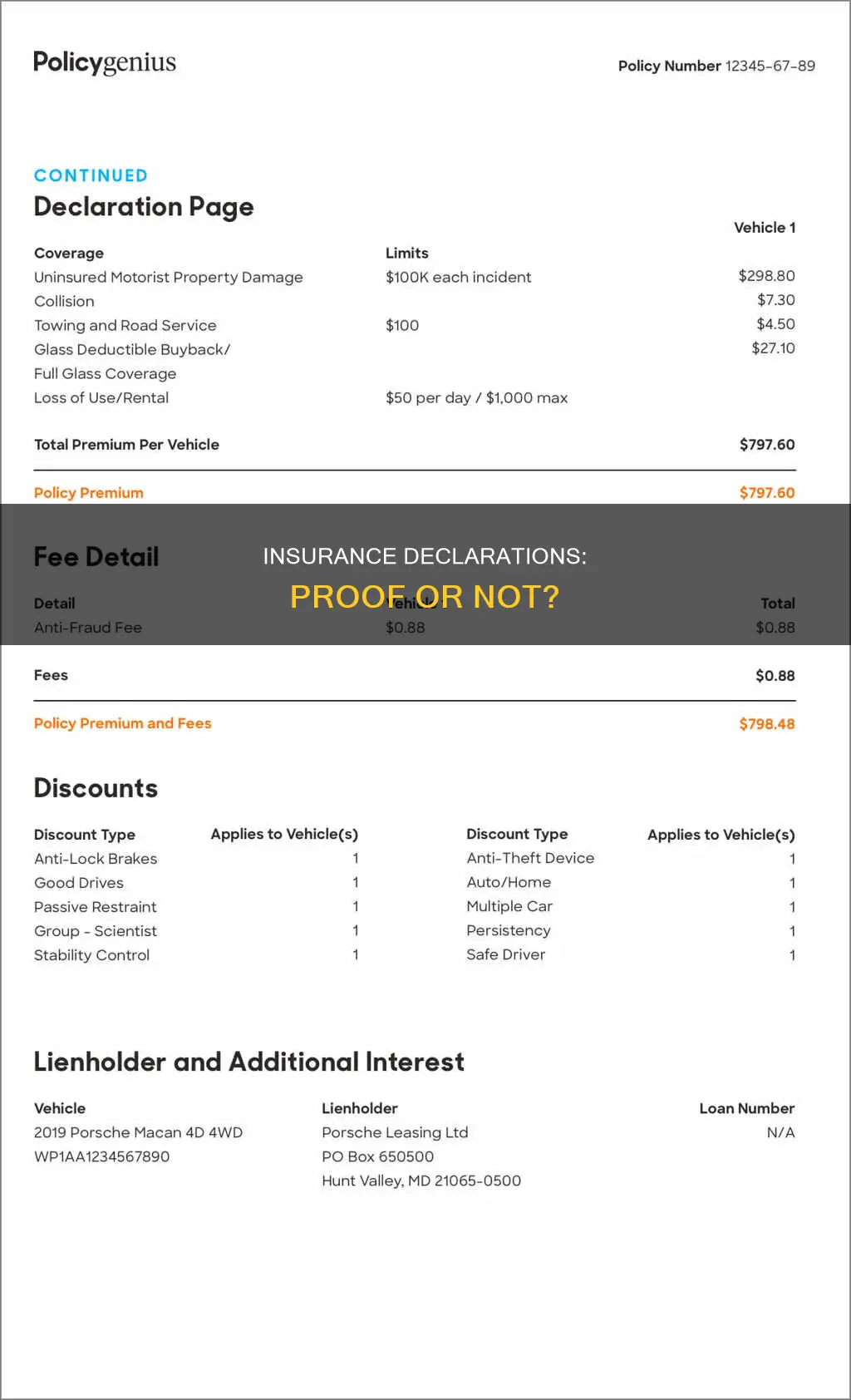

A declarations page, or dec page, is a document provided by an insurance company that summarises the coverage provided by an insurance policy. It contains the insured's name and contact information, the issuing agency's name and contact information, the insurance company's name, the policy number, and the effective and expiration dates. It also includes the insured's address, the policy endorsements, and limits for each coverage. While a declarations page is not typically considered proof of insurance, it can be used as such in certain situations, such as when purchasing a home or car, or when providing proof of insurance to a lender or mortgage company. However, it is generally recommended to carry a physical or digital insurance card as proof of insurance when driving.

