Many people are often surprised by the cost of their monthly insurance premiums, especially when they compare it to the coverage they receive. Understanding why your insurance premiums can be so high is essential to making informed decisions about your financial well-being. This paragraph will explore the various factors that can contribute to higher insurance costs, such as age, health status, location, and the type of coverage you choose. By delving into these aspects, you can gain a clearer understanding of why your insurance premiums might be higher than expected and potentially find ways to manage and reduce these costs.

What You'll Learn

- Income and Assets: Higher income or valuable assets can increase insurance premiums

- Health and Lifestyle: Poor health, smoking, or risky activities may lead to higher rates

- Age and Gender: Younger, male drivers often pay more due to statistical trends

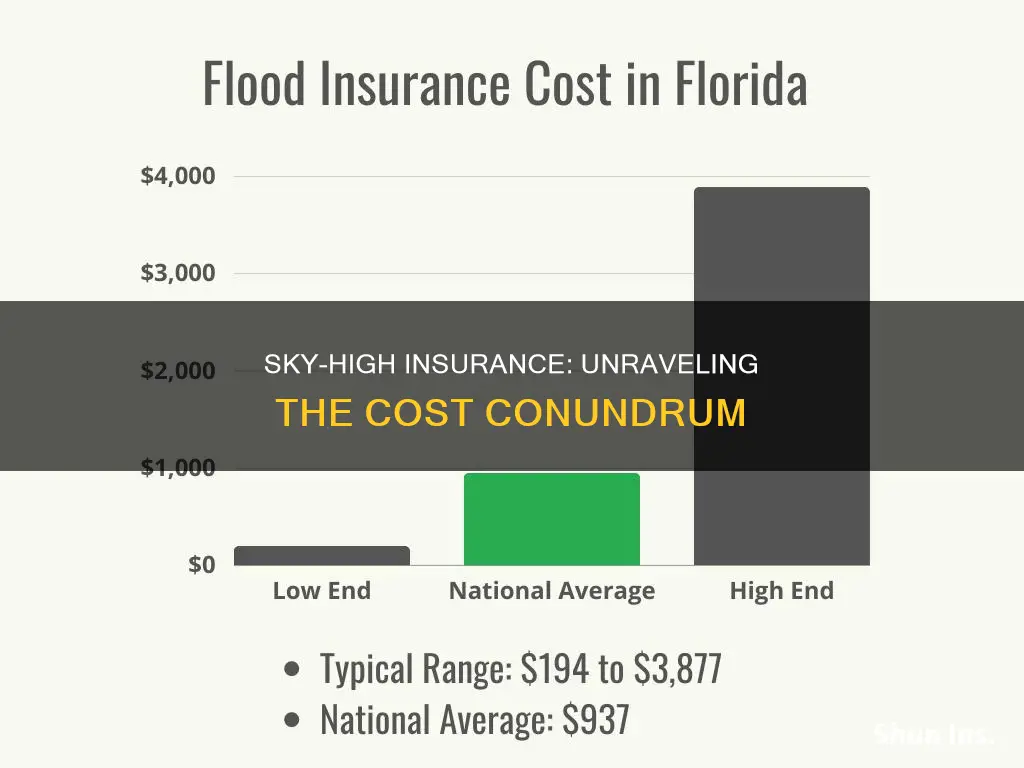

- Location and Vehicle: Urban areas, high-crime neighborhoods, and luxury cars can raise costs

- Claims History: Multiple claims or accidents in the past can significantly impact premium prices

Income and Assets: Higher income or valuable assets can increase insurance premiums

The cost of insurance can vary significantly based on an individual's financial situation, and this is often a result of the relationship between income and assets. Higher income and valuable assets can indeed lead to increased insurance premiums, and understanding why this is the case is essential for anyone looking to manage their insurance costs effectively.

For many insurance companies, an individual's income is a critical factor in assessing risk. When you earn a higher income, it often indicates a greater capacity to afford more expensive items and a larger financial cushion. This can be a double-edged sword in the insurance context. On one hand, a higher income suggests that you might be insuring more valuable assets, such as a luxury car or a high-end home. These items typically require more comprehensive insurance coverage, which can result in higher premiums. Additionally, a higher income may imply a greater potential for financial loss if something were to happen, making the insurance company view you as a higher-risk client.

Assets, such as property, investments, or valuable collections, also play a significant role in determining insurance rates. If you own valuable assets, you are more likely to file a claim in the event of a loss, as these items have a higher monetary value. Insurance companies often require policyholders to declare the value of such assets, and this information is used to calculate the premium. For instance, insuring a high-end sports car or a valuable piece of art will likely result in a higher premium due to the increased risk and potential payout associated with these items.

Moreover, a higher income can indirectly impact insurance costs through the tax system. In some countries, insurance premiums are tax-deductible expenses, which means that individuals with higher incomes may benefit from this deduction, potentially reducing their overall insurance costs. However, this advantage is often offset by the higher premiums they may pay due to their financial situation.

