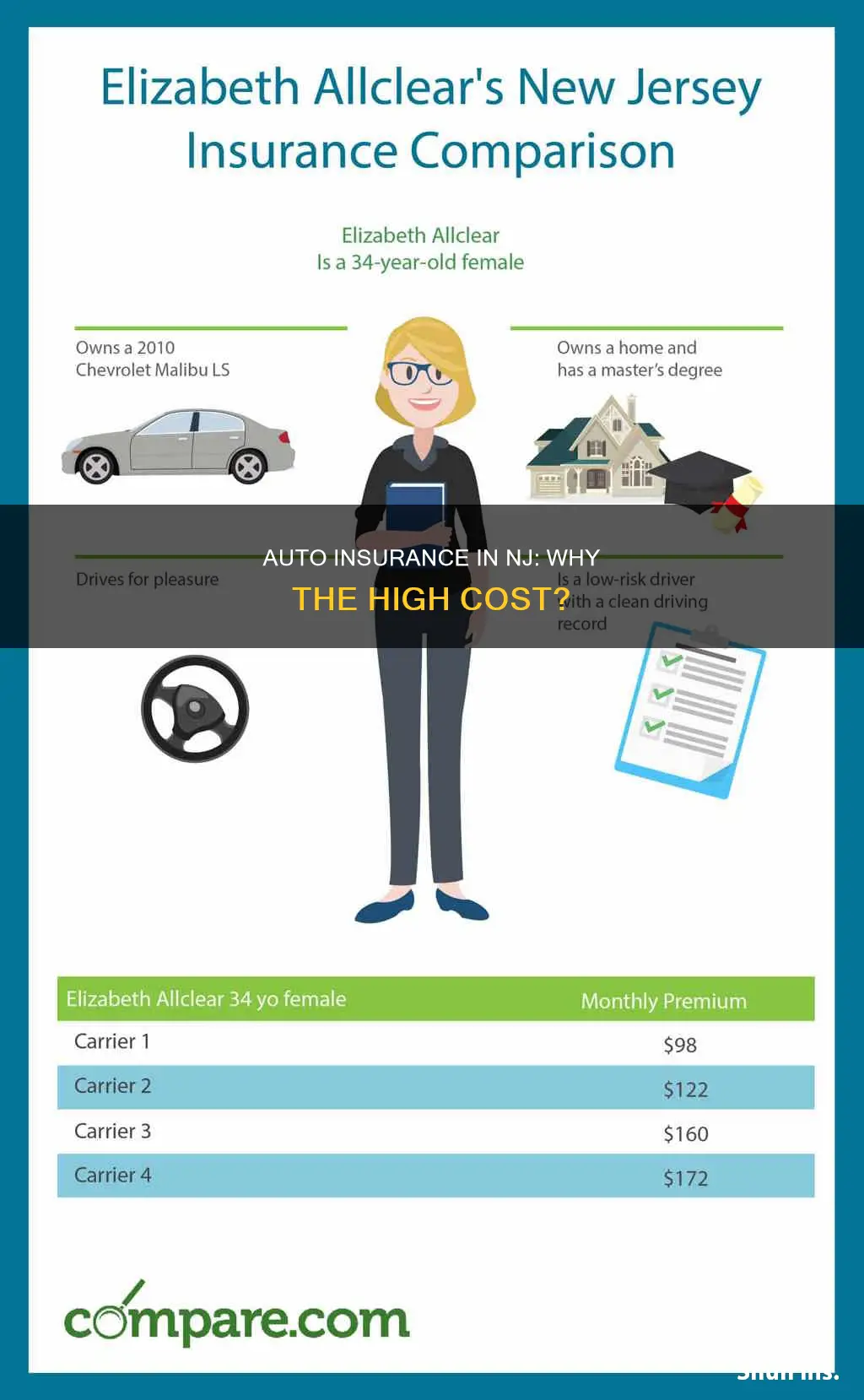

New Jersey has some of the most expensive car insurance rates in the country. The average cost of car insurance in the state is $117 per month for minimum coverage and $253 per month for full coverage. There are several reasons why car insurance in New Jersey is so expensive. One of the main factors is the state's high population density and urbanization, which increase the likelihood of traffic accidents, thefts, and vandalism. Additionally, New Jersey has strict legal requirements for car insurance, including personal injury protection, which can drive up the cost. The state's high living costs and the rising cost of vehicle repairs and medical expenses also contribute to higher insurance premiums.

