Veterans' Group Life Insurance (VGLI) is a great option for those who are unable to medically qualify for a regular life insurance policy. VGLI offers guaranteed acceptance without a medical exam for those who apply within 240 days of leaving the service. However, VGLI rates increase with age, and the coverage amount is relatively low compared to other options. On the other hand, private insurance may offer more coverage but requires a health review for eligibility. Therefore, those with medical conditions that may affect their insurability should consider converting to VGLI, while those in good health may find better value with a private term life insurance policy.

| Characteristics | Values |

|---|---|

| Premiums | Affordable for younger veterans but become expensive for older veterans as they increase significantly with age |

| Coverage | Enough to meet your needs? VGLI offers $10,000-$500,000 in term life insurance benefits. |

| Type of insurance | Term insurance may not be your best option; VGLI offers only term life insurance with no cash value |

| Features | VGLI does not have membership or enrollment fees, and there is no health review if you apply within 240 days of separation |

What You'll Learn

- Private insurance may be more cost-effective in the long run

- Private insurance can provide permanent coverage

- Private insurance may offer higher coverage amounts

- Private insurance may be a better option for healthy, non-smoking veterans

- Private insurance may be a good option if you want to avoid increasing premiums

Private insurance may be more cost-effective in the long run

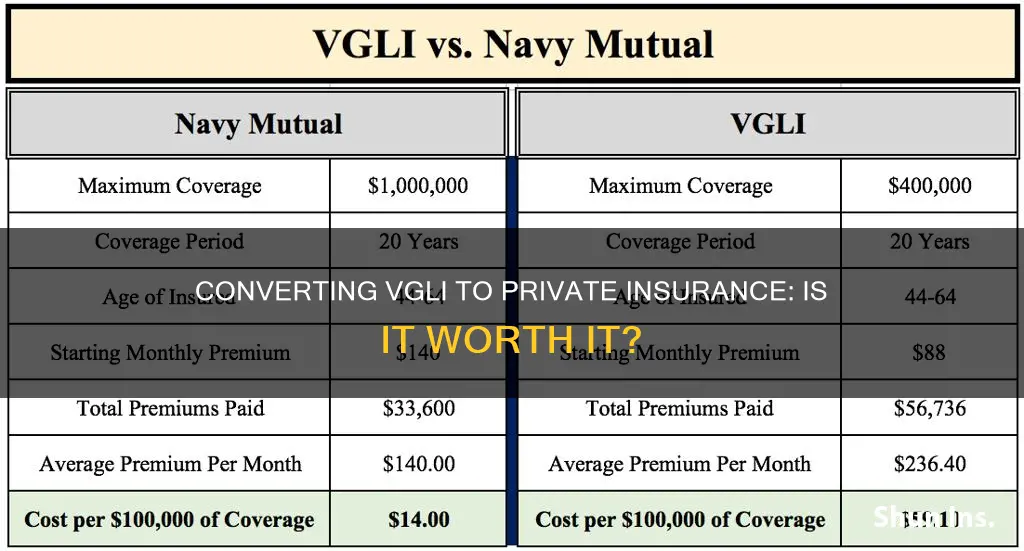

VGLI rates are affordable for younger veterans, but they increase significantly as the policyholder ages. For example, a $100,000 policy for a 35-year-old veteran would cost $12 a month, but the same policy for a 55-year-old veteran would cost $60 a month. In contrast, term life insurance policies have fixed rates, meaning that the premium remains the same for the entire term.

For example, an AAFMAA Level Term II policy can save you thousands of dollars in premiums over the life of the policy. For a 45-year-old male, the monthly premium for a $400,000 10-year Level Term II policy would be significantly lower than the cost of a VGLI policy for the same coverage. Over 10 years, the savings would amount to $10,488.

Additionally, VGLI has a low death benefit cap of $500,000. If you require a policy that pays out more than this amount, you would need to find additional coverage. In contrast, term life insurance policies can provide coverage into the millions.

Finally, VGLI offers only term life insurance, which means the policy has a death benefit but does not build any cash value. On the other hand, permanent life insurance policies are more expensive but can build cash value over time. While VGLI can be a good option for those who cannot qualify for regular life insurance, private insurance may be more cost-effective in the long run for those who are in good health.

Private Insurance: Drug Screening for Opioid Users?

You may want to see also

Private insurance can provide permanent coverage

Permanent life insurance policies generally last for the entirety of the policyholder's life and allow them to build cash value, which can be accessed while they are alive. The policy charges and coverage length contribute to the higher cost of permanent life insurance compared to term life insurance.

Permanent life insurance is a good option for those who:

- Want to build cash value.

