Permanent life insurance, while offering long-term coverage and potential cash value accumulation, may not be the best choice as a retirement supplement. This is because the primary purpose of permanent life insurance is to provide a death benefit to beneficiaries, not to generate retirement income. The premiums for permanent life insurance can be substantial, and the cash value growth, if any, is typically slow and may not keep pace with the rising costs of retirement. Additionally, the tax-deferred growth in the cash value is not guaranteed and can be subject to market volatility. As a result, permanent life insurance may not be an efficient or cost-effective way to supplement retirement savings, and other retirement income sources should be carefully considered to ensure a secure and sustainable retirement plan.

What You'll Learn

- High Costs: Permanent life insurance can be expensive, potentially outpacing savings for retirement

- Tax Implications: The tax treatment of permanent life insurance may not be favorable for retirement funds

- Limited Flexibility: It may not offer the flexibility needed for retirement income adjustments

- Market Volatility: Policy values can fluctuate, impacting retirement savings

- Alternative Investments: Other vehicles may provide better returns and liquidity for retirement

High Costs: Permanent life insurance can be expensive, potentially outpacing savings for retirement

The high costs associated with permanent life insurance can be a significant deterrent for those seeking to supplement their retirement savings. While it provides lifelong coverage, the financial burden it imposes can be substantial, often surpassing the savings accumulated for retirement. This is particularly true for those with larger coverage amounts, as the premiums can be substantial. The cost of permanent life insurance is derived from the insurance company's need to guarantee a death benefit and maintain the policy's cash value over time. This results in higher premiums compared to term life insurance, which only provides coverage for a specified period.

For individuals, the expense of permanent life insurance can be a challenge, especially when considering the long-term financial goals of retirement. The premiums may be a significant monthly or annual expense, potentially diverting funds that could otherwise be allocated to retirement savings. Over time, these premiums can accumulate and, in some cases, exceed the total savings one has set aside for retirement. This is especially true if the individual has a substantial coverage amount, as the insurance company needs to ensure the policy's value and the death benefit, which contributes to the higher costs.

The complexity of permanent life insurance policies can also contribute to the high costs. These policies often include various riders and options, such as accelerated death benefits or long-term care riders, which can increase the overall price. While these additional features may provide valuable benefits, they can also make the policy more expensive, especially if the individual doesn't require or utilize these extra protections. As a result, the overall cost of the policy can be higher than what is necessary for basic life insurance coverage.

Furthermore, the investment component of permanent life insurance, known as the cash value, can also impact the overall cost. The cash value grows over time, providing a tax-deferred investment opportunity. However, this growth is often slow, and the returns may not keep pace with inflation, especially in a low-interest-rate environment. As a result, the individual may not see significant growth in their cash value, and the policy's overall cost can still be high, making it less attractive as a retirement supplement.

In summary, the high costs of permanent life insurance can be a critical factor in its potential drawbacks as a retirement supplement. The substantial premiums, combined with the potential for slow cash value growth, may result in individuals spending more on insurance than they save for retirement. It is essential for individuals to carefully consider their financial goals and explore alternative retirement savings options to ensure they make informed decisions about their long-term financial well-being.

Understanding Connecticut Insurance Payouts: How Long Do They Take?

You may want to see also

Tax Implications: The tax treatment of permanent life insurance may not be favorable for retirement funds