In summary, income and assets are key determinants of insurance premiums. Higher income and valuable assets can lead to increased insurance costs because they suggest a greater potential for financial loss and a higher risk profile. Understanding these factors can help individuals make informed decisions about their insurance coverage and explore options to manage their premiums effectively.

Auto Insurance in Ohio: Understanding the Legal Requirements

You may want to see also

Health and Lifestyle: Poor health, smoking, or risky activities may lead to higher rates

When it comes to insurance premiums, your health and lifestyle choices play a significant role in determining the cost. Insurance companies often consider various factors to assess the risk associated with insuring an individual, and these factors can directly impact the amount you pay each month. One of the primary reasons why your monthly insurance rates might be high is your overall health and lifestyle.

Poor health can significantly contribute to increased insurance premiums. Individuals with pre-existing medical conditions or chronic illnesses often require more frequent medical attention and may have higher healthcare costs. For example, if you have a history of heart disease, diabetes, or cancer, insurance providers might consider you a higher-risk client. This is because these conditions can lead to more frequent hospital visits, medical procedures, and long-term treatment, which translates to higher insurance costs. Similarly, individuals with a sedentary lifestyle or those who are overweight or obese may also face higher premiums due to the increased likelihood of developing health issues.

Smoking is another critical factor that can drive up insurance rates. The harmful effects of smoking are well-documented and can have severe consequences for your health. Smokers are at a higher risk of developing various diseases, including lung cancer, heart disease, and respiratory issues. Insurance companies often view smokers as high-risk individuals due to the potential long-term health complications associated with smoking. As a result, they may charge higher premiums to offset the anticipated medical expenses and increased likelihood of health-related claims.

Engaging in risky activities or hobbies can also impact your insurance rates. Certain activities, such as extreme sports, skydiving, or racing, are considered more dangerous and may lead to higher insurance premiums. These activities often involve a higher risk of injury or accidents, which can result in more frequent insurance claims. Additionally, hobbies like racing cars or motorcycles can also be a concern, as they may increase the likelihood of accidents and subsequent insurance payouts. Insurance providers take these factors into account when calculating premiums, as they aim to ensure that the policyholders are adequately covered for potential risks.

In summary, your health and lifestyle choices have a direct impact on your insurance premiums. Poor health, smoking, and engaging in risky activities can all contribute to higher insurance rates. Insurance companies use these factors to assess the potential risks and costs associated with insuring an individual. By maintaining a healthy lifestyle, quitting smoking, and avoiding high-risk activities, you can potentially lower your insurance premiums and ensure that you are adequately protected. It is essential to be mindful of these factors and make informed decisions to manage your insurance costs effectively.

Full AAA Auto Insurance Coverage: What's Included?

You may want to see also

Age and Gender: Younger, male drivers often pay more due to statistical trends

The insurance industry has long recognized that younger, male drivers often face higher insurance premiums, and this is primarily due to statistical trends and historical data. On average, younger males are statistically more likely to be involved in traffic accidents and file insurance claims. This is a well-documented phenomenon and is influenced by various factors.

One of the primary reasons is the higher risk-taking behavior associated with younger males. Research suggests that younger drivers, especially those in their teens and early twenties, are more prone to engaging in risky driving behaviors such as speeding, reckless driving, and driving under the influence. These actions significantly increase the chances of accidents and, consequently, insurance claims. Insurance companies use statistical models to predict the likelihood of accidents based on age, gender, and other demographics, and these models often indicate higher risk for younger males.

Additionally, the cost of medical treatment and property damage associated with accidents involving younger males can be higher. This is partly due to the higher average age and health status of younger males, who may require more extensive medical care after an accident. Insurance companies factor in these potential costs when setting premiums, as they need to ensure they have sufficient funds to cover potential claims.

Furthermore, the insurance industry's historical data plays a role in this trend. Over time, insurance companies have observed that younger males have a higher incidence of accidents and claims, leading to higher average costs. This data-driven approach influences premium calculations, as companies aim to balance the need to cover potential losses with the desire to attract and retain customers.

It's important to note that while younger males may face higher insurance premiums, other factors also contribute to insurance costs. Age and gender are just two of many variables that insurance companies consider. Other factors, such as driving experience, vehicle type, location, and driving record, also play a significant role in determining insurance rates. Understanding these statistical trends can help individuals make informed decisions about their insurance coverage and potentially find ways to reduce their premiums.

Maryland Auto Insurance: Unraveling the MD Requirement for PIP Coverage

You may want to see also

Location and Vehicle: Urban areas, high-crime neighborhoods, and luxury cars can raise costs

Living in an urban area can significantly impact the cost of your insurance premiums. City centers often have higher population densities, which means more potential accidents and claims. Insurance companies consider the increased risk of accidents and theft in these areas, leading to higher rates. For instance, if you reside in a bustling metropolis, you might find that your monthly insurance bill is higher compared to someone in a rural setting. This is because the likelihood of incidents, such as collisions or break-ins, is generally higher in urban environments.

