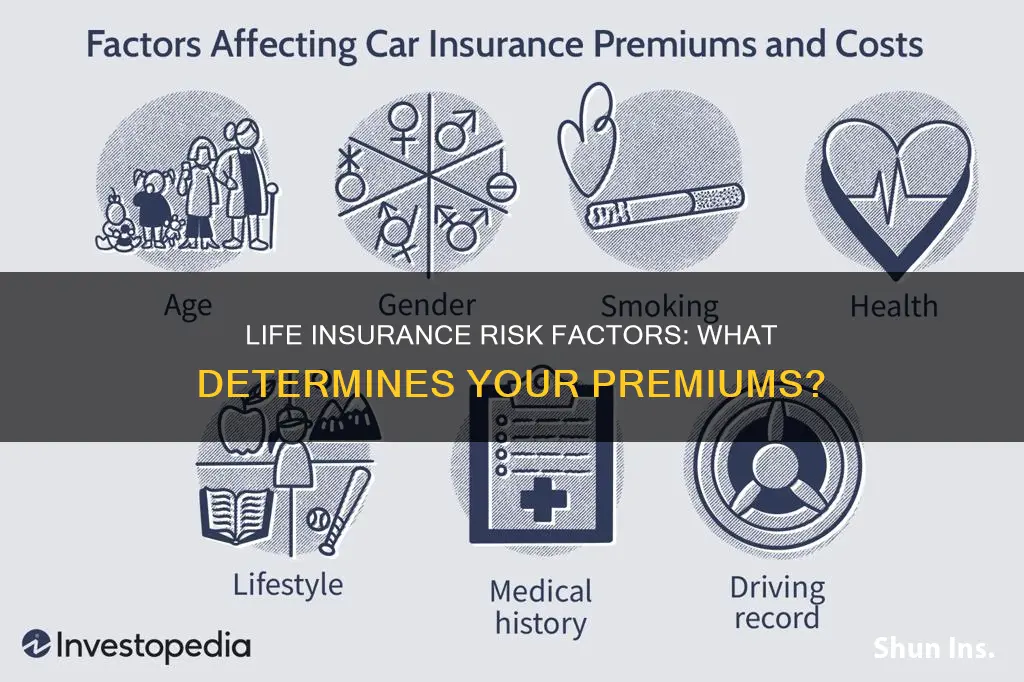

Life insurance companies base coverage costs on individual risk factors. These include age, gender, health, lifestyle, and family medical history. The younger you are, the lower your payments. Women generally live longer than men and therefore pay less for life insurance. Your health, including the presence of pre-existing conditions, can also affect your premium. For example, high blood pressure, high cholesterol, and diabetes are all risk factors that can increase the cost of your premium. Your lifestyle and hobbies can also impact your premium. If you have dangerous hobbies, such as racing cars or scuba diving, you will likely pay more for insurance. Similarly, if you have a risky job, such as a construction worker or miner, your premiums may be higher.

| Characteristics | Values |

|---|---|

| Age | The younger you are, the lower your payments. |

| Gender | Women generally live longer than men, so they pay lower premiums. |

| Medical History | History of serious illnesses such as heart disease or cancer will increase your premiums. |

| Weight | Being overweight can increase your premiums. |

| Cholesterol | High cholesterol can increase your premiums. |

| Blood Pressure | High blood pressure can increase your premiums. |

| Smoking | Smokers pay more than non-smokers. |

| Family Medical History | A family history of illness, especially hereditary diseases, could increase your premiums. |

| Driving Record | A history of DUIs, reckless driving convictions, or suspended or revoked licenses will often lead to higher rates. |

| Occupation | Some jobs are considered more dangerous than others, and therefore increase your premiums. |

| Hobbies | Some hobbies are considered dangerous and can increase your premiums. |

What You'll Learn

Age and gender

Age

The younger you are, the lower your life insurance premium will tend to be. This is because the older you are, the more likely you are to become ill or die while under coverage. The cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely that day is to come.

Typically, the premium amount increases by about 8% to 10% for every year of age. This can be as low as 5% annually in your 40s and as high as 12% annually if you're over 50.

Age also affects whether a person will qualify for life insurance coverage at all, with qualifying medical exams getting more stringent as you get older. Many insurers stop issuing new life insurance policies to seniors over a certain age, usually around 80 or 85.

Gender

Gender is also a significant factor in the price of life insurance. Women generally live longer than men and therefore have lower rates. Men have a shorter average life expectancy and are at higher risk of an early heart attack, among other risks. The average lifespan for men is 74 to 75, while for women it is about 79 to 80. This difference increases the likelihood of insurers having to pay out a death benefit.

However, gender isn't the only factor that determines the price of premiums. Other factors like lifestyle and age can also make a policy more expensive.

Group Life Insurance: Resignation Impact Explained

You may want to see also

Medical history

When applying for life insurance, you will be asked about your medical history, including any past or current health problems, treatments, and prescription medications. This is because your health is a significant factor in determining your risk class and the cost of your premium.

Insurance companies will often request medical records and require a medical examination to identify any malfunctioning of vital organs, detected through a blood test and urinalysis. If you are awaiting diagnostic testing or surgery, are currently undergoing treatment for any health condition, or have not fully recovered from an illness, you may be denied coverage.

