Life insurance is a vital financial tool that provides a safety net for individuals and their families during times of uncertainty and loss. It offers a sense of security and peace of mind, knowing that your loved ones will be taken care of in the event of your untimely death. This essay will explore the significance of life insurance, highlighting its role in protecting families, covering financial obligations, and ensuring a secure future for those who depend on you. By understanding the importance of life insurance, individuals can make informed decisions to safeguard their loved ones and themselves.

What You'll Learn

- Financial Security: Protects loved ones from financial hardship after death

- Long-Term Savings: Builds wealth over time through premium payments

- Peace of Mind: Reduces stress and anxiety about the future

- Legacy Planning: Ensures a financial legacy for beneficiaries

- Health Coverage: Provides additional medical expenses not covered by other insurance

Financial Security: Protects loved ones from financial hardship after death

Life insurance is a vital tool for ensuring financial security and providing peace of mind for individuals and their loved ones. When someone passes away, the impact of their absence can be financially devastating for their family, especially if they were the primary breadwinner. This is where life insurance steps in as a crucial safeguard, offering a safety net that can help protect against the financial strain of losing an income.

The primary purpose of life insurance is to provide financial security and stability during challenging times. It does so by offering a lump sum payment, known as a death benefit, to the policyholder's beneficiaries upon their passing. This financial cushion can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even the day-to-day living expenses of the family. By having this financial support, the loved ones of the deceased can focus on grieving and healing without the added stress of financial worries.

One of the key advantages of life insurance is its ability to ensure that the family's standard of living remains intact even after the primary provider is gone. It can help maintain the family's lifestyle, cover educational expenses for children, and provide for the long-term financial goals of the family. For instance, if a family relies on the income of a parent to cover daily expenses and has no other sources of revenue, life insurance can step in to fill that gap, preventing financial hardship and ensuring that the family's basic needs are met.

