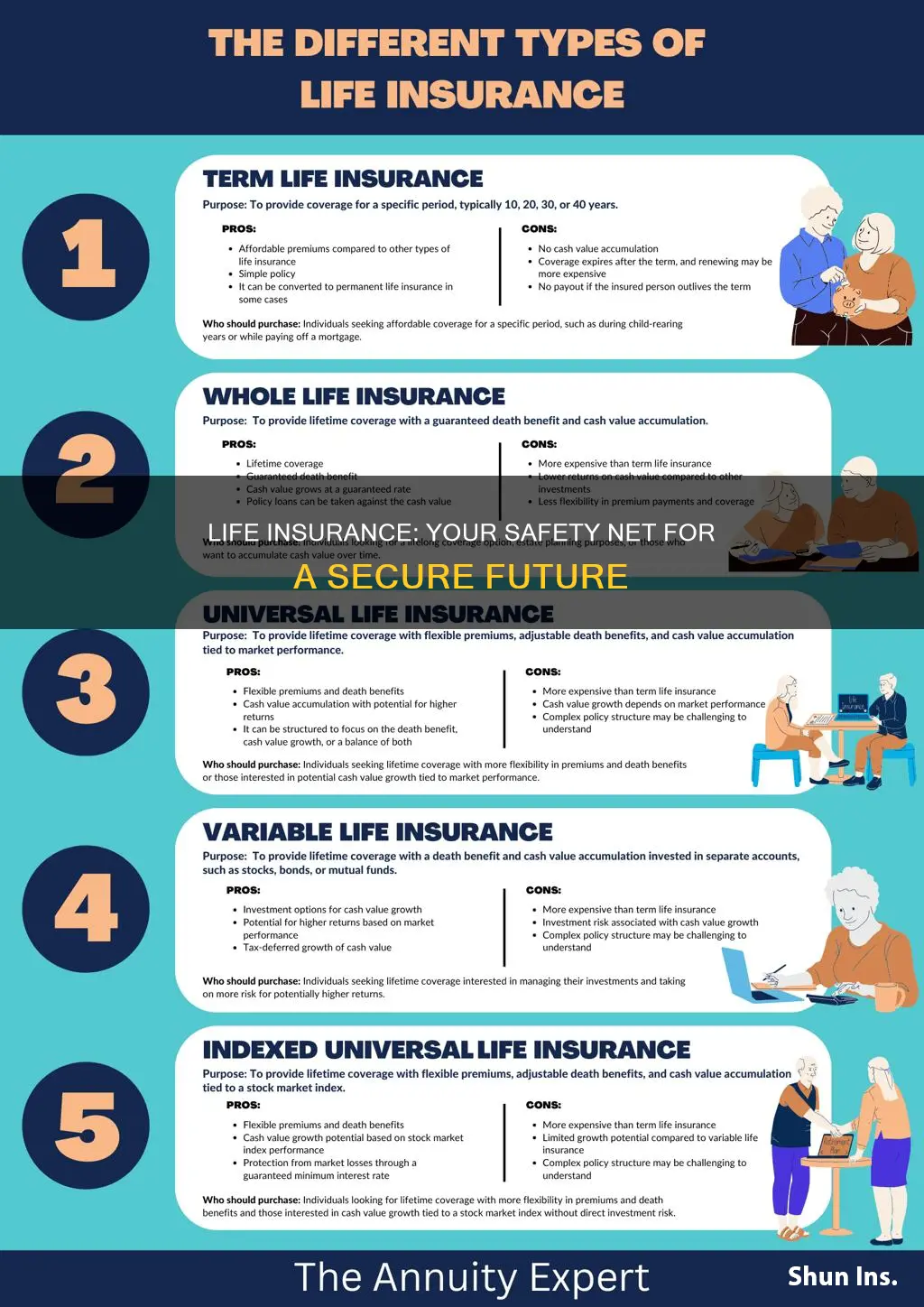

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers peace of mind by ensuring that loved ones are protected in the event of the insured's death. The primary purpose of life insurance is to provide financial security and support to those who depend on the policyholder, covering essential expenses such as mortgage payments, funeral costs, and daily living expenses. This insurance policy can also help achieve long-term financial goals, such as saving for children's education or retirement planning. Understanding the importance of life insurance is essential for anyone seeking to safeguard their loved ones and secure their financial future.