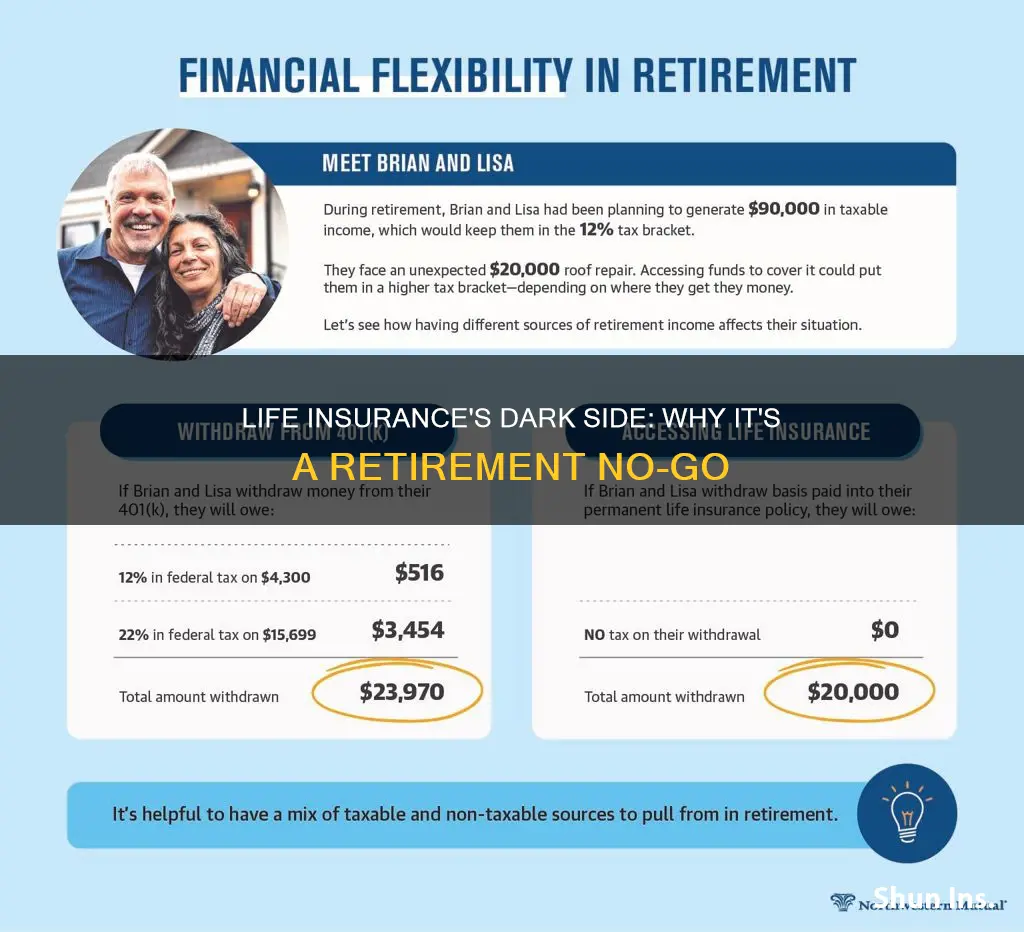

The tax implications of permanent life insurance can significantly impact its suitability as a retirement supplement. Unlike traditional retirement accounts, such as 401(k)s or IRAs, permanent life insurance policies are not subject to the same tax-advantaged treatment. When you invest in a retirement fund, contributions are typically tax-deductible, and earnings grow tax-free until withdrawal. However, with permanent life insurance, the situation is different.

One critical aspect is the taxation of policy loans and withdrawals. Policyholders can borrow money from their permanent life insurance policy, and these loans are generally taxable. The loan amount is treated as a distribution, and the policyholder must pay income tax on the borrowed amount. This can be a significant drawback, especially if the policyholder needs to access funds for retirement and must pay taxes on the loan, reducing the overall value of the policy.

Additionally, the cash value of a permanent life insurance policy, which grows over time, is often subject to income tax when withdrawn. The policyholder may be taxed on the investment gains and the policy's cash value, depending on the policy's structure. This tax burden can be substantial, as the cash value grows, and it may negate the potential tax benefits one might expect from a retirement supplement.

Furthermore, the tax treatment of permanent life insurance can be complex and may vary depending on the jurisdiction and the specific policy terms. It is essential to understand the tax rules and regulations in your region to make an informed decision. In some cases, the tax implications might make permanent life insurance less attractive compared to other retirement savings options, which offer more favorable tax treatment and flexibility.

