Life insurance is a financial product that pays out a lump sum in the event of the policyholder's death, providing financial support to their beneficiaries and heirs. While the proceeds from a life insurance policy that you receive as a beneficiary are generally not considered gross income and do not have to be reported on your income taxes, there are some exceptions. Whole life insurance, for example, combines life insurance with an investment component, and the interest generated from these policies is not taxed until the policy is cashed out. Additionally, if the policy is left to the estate instead of directly to a person, it may trigger estate taxes.

| Characteristics | Values |

|---|---|

| Coverage | Whole life |

| Duration | Lifetime |

| Premium | Fixed |

| Death benefit | Guaranteed |

| Cash value | Grows in a tax-deferred account |

| Investment | Yes |

| Tax on interest | Not taxed until the policy is cashed out |

What You'll Learn

- Whole life insurance provides coverage for the entire life of the insured person

- Whole life insurance has a savings component, which is called the cash value

- Interest accrues on a tax-deferred basis, and withdrawals are tax-free up to a certain limit

- Whole life insurance policies have level premiums, meaning the amount paid every month stays the same

- The death benefit is guaranteed and is usually tax-free for beneficiaries

Whole life insurance provides coverage for the entire life of the insured person

Whole life insurance policies are often more expensive than term life insurance policies because they offer lifelong coverage and include a cash value component. The premiums for whole life insurance are typically level, meaning the amount paid each month will remain the same. This is in contrast to term life insurance, which only covers the insured person for a specific number of years and does not include a cash value component.

