Life insurance is a crucial aspect of financial planning, especially as we age. For many, the decision to purchase life insurance becomes more pressing as we approach retirement age. In this case, the individual is considering a life insurance policy that costs $1,000 per month at the age of 64. This decision is likely driven by the need to provide financial security for their loved ones in the event of their passing. The $1,000 monthly premium may seem significant, but it's a small price to pay for the peace of mind and financial protection it offers. This article will explore the reasons behind this choice, including the potential benefits and considerations of such a policy.

What You'll Learn

- Age and Health: Older age and health issues increase insurance costs

- Term Length: Longer coverage at younger ages is often more affordable

- Benefits and Needs: Higher benefits and needs justify the monthly premium

- Market Rates: Current market rates for life insurance at 64

- Alternative Options: Compare with other insurance providers and policies

Age and Health: Older age and health issues increase insurance costs

As individuals age, the likelihood of developing health issues increases, and this is a critical factor in determining life insurance premiums. For those in their 60s, the risk of various health conditions becomes more prevalent, which directly impacts the cost of insurance. At the age of 64, an individual's health may be a significant consideration for insurance providers, leading to higher monthly premiums. This is because older adults often face a higher risk of chronic illnesses, such as heart disease, diabetes, and cancer, which can significantly impact their life expectancy and overall health.

The insurance industry takes into account the overall health and medical history of an individual when calculating premiums. Pre-existing conditions, chronic diseases, and any recent health scares can all contribute to higher insurance rates. For instance, a 64-year-old with a history of heart disease or diabetes may be considered a higher-risk candidate, resulting in a more expensive policy. This is because the insurance company aims to cover potential medical expenses and ensure financial protection for the policyholder and their beneficiaries.

Age-related health concerns are a primary reason for the increased cost of life insurance for older individuals. As people get older, their bodies undergo various changes that can impact overall health. For example, older adults may experience a decline in physical strength, reduced organ function, and a higher susceptibility to injuries. These factors can make it more challenging for them to recover from accidents or illnesses, thus increasing the insurance company's liability.

Furthermore, the insurance industry often considers the individual's lifestyle and habits when assessing risk. Smoking, excessive alcohol consumption, and a sedentary lifestyle can all contribute to higher health risks at an older age. These factors may lead to increased insurance premiums as they directly correlate with a higher likelihood of health complications. It is essential for individuals in their 60s to be aware of these potential factors and take proactive steps to improve their health, which could potentially lower their insurance costs.

In summary, the age of 64 is a significant marker when it comes to life insurance premiums. Health issues and age-related concerns are major contributors to the higher costs. Insurance providers aim to balance the need for financial protection with the increased risks associated with older individuals. Understanding these factors can help individuals make informed decisions about their insurance coverage and potentially explore options to manage their insurance costs effectively.

Canceling ClientLife Insurance: A Step-by-Step Guide to Freedom

You may want to see also

Term Length: Longer coverage at younger ages is often more affordable

When considering life insurance, one of the critical factors to determine is the term length, which refers to the duration for which the policy is in effect. For individuals seeking long-term financial security, opting for a longer term length at a younger age can be a strategic decision with significant advantages. This approach allows individuals to secure their loved ones' financial future over an extended period, ensuring that the policy remains in force until the desired level of coverage is achieved or until the individual reaches a specific age.