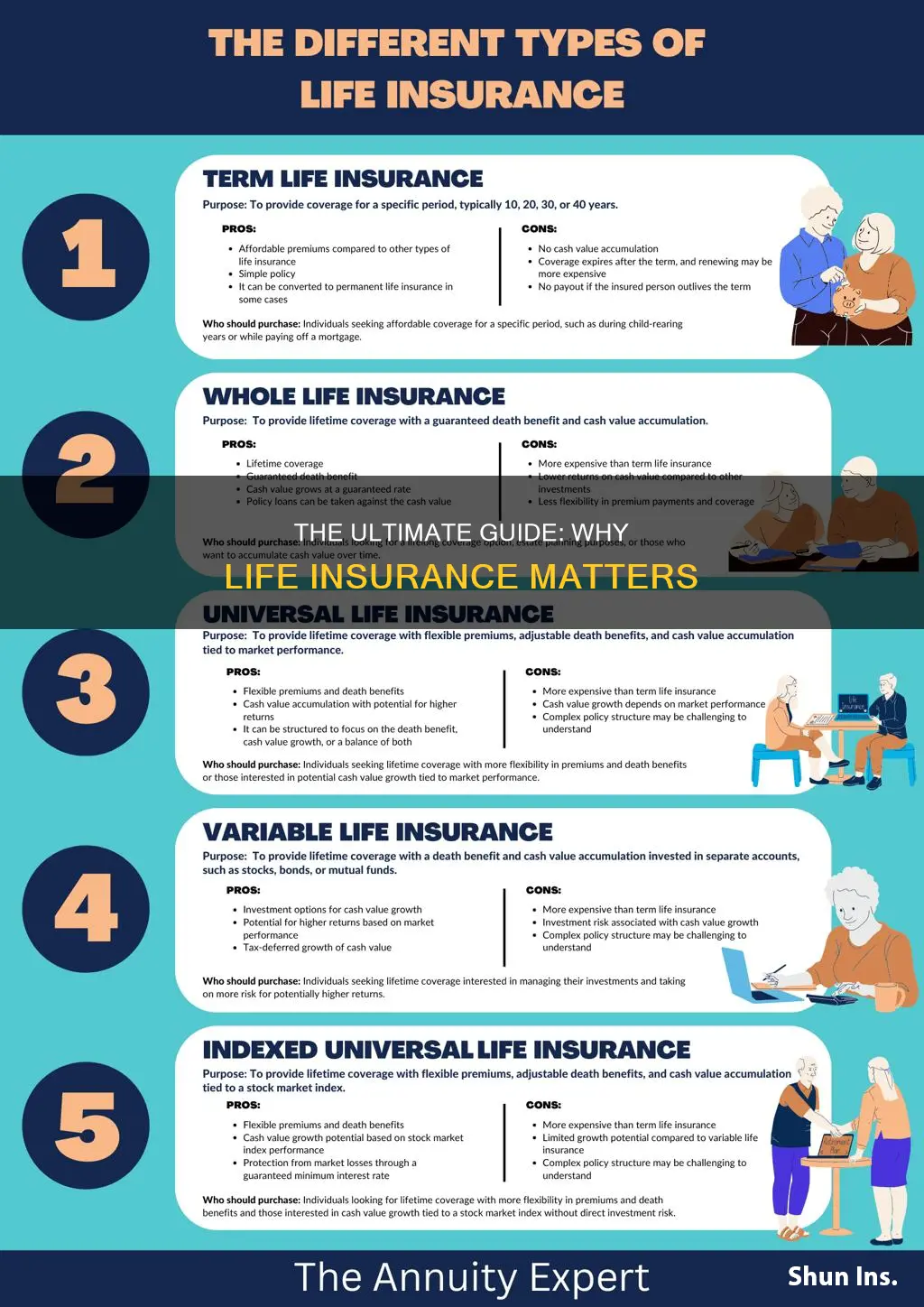

Moreover, life insurance can also be tailored to suit specific needs and circumstances. There are different types of policies, such as term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage and a cash value component. Policyholders can choose the coverage amount and duration that best align with their financial goals and the level of protection required for their loved ones. This flexibility ensures that the insurance policy can be adapted as the family's situation changes over time.

In summary, life insurance is an essential tool for protecting loved ones from financial hardship after the death of a family member. It provides a financial safety net, ensuring that the family can maintain their standard of living, cover essential expenses, and achieve their long-term financial objectives. By investing in life insurance, individuals can give themselves and their loved ones the peace of mind that comes with knowing they are financially secure, even in the face of life's uncertainties.

Who Are Your Life Insurance Beneficiaries? Inform Them Now!

You may want to see also

Long-Term Savings: Builds wealth over time through premium payments

Life insurance is a powerful tool that offers a multitude of benefits, and one of its most significant advantages is its ability to facilitate long-term savings. This aspect of life insurance is often overlooked, but it plays a crucial role in building wealth and securing financial stability for individuals and their families. By understanding how life insurance contributes to long-term savings, you can make informed decisions about your financial future.

When you purchase a life insurance policy, you make regular premium payments, which are essentially investments in your financial security. These premium payments are typically fixed over a long period, often spanning several years or even decades. During this time, the insurance company invests a portion of these premiums, and the returns generated can be substantial. The key advantage here is the power of compounding, where the interest earned on your initial investment also earns interest, leading to exponential growth over the long term. This is in contrast to traditional savings accounts, where the interest earned is often minimal and may not keep pace with inflation.

The long-term savings aspect of life insurance becomes even more valuable when considering the potential for tax advantages. In many jurisdictions, the growth of your investment within a life insurance policy may be tax-deferred, meaning you won't have to pay taxes on the earnings until you withdraw the money. This allows your savings to grow faster, providing a substantial financial cushion over time. Additionally, the death benefit of a life insurance policy can be a significant tax-free asset, ensuring that your loved ones receive a substantial sum without incurring large tax liabilities.