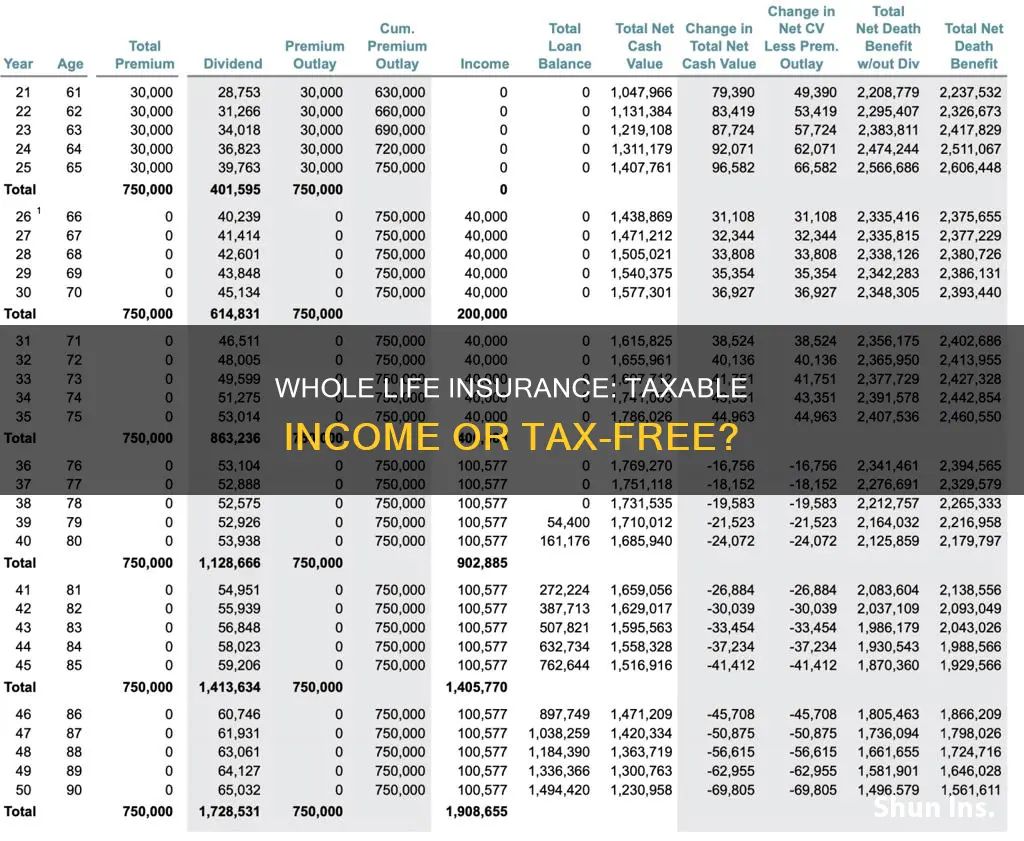

The cash value of a whole life insurance policy grows over time, tax-free, and can be accessed by the policyholder through withdrawals or loans. This cash value can be used for various purposes, such as supplementing retirement income or making large purchases. However, withdrawals and outstanding loans will reduce the death benefit paid out to beneficiaries.

Whole life insurance rates are determined by factors such as age, health, gender, and the chosen policy type. The older and less healthy an individual is, the higher their premiums are likely to be. Additionally, women tend to pay lower premiums than men due to their longer life expectancy.

Overall, whole life insurance can provide financial security and peace of mind, knowing that loved ones will receive a benefit upon the insured person's death, regardless of when it occurs.

Finding Unclaimed Life Insurance: A Free, Easy Guide

You may want to see also

Whole life insurance has a savings component, which is called the cash value

Whole life insurance is a type of permanent life insurance that covers the insured person for their entire life. It is different from term life insurance, which only provides coverage for a specific number of years. Whole life insurance also has a savings component, known as the cash value, which offers several benefits to the policyholder.

The cash value of whole life insurance is a living benefit that the policyholder can access while they are still alive. This means that they can withdraw funds or take out a loan against the cash value. Withdrawals are typically tax-free up to the value of the total premiums paid. Interest is charged on policy loans, but the rates are generally lower than those for personal or home equity loans. The cash value can also be used to cover monthly premium payments, so the policyholder doesn't have to pay out of pocket.

The cash value of whole life insurance grows over time and earns interest. Part of each premium payment goes towards the policy's cash value, which can be withdrawn or borrowed against later in life. The cash value grows quickly when the insured is young but slows down as they get older due to higher risks associated with age.

The cash value of whole life insurance can be a useful savings tool, especially for those looking to build a nest egg over several decades. It can be used to make large purchases, such as a home, or to supplement retirement income when markets are low. However, it is important to note that withdrawals and unpaid loans against the cash value will reduce the death benefit.

Life Insurance After Cancer: Is It Possible?

You may want to see also

Interest accrues on a tax-deferred basis, and withdrawals are tax-free up to a certain limit

Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured person. It offers a death benefit and a savings component, known as the "cash value," which accumulates over time. Interest accrues on this cash value, and it does so on a tax-deferred basis. This means that the interest is not taxed until it is withdrawn.

The tax-deferred status of whole life insurance policies is a significant advantage, allowing the cash value to grow without immediate tax implications. This is similar to retirement savings accounts, such as 401(k)s or IRAs, where individuals can contribute pre-tax earnings and postpone paying income taxes until withdrawal during retirement.

Withdrawals from whole life insurance policies are generally tax-free up to a certain limit, which is the total amount of premiums paid into the policy. This is because the premiums were paid with after-tax dollars, so they are not taxed again upon withdrawal. However, if the withdrawal exceeds the total premiums paid, the additional amount withdrawn, which represents earnings, will be subject to income tax.

For example, if a policy has a cash value of $18,000, and the policyholder has paid $12,000 in premiums, they can withdraw up to $12,000 tax-free. However, withdrawing $15,000 would result in income tax on the additional $3,000, which represents earnings.

It is important to note that outstanding loans and withdrawals from the cash value of a whole life insurance policy will reduce the death benefit paid out to beneficiaries.

Life Insurance for Incarcerated: Is It Possible?

You may want to see also

Whole life insurance policies have level premiums, meaning the amount paid every month stays the same

Whole life insurance is a permanent life insurance policy that covers the insured person for their entire life. It is different from term life insurance, which only covers the insured for a specific number of years. Whole life insurance policies have level premiums, meaning the amount paid every month stays the same. This is in contrast to term life insurance, where premiums increase at each renewal as the insured person gets older.