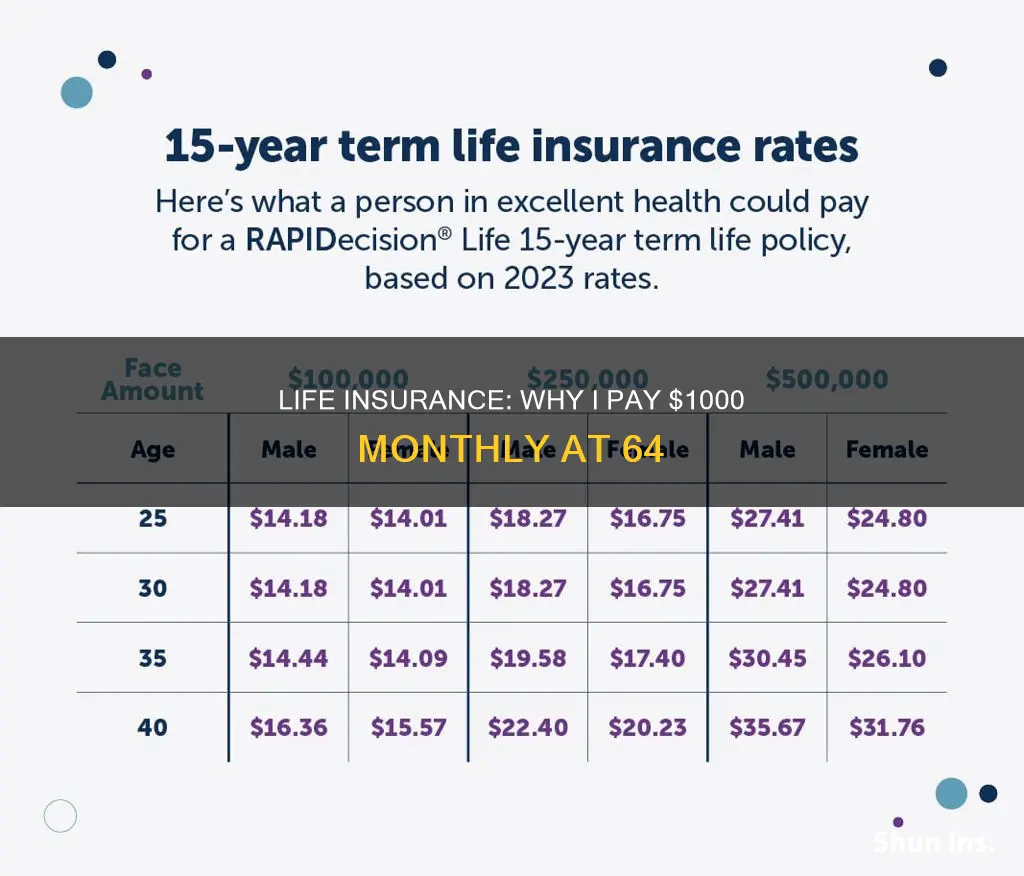

The affordability of longer coverage at a younger age is a compelling reason to choose this option. As we age, the risk factors associated with certain health conditions and lifestyle choices increase, which can lead to higher insurance premiums. By purchasing a longer-term policy when you are younger and healthier, you can take advantage of lower rates and more favorable terms. Younger individuals typically have lower mortality rates, and insurance providers often offer more competitive prices during this period, making it an opportune time to secure comprehensive coverage.

Longer term lengths are particularly beneficial for those who want to ensure their family's financial stability over an extended period. For instance, if you have a mortgage, children's education expenses, or other long-term financial commitments, a longer term will provide peace of mind, knowing that your loved ones will be protected even if you are no longer around. This extended coverage can help cover various expenses and ensure that your family's financial goals are met, even in the event of your untimely passing.

Additionally, opting for a longer term length can be a strategic move for those who anticipate changes in their financial situation or life goals. For example, someone who plans to start a business or has aspirations of starting a family in the future might want to consider a longer term to account for these potential life events. By extending the coverage, you can adapt to changing circumstances and ensure that your insurance remains relevant and valuable over time.

In summary, choosing a longer term length for life insurance at a younger age is a financially prudent decision. It provides more affordable coverage, ensuring that your loved ones are protected for an extended period. This approach allows you to adapt to life's changes and financial goals while securing a comprehensive safety net for your family's future. It is a strategic move that can offer peace of mind and long-term financial security.

Cash Value Life Insurance: Tax-Free Benefits Explained

You may want to see also

Benefits and Needs: Higher benefits and needs justify the monthly premium

When considering life insurance, especially at an age like 64, it's crucial to understand the relationship between the benefits you receive and the premium you pay. The monthly premium of $1000 might seem substantial, but it's essential to recognize that this cost is justified by the higher benefits and needs that come with aging. As individuals progress into their later years, the need for comprehensive coverage increases due to various factors.

One significant factor is the accumulation of assets and financial responsibilities. At 64, many individuals have spent decades building their careers, homes, and families. They may have substantial savings, investments, or business interests that require protection. Life insurance can provide a financial safety net to ensure that these assets are preserved for the benefit of loved ones in the event of the insured's passing. Additionally, older individuals often have more significant financial obligations, such as mortgage payments, children's education funds, or business loans, which further emphasize the need for adequate insurance coverage.

Another consideration is the changing health and medical needs of individuals as they age. At 64, one's health may require more frequent medical attention, specialized care, or long-term treatment. Life insurance can help cover these expenses, ensuring that the insured's family is not burdened with overwhelming medical bills. Moreover, older individuals may have specific health concerns or pre-existing conditions that require regular monitoring and management, making comprehensive insurance coverage even more critical.

Furthermore, the role of life insurance extends beyond financial protection. It provides peace of mind and security, knowing that your loved ones will be taken care of in your absence. For a 64-year-old, this can be particularly important, as it allows them to focus on enjoying their later years without the constant worry of financial strain on their family. The higher premium reflects the increased value and security that comprehensive life insurance offers during this life stage.

In summary, the $1000 monthly premium for life insurance at 64 is a significant investment in your future and the well-being of your loved ones. It ensures that you have the necessary benefits to cover potential financial losses, medical expenses, and the emotional support that comes with knowing your family is protected. Understanding the benefits and needs that justify this premium is essential in making an informed decision about life insurance coverage.

USDA Mortgage Insurance: A Lifetime Commitment?

You may want to see also

Market Rates: Current market rates for life insurance at 64

The cost of life insurance can vary significantly depending on several factors, including age, health, lifestyle, and the type of policy. At age 64, individuals may find themselves in a unique position when it comes to life insurance rates. While it is true that life insurance premiums tend to decrease with age, the rate of decrease can slow down, and the overall cost can still be substantial.

