Life insurance is often provided by employers as a benefit for their employees. This is known as group life insurance, and it covers everyone who chooses to participate. While it is not a requirement for employers to provide life insurance, it is a popular benefit that can be offered as part of an employee benefits package. The amount of coverage provided varies, but it is typically based on an employee's salary and can range from $20,000 to $50,000, or one to two times their annual salary. Employers usually pay most or all of the premiums for this type of insurance. Group life insurance is advantageous as it is convenient, simple to sign up for, and often guaranteed, even for those with serious medical conditions. However, it is important to note that this type of insurance is usually tied to employment, and employees may lose their coverage if they leave their job. Additionally, the coverage amounts may not be sufficient for individuals with dependents or significant financial obligations. As such, many people choose to purchase supplemental life insurance or an additional individual policy to ensure they have adequate coverage.

| Characteristics | Values |

|---|---|

| Required by law | No |

| Common | Yes |

| Type | Group term life insurance |

| Coverage | Typically one year's salary or $50,000 |

| Cost to employee | Free or low cost |

| Coverage for | Employee only |

| Coverage period | While employee remains employed by the company |

| Coverage amount determined by | Multiple of employee's annual salary or employee's position at the company |

| Who pays the premium | Employers pay most or all of the premium |

| Additional coverage | May be available through the group plan |

| Riders | May be available for added protection |

What You'll Learn

What are the benefits of employer-provided life insurance?

Benefits of employer-provided life insurance

Employer-provided life insurance is a popular employee benefit that offers several advantages. Here are some of the key benefits:

Convenience

Opting into employer-provided life insurance is straightforward and simple. Employees can usually start coverage by filling out the necessary forms provided by the company's human resources department. This convenience makes it easy for employees to access life insurance without having to go through a separate application process with an external provider.

Savings

Employers typically pay most or all of the premiums for group life insurance. This saves employees money that they would otherwise spend on individual coverage. These savings can then be used for other financial needs or priorities.

Acceptance

Most employer-provided life insurance plans are guaranteed, meaning employees are accepted regardless of their medical history or current health condition. This is especially beneficial for individuals with serious medical conditions who may struggle to obtain life insurance coverage elsewhere.

Early Protection

For those who are early in their careers or just starting out, employer-provided life insurance can offer financial security for dependents. At this stage, individuals may not have the funds available for a separate life insurance policy, so the employer-provided option can be a valuable safety net.

Added Coverage

As life events and needs change, employees often have the option to increase their coverage. Employers may offer the choice to pay an additional premium to enhance basic protection. This flexibility allows employees to adjust their coverage as their circumstances evolve.

Riders for Extra Protection

Employers may also offer riders, which are additional features or benefits that can be added to the basic policy. These riders provide extra protection for specific situations, such as certain degrees of illness or disability.

OPM Life Insurance: War Death Coverage?

You may want to see also

What are the drawbacks of employer-provided life insurance?

While employer-provided life insurance is a great benefit, there are some drawbacks to relying solely on it. Here are some reasons why you might want to consider purchasing additional coverage or a separate personal policy:

Limited Coverage

One of the biggest drawbacks of employer-provided life insurance is that the coverage provided is often not enough to meet the financial needs of an employee's family. The median coverage is typically around $20,000 or one year's salary, which may not be sufficient for dependents or paying off debts. Most experts recommend having coverage worth five to ten times your annual salary.

Loss of Coverage When Leaving the Job

Employer-provided life insurance usually covers employees only during their employment. If you leave your job, whether by choice or due to unforeseen circumstances, you will likely lose your life insurance coverage. This can put you in a difficult position, especially if your health has declined or if you have developed medical conditions, as purchasing a new policy may be more expensive or challenging to obtain.

Inadequate Coverage for Spouse

The benefits package provided by employers may not include adequate life insurance coverage for an employee's spouse. In the event of the spouse's death, the surviving employee and their family may face economic hardship, especially if the spouse was also a source of income.

Cost Increases with Age

The cost of employer-provided life insurance tends to increase as employees age. While it may be cheaper when employees are younger, the premiums can become significantly more expensive as they get older, making it less affordable over time.

Limited Service and Customization

With employer-provided life insurance, employees have limited control over the insurance company and the type of policy they receive. They cannot choose a different insurance provider or opt for alternative policies such as whole life insurance. This lack of customization may be unsatisfactory for those who prefer a different kind of coverage or desire more personalized service from an independent insurance agent.

In summary, while employer-provided life insurance can be a convenient and cost-effective option, it is important to carefully consider your financial situation, future plans, and the potential risks associated with relying solely on this coverage. Purchasing additional insurance or a separate personal policy can help ensure that you and your loved ones have the protection you need.

New York Life Insurance: Drug Testing Policy Explained

You may want to see also

How much life insurance do employers typically provide?

