Billing insurance as a BCBA can be a challenging and time-consuming process. Board-certified behaviour analysts (BCBAs) often face difficulties when dealing with insurance billing due to the complexity of ABA claims. This can result in a higher rate of denied claims, requiring significant time and resources to manage. To streamline the process, it is essential to understand the steps involved in the ABA insurance claims cycle, which typically consists of verification, patient contribution, claim generation, claim follow-up, and reconciliation. Additionally, staying up-to-date with billing codes and trends is crucial to avoid errors and claim denials. Outsourcing billing services to a third-party provider with expertise in the field can be beneficial, allowing BCBAs to focus more on patient care and improve the overall quality of their practice.

| Characteristics | Values |

|---|---|

| State | Arizona, Florida, Illinois, Indiana, Louisiana, Minnesota, Pennsylvania, South Carolina, and Texas require insurance providers to cover ABA therapy. |

| Insurance Provider | Contact the insurance provider to discover the conditions and requirements for coverage. |

| Forms | Obtain billing claim forms from the insurance provider and complete them with the proper service code, units, and other information. |

| Certification | Consider becoming certified through the Behavior Analyst Certification Board. |

| Third-Party Provider | Select a third-party provider with a good depth of understanding of the diagnosis, treatment, and supportive services provided by the BCBA. |

| Medical Billing Accuracy | The third-party provider must be able to verify accurate patient medical billing data and ensure all industry standards are maintained throughout the claim submission process. |

| Claims Management | The third-party provider must manage the entire claims process professionally and comprehensively, including coordinating with insurers to confirm all claims are accepted. |

| Denial Reduction | The services provided by the third-party provider should lead to a reduction in the number of claim denials for the practice. |

| Patient Billing Management | The third-party provider should be able to manage patient billing for any remaining cost or for full payment when a person lacks proper insurance coverage. |

| Complete RCM Services | Revenue cycle management (RCM) enables practices to better manage claims and collect payment for each service rendered to clients. |

| Working With In-House Staff | Choose a third-party provider that can work in conjunction with in-house staff to manage the billing process efficiently. |

What You'll Learn

Verify client's insurance eligibility to determine coverage for ABA

Verifying a client's insurance eligibility is a crucial step in the billing process. Without proper eligibility, your claim will be denied before it even starts.

To verify a client's insurance eligibility, you will need some basic information, such as their insurance member ID or subscriber number. If you need to verify a specific service, you may also need the procedure code, ICD-10, CPT, or HCPCS codes.

There are several ways to check a client's insurance eligibility:

- Go directly to payer portals and sites: Many insurance companies, such as Blue Cross Blue Shield, Aetna, and United Healthcare, allow providers to enter information directly into their portal to verify eligibility and benefits.

- Use a clearinghouse: If you accept multiple insurance plans, you can use tools like Availity and Ability Network to check the eligibility of multiple payers in one portal, rather than having to navigate different websites. Clearinghouses may also have eligibility verification tools that can provide basic information.

- Check eligibility through your software: Some practice management software has integrated eligibility checks, allowing you to verify a patient's eligibility before their visit or generate an eligibility check immediately.

- Call the payer directly: You can call the insurance company directly and use their interactive voice response system (IVR) to verify eligibility. However, hold times can be long, and it may be challenging to speak with a human representative.

When verifying eligibility, it is important to remember that the presentation of an insurance ID card is not a guarantee of eligibility. The provider is responsible for verifying the member's current enrollment status before providing care.

Eligibility can change over time, so it is essential to stay informed and communicate with patients about any job changes or moves to a different state, as these can impact their insurance coverage.

Once you have verified a client's insurance eligibility, you can determine their coverage for Applied Behavior Analysis (ABA) therapy. ABA therapy is typically covered by insurance plans, but the extent of coverage can vary depending on the state, insurance company, and specific insurance plan. Some plans may have limits on the number of therapy sessions covered, while others may not cover ABA therapy at all. Therefore, it is crucial to check with the insurance provider to understand the specific ABA therapy benefits and any limitations or exclusions.

