Independent life insurance offers a unique advantage in the market, providing consumers with the freedom to choose policies that best suit their individual needs. Unlike traditional insurance providers, independent agents are not tied to a specific company, allowing them to offer a wide range of options from various insurers. This independence enables them to provide unbiased advice, ensuring that clients receive the most suitable coverage at competitive rates. By working with independent agents, individuals can benefit from personalized service, expert guidance, and the flexibility to customize their insurance plans, ultimately leading to better financial protection and peace of mind.

What You'll Learn

- Financial Security: Independent insurance offers tailored coverage, ensuring comprehensive protection for your loved ones

- Customized Plans: You can choose policies that align with your specific needs and budget

- Expert Advice: Independent agents provide unbiased guidance, helping you make informed decisions

- Competitive Rates: Access to a variety of providers can lead to lower premiums

- Peace of Mind: Having an independent policy ensures you're not tied to a single company, offering flexibility

Financial Security: Independent insurance offers tailored coverage, ensuring comprehensive protection for your loved ones

Financial security is a cornerstone of a stable and comfortable life, and one of the most effective ways to ensure this is through independent life insurance. This type of insurance provides a tailored approach to coverage, offering a level of protection that is specifically designed to meet the unique needs of an individual and their loved ones. By choosing an independent insurance provider, you gain the freedom to customize your policy, ensuring that it aligns perfectly with your financial goals and the well-being of your family.

