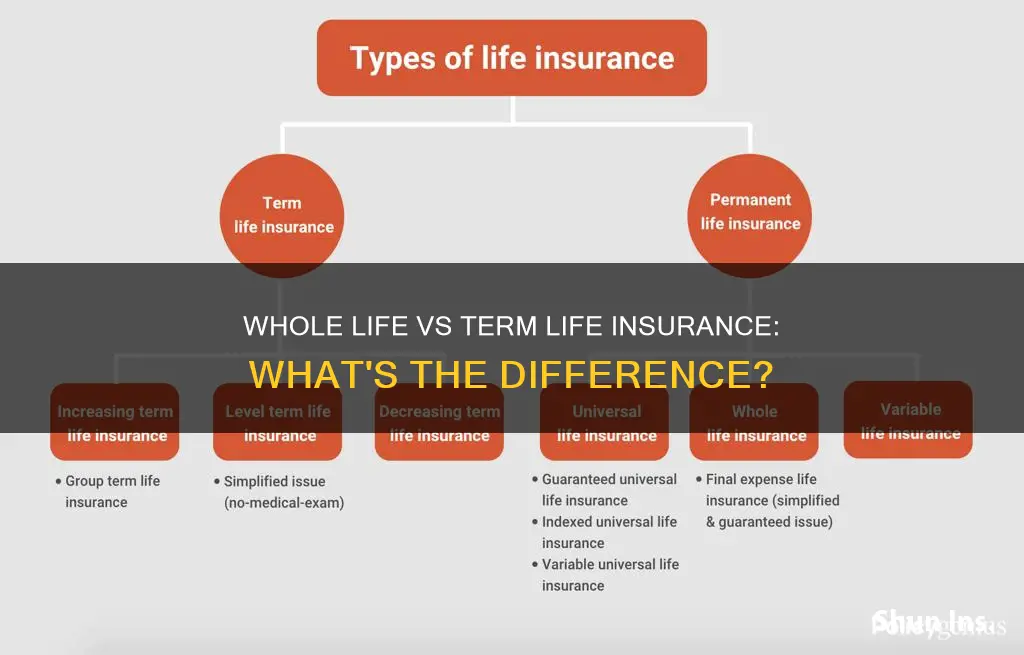

Whole life insurance and term life insurance are two of the most common types of life insurance available. Term life insurance is a good option for those looking for a more affordable choice that provides coverage for a specific period. On the other hand, whole life insurance is more expensive but offers lifelong coverage and includes a cash value component that can be borrowed against or withdrawn.

What You'll Learn

- Whole life insurance is permanent, term life insurance is temporary

- Whole life insurance is more expensive than term life insurance

- Whole life insurance has a cash value component, term life insurance does not

- Whole life insurance premiums are fixed, term life insurance premiums may change

- Whole life insurance is more complex than term life insurance

Whole life insurance is permanent, term life insurance is temporary

Whole life insurance is permanent, whereas term life insurance is temporary.

Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life rather than a fixed period of time. As long as the policyholder keeps making premium payments, this type of lifelong coverage will pay a guaranteed death benefit when they die. Whole life insurance policies also have a cash value component that grows over time, tax-free, and that the policyholder can borrow against or withdraw under certain conditions. The premiums for whole life insurance are typically much higher than those for term life insurance because the coverage lasts a lifetime and the policy grows in cash value. Whole life insurance is a good fit for those who want lifelong coverage, to build cash value, or to fund a life insurance trust.

Term life insurance, on the other hand, offers coverage for a specific period, or term, which usually ranges from 10 to 30 years. If the policyholder dies during this period, their beneficiary will receive a payout. Term life insurance tends to be much cheaper than whole life insurance because it offers temporary coverage and does not have a cash value component. Term life insurance is a good option for those who want coverage for a specific period, such as the length of their mortgage, or who want to ensure their family is protected against large debts or expenses.

While whole life insurance is permanent and offers lifelong coverage, term life insurance is temporary and provides coverage for a fixed period. Whole life insurance typically costs more than term life insurance due to its permanent nature and the accumulation of cash value. Those seeking lifelong coverage, investment potential, and access to cash value may prefer whole life insurance. On the other hand, those seeking affordable, temporary coverage for specific needs may find term life insurance more suitable.

Term Life Insurance: Benefits and Peace of Mind

You may want to see also

Whole life insurance is more expensive than term life insurance

The cost of whole life insurance is typically much higher than that of term life insurance. Whole life insurance premiums can be as much as 17 times more than those of term life policies with the same death benefit. This is because whole life insurance includes both insurance and investment components. The higher cost of whole life insurance can make it difficult for some consumers to keep up with payments.

Whole life insurance provides coverage for the entire life of the insured, as long as premium payments are made. It also includes a cash value account that grows tax-free over time and can be withdrawn from or borrowed against. In contrast, term life insurance only covers the insured for a set period, such as 10, 20, or 30 years, and does not accrue any cash value.

Term life insurance is generally the most affordable type of life insurance, as it is straightforward insurance without a savings or investment component. It is a good option for those who want basic protection at a lower cost. However, term life insurance may not be suitable for those who need permanent coverage or want to build cash value.

The choice between term and whole life insurance depends on an individual's budget, time frame, and need for a savings component. Whole life insurance is more expensive but offers permanent coverage and a cash value component, while term life insurance is cheaper but only provides temporary coverage without any savings or investment benefits.

Group Life Insurance: Contestability and You

You may want to see also

Whole life insurance has a cash value component, term life insurance does not

Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life, whereas term life insurance only covers the policyholder for a set period. Whole life insurance policies also include a cash value component that the policyholder can borrow against or withdraw from under certain conditions. This is not the case with term life insurance policies, which are simply insurance policies without a savings or investment component.