Market rates for life insurance at 64 can vary widely, and several factors influence these rates. Firstly, age is a critical determinant; older individuals generally face higher premiums due to the increased risk associated with longevity. At 64, one's life expectancy is already relatively low compared to younger individuals, making the insurance company's risk assessment higher. Additionally, health status plays a pivotal role. Individuals with pre-existing medical conditions or those who have not maintained a healthy lifestyle may be considered higher-risk, leading to more expensive premiums.

The type of life insurance policy also impacts the cost. Term life insurance, which provides coverage for a specified period, typically offers more affordable rates compared to permanent life insurance, such as whole life or universal life. At 64, if you are considering term life insurance, the rates might be more competitive, but the coverage period could be shorter, ensuring you have adequate protection for the remaining years of your life. On the other hand, permanent life insurance policies, which offer lifelong coverage, often come with higher premiums, especially at this age.

Another factor to consider is the amount of coverage you require. Higher coverage amounts will result in more expensive premiums. At 64, individuals might be seeking to secure financial support for their families or cover specific financial obligations. The insurance company will assess the need for coverage and adjust the premium accordingly. It is essential to strike a balance between the desired coverage and the financial commitment of the premium.

In summary, the market rates for life insurance at 64 are influenced by age, health, policy type, and coverage amount. While it is understandable to want to secure financial protection, it is crucial to carefully evaluate your options and consider alternative ways to manage risks. Consulting with insurance professionals can provide valuable insights and help you make informed decisions regarding your life insurance coverage and financial planning.

Life Insurance Rule Change: What You Need to Know

You may want to see also

Alternative Options: Compare with other insurance providers and policies

When considering life insurance at an older age, such as 64, it's important to explore alternative options and compare them to the policy you're currently evaluating. Here's a detailed look at how to approach this comparison:

Research and Compare Providers: Start by researching multiple life insurance providers. Look for companies that offer coverage for individuals in their 60s. Compare their rates, coverage options, and policy terms. Online comparison tools can be a great resource to quickly assess different providers' offerings. By gathering quotes from various insurers, you can identify potential savings and find a policy that better suits your needs and budget.

Consider Term Life Insurance: One alternative to high-monthly-premium whole life insurance is term life insurance. Term policies typically have lower premiums and provide coverage for a specific period, such as 10, 20, or 30 years. If you only need coverage for a certain duration, term life insurance can be more cost-effective. For example, if you're planning to cover your children's education or a mortgage, a term policy might be sufficient and less expensive than a permanent life insurance plan.

Evaluate Policy Features: When comparing policies, pay attention to the features and benefits included. Some insurers may offer additional riders or options that provide extra coverage for specific needs. For instance, you might find policies with an accelerated benefit rider that allows you to receive a portion of your death benefit if you're diagnosed with a critical illness. These additional features can enhance the policy's value, but they often come at a higher cost. Carefully assess whether these extra benefits justify the premium increase.

Review Conversion Options: Another aspect to consider is the conversion privilege. Some life insurance policies allow you to convert your term life insurance into a permanent policy without a medical examination. This can be advantageous if you anticipate needing long-term coverage and want to avoid a potential rate increase when converting. Understanding the conversion process and terms will help you make an informed decision, especially if you believe your insurance needs may change over time.

Consult a Financial Advisor: Given the complexity of insurance products, consulting a financial advisor or insurance specialist can be beneficial. They can provide personalized advice based on your unique circumstances and help you navigate the various policy options. These professionals can assist in understanding the fine print, ensuring you make an informed choice, and potentially saving you money by identifying the most suitable coverage.

By exploring alternative insurance providers and policies, you can find a more affordable and comprehensive solution. Remember, the goal is to obtain the necessary coverage while managing your finances effectively, especially as you approach retirement age.

Horace Mann Traditional Life Insurance: A Comprehensive Overview

You may want to see also

Frequently asked questions

Life insurance premiums can increase with age due to several factors. Firstly, older individuals may have a higher risk profile as they are more likely to have pre-existing health conditions or a reduced life expectancy. Insurance companies often consider age as a significant factor in determining premiums, and older applicants might be offered lower coverage amounts at higher rates. Additionally, the cost of living and medical expenses tend to rise with age, which can impact insurance pricing.

Yes, there are strategies to potentially lower your life insurance premium. Firstly, consider taking a lower coverage amount. Reducing the policy's death benefit can decrease the premium significantly. You could also explore the option of a term life insurance policy, which typically offers coverage for a specific period, often at lower rates than whole life insurance. Additionally, maintaining a healthy lifestyle by quitting smoking, exercising regularly, and managing any existing health issues can improve your insurability and potentially lead to lower premiums.

The premium of $1000 per month at 64 years old might seem high, but it's essential to understand the coverage you are receiving. Life insurance policies often have a maximum coverage amount, and at 64, you may be considered a higher-risk individual. The $1000 premium could provide a substantial death benefit, ensuring financial security for your beneficiaries. It's crucial to assess your financial needs and consult with an insurance advisor to determine if the coverage amount is appropriate for your situation.