Life insurance cash value can decrease for several reasons, primarily due to the policy's investment performance and the policyholder's actions. One common factor is the investment risk associated with the policy's investment options, which can lead to fluctuations in the cash value. Additionally, if the policyholder makes withdrawals or surrenders the policy, the cash value may decrease due to fees and penalties. Another reason could be the policy's loan feature, where borrowing from the cash value can reduce it over time. Understanding these factors is crucial for policyholders to manage their insurance effectively and ensure the policy remains a valuable financial asset.

What You'll Learn

Policy Loans: Borrowing against cash value can reduce it

Life insurance policies, particularly those with cash value accumulation, offer a unique financial tool that can be utilized in various ways. One such method is taking out a policy loan, which involves borrowing money from the policy's cash value. While this can provide immediate financial benefits, it's essential to understand the potential drawbacks, especially how policy loans can impact the cash value of your life insurance.

When you take out a loan against your life insurance policy, the insurance company typically advances a portion of the cash value accumulated in the policy. This loan is secured by the policy itself, meaning the insurance company has the right to deduct the loan amount, plus interest, from the policy's cash value. The interest charged on these loans is usually quite high, often exceeding the interest rates on traditional loans. As a result, the loan principal and the associated interest can significantly reduce the cash value of your policy.

The reduction in cash value can have several implications. Firstly, it diminishes the policy's ability to accumulate future cash value, which is a critical aspect of permanent life insurance policies. This reduction can also impact the policy's death benefit, as the cash value is used to fund the payout in the event of the insured's death. Over time, repeated policy loans can deplete the cash value, potentially leading to a situation where the policy no longer has sufficient cash value to cover the loan's interest and principal.

It's important to note that policy loans are not a form of withdrawal. Unlike taking out a loan from a savings account, policy loans do not reduce the overall cash value of the policy. Instead, they create a lien on the policy, which means the insurance company has a claim on the policy's assets to recover the loan. If the policy's cash value is insufficient to cover the loan, the insurance company may have to sell the policy or reduce the death benefit to recover the debt.

In summary, while policy loans can provide immediate financial relief, they should be approached with caution. The high-interest rates and potential for cash value depletion mean that borrowing against your life insurance's cash value can have long-term consequences. It is crucial to carefully consider the terms of any loan and explore alternative financial strategies to ensure the preservation and growth of your life insurance's cash value.

Understanding Life Insurance Death Benefits Payouts

You may want to see also

Surrenders: Taking out cash value may decrease it

Surrenders, or taking out cash value from a life insurance policy, can have a significant impact on the policy's future value and overall performance. When you surrender a policy, you essentially withdraw a portion of the cash value, which can lead to a decrease in the policy's overall value. This process is often a last resort for policyholders who may be facing financial difficulties or need immediate funds. However, it's important to understand the potential consequences before making such a decision.

When you surrender a life insurance policy, the insurance company typically pays out the cash value, which is the accumulated amount of money that has been invested in the policy over time. This cash value is built up through regular premium payments and investment gains. However, taking out this cash value can disrupt the policy's growth and investment strategy. The policy's investment performance is designed to generate returns over the long term, and withdrawing cash value can disrupt this carefully planned investment journey.

The impact of surrenders on the policy's value is twofold. Firstly, the policy's investment performance may be negatively affected. When you take out cash value, the policy's investment portfolio may become imbalanced, as the insurance company may need to adjust the asset allocation to compensate for the withdrawal. This adjustment can lead to short-term fluctuations in the policy's value and potentially lower overall returns. Secondly, the policy's death benefit, which is the main purpose of the insurance, may be reduced. As the cash value decreases, the policy's ability to provide a substantial death benefit upon the insured's passing may be compromised.

It's important to note that surrenders can also result in fees and penalties. Insurance companies often charge surrender charges or penalties when policyholders withdraw cash value within a certain period, typically the first few years of the policy. These charges can further reduce the overall value of the policy and may discourage policyholders from accessing their cash value prematurely.

In summary, surrenders or taking out cash value from a life insurance policy can lead to a decrease in the policy's future value and overall performance. It can disrupt the investment strategy, potentially impacting long-term returns and the policy's ability to provide a substantial death benefit. Policyholders should carefully consider the reasons for needing immediate funds and explore alternative options before surrendering their valuable life insurance policies. Understanding the potential consequences is crucial to making informed financial decisions.