To get insurance coverage for ABA therapy, a diagnosis of autism from a qualified healthcare provider is usually required. Additionally, documentation from a BCBA or other qualified provider stating that ABA therapy is medically necessary may also be needed.

By verifying clients' insurance eligibility and understanding their coverage for ABA therapy, you can gain clarity on the likely cost of treatment and avoid billing issues down the line.

Understanding Insurance Billing for Nexplanon: A Comprehensive Guide

You may want to see also

Understand the CPT codes for ABA billing

CPT stands for Current Procedural Terminology. These codes are used to streamline the reporting of medical, surgical, and diagnostic services and procedures. CPT codes are also used for administrative purposes such as claims processing and developing guidelines for medical care review. They are critical for billing and insurance claims, ensuring therapists and healthcare providers are properly compensated for their services.

CPT codes are maintained by the American Medical Association (AMA) and are updated regularly to reflect current clinical practice and innovation in medicine. The codes are divided into three categories:

Category I:

The largest body of codes, consisting of those commonly used by providers to report their services and procedures. These codes are arranged in numerical order and are typically denoted by five numeric characters.

Category II:

Supplemental tracking codes used for performance management. These codes consist of four numbers and the letter F and are not linked to reimbursement.

Category III:

Temporary codes used to report emerging and experimental services and procedures. These codes consist of four numbers and the letter T.

When billing for ABA services, it is essential to use the correct CPT codes to ensure accurate and efficient reimbursement. As of April 2023, some of the key CPT codes relevant to ABA therapy include:

- 97151–97152: This code is used for the initial and re-assessment by a physician or other qualified healthcare professional. It covers the time spent reviewing patient history, conducting assessments, and developing a treatment plan.

- 97153: These codes cover adaptive behavior treatment by protocol, administered by technicians under the direction of a physician or other qualified healthcare professional.

- 97155: These codes are for adaptive behavior treatment with protocol modification, involving more direct service delivery from the physician or other qualified healthcare professional.

- 97154: This code is specifically for group adaptive behavior treatment, involving two or more patients.

- 97158: This code is for group adaptive behavior treatment with the BCBA, or supervisor, present.

- 97156: This code is for family adaptive behavior treatment guidance, involving training for the patient's family to support the patient's treatment plan.

It is important to note that CPT codes can change over time as healthcare regulations and practices evolve. Therefore, it is crucial to stay updated on the latest CPT codes and billing practices to ensure accurate and efficient billing for ABA services.