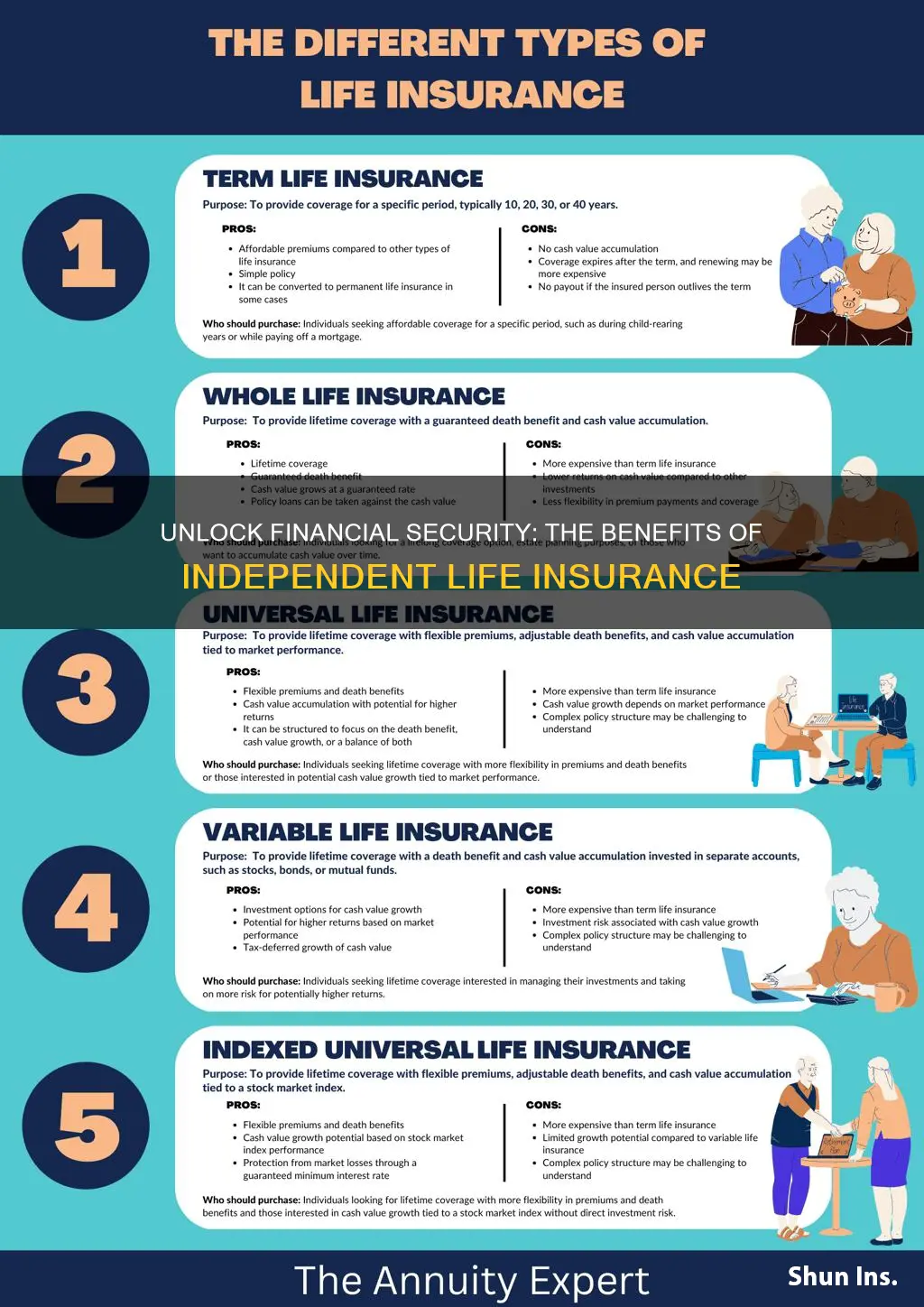

When it comes to financial security, the primary objective is to safeguard your loved ones from the financial impact of your passing. Independent life insurance achieves this by providing a comprehensive safety net. It offers a range of coverage options, including term life, whole life, and universal life policies, each with its own benefits. For instance, term life insurance provides coverage for a specified period, ensuring a steady income for your family during that time. Whole life insurance, on the other hand, offers lifelong coverage with a cash value component, allowing for potential investment opportunities.

The beauty of independent insurance lies in its ability to be tailored to your specific circumstances. You can choose the coverage amount based on your family's needs, ensuring that your loved ones have the financial resources to maintain their standard of living and cover essential expenses. Additionally, you can select the policy duration, whether it's for a specific number of years or indefinitely, providing long-term peace of mind. This level of customization ensures that your insurance policy is not a one-size-fits-all solution but rather a personalized financial safety net.

Furthermore, independent insurance providers often offer additional benefits and riders that can enhance your policy's value. These may include accelerated death benefits, which allow policyholders to access a portion of their death benefit early if they are diagnosed with a critical illness, providing immediate financial support. Other riders could offer waiver of premium benefits, ensuring that your policy remains in force even if you become unable to make payments due to illness or injury. These extra features demonstrate how independent insurance goes beyond basic coverage, providing comprehensive protection.

In summary, independent life insurance is a powerful tool for achieving financial security. It empowers individuals to take control of their family's future by offering tailored coverage, ensuring that their loved ones are protected in the event of their passing. With the ability to customize policies, choose coverage amounts and durations, and add valuable riders, independent insurance provides a level of flexibility and comprehensive protection that is essential for long-term financial well-being.

Whole Life Insurance: Breaking Even Reasonable?

You may want to see also

Customized Plans: You can choose policies that align with your specific needs and budget

When it comes to life insurance, one of the most appealing aspects of working with an independent agent is the ability to customize your policy. Unlike working with a captive agent who represents a single insurance company, independent agents have access to a wide range of carriers and policies. This means you can find a plan that truly fits your unique circumstances and financial goals.

Customizing your life insurance policy is essential because everyone's needs are different. For instance, a young, healthy individual might prioritize a low-cost policy with basic coverage, while a family with children and substantial financial responsibilities may require a more comprehensive plan. An independent agent can help you navigate these options and tailor a policy that addresses your specific concerns. They can explain the various types of coverage, such as term life, whole life, and universal life, and how each can provide different benefits over time.