Whole life insurance policies are more expensive than term life insurance policies because they accumulate cash value and cover the insured for their whole life. The cash value of a whole life insurance policy typically grows over time and can be accessed by the policyholder while they are still alive. This cash value is often used as a savings component, with interest accruing on a tax-deferred basis. The ability to accumulate cash value is a significant advantage of whole life insurance over term life insurance.

The level premiums of whole life insurance policies mean that the amount paid every month remains the same throughout the duration of the policy. This is a guarantee provided by whole life insurance companies, ensuring that premiums won't increase over time. The level premiums are a defining feature of whole life insurance, providing stability and predictability for the policyholder.

The stability of level premiums in whole life insurance policies offers several benefits to policyholders. Firstly, it allows for better financial planning and budgeting, as the fixed monthly payments are easier to incorporate into long-term financial strategies. Secondly, the level premiums ensure that the policy remains affordable over time, especially when compared to term life insurance, where premiums increase with age. This affordability is crucial for long-term financial planning and maintaining coverage throughout one's life.

In addition to the level premiums, whole life insurance policies offer a guaranteed death benefit. This means that the death benefit amount remains the same and is paid out to beneficiaries when the insured person passes away, regardless of how long they live. This guarantee provides peace of mind and financial security for families and dependents.

While the level premiums of whole life insurance policies offer stability, it's important to note that the premiums tend to be higher compared to term life insurance. The higher premiums are due to the lifelong coverage and the accumulation of cash value. However, the level premiums ensure that the policy remains affordable relative to the benefits provided.

Term Life Insurance: Rising Premiums and What to Expect

You may want to see also

The death benefit is guaranteed and is usually tax-free for beneficiaries

Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured person. It is designed to offer financial security to the insured person's family or beneficiaries in the event of their death. One of the key features of whole life insurance is the death benefit, which is guaranteed and usually tax-free for the beneficiaries.

The death benefit in whole life insurance is a guaranteed payout that the beneficiaries will receive when the insured person passes away. This benefit is typically specified in the policy contract and remains fixed throughout the duration of the policy. It is important to note that the death benefit is usually tax-free for the beneficiaries, meaning they will receive the full amount without any tax deductions.

Whole life insurance policies also include a savings component known as the "cash value." This cash value accumulates over time, and the policyholder can access it while they are still alive. The cash value grows in a tax-deferred account, allowing tax-free growth. However, if the policyholder withdraws more than the total premiums paid, the excess amount may be subject to taxes.

The death benefit and the cash value are two distinct but interconnected components of whole life insurance. Withdrawals and outstanding loans against the cash value can reduce the death benefit. Therefore, it is crucial for policyholders to carefully consider their decisions regarding the cash value to ensure that the death benefit remains intact for their beneficiaries.

Whole life insurance offers a sense of security and peace of mind by guaranteeing a death benefit that will be paid to the beneficiaries when the insured person passes away. The tax-free nature of the death benefit ensures that the beneficiaries receive the full amount, providing financial support during a difficult time. This feature makes whole life insurance an attractive option for individuals seeking to provide for their loved ones after their death.

Whole Life vs Term Life Insurance: What's the Difference?

You may want to see also

Frequently asked questions

No, whole life insurance premiums are not included in income. However, if your employer pays for your life insurance, the premium paid on policy amounts above $50,000 is considered part of your taxable income.

Yes, there are some tax advantages to having a whole life insurance policy. The cash value of a whole life insurance policy grows tax-free, and withdrawals are not taxed as long as they are less than the total premiums paid. Additionally, loans taken out against the policy are not taxable.

Life insurance premiums are generally not tax-deductible. However, you may be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy.

Life insurance death benefits are generally not taxed. However, they may be taxable if they are included as part of your estate and if you meet the $12.9 million filing threshold.

Yes, it is important to note that the cash value of a whole life insurance policy is considered income, and you may have to pay taxes on it when you cash out the policy. The amount taxable is the difference between the cash value received and the total amount paid in premiums.