Unraveling the Web of Deceit: Insurance Fraud Treatment Centers Exposed

You may want to see also

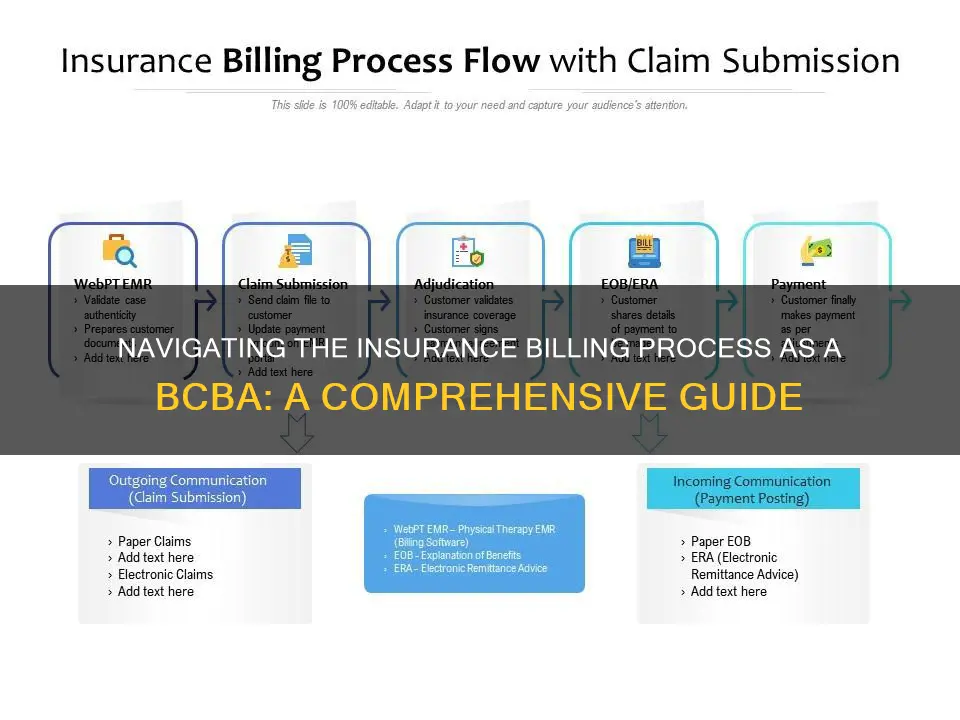

Learn how to submit claims

Submitting claims is a complex process that requires attention to detail and accuracy. Here are the steps to follow when submitting claims for ABA therapy:

Verification:

Before the first appointment, verify the client's insurance eligibility to determine their coverage for ABA therapy. This step helps the client understand the likely cost of treatment and any limitations in coverage.

Patient Contribution:

Many clients will have a copay for ABA treatment. While it is not mandatory to collect this before the appointment, it is recommended to have a policy requiring patient contributions after each session. Not collecting copays promptly can lead to difficulties in reconciling claims and financial challenges for clients.

Claim Generation:

After each appointment, a claim must be generated using the correct CPT code for the client's diagnosis and service provided. A "clean claim" must be submitted in an acceptable format to the insurer. A clean claim includes all necessary information and is free from errors.

Claim Follow-Up:

It is important to track the progress of insurance claims regularly. Some claims may be processed quickly, while others may require further information or be denied. The longer a claim with issues is left unattended, the lower the likelihood of a positive outcome.

Reconciliation:

Once a claim has been reimbursed, and any client contributions are received, the claim should be reconciled in the practice owner's accounts software and EMR. Sending confirmation of the resolution to the client is also recommended to provide clarity and peace of mind.

Common Challenges:

There are several challenges that practitioners may face when submitting claims, even with good systems in place:

- Errors on claims, such as incorrect patient information or diagnosis codes, can delay reimbursement.

- High rates of claims denials can be time-consuming to address.

- Lower-than-expected reimbursement rates may occur if relevant CPT codes related to the client's diagnosis are not maximized.

- Difficulty reconciling patient accounts due to errors in determining coverage or calculating copays.

- Disputes between patients, insurers, and clinicians may arise due to uncertainty or surprises in billing.

To overcome these challenges, it is essential to have a predictable, well-organized, and transparent claiming and billing system. Additionally, utilizing revenue cycle management services or partnering with a billing specialist can help reduce the burden on solo or small practice operators.

The Hidden Dangers of Morale Hazards: Unraveling the Complexities in Insurance

You may want to see also

Confirm client's coverage eligibility

Confirming a client's insurance coverage eligibility is an essential step in the billing process, and it can be done in three easy steps:

- Collect the client's insurance information: When a new client calls to set up their first appointment, be sure to ask for their insurance information. Record their name, date of birth, the name of their insurance company, the name of the primary insurance plan holder and their relationship to the client, the client's policy number and group ID number (if applicable), and the insurance company's contact information. Don't forget to inquire about any secondary insurance plans they may have as well.

- Contact the insurance company before the client's initial visit: It is recommended to initiate contact with the insurance company at least 72 hours before the client's first visit. This can usually be done over the phone by calling the insurance carrier and providing the client's information. It is important to confirm that you are speaking with a representative on the provider services line, as some companies have separate lines for hospital admissions or referrals. Be prepared to provide information about your practice to confirm that the exchange is HIPAA-compliant. The representative will then ask for the client's information to locate their policy. If you are having trouble reaching someone over the phone, try calling back at a different time or day. Alternatively, you can opt to use the insurance company's online eligibility-checking resources to find the information you need. However, keep in mind that these resources may not always be up-to-date.

- Gather crucial benefits information and record it: Once you have a representative on the phone or have accessed the eligibility information online, it's time to gather the details you need to avoid claim denials. Ask questions such as:

- Can you confirm the patient's policy and group number, the name of the policyholder, and their relationship to the patient?

- Can you confirm your claims address?

- Is this policy active, and if so, what is its end date?