Certain medical conditions are considered riskier than others and can result in higher life insurance rates. These include:

- High blood pressure and hypertension

- Anxiety or depression

- Sleep apnea

- High cholesterol

- Diabetes

- Obesity

- Cancer

- Heart disease

- Kidney disease

- Stroke

- Congenital heart disease

- Alzheimer's disease

- Amyotrophic lateral sclerosis (ALS)

- Huntington's disease

Additionally, your family's medical history can also impact your life insurance rates, especially if there is a history of serious illnesses such as cancer, heart disease, kidney disease, or diabetes that resulted in premature death.

Disability Insurance: Haven Life's Comprehensive Coverage for Peace of Mind

You may want to see also

Lifestyle choices

Substance Use

Substance use, including both legal and illegal drugs, alcohol, and tobacco, is a significant consideration for insurance companies. Smoking, in particular, is associated with higher health risks, and smokers often pay more than twice the premiums of non-smokers. The use of other tobacco products, such as cigars, pipes, chewing tobacco, and vaping devices, can also lead to higher rates. Insurance companies may also inquire about alcohol consumption, as heavy drinking poses a significant mortality risk due to potential health damage.

High-Risk Hobbies

Engaging in dangerous hobbies such as racing cars, scuba diving, skydiving, rock climbing, or piloting planes can result in substantially higher insurance costs. These activities are considered high-risk, and insurance companies will charge more to insure individuals who participate in them.

Driving Record

Insurance companies often consider an individual's driving record when determining risk factors. A history of driving under the influence (DUI), reckless driving convictions, or suspended/revoked licenses can lead to higher rates. These infractions are seen as indicators of high-risk behaviour and can impact an individual's insurance premiums.

Criminal Record

A criminal record can also influence life insurance risk factors and eligibility. Felonies, major convictions, or multiple criminal convictions can result in higher rates or even application denial. Awaiting trial, being on probation, or having a recent felony conviction can significantly impact an individual's insurance options.

Financial Issues

Recent financial issues, such as bankruptcies, can also be a factor in life insurance risk assessment. Insurance companies may consider an individual with recent bankruptcies to be a higher risk and may decline coverage or offer higher rates. Additionally, credit scores and financial stability can play a role in some risk scores used by insurers.

In conclusion, lifestyle choices can have a significant impact on life insurance risk factors. Insurance companies consider various aspects of an individual's lifestyle, including substance use, risky hobbies, driving record, criminal history, and financial stability, when determining risk profiles and premiums. Making positive lifestyle choices and reducing risky behaviours can help lower an individual's risk factors and potentially result in lower insurance costs.

Life Insurance and Sunsuper: What's the Deal?

You may want to see also

Family medical history

When applying for life insurance, you will be asked about your family's medical history, including illnesses or trends that could suggest a higher risk of developing certain conditions. This is because certain medical conditions are hereditary, and a family history of these conditions may increase your insurance risk.

The most common health conditions that life insurance providers ask about include:

- Cancer (including breast, colon, lung, melanoma, and prostate cancer)

- Heart disease

- Kidney disease

- Diabetes

You may also be asked about other conditions that can have a genetic component, such as Alzheimer's disease, ALS, Huntington's disease, and attempted suicide.

The number of family members affected by a condition and their age at diagnosis are also taken into consideration. If a condition was diagnosed late in life (after age 60 or 65), it may be disregarded and have no impact on your premiums. Additionally, if the condition is gender-related and you are of a different gender, it will not affect your premium. For example, a history of ovarian cancer in the family would not impact a male applicant's premium.

While your personal health profile is a bigger factor in determining the cost of your life insurance, a family history of serious illnesses may result in higher premiums.

Life Insurance for Veterans: Who Qualifies and What's Covered?

You may want to see also

Occupation and hobbies

Life insurance companies consider certain occupations and hobbies to be "high-risk", which can affect the quotes that individuals receive and their ability to qualify for life insurance plans. These are jobs and activities that are deemed to carry a higher risk of sudden or premature death.

Occupations

Occupations that are considered high-risk include those that have a higher fatality rate than the average of 3.5 fatalities per 100,000 full-time workers, according to the Bureau of Labor Statistics. Some examples of high-risk jobs are:

- First responders (e.g. law enforcement, firefighters)

- Active military personnel

- Workers in emerging countries or war zones (e.g. government, media, and medical workers)

- Aviation jobs (e.g. pilots)

- Construction workers

- Natural resources workers (e.g. in the oil and gas industry, mining industry, fishing industry)

- Bartenders

- Workers in the marijuana industry

Hobbies

Hobbies that are considered high-risk are those that are adventurous or risky and can put individuals at greater risk of injury or death. Some examples of high-risk hobbies are:

- Scuba diving

- Skydiving

- Racing cars

- Bungee jumping

- Rock climbing

- Mountain climbing

- Aviation

If an individual's occupation or hobby is considered high-risk, they may be placed in a higher risk class and pay a higher premium for their life insurance. However, this varies among insurance companies, as they evaluate risk factors differently.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Frequently asked questions

The main factors are age, gender, health, lifestyle, and family medical history.

The younger you are, the lower your risk of dying, so the lower your life insurance premium will be.

Women generally live longer than men, so they pay lower premiums.