| Characteristics | Values |

|---|---|

| Average cost of car insurance | $1,827 per year for full coverage |

| $1,052 per year for minimum coverage | |

| Average monthly cost | $152 for full coverage |

| $88 for minimum coverage | |

| Ranking in the U.S. | 5th highest |

| Factors influencing the cost | Driving record, age, location, credit score, vehicle type, coverage level, collision and comprehensive insurance, gender, marital status |

What You'll Learn

New Jersey's no-fault status for insurance

New Jersey is a "no-fault" state for insurance. This means that drivers file claims with their own insurance companies following a collision, regardless of who caused the accident. In a no-fault state, each driver's insurance will pay for their medical costs, lost wages, and essential services no matter who is to blame for the accident. However, the at-fault driver will still be held responsible for vehicle repairs.

In New Jersey, drivers are required to carry personal injury protection (PIP) coverage. PIP covers the cost of treatment and any medical equipment. PIP can also provide reimbursement for expenses related to an injury sustained in a car accident, including income continuation or essential services.

New Jersey's car insurance system is often referred to as "choice" no-fault, as drivers can choose between the "limited" and "unlimited" right to sue after a car accident. With a Basic Policy, the claimant is automatically bound by a "limited right to sue". The injured person can only pursue legal action against the at-fault driver if the accident caused significant disfigurement, scarring, a displaced fracture, or permanent injury. With a Standard Policy, the claimant has an "unlimited right to sue", meaning there are no restrictions on their right to sue.

Insurance Gaps: Hidden Costs Revealed

You may want to see also

Rising auto theft

Auto theft is a rising problem in New Jersey, with a 21.5% increase in the rate of car thefts from 2017 to 2022. This has posed an increased risk of payouts for car insurance companies, contributing to higher insurance premiums for New Jersey residents.

Auto theft is a serious issue, as stolen vehicles are often used to commit other, often violent, crimes. In response to the rise in auto theft, Governor Phil Murphy has announced new legislation to protect New Jersey residents. The Office of the Attorney General has taken a comprehensive approach to combating auto theft, including re-launching the "Lock It or Lose It" public awareness campaign. This campaign aims to discourage residents from leaving their cars unlocked with the key fob inside, as the majority of stolen vehicles had the key fob left inside.

The Auto Theft Task Force (ATTF), led by the New Jersey Division of State Police, was formed to address the spike in auto thefts. The task force works to recover stolen vehicles and investigate car theft organizations. Over the course of 2022, the task force recovered dozens of stolen vehicles worth millions of dollars.

In addition to law enforcement efforts, technology is also being leveraged to combat auto theft. Governor Murphy has announced a $17 million investment in automated license plate recognition technology and gunshot detection equipment to reduce motor vehicle theft and gun violence in the state.

To protect yourself from auto theft, it is important to take preventive measures such as ensuring your vehicle is locked, never leaving valuables in sight, and using anti-theft devices such as steering wheel locks and vehicle tracking devices.

Get Your Auto Insurance Claim Admitted: Strategies to Force Acceptance

You may want to see also

Increasing fatal accidents

An increase in fatal accidents in New Jersey has been a significant contributor to rising auto insurance rates in the state. According to Crime Data Explorer, between 2017 and 2021, there was a concerning 13.2% increase in the state's fatal accident rate. This trend has undoubtedly captured the attention of insurance companies, who are faced with the reality of increased financial risk.

The consequences of these tragic accidents extend beyond the immediate loss of life. They trigger substantial insurance payouts to cover medical expenses and property losses. As a result, insurance companies are forced to reevaluate their rates to account for this heightened financial exposure.

The issue of fatal accidents is further exacerbated by the fact that New Jersey is a "no-fault" state for insurance. In the event of a collision, regardless of who is at fault, drivers must file claims with their own insurance companies. This system inherently increases the number of claims made, as both parties involved in an accident will need to seek compensation from their respective insurers.