What You'll Learn

- Financial Security: Life insurance provides a safety net for loved ones in the event of death

- Peace of Mind: Knowing you're protected offers reassurance and reduces stress

- Long-Term Savings: Policies can accumulate value over time, offering financial growth

- Debt Relief: It can help pay off debts, ensuring a legacy for beneficiaries

- Legacy Planning: Life insurance ensures your wishes are honored and a legacy is left

Financial Security: Life insurance provides a safety net for loved ones in the event of death

Life insurance is a crucial financial tool that offers a safety net for individuals and their families, ensuring financial security and peace of mind. When an individual purchases life insurance, they are essentially making a commitment to their loved ones, promising to provide financial support even if they are no longer around. This commitment is a powerful way to safeguard the financial well-being of those who depend on the insured person.

In the event of the insured's death, the life insurance policy comes into effect, and the beneficiaries receive a lump sum payment or regular income, depending on the policy type. This financial support can cover various expenses, such as mortgage payments, children's education, daily living costs, and even funeral arrangements. By providing this financial cushion, life insurance ensures that the family can maintain their standard of living and cover essential costs, even when the primary breadwinner is gone.

The beauty of life insurance lies in its ability to provide long-term financial security. It allows individuals to plan for the future, knowing that their loved ones will be taken care of. For example, a young family with a mortgage and children's future education expenses can ensure that these financial obligations are met even if the primary earner passes away. This financial security can reduce stress and anxiety, allowing the family to focus on grieving and healing during a difficult time.

Moreover, life insurance can also help in managing debt. Many people take out loans or have credit card debt, and in the event of their death, these financial obligations can become a burden for their loved ones. Life insurance proceeds can be used to settle such debts, ensuring that the family is not left with overwhelming financial liabilities. This aspect of financial security is particularly important for those with significant financial commitments.

In summary, life insurance is an essential tool for providing financial security and peace of mind. It ensures that loved ones are protected financially, even in the worst-case scenario. By offering a safety net, life insurance allows individuals to focus on living their lives to the fullest while knowing that their family's financial future is secure. It is a commitment to loved ones and a way to leave a lasting legacy of financial stability.

Navigating Pakistan's Life Insurance Options: Finding the Best Fit

You may want to see also

Peace of Mind: Knowing you're protected offers reassurance and reduces stress

Life insurance is a powerful tool that provides individuals with a sense of security and peace of mind, knowing that they and their loved ones are protected in the event of unforeseen circumstances. It is an essential aspect of financial planning that often goes overlooked, but its importance cannot be overstated. When you have life insurance, you are essentially creating a safety net for your future and the well-being of your family. This financial product offers a unique and valuable service that goes beyond just monetary compensation.

The primary benefit of life insurance is the reassurance it provides. It allows individuals to face the future with confidence, knowing that their loved ones will be taken care of if something happens to them. This peace of mind is invaluable, as it reduces stress and anxiety associated with financial responsibilities. Without life insurance, the thought of providing for one's family in the long term can be overwhelming, leading to constant worry and a sense of insecurity. With a policy in place, you can rest easy, knowing that your family's financial needs will be met, even if you are no longer around.

Having life insurance means that your loved ones won't have to face the burden of unexpected expenses and debt. It ensures that your family can maintain their standard of living, cover essential costs, and potentially even achieve their financial goals. This financial security is a significant advantage, as it allows your family to grieve without the added stress of financial worries. The policy acts as a safeguard, providing a steady income to cover daily expenses, mortgage payments, or even fund your children's education.