| Characteristics | Values |

|---|---|

| Purpose | To summarize the major coverage and limits of the insured policy onto a single page for easy reference |

| Use as proof of insurance | Yes, but not recommended for use in place of an insurance card when pulled over |

| Details included | Name and address of the insurance company, policy number, effective date and expiration date, name of the insured, vehicle details, coverage details, deductible amount, premium, discounts, endorsements, contact information of insured and insurance company |

| Format | A full-size piece of paper, usually the first page of the insurance policy |

What You'll Learn

- Declarations page as proof of insurance when pulled over by police

- Declarations page as proof of insurance for mortgage lenders

- Declarations page as proof of insurance when losing auto insurance ID card

- Declarations page as proof of insurance for landlords

- Declarations page as proof of insurance for lenders or condo associations

Declarations page as proof of insurance when pulled over by police

A declarations page, or "dec page," is a document provided by your insurance company that summarizes the coverage provided by your insurance policy. It contains all the most pertinent information regarding your insurance policy, including the policy number, the insured parties, the address of the insured property, the policy period, and the coverage types and limits.

When it comes to using a declarations page as proof of insurance when pulled over by the police, there is some discrepancy in the information provided. Some sources state that a declarations page is not generally considered proof of insurance in that situation and that it is better to carry a physical or digital insurance card for that purpose. However, other sources claim that a declarations page can indeed be used as proof of insurance if you are pulled over, as it verifies your coverages, limits, and the insured parties named in the policy.

It is important to note that the requirements for proof of insurance may vary depending on your location and the specific circumstances. While a declarations page may be sufficient in some cases, it is always a good idea to carry a physical or digital insurance card with you when driving, as this is more convenient and widely accepted as proof of insurance.

In summary, while a declarations page may contain all the necessary information to serve as proof of insurance, it is not specifically designed for that purpose and may not be accepted by law enforcement in all situations. Therefore, it is recommended to have a dedicated insurance card readily available when driving, which serves as a more standardized and widely accepted form of proof of insurance.

Understanding BetterHelp's Insurance Billing Practices: What You Need to Know

You may want to see also

Declarations page as proof of insurance for mortgage lenders

A declarations page, often referred to as a "dec page", is a document provided by an insurance company that summarises the coverage provided by a policy. It is usually the first page of an insurance policy document and contains specific information about the coverages for a vehicle or home.

A declarations page can be used as proof of insurance in many cases. When purchasing a home or vehicle, a lender will require proof of insurance. A declarations page can be used to show the lender that the borrower has the coverages and limits they require.

A declarations page can also be used as proof of insurance for a mortgage lender. Mortgage companies will typically require an up-to-date declarations page as proof of homeowners insurance about once a year to ensure the borrower has adequate financial protection for their house. If the borrower does not provide this proof of insurance, the lender has the right to purchase homeowners insurance on their behalf and add the premium to the borrower's mortgage payments.

A declarations page can be obtained from an insurance company via email, fax, regular mail, or online.

Updating Your Email Address with Hagerty Insurance: A Step-by-Step Guide

You may want to see also

Declarations page as proof of insurance when losing auto insurance ID card

A declarations page is a document provided by your insurance company that summarises the coverage provided by your insurance policy. It contains all the most pertinent information regarding your insurance, such as the insured, the insurance provider, the lender (if applicable), and the address of the insured property. It also includes the policy number, the deductible, the premium, and the effective dates of the policy.