The customization process involves assessing your current financial situation, future goals, and any specific risks you may want to mitigate. For example, if you're a high-risk profession, you might want to consider additional coverage to account for the increased likelihood of accidents or injuries. An independent agent can help you understand the implications of different policy features, such as riders that provide additional benefits like critical illness or accident coverage. By taking these factors into account, you can make an informed decision about the level of protection you need.

Budget is another critical aspect of customization. Independent agents can work with you to find policies that offer the best value for your money. They can compare rates and benefits across multiple carriers to ensure you're getting a fair deal. This personalized approach allows you to get the most coverage possible while staying within your financial means. Moreover, as your life circumstances change, an independent agent can help you adjust your policy accordingly, ensuring that your coverage remains appropriate and cost-effective.

In summary, the ability to customize your life insurance policy is a significant advantage of working with an independent agent. This customization ensures that your policy is tailored to your specific needs, whether it's comprehensive coverage for a family or a basic plan for an individual. By taking the time to understand your unique situation, an independent agent can help you make an informed decision, providing peace of mind and financial security for you and your loved ones.

Understanding Group Permanent Life Insurance: A Comprehensive Guide

You may want to see also

Expert Advice: Independent agents provide unbiased guidance, helping you make informed decisions

Independent life insurance agents offer a unique and valuable service to consumers by providing unbiased guidance and expert advice. When it comes to making important financial decisions, having an independent agent on your side can be a game-changer. Here's why their expertise is worth considering:

Unbiased Recommendations: One of the key advantages of working with independent agents is their commitment to impartiality. Unlike company representatives who may have a vested interest in promoting their employer's products, independent agents are free from such constraints. They assess your needs and recommend policies from various insurers, ensuring you receive the best coverage at the most competitive prices. This unbiased approach allows you to make informed choices tailored to your specific requirements.

Personalized Service: Independent agents take the time to understand your unique circumstances, risk factors, and financial goals. They provide personalized advice, considering your individual needs rather than pushing standardized products. This tailored approach ensures that the insurance policies recommended are not just suitable but also aligned with your long-term objectives. By offering customized solutions, independent agents help you navigate the complex world of insurance with confidence.

Market Knowledge: These agents have a deep understanding of the insurance market, including its various players and products. They stay updated on industry trends, regulatory changes, and emerging risks. This expertise enables them to provide valuable insights and educate clients on the pros and cons of different insurance options. With their market knowledge, independent agents can help you avoid potential pitfalls and make well-informed decisions.

Negotiation Power: Working with an independent agent gives you an advantage in negotiating with insurance companies. They have established relationships with numerous insurers and can leverage their network to secure better rates and terms for their clients. This negotiation power can result in significant savings and more comprehensive coverage, ultimately benefiting the policyholder.

Long-Term Support: Independent agents often provide ongoing support and assistance, even after the initial policy purchase. They can help with policy reviews, adjustments, and claims processing, ensuring that your insurance coverage remains relevant and adequate over time. This long-term relationship allows for continuous guidance and support as your life circumstances evolve.

In summary, independent life insurance agents offer a wealth of knowledge, impartiality, and personalized service. Their expertise empowers individuals to make informed decisions, secure the best coverage, and potentially save money. By providing unbiased guidance, independent agents play a crucial role in helping consumers navigate the complex insurance landscape with confidence and peace of mind.

Get a Life Insurance License in South Carolina Easily

You may want to see also

Competitive Rates: Access to a variety of providers can lead to lower premiums

When it comes to life insurance, choosing an independent broker can be a strategic move, especially if your goal is to secure competitive rates. The insurance industry is highly competitive, and independent brokers often have access to a wide range of insurance providers, each with its own unique pricing structures and offerings. This diversity allows them to shop around and negotiate on your behalf, ensuring you get the best deal possible.

