies, seek clarifications from insurers or agents, and ensure that your coverage aligns with your changing needs and circumstances.

Gap Insurance: Who Qualifies?

You may want to see also

Frequently asked questions

Gap insurance is an optional type of insurance that covers the difference between the compensation received after a total loss of an asset and the amount still owed on its financing.

Gap insurance is important because it protects individuals from financial losses when the asset's value depreciates faster than the loan can be paid off.

Gap insurance is particularly relevant when an individual has a long-term loan, has made a low down payment, or has rolled over negative equity from a previous loan.

Gap insurance can be purchased from car dealerships, lenders, or traditional insurance companies, but it is often added to an existing insurance policy.