In summary, the tax implications of permanent life insurance can be a significant consideration when evaluating it as a retirement supplement. The potential for taxable policy loans, the taxation of cash value withdrawals, and the complexity of tax rules may impact the overall effectiveness of this insurance type as a retirement strategy. It is advisable to consult with financial advisors and tax professionals to fully understand the tax consequences and explore alternative retirement savings options that better align with your financial goals.

Life Insurance Death Benefits: Taxable or Not?

You may want to see also

Limited Flexibility: It may not offer the flexibility needed for retirement income adjustments

Permanent life insurance, while offering lifelong coverage, may not be the ideal choice for those seeking a flexible retirement income supplement. One of the primary drawbacks is the lack of adaptability in policy terms. Once a permanent life insurance policy is in place, it becomes a long-term commitment, often with fixed premiums and benefits. This rigidity can be problematic as individuals' financial needs and circumstances evolve over time.

During retirement, individuals often require a flexible income stream that can adjust to changing economic conditions and personal preferences. Permanent life insurance, with its predetermined payout structure, may not provide the necessary adaptability. For instance, if an individual's retirement expenses decrease or their investment goals shift, the fixed death benefit of the policy might not align with their current financial needs.

The lack of flexibility in permanent life insurance can also hinder the ability to make strategic financial decisions. For example, if an individual wants to use the policy's cash value for a specific investment opportunity or to cover unexpected expenses, the process can be cumbersome and may not be as straightforward as other retirement income options. The policy's terms and regulations might restrict the ability to access funds without penalties, making it less suitable for those seeking a dynamic retirement plan.

Furthermore, the fixed nature of these policies can limit the potential for growth and accumulation. Unlike certain retirement accounts or investment vehicles, permanent life insurance may not offer the opportunity to benefit from market fluctuations or strategic investments. This can result in a less tailored and potentially less advantageous retirement income plan, especially for those who require a more personalized approach to meet their financial objectives.

In summary, while permanent life insurance provides long-term financial security, its limited flexibility in terms of income adjustments can be a significant consideration for retirees. It is essential to evaluate one's retirement goals and financial requirements to determine if this type of insurance aligns with the desired level of adaptability and customization.

Life Insurance: More Than Savings and 401(k)s

You may want to see also

Market Volatility: Policy values can fluctuate, impacting retirement savings

Market volatility is a significant concern when considering permanent life insurance as a retirement supplement. This type of insurance, often referred to as whole life or permanent life insurance, offers a guaranteed death benefit and a fixed premium, which can be attractive for long-term financial planning. However, the very nature of these guarantees can sometimes lead to market volatility, impacting the value of your retirement savings.

The primary issue arises from the investment component of permanent life insurance policies. These policies typically feature an investment account where a portion of your premium is invested in various financial instruments. The performance of these investments directly affects the cash value of your policy, which grows over time. While this investment component can provide potential for growth, it also means that your retirement savings are subject to market fluctuations.

Market volatility refers to the unpredictable and often rapid changes in the value of investments. When the stock market, bonds, or other investment assets experience a downturn, the value of your permanent life insurance policy's investment account can decrease. This reduction in value can impact your retirement savings, as the cash value of your policy may be lower than expected, potentially affecting the amount available for retirement. For instance, if you rely on the policy's cash value to provide income during retirement, a market decline could result in a smaller retirement fund than anticipated.

To mitigate this risk, it's crucial to carefully review the investment options offered by different insurance companies. Some insurers provide more stable investment choices, such as fixed-interest accounts, while others may offer more aggressive, market-linked investments. Understanding the potential risks and rewards of each investment option is essential to making an informed decision. Additionally, diversifying your investments across various asset classes can help reduce the impact of market volatility on your retirement savings.

In summary, while permanent life insurance can be a valuable tool for long-term financial planning, market volatility in the investment component can impact retirement savings. Policyholders should be aware of the potential fluctuations in policy values and carefully consider their investment choices to ensure a more stable and secure retirement supplement. Staying informed about market trends and regularly reviewing your policy's performance can help you navigate this aspect of permanent life insurance effectively.