Moreover, life insurance offers a sense of protection and control over one's legacy. It allows individuals to leave a financial legacy for their beneficiaries, ensuring that their hard-earned wealth is passed on according to their wishes. This aspect of life insurance provides a sense of comfort, knowing that your family's future is secure and that your financial contributions will continue to support them long after your passing.

In summary, life insurance is a vital component of personal finance, offering peace of mind and a sense of security. It empowers individuals to face the future with confidence, knowing that their loved ones are protected. By providing financial stability and reassurance, life insurance allows people to live their lives to the fullest, free from the constant worry of what might happen tomorrow. It is a wise investment that ensures your family's well-being and financial future, making it an essential consideration for anyone seeking to secure their loved ones' happiness and financial freedom.

Life Insurance: Part of the Gross Estate?

You may want to see also

Long-Term Savings: Policies can accumulate value over time, offering financial growth

Life insurance is often seen as a tool for providing financial security and peace of mind, but it also plays a crucial role in long-term financial planning and savings. One of the key benefits of life insurance is its ability to accumulate value over time, making it an excellent vehicle for long-term savings and financial growth.

When you purchase a life insurance policy, you typically pay regular premiums to the insurance company. These premiums are invested in various financial instruments, such as stocks, bonds, and other assets, depending on the type of policy you choose. Over time, as the policy grows, the value of these investments increases, and so does the overall value of your policy. This growth is particularly beneficial for long-term savings goals.

The long-term savings aspect of life insurance is advantageous because it allows individuals to build a substantial financial reserve without the need for frequent contributions. Traditional savings accounts or investment portfolios may require regular deposits, which can be challenging to maintain over an extended period. In contrast, life insurance policies provide a structured and disciplined approach to saving. As you consistently pay premiums, the policy's cash value grows, and this accumulated value can be used for various financial objectives.

One of the advantages of this long-term savings strategy is the potential for compound growth. As the policy's value increases, the interest or earnings generated on the investments contribute to further growth. This compounding effect can significantly boost the overall savings, providing a substantial financial cushion for the future. Moreover, the growth is often tax-deferred, allowing the savings to accumulate more efficiently.

In summary, life insurance policies offer a unique opportunity for long-term savings and financial growth. By investing premiums in various assets, these policies can accumulate value over time, providing individuals with a reliable and structured approach to building their financial reserves. This feature of life insurance is particularly valuable for those seeking a consistent and disciplined way to save for the future, ensuring financial security and achieving their long-term financial goals.

American Express Credit Cards: Life Insurance Benefits Explained

You may want to see also

Debt Relief: It can help pay off debts, ensuring a legacy for beneficiaries

Life insurance is a powerful financial tool that can provide numerous benefits, and one of its most significant advantages is debt relief. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon their death. This benefit can be a lump sum payment, an annuity, or a series of payments, and it is designed to provide financial security for the policyholder's loved ones.

The primary purpose of life insurance is to ensure that the financial obligations and debts of the insured person are met, even after their passing. This is particularly crucial for those with substantial debts, such as mortgages, business loans, or personal loans. By taking out a life insurance policy, individuals can create a safety net for their families and beneficiaries, ensuring that their debts are paid off, and their loved ones are protected. For example, if a family relies on the income of a primary breadwinner, life insurance can cover their mortgage payments, ensuring the family can maintain their home and avoid financial hardship.

In the event of the insured's death, the life insurance policy pays out a death benefit, which can be used to settle any outstanding debts. This benefit can be a significant amount, especially for those with large families or financial commitments. The proceeds from the policy can be used to pay off debts, such as student loans, car loans, or credit card debt, leaving the beneficiaries with a sense of financial relief and security. Moreover, life insurance can also cover funeral expenses, which can be a substantial financial burden for families, especially in the immediate aftermath of a loved one's passing.

The peace of mind that comes with knowing your debts are covered is invaluable. It allows individuals to focus on their loved ones and ensure a better future for their families. Additionally, life insurance can be structured to provide a legacy for beneficiaries, ensuring that the financial security of the family is maintained even after the insured's passing. This legacy can be in the form of a lump sum payment, which can be invested or used to start a new business, or it can be an ongoing income stream to support the beneficiaries' lifestyle.