Another advantage of using life insurance for long-term savings is the guaranteed return on investment. Unlike some other investment vehicles, life insurance policies offer a fixed rate of return, which is typically higher than what you might find in traditional savings accounts. This predictability allows you to plan for the future with greater confidence, knowing that your savings are growing at a steady rate. Over time, this can accumulate into a substantial amount, providing financial security and potentially funding major life goals, such as purchasing a home, funding education, or starting a business.

In summary, life insurance is an excellent vehicle for long-term savings and wealth-building. Through regular premium payments, individuals can take advantage of the power of compounding, tax advantages, and guaranteed returns. This financial strategy not only provides peace of mind but also ensures that your money works hard for you over the long term, ultimately contributing to a more secure and prosperous future. It is a valuable tool that should be considered as part of a comprehensive financial plan.

Absolute Assignment: Life Insurance Beneficiary Transfer

You may want to see also

Peace of Mind: Reduces stress and anxiety about the future

Life insurance is a powerful tool that provides a sense of security and peace of mind, allowing individuals to navigate life's uncertainties with reduced stress and anxiety. The importance of this financial product lies in its ability to offer a safety net for the future, ensuring that loved ones are protected and financial obligations are met even in the event of an untimely demise.

One of the primary benefits of life insurance is its role in providing financial security. When an individual purchases a life insurance policy, they are essentially making a commitment to their beneficiaries, promising to provide financial support in the event of their death. This commitment alleviates the stress associated with providing for loved ones, especially those who depend on the policyholder's income. Knowing that a regular income will continue, even after the policyholder's passing, brings a sense of reassurance and peace of mind. For example, a family with a young child and a mortgage can rest easy, knowing that their child's education and living expenses will be covered, and the mortgage will be paid off, thanks to the life insurance policy.

Moreover, life insurance offers a sense of control over one's future. It empowers individuals to plan for the unexpected, ensuring that their loved ones are not left in a vulnerable position. By having a life insurance policy, you can take proactive steps to secure your family's financial well-being. This control over one's destiny is a powerful antidote to anxiety, as it provides a sense of preparedness and the ability to make informed decisions about the future. For instance, a young professional can choose a term life insurance policy to cover their mortgage and children's education, knowing that their family's financial stability is temporarily secured.

The peace of mind that comes with life insurance is invaluable. It allows individuals to focus on the present without constantly worrying about the future. With financial security in place, people can make decisions with confidence, knowing that their loved ones are protected. This sense of security enables individuals to pursue their passions, take risks, and make life-changing decisions without the constant fear of financial hardship. For example, a small business owner can invest in their business expansion, knowing that their family's financial future is insured, and their employees' livelihoods are protected.

In summary, life insurance is a vital tool for achieving peace of mind and reducing stress and anxiety about the future. It provides financial security, a sense of control, and the freedom to make decisions without constant worry. By ensuring the protection of loved ones and financial obligations, life insurance empowers individuals to live their lives to the fullest, knowing that they have taken the necessary steps to secure a brighter future for those they care about. This financial product is a testament to the power of planning and the positive impact it can have on one's overall well-being.

Understanding GI Life Insurance: A Comprehensive Guide

You may want to see also

Legacy Planning: Ensures a financial legacy for beneficiaries

Legacy planning is a crucial aspect of financial management that ensures your loved ones are taken care of and your wishes are honored after your passing. It involves making strategic decisions to secure the financial future of your beneficiaries and create a lasting impact on their lives. One of the most effective tools for achieving this is life insurance.

When you purchase life insurance, you are essentially providing a financial safety net for your beneficiaries. This is particularly important if you have a family or dependents who rely on your income. In the event of your death, the life insurance policy will pay out a lump sum or regular payments to the designated beneficiaries. This financial support can help cover essential expenses, such as mortgage payments, education costs, or daily living expenses, ensuring that your loved ones are financially secure during a challenging time.

The beauty of life insurance in the context of legacy planning lies in its ability to provide peace of mind. Knowing that your family will be financially protected allows you to focus on other important aspects of your life, such as building a business, investing in assets, or pursuing personal goals. It empowers you to leave a lasting financial legacy, ensuring that your beneficiaries can maintain their standard of living and achieve their long-term financial objectives.