The declarations page is usually the first page of your insurance policy. It is a great resource for quick, up-to-date information on your insurance policy. It is also considered proof of insurance in most cases, especially when loans are involved. For example, when purchasing a home or a car, your lender will require proof of insurance, and the declarations page can be used for this purpose.

If you lose your auto insurance ID card, you can use your declarations page as proof of insurance. However, it is important to note that a declarations page generally should not be used as proof of insurance when pulled over by law enforcement. In such cases, it is recommended to carry a physical insurance card or a digital insurance card, which is accepted in most states.

To obtain your declarations page, you can log in to your online account and access your policy documents. You can also contact your insurance company or agent for assistance if needed.

Chiropractor: Insurance Specialist Status?

You may want to see also

Declarations page as proof of insurance for landlords

A declarations page, also known as a "dec page", is a document provided by an insurance company that outlines the details of a policy. It includes information about the insured, the insurance provider, the policy number, the coverage amount, the deductible, and the premium. The declarations page is usually the first page of an insurance policy document and can be used as proof of insurance in certain situations.

For landlords, a declarations page can serve as proof of insurance when purchasing a home or renting out a property. When purchasing a home, a lender will typically require proof of insurance before issuing a mortgage. The declarations page can be provided as documentation to show that the homeowner has the necessary coverage in place.

Additionally, landlords may require tenants to purchase renters insurance and provide proof of this coverage. The tenant can then share their declarations page with the landlord as proof of their renters insurance policy. This allows the landlord to verify that the tenant has the required level of coverage, such as personal liability insurance and personal property coverage.

It is important to note that while a declarations page can often be used as proof of insurance, there may be instances where a separate proof of insurance document is required. This may depend on the specific requirements of the lender or landlord, as well as any state or federal regulations. In some cases, an insurance company may provide a separate proof of insurance document, such as an insurance card or a certificate of insurance.

The Surprising Truth Behind Hospital Billing: Unraveling the Insurance Enigma

You may want to see also

Declarations page as proof of insurance for lenders or condo associations

A declarations page, often called a "dec page," is a document provided by your insurance company that summarizes the coverage provided by your insurance policy. It contains all the most pertinent information regarding your insurance. It is usually the first page of your insurance policy and can be used as proof of insurance in many cases.

When you buy a new home, one of the most important things to consider is homeowners insurance. A declarations page is a one-page summary of all the key components of your policy. It includes the named insured, policy number and effective dates, home information, coverage types, coverage limits and deductibles, discounts, and the premium.

Your declarations page will list the physical address of the insured property and your mailing address if it's different. If you have a homeowners insurance provider or lender, those addresses and contact information will also be listed.

If you have a mortgage, your mortgage company will typically require you to provide an up-to-date declarations page for proof of your homeowners insurance about once a year to ensure you have adequate financial protection for your house. If you don't provide this proof of insurance, your lender has the right to purchase homeowners insurance for you and add the premium to your mortgage payments. This is called 'force-placed insurance'.

A declarations page can be used as proof of insurance for lenders or condo associations. It is a great resource for quick, up-to-date information on your insurance policy.

Understanding Door Dash Insurance: Making Changes to Suit Your Needs

You may want to see also

Frequently asked questions

A declarations page is a document provided by an insurance company that summarises the coverage provided by an insurance policy. It contains all the most important information regarding the insurance.

A declarations page will include the insured's name and address, the policy endorsements, and limits for each coverage. It will also include the policy number and policy period, covered vehicle information, the name of the lienholder, lender, or loss payee, and the type of homeowners insurance.

A declarations page can be used as proof of insurance in certain situations, such as when purchasing a home or auto, or when providing proof of insurance to a lender. However, it is generally recommended to carry a physical or digital insurance card as proof of insurance when driving.

An insurance binder shows that you have temporary coverage, while a declarations page lasts the full term of the policy. A binder is typically valid for 30 to 90 days, whereas a declarations page lasts for six months to a year.

The purpose of a declarations page is to provide a concise summary of the major coverages and limits afforded by the insurance policy. It allows policyholders to quickly access important information about their coverage and serves as a reference document.