Chronic Tonic Seizures: Life Insurance Impact and Exclusions

You may want to see also

Policy Lapse: Missed payments can lead to cash value decline

Missed payments on a life insurance policy can have a significant impact on the cash value of the policy, and it's important to understand why this happens and what it means for policyholders. When an individual takes out a life insurance policy, they typically make regular premium payments to ensure the policy remains in force. These payments contribute to the policy's cash value, which grows over time and can be borrowed against or withdrawn. However, if payments are missed, the policy's cash value can decline, and this process is known as "policy lapse."

The primary reason for this decline is the accumulation of interest and investment earnings, which are crucial for the policy's cash value growth. Life insurance companies invest the premiums they receive in various financial instruments, generating interest and investment returns. These earnings are used to build the policy's cash value. When payments are missed, the policy's investment account is not replenished, and the interest and investment earnings are not applied to the policy's value. As a result, the cash value may decrease, and the policy may no longer have sufficient funds to cover its costs and benefits.

In the event of a policy lapse, the insurance company may offer a grace period during which they will not cancel the policy. This grace period typically lasts for a specific number of days or months, depending on the policy terms. During this time, the policyholder can make up the missed payments to avoid a lapse. If the payments are not made during the grace period, the policy may be canceled, and the cash value could be significantly reduced or even depleted.

It's essential for policyholders to understand their payment obligations and the consequences of missing payments. Life insurance policies often have strict rules regarding payment schedules and grace periods. Missing a payment can have long-term effects on the policy's value and its ability to provide financial security. Policyholders should review their policies regularly and ensure they are making the necessary payments to maintain the desired level of coverage and cash value.

In summary, missed payments on a life insurance policy can lead to a policy lapse, causing a decline in the cash value. This decline occurs because the policy's investment earnings and interest are not replenished, affecting the overall value. Policyholders must be aware of their payment responsibilities to avoid potential financial losses and ensure their life insurance policies remain effective. Regular review and timely payments are key to maintaining the desired cash value and the policy's intended benefits.

Understanding UTMA: A Comprehensive Guide to Life Insurance

You may want to see also

Investment Performance: Poor investment returns can impact cash value

Life insurance policies with cash value accumulation often invest in a portfolio of assets to generate returns and build the policy's cash value. However, the performance of these investments is crucial to the policy's overall growth. When investment returns are poor, it can significantly impact the cash value of a life insurance policy.

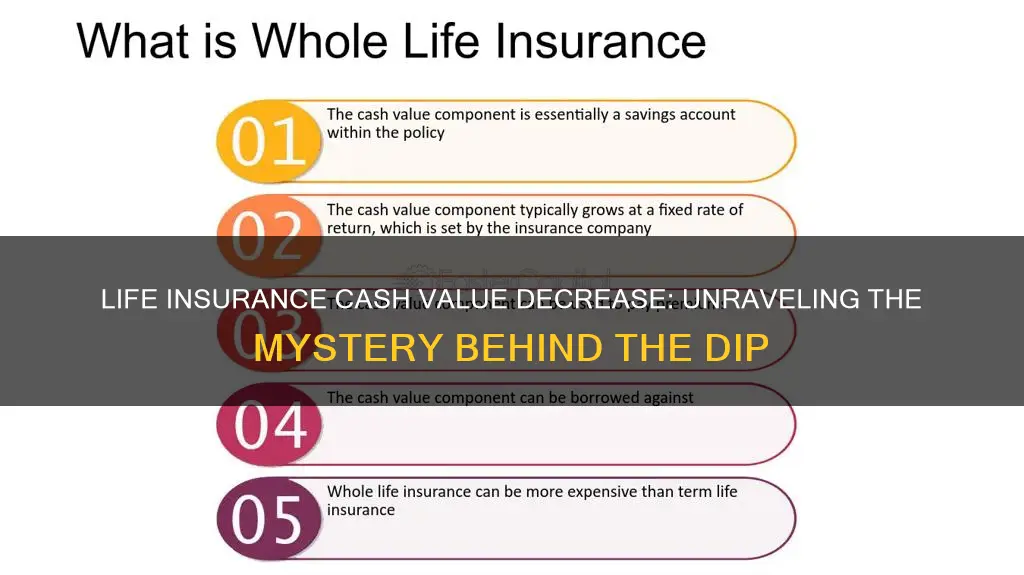

The cash value of a life insurance policy is essentially the investment account within the policy. It grows over time through the accumulation of interest and investment earnings. This cash value can be borrowed against or withdrawn, providing a source of funds for the policyholder. If the investments within the policy underperform, the cash value may decrease, leading to a reduction in the policy's overall value.