The neighborhood you live in also plays a crucial role in determining insurance costs. High-crime neighborhoods are often associated with a higher risk of theft, vandalism, and other criminal activities. Insurance providers take this into account when calculating premiums. If your home or vehicle is in a location with a reputation for crime, you may face higher insurance rates. This is a direct result of the increased potential for losses and the higher likelihood of making insurance claims.

The type of vehicle you drive is another critical factor. Luxury cars, sports cars, and high-performance vehicles often come with a higher price tag when it comes to insurance. These cars tend to have a higher value, making them more attractive targets for theft. Additionally, they may have more expensive repair costs, which can drive up insurance premiums. Insurance companies consider the make, model, and age of your vehicle, and if it falls into the luxury or high-performance category, you might notice a significant increase in your monthly insurance expenses.

Furthermore, the age and condition of your vehicle matter. Older cars or those with a history of accidents or repairs may be considered high-risk. Insurance companies might charge more for insuring these vehicles due to the potential for future claims. Similarly, if your car is in poor condition or has been involved in previous accidents, the insurance provider may adjust the premium accordingly.

In summary, the location and the type of vehicle you own have a direct impact on your insurance costs. Urban areas, high-crime neighborhoods, and luxury cars can all contribute to higher premiums. Understanding these factors can help you make informed decisions to potentially lower your insurance expenses.

Audi Connect: Insurance Tracking System?

You may want to see also

Claims History: Multiple claims or accidents in the past can significantly impact premium prices

The frequency and nature of your insurance claims can have a substantial impact on the cost of your monthly premiums. Insurance companies often use a person's claims history as a key factor in determining the risk associated with insuring them. If you have a history of multiple claims, especially those related to accidents, it indicates a pattern of frequent incidents, which can be a red flag for insurers. This pattern suggests that you may be more prone to making future claims, and thus, the insurance provider may consider you a higher-risk customer.

When you file a claim, it is recorded in your insurance profile, and this information is shared among insurance companies. If you've had multiple accidents and filed claims in the past, it suggests a higher likelihood of future incidents. Insurers often use statistical models to predict the likelihood of future claims based on past data. A history of frequent claims can lead to a higher risk assessment, resulting in increased premium prices. For example, if you've had multiple car insurance claims due to accidents, the insurer may conclude that you are more likely to be involved in further accidents, and therefore, they may increase your premium to compensate for this perceived higher risk.

The impact of a claims history on premium prices is often more pronounced in certain types of insurance. For instance, in the case of auto insurance, multiple accident claims can significantly raise the premium. Insurers may view you as a high-risk driver, especially if the accidents were caused by your negligence or were your fault. Similarly, in health insurance, a history of frequent medical claims or hospital visits can lead to higher premiums, as it indicates ongoing health issues or a higher utilization of healthcare services.

It's important to note that the severity of the accidents and the time elapsed since the last claim also play a role. Even if you've had a single major accident in the past, it may still impact your premiums for a few years. However, if you've had multiple minor accidents or claims over a short period, the impact on your premiums could be more significant. Insurance companies often consider the frequency and pattern of claims rather than just the number of claims alone.

Understanding your claims history and its potential impact on your insurance premiums is essential. If you have a history of multiple claims, consider reviewing your insurance policies and seeking ways to improve your risk profile. This might include improving your driving record, maintaining a good health status, or taking steps to prevent future accidents or claims. By proactively managing your risk factors, you may be able to negotiate lower premiums or find more affordable insurance options that better suit your needs.

Credit Checks: Auto Insurance's Hard Pull

You may want to see also

Frequently asked questions

Insurance premiums can vary significantly based on several factors, including your age, health, location, and the type of coverage you choose. For instance, if you're a young driver, your car insurance might be higher due to the increased risk of accidents. Similarly, comprehensive health insurance plans often come with higher premiums to cover a wider range of medical expenses. Additionally, living in an area with a higher crime rate or natural disaster risk can also impact your insurance costs.

There are several strategies to reduce insurance costs. Firstly, consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. This can lower your premium but ensure you have enough savings to cover the deductible. Another option is to review your coverage and cancel any unnecessary add-ons or riders. Shopping around and comparing quotes from different insurance providers can also help you find more competitive rates.

Yes, there are various programs and incentives to assist with insurance expenses. Government-sponsored health insurance programs like Medicaid or Medicare offer affordable coverage options for eligible individuals. Additionally, many employers provide group health insurance plans, which often come with lower premiums compared to individual policies. These programs can significantly reduce your insurance costs, especially for essential health coverage.