In summary, life insurance is an essential tool for debt relief and legacy planning. It provides a financial safety net, ensuring that debts are paid off, and loved ones are protected. With the right policy, individuals can rest assured that their financial obligations will be met, and their beneficiaries will have a secure future. It is a wise investment that offers both immediate and long-term benefits, making it a crucial consideration for anyone looking to provide for their family and secure their financial legacy.

Who Gets Your Life Insurance: Contingent Beneficiary Basics

You may want to see also

Legacy Planning: Life insurance ensures your wishes are honored and a legacy is left

Life insurance is a crucial aspect of financial planning, especially when considering the long-term impact on your loved ones and the legacy you wish to leave behind. It provides a safety net and peace of mind, knowing that your family's financial future is protected, even in your absence. When it comes to legacy planning, life insurance plays a pivotal role in ensuring your wishes are honored and a meaningful legacy is established.

In the context of legacy planning, life insurance serves as a powerful tool to secure your family's financial stability and achieve your long-term goals. It allows you to provide for your loved ones by covering various expenses and ensuring their well-being. The primary purpose of life insurance is to offer financial protection, and this becomes even more critical when planning for the future. By having a life insurance policy, you can guarantee that your family will have the necessary financial resources to cover essential costs, such as mortgage payments, education expenses, or daily living expenses, even if you are no longer around. This financial security enables your loved ones to maintain their standard of living and pursue their dreams without the added stress of financial burdens.

Moreover, life insurance provides an opportunity to fulfill your personal and financial goals. You can use the policy to fund specific objectives, such as starting a business, investing in real estate, or creating a trust for your children's future. The death benefit from a life insurance policy can be a significant source of capital, allowing you to leave a substantial legacy for your beneficiaries. This financial legacy can be used to support your family's long-term financial needs, provide for charitable causes you care about, or even pass on a business to the next generation.

When creating a legacy plan, it is essential to consider the specific wishes and goals you have for your family. Life insurance can be tailored to accommodate these desires. For instance, you can choose the amount of coverage that aligns with your family's needs and future plans. This ensures that the financial support provided by the life insurance policy is sufficient to cover the intended expenses and contribute to the legacy you envision. Additionally, you can select beneficiaries who will receive the death benefit, allowing you to directly influence how your insurance proceeds are utilized.

In summary, life insurance is an indispensable component of legacy planning. It empowers you to honor your wishes and create a lasting impact on your loved ones' lives. By providing financial security and the means to achieve personal goals, life insurance ensures that your legacy extends beyond your lifetime, offering peace of mind and a sense of fulfillment. It is a powerful tool to protect your family's future and leave a meaningful inheritance.

Understanding Family Servicemembers Group Life Insurance Benefits

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers financial protection and peace of mind by ensuring that your loved ones are taken care of in the event of your untimely death. The policy proceeds can help cover essential expenses, such as mortgage payments, children's education, and daily living costs, providing a sense of security and stability during difficult times.

In the event of your passing, life insurance can provide a substantial financial payout to your beneficiaries. This amount can be used to replace lost income, cover funeral expenses, and ensure that your family's standard of living remains intact. It allows your loved ones to focus on grieving and healing while having the financial resources to maintain their lifestyle and future plans.

Yes, life insurance is not solely for those with dependents. It can be valuable for anyone, regardless of marital status or the presence of dependents. Life insurance can help cover debts, such as student loans or credit card debt, and provide financial security for yourself in case of an unexpected illness or accident. Additionally, it can be used to fund personal goals, such as starting a business or investing in a retirement plan.

Absolutely! Term life insurance, in particular, can be an excellent tool for achieving long-term financial objectives. It provides coverage for a specific period, allowing you to secure your family's financial future during that time. Over time, the premiums paid can accumulate cash value, which can be borrowed against or withdrawn, providing a source of funds for various financial goals, such as buying a home, funding education, or starting a business.