- Want to ensure a death benefit payout for their loved ones, regardless of their age.

- Need lifelong life insurance protection because of financially dependent individuals.

- Want to fund a life insurance trust.

- Desire to leave a financial legacy to their heirs.

There are several types of permanent life insurance policies, including whole life insurance and universal life insurance. Whole life insurance offers fixed premiums, rate of return on cash value, and death benefit, whereas universal life insurance provides more flexibility in adjusting premium payments and death benefits.

Converting VGLI to private insurance can provide permanent coverage, which guarantees lifelong protection and allows individuals to build cash value. This option may be preferable for those seeking lifelong coverage and the ability to access their policy's value while alive.

Private Insurance Patients: Face-to-Face Requirements Explained

You may want to see also

Private insurance may offer higher coverage amounts

The amount of coverage you need depends on your unique circumstances, including your age, financial obligations, and lifestyle. If you require more than $500,000 in coverage, private insurance may be a better option.

Additionally, VGLI premiums increase as you age, whereas level term life insurance policies from private insurers offer fixed rates for the duration of the policy. As a result, term life insurance from a private insurer may provide better value in the long run, especially for older individuals.

It's important to carefully consider your needs and compare the coverage amounts and premiums of VGLI and private insurance options to determine which best suits your requirements.

Understanding Private Pilot Insurance: Are You Covered?

You may want to see also

Private insurance may be a better option for healthy, non-smoking veterans

- Cost: VGLI premiums increase significantly as you age, and can become expensive for older veterans. In contrast, term life insurance rates from private insurers remain the same for the duration of the policy, and are often cheaper than VGLI for older individuals.

- Coverage Amount: VGLI has a relatively low death benefit cap of $500,000. If you require a policy that pays out more than this amount, you would need to find additional coverage. Private insurers often offer higher coverage amounts.

- Permanent Policy Options: VGLI only offers term life insurance, which means it has a death benefit but does not build any cash value. If you're looking to build cash value through your policy, private insurers offer permanent life insurance options, such as whole life insurance.

- Medical Exam: While VGLI does not require a medical exam if you enroll within 240 days of leaving the military, private insurance may offer more flexibility for healthy individuals. If you are in good health, you may qualify for lower rates with private insurance that takes your health into account.

- Coverage Period: VGLI offers coverage for life as long as you pay the premiums. However, if you are a healthy non-smoker, you may only require coverage for a specific period. Private insurance allows you to choose the duration of your coverage, such as 10 or 30 years, which can be more cost-effective.

In summary, while VGLI has its advantages, private insurance may offer healthier, non-smoking veterans more flexibility in terms of coverage amounts, policy types, and potentially lower rates, especially as they age. It is important to carefully evaluate your insurance needs and compare different options before making a decision.

Morgan Stanley Private Bank: Insured Accounts Explained

You may want to see also

Private insurance may be a good option if you want to avoid increasing premiums

For example, if you are in good health after leaving service, you may get more value from a civilian term life insurance policy. Term life insurance allows you to fix rates for periods usually up to 30 years, and coverage amounts can range into the millions. If you need more coverage than VGLI provides, term policies are usually the cheapest life policies available.

Another alternative is permanent life insurance. If you want to build cash value, you may be able to lock in rates for policies such as whole life insurance. Permanent life insurance is more expensive than term life, but coverage can last for the rest of your life, and your premiums won't increase over time.

If you are looking for a policy that will pay out more than $500,000 to your life insurance beneficiaries, VGLI may not be the best option. VGLI has a relatively low death benefit cap of $500,000, and it does not build any cash value.

It's important to evaluate whether VGLI will meet your life insurance needs. Consider if the premiums will be affordable, if the coverage is enough, if term insurance is your best option, and if the plan contains features that are important to you.

Billing Insurance in Private Practice: A Guide to Get Started

You may want to see also

Frequently asked questions

VGLI rates increase every five years according to age, whereas level term life premiums remain the same for the entire term. Private insurance can, therefore, be cheaper than VGLI in the long run.

VGLI is a great option for those who cannot medically qualify for regular life insurance. It offers guaranteed acceptance, no medical exam, a payout that stays the same, and no membership fees. However, VGLI rates increase with age and there are no permanent policy options or high coverage amounts.

You can convert your VGLI policy to an individual permanent life policy with a participating insurance company, without proof of good health. First, select a company from the participating companies listing, then apply at the local sales office of your chosen company. Finally, obtain a letter from the Office of Servicemembers' Group Life Insurance (OSGLI) verifying coverage and give a copy of that notice to the agent who takes your application.