- How many therapy visits or other services does the patient have covered this year?

- What is the patient's copay and/or coinsurance?

- What is the patient's deductible?

- Are there any requirements for physician referrals, pre-authorizations, or certificates of medical necessity for reimbursement?

- Are there any coverage limitations or documentation requirements I should be aware of?

- Is the therapist the patient plans to see in-network or out-of-network?

Record all the necessary information in your electronic medical records (EMR) system. It is also a good idea to scan the patient's insurance card and picture ID, if possible, for future reference.

Additionally, it is recommended to reverify the client's insurance information on a regular basis, ideally once a month, as insurance plans can change due to various life events.

Understanding the Art of Calculating Sum Assured in Term Insurance

You may want to see also

Understand the challenges of ABA billing

Understanding the challenges of ABA billing is essential for any practitioner looking to provide this service. The process can be complex and time-consuming, often taking valuable resources and time away from your practice. Here are some of the key challenges you may encounter:

Continuously Changing CPT Codes

The emergence of new CPT (Current Procedural Terminology) codes can make it tricky to keep up with the latest billing requirements. CPT codes change over time due to healthcare regulations and other factors. This can be especially challenging for newer or solo practitioners who haven't specialized in CPT codes. Using outdated codes can lead to incorrect diagnostic codes, treatment codes, or billing codes, resulting in claim denials by insurance companies.

CPT Code Categorization

The two broad categories of ABA billing codes can be confusing, especially when managing other administrative tasks. The first category addresses patient assessment before developing an ABA therapy plan, while the second covers different ABA treatment services. Some codes are time-based, and certain therapies may have multiple billing codes depending on the duration of the session.

Involvement of Multiple Therapists

Billing for ABA services becomes more complex when multiple therapists are involved in treating the same client. This can sometimes result in accidental double-billing, especially when the professionals work in different facilities. For example, an in-home visit by an RBT supervised by a BCBA via telehealth could lead to incorrect billing.

Procedural Issues

Even with a good understanding of ABA billing codes, procedural issues within your practice can still cause delays or denials of claims. These issues include incorrect data entry, failure to confirm patient insurance coverage, sloppy handwriting and documentation, duplicate record generation, and missing claim submission deadlines.

High Rates of Claims Denials

Insurance companies sometimes deny claims without requesting further information or clarification. Denials can be time-consuming to address, so it's essential to focus on preventing them in the first place. This may include ensuring accurate coding, providing all necessary documentation, and understanding insurance requirements.

Lower-Than-Expected Reimbursement Rates

Maximizing reimbursement rates is crucial for the financial sustainability of your practice. This involves strategically using relevant CPT codes related to your client's diagnosis to fund the maximum amount of therapy they are entitled to. Understanding billing codes and staying up-to-date with changes can help optimize reimbursement.

Difficulty Reconciling Patient Accounts

Reconciling patient accounts can be challenging, especially when errors occur in determining coverage or calculating copays. In these cases, the clinician may receive lower reimbursement than expected, leading to financial losses for the practice.

Disputes Between Patient, Insurer, and Clinician

ABA patients often experience emotional and financial stress, and uncertainties or surprises around billing can lead to communication difficulties and conflicts. To avoid this, it's essential to have a transparent, well-organized, and predictable claiming and billing system that all parties can understand.

Lack of Standardized Billing Codes

Historically, there was a lack of standardized billing codes specific to ABA therapy, leading to confusion, inconsistency, and claim denials. While new CPT codes have been implemented to address this issue, staying up-to-date with the latest codes is crucial to avoid further challenges.

Understanding Bite Splints: Navigating Insurance Coverage for This Dental Appliance

You may want to see also

Frequently asked questions

BCBA stands for Board-Certified Behavior Analyst. They provide guidance and structure to people with conditions such as autism spectrum disorder and spend a significant amount of time working closely with patients.

Using a third-party billing service can help maximize the reimbursement received for services rendered, minimize payroll costs, and allow BCBAs to spend more time with patients.

Some common challenges with ABA claiming include errors on claims, high rates of claims denials, lower than expected reimbursement rates, and difficulty reconciling patient accounts.