The amount of life insurance provided by employers varies, but it is typically determined using a multiple of an employee's annual salary. The median coverage is $20,000 or one year's salary, with some companies offering plans that pay two or three times the employee's salary. Many employers provide their employees with about $50,000 to $100,000 worth of coverage, or about a year's salary. Some employers offer a set amount of insurance, such as a $10,000 policy for each employee, while others base the policy value on the employee's salary, with values of one, two, or three times the yearly salary.

In the case of group-term life insurance, the most common type of employer-provided life insurance, the amount of insurance is often based on a multiple of each employee's compensation. The first $50,000 of group-term life insurance is usually tax-exempt for the employee, while any amount above that is considered taxable income.

It is important to note that employer-provided life insurance may not be sufficient to meet all your financial needs, especially if you have dependents or significant financial obligations. In such cases, you may need to purchase additional coverage through a supplemental plan or an individual policy outside of your employer's group plan.

Life Insurance: What's Covered and What's Not

You may want to see also

Can you lose employer-provided life insurance?

Life insurance is a valuable benefit for employees, and many employers offer it as part of their benefits package. However, it is not mandatory for employers to provide life insurance to their employees. While it is a great benefit to have, there are some considerations to keep in mind, as you may lose employer-provided life insurance under certain circumstances.

Firstly, it is important to understand that employer-provided life insurance is typically group term life insurance. This means that it is offered to all employees, and the coverage is usually determined by the employee's annual salary or position within the company. The policy remains in effect only while the employee remains employed by the company, and it does not extend to their spouse or children. Therefore, if you leave your job, either voluntarily or involuntarily, your life insurance coverage will likely cease.

In some cases, you may be able to convert your group policy to an individual policy, but this option is not always available, and the premiums may be higher. Additionally, if you have purchased additional coverage through your group plan, you may need to answer medical questions or undergo a physical examination, and certain medical conditions could prevent you from adding to your policy.

Furthermore, employer-sponsored life insurance may not provide sufficient coverage for your family's needs. The median coverage is around $20,000 or one year's salary, which may not be adequate, especially if you have dependents or aging parents relying on your income.

Therefore, it is generally recommended to have additional life insurance independent of your employer-provided policy. This ensures that you have continuous coverage, regardless of career changes, and it provides more flexibility and customization to meet your specific needs.

Skydiving: Is Your Life Insurance Policy Still Valid?

You may want to see also

What are the alternatives to employer-provided life insurance?

While employer-provided life insurance is a good benefit to have, it may not be enough to meet your needs. Here are some alternatives to consider:

Convert employer life insurance to personal life insurance:

If your employer offers this option, you can convert your employer-provided life insurance to personal life insurance. This option usually does not require a medical exam. However, once the coverage switches from group to personal, you will be responsible for the full monthly payments. You may be able to get a better deal on cost and coverage by shopping around for a new life insurance policy.

Purchase a separate personal policy:

If the life insurance provided by your employer is insufficient, you can consider purchasing a separate personal policy in addition to the group policy offered by your workplace. This is especially important if you have dependents or financial obligations that exceed the coverage provided by your employer.

Supplemental life insurance policies:

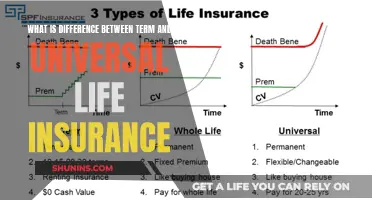

Supplemental life insurance policies offer extra coverage through options like whole life, universal life, or term life insurance. These policies can enhance your protection and ensure your loved ones are adequately provided for.

No-medical exam life insurance:

If you are older or have a medical condition that affects your eligibility for competitively priced coverage, you may want to consider no-medical exam life insurance. This option allows you to obtain coverage without undergoing a physical examination.

Group accidental death and dismemberment insurance:

Also known as "AD&D" in the industry, this type of coverage pays benefits to the employee's beneficiary in the event of death due to an accident or if the employee loses the use of certain body parts.

Business travel accident insurance:

This type of insurance covers a narrow scenario: the death of the employee while travelling for business. If your employees rarely travel, this option may not be worth the cost.

Split-dollar life insurance:

This type of insurance is paid by both the employer and employee and has a substantial investment element. It is typically considered for key employees rather than the entire employee group.

Life insurance plan riders:

Riders are additional features or benefits that can be added to an existing insurance policy. For example, you could add an accidental death and dismemberment rider to a group-term life insurance policy, which would pay double the death benefit if the employee died due to an accident.

FHA Loan: Understanding Life Mortgage Insurance Inclusion

You may want to see also

Frequently asked questions

No, it is completely optional for employers to offer life insurance benefits to their employees. However, it is a popular benefit for both employers and employees.

Group insurance can be a great addition to an employee benefits package and can give a hiring advantage over businesses without a group plan. It is also a good way to provide insurance to employees with serious health issues who may otherwise struggle to get insured.

Group insurance may not provide enough coverage for employees with a lot of financial obligations, such as a mortgage, high salary, or dependent family members. It is also usually temporary and ends when an employee leaves the company.

Employees can purchase their own life insurance policies, which can be a good idea if the group insurance provided by their employer is insufficient or does not allow for much customization.