Whole life insurance policies are more complex than term life insurance policies. They are designed to last a lifetime and include a savings component that grows over time. This cash value component is a significant feature of whole life insurance, and it offers financial flexibility to the policyholder. The cash value grows in a tax-deferred account at a guaranteed rate, and the policyholder can borrow against it or withdraw from it. The ability to borrow against the policy makes whole life insurance a more flexible financial tool than term life insurance.

The cash value component of whole life insurance policies is an investment that can grow throughout the policyholder's lifetime, tax-free. This is in contrast to term life insurance, which does not offer any investment opportunities. The cash value of a whole life insurance policy is also guaranteed to grow at a fixed rate set by the insurer. This guaranteed growth provides a level of security and predictability for the policyholder.

The cash value component of whole life insurance policies allows policyholders to build wealth over time. This is a significant advantage over term life insurance, which does not offer any wealth-building opportunities. The ability to build cash value means that whole life insurance can be used as a savings vehicle for retirement or other financial needs. Policyholders can borrow against the cash value or withdraw it to meet future financial needs.

The cash value component of whole life insurance also offers policyholders the opportunity to surrender the policy for cash. If the policyholder decides to cancel the policy, they can receive the cash value minus any surrender charges. This provides policyholders with the option to access their money if they no longer want or need the coverage.

Cancer and Term Life Insurance: Does Level Death Benefit?

You may want to see also

Whole life insurance premiums are fixed, term life insurance premiums may change

Whole life insurance premiums are fixed for the duration of the policy, whereas term life insurance premiums may change over time. Here are some key points to consider:

Fixed Premiums for Whole Life Insurance

- Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life.

- One of the key features of whole life insurance is that the premiums remain fixed and do not change throughout the policy's duration. This predictability can make budgeting easier.

- The premium amount is locked in when you purchase the policy, and it will not increase as long as you continue to make payments.

- The premium amount is typically determined by the desired death benefit, with higher benefits resulting in higher premiums.

- Whole life insurance policies also include a cash value component that grows over time, and the premiums contribute to building this cash value.

Variable Premiums for Term Life Insurance

- Term life insurance, on the other hand, is temporary coverage that lasts for a specific period, such as 10, 20, or 30 years.

- Term life insurance premiums may change over time, depending on the type of policy chosen.

- The most common type of term life policy is level term, which offers fixed premium rates throughout the duration of the policy.

- However, there are also policies where premiums may increase after a certain period or at specific ages. These changes are usually outlined in the policy details.

- Term life insurance does not accumulate cash value, which is one reason why it is generally more affordable than whole life insurance.

Weighing the Options

- When deciding between whole life and term life insurance, it's important to consider your budget, timeframe, and the desired features of your policy.

- Whole life insurance provides permanent coverage, fixed premiums, and a cash value component but tends to be more expensive.

- Term life insurance offers temporary coverage, often with fixed premiums during the initial term, and is generally more affordable.

- It's essential to carefully review the details of any insurance policy before purchasing it to understand the potential for premium changes over time.

Life Insurance Underwriter: Your Career Guide

You may want to see also

Whole life insurance is more complex than term life insurance

Term life insurance is often the most affordable type of life insurance because it offers temporary coverage without any cash value component. In contrast, whole life insurance is significantly more expensive because it provides lifelong coverage and includes a cash value account that grows tax-free over time. The cash value component of whole life insurance policies adds to their complexity, as policyholders need to consider how to utilize this feature effectively. They may borrow against the cash value or withdraw it, but they must be mindful that any outstanding loans or withdrawals will reduce the death benefit paid out to their beneficiaries.

Term life insurance policies are also simpler in terms of their premiums. While whole life insurance policies typically have level premiums that remain the same throughout the policy, term life insurance premiums may change over time, depending on the specific policy. Additionally, term life insurance policies do not require the policyholder to choose a term length, as they are designed to provide coverage for a specific period. In contrast, whole life insurance policies require the policyholder to commit to lifelong coverage and consistent premium payments.

Another factor that adds complexity to whole life insurance is the potential for dividends. Some whole life insurance companies offer participating policies that pay dividends based on the company's financial performance. These dividends are not guaranteed but can provide additional value to the policyholder. Term life insurance policies, on the other hand, do not typically offer dividends, further simplifying their structure.

In summary, whole life insurance is more complex than term life insurance due to its permanent nature, cash value component, premium structure, and potential for dividends. Term life insurance offers temporary coverage for a specific period, with straightforward premiums and no cash value accumulation. Whole life insurance, on the other hand, provides lifelong coverage, includes an investment component, and offers more flexibility in terms of premiums and dividends. These additional features make whole life insurance a more complex product to understand and manage.

Metropolitan Life Insurance: What's the Deal with NYSRLS?

You may want to see also

Frequently asked questions

Whole life insurance is a form of permanent life insurance that covers the person for their entire life, whereas term life insurance is temporary and only covers a person for a set period.

Whole life insurance tends to be significantly more expensive than term life insurance. This is because whole life insurance policies typically last a lifetime and include a cash value component that grows over time, whereas term life insurance only covers a set period and does not accrue any cash value.

Whole life insurance offers permanent coverage and includes a cash value component that can be borrowed against or withdrawn. It also provides guaranteed premiums that do not increase over time.

Whole life insurance is typically more complex and expensive than term life insurance. The death benefit may also be reduced if loans or withdrawals are taken out against the cash value and not repaid.

Yes, it is possible to convert a term life insurance policy to a whole life insurance policy, depending on the insurer and the specific policy. However, the deadline for conversion may vary, and the new premium will likely be much higher.