Understanding Tax Implications of Life Insurance Cash Surrender

You may want to see also

Alternative Investments: Other vehicles may provide better returns and liquidity for retirement

When considering retirement savings and investments, it's important to explore various options that can offer both growth potential and liquidity. While permanent life insurance might be considered by some as a retirement supplement, it may not be the most suitable choice for several reasons. Firstly, permanent life insurance policies often have high upfront costs, including commissions and fees, which can eat into your investment capital. This can result in lower overall returns compared to other investment vehicles. Additionally, the cash value accumulation in these policies is typically slow and may not keep pace with inflation, potentially reducing the purchasing power of your retirement savings.

Alternative investments, such as real estate, mutual funds, or exchange-traded funds (ETFs), can provide more favorable outcomes for retirement planning. Real estate, for instance, offers the potential for both capital appreciation and rental income, providing a steady cash flow during retirement. Mutual funds and ETFs, on the other hand, offer diversification and professional management, which can lead to better risk-adjusted returns over the long term. These investment options also provide liquidity, allowing you to access your funds when needed without incurring significant penalties.

Consider investing in stocks or stock-based mutual funds, which have historically provided higher returns over extended periods. While stock markets can be volatile in the short term, they offer the potential for significant capital growth and dividend income, which can be reinvested to compound your returns. Another alternative is to explore tax-efficient retirement accounts, such as Roth IRAs or 401(k)s, which allow your investments to grow tax-free and provide tax-free withdrawals during retirement. These accounts offer flexibility and can be an excellent way to build a substantial retirement nest egg.

Furthermore, you might consider consulting a financial advisor who can provide personalized advice based on your risk tolerance, financial goals, and time horizon. They can help you navigate the complex world of investments and create a well-diversified portfolio that aligns with your retirement objectives. By diversifying your retirement investments, you can potentially achieve better returns and maintain the liquidity needed to adapt to changing financial circumstances during your retirement years.

In summary, permanent life insurance may not be the best choice for a retirement supplement due to its high costs and slow growth. Exploring alternative investments, such as real estate, mutual funds, ETFs, stocks, and tax-efficient retirement accounts, can provide better returns and liquidity. Diversification and professional guidance are key to making informed decisions and ensuring a secure retirement.

Stranger-Owned Life Insurance: Understanding Voided Policies and Legal Implications

You may want to see also

Frequently asked questions

While permanent life insurance can provide a significant death benefit, it is not typically considered an ideal retirement supplement. One of the main reasons is that the cash value in a permanent life insurance policy grows relatively slowly compared to other investment options. This slow growth means that the policy may not accumulate enough value to provide a substantial retirement income. Additionally, the high costs associated with permanent life insurance, including higher premiums and surrender charges, can make it financially inefficient for retirement planning.

The cost of permanent life insurance can be a significant factor in retirement planning. Permanent policies often have higher premiums because they offer lifelong coverage and a cash value component. These higher costs can reduce the overall retirement savings available, especially if a large portion of the budget is allocated to insurance premiums. It's important to consider alternative investment strategies that offer potentially higher returns with more manageable costs.

Yes, there are several alternatives that might be more suitable for generating retirement income. Annuities, for example, can provide a steady stream of payments during retirement. They offer various options, such as fixed, variable, or indexed annuities, each with different risk and reward profiles. Additionally, retirement accounts like 401(k)s or IRAs often provide more flexible investment choices, allowing retirees to customize their portfolios to meet their income needs.

Absolutely. Permanent life insurance can be a valuable component of a comprehensive retirement strategy. It can serve multiple purposes, such as providing a death benefit to ensure financial security for beneficiaries, offering a source of funds for long-term care, or even as a way to access cash value for retirement income. However, it's essential to carefully consider the overall impact on retirement savings and explore other options to optimize the retirement plan.