The impact of fatal accidents on insurance rates is not limited to New Jersey. On a national scale, the rate of fatalities per hundred million vehicle miles travelled reached a historic low of 1.6. However, this low rate of fatalities has not prevented insurance premiums from rising across the country.

The decrease in fatalities may be a factor in the rising insurance rates, as insurance companies seek to maintain profitability in the face of decreasing revenue streams. As the number of claims decreases, insurance companies may adjust their rates to ensure they can continue to cover the costs of severe accidents, which often result in substantial payouts.

While the increase in fatal accidents is a contributing factor to the high cost of auto insurance in New Jersey, it is important to consider other factors as well. Insurance rates are complex and dynamic, influenced by a multitude of variables, including an individual's driving record, age, credit score, and location.

Understanding Auto Insurance: Decoding 300K CSL Coverage

You may want to see also

Inflation

The impact of inflation on car insurance rates in New Jersey is evident when comparing the state's insurance costs to the national average. New Jersey's average annual cost for minimum-coverage car insurance is 62% higher than the national average. The state's full-coverage insurance costs are also significantly higher, with an average annual premium of $1,827, compared to the national average of $1,330.

In addition to inflation, other factors contributing to the high cost of car insurance in New Jersey include the state's no-fault status, rising auto theft rates, and an increase in fatal accidents. The required personal injury protection coverage in New Jersey also significantly affects insurance costs.

The rising cost of car insurance due to inflation and other factors has led to concerns about the affordability of coverage for low-income drivers. Some experts argue that the mandated minimum coverage limits may provide more protection than some drivers need or can afford. As a result, there are worries that the increasing costs could lead to more drivers forgoing insurance altogether, potentially raising the uninsured rate in the state.

U.S. Auto Insurance: Understanding Ton Pickup Truck Coverage

You may want to see also

High population density

New Jersey's high population density is a significant factor contributing to its expensive auto insurance rates. Population density is closely linked to various factors that influence insurance costs.

Firstly, urban areas with higher population densities tend to have more congested roads and heavier traffic. This increases the risk of collisions and accidents, leading to higher insurance rates. The greater the number of drivers on the road, the more likely it is for claims to occur, which insurance companies need to offset.

Secondly, population density is associated with higher rates of vehicle-related crimes, such as theft or vandalism. Statista has calculated crime statistics that show a higher likelihood of vehicle damage or theft in certain areas. Insurance companies charge higher rates in these areas to insure against potential losses.

Additionally, population density can impact the cost of insurance by affecting the duration or distance of commutes. Longer commutes mean spending more time on the road, increasing the chances of being involved in a collision. As a result, insurance companies may charge higher rates for individuals with longer commutes, even if they relocate to areas with better driving conditions or safer environments.

Furthermore, population density is often correlated with higher living costs. Higher living expenses can lead to higher insurance rates as companies take into account the overall financial landscape of an area when setting premiums.

Lastly, population density can be a factor in determining the stringency of legal requirements and regulations related to auto insurance. States with higher population densities may have more comprehensive insurance mandates, which can contribute to higher insurance costs.

While there are other factors influencing insurance rates in New Jersey, such as driving history, age, and credit score, population density plays a significant role in making auto insurance in the state more expensive compared to other regions.

Unlicensed Vehicles: Need Insurance?

You may want to see also

Frequently asked questions

New Jersey's auto insurance rates are high due to factors such as high population density, urbanization, high living costs, and stringent legal requirements. The state's no-fault status and rising auto theft rates also contribute to higher premiums.

A clean driving record can result in lower insurance premiums, while accidents, violations, and DUIs may increase rates. These can remain on your record for several years, impacting your insurance costs.

Age is a significant factor, with younger and less experienced drivers often facing higher rates due to the increased risk of accidents. Rates typically decrease with age, becoming more affordable for mature and senior drivers.

The type of vehicle you drive can affect insurance rates. High-performance, luxury, or newer vehicles with higher repair costs and an increased risk of theft tend to be more expensive to insure.