Poor investment performance can occur due to various factors. Market conditions, such as economic downturns or volatile markets, can cause asset prices to decline, resulting in lower investment returns. Additionally, the investment strategy employed by the insurance company may not be performing as expected. This could be due to poor asset allocation, subpar management of the investment portfolio, or a lack of diversification, all of which can contribute to poor investment returns.

When investment returns are poor, the insurance company may experience a decrease in the overall value of its investment portfolio. This, in turn, affects the cash value of the individual policies they underwrite. As a result, policyholders may find that their cash value is growing more slowly than anticipated or even decreasing, depending on the extent of the underperformance.

It is important for policyholders to understand the impact of investment performance on their life insurance cash value. Regularly reviewing the policy's investment-related documents and seeking professional advice can help individuals make informed decisions and potentially mitigate the effects of poor investment returns. Additionally, choosing insurance providers with a strong track record of investment management can contribute to more stable and positive cash value growth.

Whole Life Insurance in Australia: What's Available?

You may want to see also

Policy Fees: Administrative charges can reduce cash value

Life insurance policies, particularly those with cash value accumulation, can be complex financial instruments, and understanding the various factors that influence their performance is crucial for policyholders. One significant aspect that can impact the cash value of a life insurance policy is the presence of administrative charges and fees. These charges are often overlooked but can have a substantial effect on the overall value of the policy over time.

Administrative charges are typically associated with the ongoing management and maintenance of the insurance policy. These fees cover various operational costs incurred by the insurance company, such as processing claims, managing policyholder accounts, and ensuring compliance with regulatory requirements. While these services are essential for the smooth functioning of the policy, they come at a cost, which is reflected in the reduction of the cash value.

The impact of policy fees on cash value is a critical consideration for policyholders. When a policy is in force, the insurance company invests a portion of the premiums paid into various investment options, generating interest and growing the cash value. However, a portion of each premium is also allocated to cover administrative expenses. Over time, these fees can accumulate and eat into the potential growth of the cash value. As a result, the policyholder may find that the cash value does not increase as much as expected or even decreases, especially if the fees are substantial.

It is important for individuals to carefully review the fee structure of their life insurance policies. Some insurance companies provide detailed breakdowns of administrative charges, allowing policyholders to understand the specific costs associated with their policies. By being aware of these fees, individuals can make more informed decisions about their insurance coverage and potentially explore options to minimize the impact of policy fees on their cash value. This might include negotiating with the insurance provider or considering alternative insurance products that offer more favorable fee structures.

In summary, administrative charges and fees are a significant consideration when evaluating the performance of life insurance policies with cash value accumulation. Policyholders should be mindful of these costs, as they can directly influence the growth or decline of the cash value. Understanding the fee structure and its potential impact can empower individuals to make better financial decisions regarding their life insurance coverage.

Life Insurance Trust Agreements: What You Need to Know

You may want to see also

Frequently asked questions

The cash value of a life insurance policy can decrease due to several factors. Firstly, if you make regular withdrawals or take out loans against the policy's value, it can reduce the overall cash value. Secondly, certain types of policies, especially those with high surrender charges, may have a decrease in cash value if you cancel the policy early. Additionally, market fluctuations in the investment options linked to the policy can impact the cash value negatively.

Yes, the investment performance of your life insurance policy can directly influence its cash value. If the investment options chosen for your policy underperform, it may result in a lower cash value. This is because the policy's cash value is tied to the performance of the investments, and any losses or underperformance can reduce the overall value. It's important to regularly review and consider the investment options to ensure they align with your financial goals.

Changes in the policy terms and conditions can also lead to a decrease in cash value. For instance, if you modify your policy by increasing the death benefit or adding riders, it may require additional premium payments. These changes can temporarily reduce the cash value as the policy adjusts to accommodate the new terms. Additionally, if you opt for a policy with a higher commission structure, the initial cash value may be lower until the commissions are paid out.