Moreover, life insurance can be tailored to your specific needs and preferences. You can choose the amount of coverage, the type of policy (term or permanent), and the duration that best suits your circumstances. For example, term life insurance provides coverage for a specified period, typically until your children finish school or a specific financial goal is achieved. On the other hand, permanent life insurance offers lifelong coverage and can accumulate cash value over time, providing both financial security and an investment opportunity.

In summary, legacy planning is essential for securing the financial future of your loved ones and creating a lasting impact. Life insurance plays a pivotal role in this process by providing a reliable source of financial support for your beneficiaries. By carefully considering your options and seeking professional advice, you can design a comprehensive legacy plan that ensures your wishes are honored and your loved ones are protected. This way, you can leave a meaningful financial legacy that will be cherished for generations.

New York Life Insurance Agents: Payment and Commission Structures

You may want to see also

Health Coverage: Provides additional medical expenses not covered by other insurance

Health coverage is a critical component of life insurance, offering a safety net for individuals and their families in the event of unforeseen medical emergencies. This aspect of life insurance is particularly important as it ensures that policyholders can access necessary medical treatments without incurring substantial financial burdens. When purchasing a life insurance policy, it is essential to understand the different types of coverage available, especially health coverage, which can significantly impact one's financial well-being.

The primary purpose of health coverage within life insurance is to provide financial protection against unexpected medical expenses. Medical bills can quickly accumulate, especially in cases of severe illnesses or accidents, often requiring extensive treatment and hospitalization. Without adequate health coverage, individuals might find themselves in a difficult position, facing the challenge of paying for medical care while also dealing with the emotional stress of an illness or injury. Life insurance policies with comprehensive health coverage ensure that policyholders can focus on their recovery without the added worry of financial strain.

This type of coverage typically includes benefits such as hospitalization expenses, surgery costs, and the fees associated with various medical procedures. It also covers routine medical expenses, such as doctor visits, prescription medications, and diagnostic tests, which are essential for maintaining overall health. By providing this comprehensive coverage, life insurance companies help individuals manage their healthcare costs effectively, ensuring that they can access the necessary treatments and services when needed.

Moreover, health coverage in life insurance can be tailored to meet specific needs. Policyholders can choose different levels of coverage, depending on their preferences and financial capabilities. Some policies may offer basic coverage for essential medical services, while others provide more extensive benefits, including coverage for specialized treatments, mental health services, and alternative therapies. This flexibility allows individuals to customize their insurance plans to align with their unique healthcare requirements.

In summary, health coverage within life insurance is a vital feature that safeguards individuals and their families from the financial impact of medical emergencies. It ensures that policyholders can afford the necessary treatments and healthcare services, promoting better health outcomes and financial security. Understanding the details of health coverage options available in life insurance policies is essential for making informed decisions and ensuring that one's healthcare needs are adequately protected.

Canceling Life Insurance with AIG American General: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and protection to individuals and their loved ones. It offers a safety net by ensuring that the insured's beneficiaries receive a payout in the event of their death, helping to cover expenses and maintain financial stability for the family.

When an individual purchases life insurance, they create a promise to their beneficiaries, typically family members, that a sum of money will be paid out upon their passing. This financial guarantee can help cover various expenses, such as mortgage payments, children's education, funeral costs, and daily living expenses, ensuring that the family's financial situation remains stable even after the insured's death.

While life insurance primarily serves as a safety net, certain types of policies, such as permanent life insurance, can also function as long-term savings or investment vehicles. These policies accumulate cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, some plans offer investment components, allowing policyholders to potentially grow their money through market-related investments.

There are several types of life insurance policies, each with unique features and benefits. Term life insurance provides coverage for a specified period, offering affordable premiums and a death benefit. Permanent life insurance, on the other hand, provides lifelong coverage and includes an investment component. Whole life and universal life insurance are also available, offering flexible premiums and potential cash value accumulation. The choice depends on individual needs, preferences, and financial goals.