By working with an independent broker, you gain the advantage of their expertise and market knowledge. These professionals understand the various factors that influence insurance rates, such as age, health, occupation, and lifestyle. They can assess your individual circumstances and match you with providers that offer tailored policies at competitive prices. This personalized approach is crucial, as one-size-fits-all policies may not provide the best value for your specific needs.

The key to accessing competitive rates is the broker's ability to compare and contrast different insurance products. They can present you with options from multiple providers, allowing you to make an informed decision. This process often involves requesting quotes and comparing the terms and conditions of various policies. By doing so, you can identify the provider that offers the most comprehensive coverage at a price that fits your budget.

Furthermore, independent brokers can often secure discounts and special offers that may not be readily available through direct insurance companies. They have established relationships with various insurers and can leverage these connections to negotiate lower premiums. This is particularly beneficial for individuals with specific requirements or those who fall into niche market segments.

In summary, opting for an independent life insurance broker provides you with access to a diverse range of providers, increasing the likelihood of finding competitive rates. Their expertise and ability to compare policies ensure that you receive personalized recommendations, tailored to your unique circumstances. By taking advantage of their market knowledge and negotiating power, you can secure the best value for your life insurance needs.

Life Insurance: Impact on Net Worth Calculation

You may want to see also

Peace of Mind: Having an independent policy ensures you're not tied to a single company, offering flexibility

When it comes to life insurance, having an independent policy can provide a sense of peace of mind and flexibility that is often lacking with tied policies. Here's why:

Firstly, being independent means you're not locked into a single insurance company's offerings. This freedom allows you to choose the best policy for your needs without being restricted by a pre-determined plan. You can compare different providers, policies, and coverage options, ensuring you get the most suitable and comprehensive protection. This level of choice is a significant advantage, as it empowers you to make decisions based on your specific requirements and preferences.

With an independent policy, you're not tied to a specific company's terms and conditions, which can often be restrictive. This freedom to choose and switch providers means you can adapt your insurance as your life circumstances change. For example, if you want to increase your coverage or switch to a different type of policy, you can do so without the hassle of transferring your entire policy to a new provider. This flexibility is particularly valuable as it allows you to stay protected without the constraints of a single company's offerings.

Additionally, independent life insurance policies often provide more personalized service. You can work directly with an advisor who understands your unique needs, ensuring that your policy is tailored to your specific situation. This level of customization and attention to detail can be a significant benefit, as it ensures that your insurance is not just a generic product but a solution that meets your individual requirements.

In summary, having an independent life insurance policy offers peace of mind by providing flexibility, choice, and personalized service. It empowers you to make decisions that are best for your circumstances, ensuring you stay protected without being tied to a single company's offerings. This level of independence is a valuable asset when it comes to safeguarding your loved ones and your financial future.

Fidelity Term Life Insurance: Is It Worth the Cost?

You may want to see also

Frequently asked questions

Independent life insurance agents offer a unique advantage by providing unbiased advice and comparing policies from various insurers. They work for you, the client, and not for any specific company, ensuring you receive the best coverage and rates tailored to your needs.

By engaging an independent advisor, you gain access to a wide range of options. These advisors can compare different insurance providers' products, helping you find the most competitive prices and suitable coverage. They negotiate on your behalf and can often secure additional benefits or discounts.

Life circumstances change, and so should your insurance coverage. Regular reviews ensure your policy remains relevant and adequate. An independent advisor can help you assess your current situation, identify any gaps in coverage, and make necessary adjustments to protect your loved ones' financial well-being.

Absolutely! Independent life insurance agents provide ongoing support throughout the policy's lifecycle. They can assist with claims processing, policy changes, and ensuring smooth administration. Their expertise simplifies the process, providing peace of mind during challenging times.

Independent advisors are not bound to a single insurer's products. They have the freedom to recommend the most suitable options based on your specific requirements. This impartiality allows them to provide honest advice, educate clients about various policies, and help you make informed decisions.