Are you considering a career as an insurance adjuster? If so, you may be wondering if this career path is in demand. Well, you're in luck! Insurance adjusters are in high demand, and this demand is only expected to grow in the coming years.

Insurance adjusters play a crucial role in the insurance industry, as they are responsible for assessing and investigating claims to determine the monetary value of damage, loss, or injury. They are also often responsible for determining whether an insurance company should pay out for losses and damages and, if so, how much. This is no easy task, and it requires a unique blend of soft and hard skills.

The demand for insurance adjusters is driven by several factors, including the ever-growing number of insurance claims and an aging insurance workforce. Natural disasters, such as hurricanes and floods, also contribute to spikes in demand for skilled adjusters. Additionally, the insurance industry itself is evolving, with employers seeking fresh talent to replace retiring professionals.

The job outlook for insurance adjusters has been positive since 2004, with vacancies increasing by 22.22% nationwide during that time. This trend is expected to continue, with an anticipated annual increase of 0.94% in the next few years. So, if you're considering a career as an insurance adjuster, now is a great time to pursue this in-demand profession.

| Characteristics | Values |

|---|---|

| Demand | Demand for insurance adjusters is expected to increase, with an estimated 24,340 new jobs to be filled by 2029. |

| Salary | Insurance adjusters earn a mean annual salary of $73,380, with the potential to earn a six-figure salary with experience. |

| Career Outlook | Positive, with vacancies increasing by 22.22% nationwide since 2004, and an average growth rate of 1.39% per year. |

| Labour Shortage | The insurance industry faces a historic labour shortage due to the retirement of the baby boomer generation, the impact of the pandemic, and a changing labour market. |

| Skills Required | Objectivity, analytical thinking, communication skills, attention to detail, time management, self-discipline, and a strong work ethic. |

| Specialisations | Field adjuster, desk adjuster, staff adjuster, independent adjuster, catastrophe adjuster, auto damage appraiser, property claims adjuster, and more. |

What You'll Learn

Insurance adjusters are in demand due to a worker shortage

Insurance adjusters are in high demand due to a worker shortage. This demand is caused by several factors, including natural disasters, an aging workforce, and the high entry requirements for the role.

Natural Disasters

Hurricanes, tornados, and flooding can cause severe damage to properties, leading to a high number of insurance claims being filed. As a result, there may not be enough adjusters to inspect the property damage, causing a delay in the claims process. This is what happened in Florida after Hurricane Irma in 2017, when many adjusters were in Texas dealing with the aftermath of Hurricane Harvey.

Aging Workforce

The insurance industry faces an inevitable employment gap due to the retirement of the baby boomer generation. In the next year, a quarter of insurance professionals will be looking to retire within a decade. This is part of a wider phenomenon, dubbed "The Great Resignation" by the United States Bureau of Labor Statistics, which also takes into account an aging workforce, the wake of COVID-19, a changing labor market, challenging working environments, and a desire for better work-life balance among younger generations.

High Entry Requirements

Becoming an insurance adjuster requires specific skills and qualifications. While the educational requirements are relatively simple, with a high school diploma and a few weeks of coaching being sufficient, other skills are needed to stand out. These include self-discipline, excellent communication skills, and a strong work ethic.

The combination of these factors has created a perfect storm for a worker shortage, leading to a high demand for insurance adjusters. This demand is expected to continue, with an annual increase in jobs of 0.94% predicted over the next few years.

The Eagle-Eyed Approach: Insurance Adjusters' Roof Inspection Secrets

You may want to see also

Vacancies have increased by 22.22% since 2004

Vacancies for insurance adjusters have increased by 22.22% nationwide since 2004, with an average growth of 1.39% per year. This positive job outlook is expected to continue, with a predicted increase of 0.94% per year until 2029. This will result in an additional 24,340 jobs.

The demand for insurance adjusters is driven by the ever-growing number of insurance claims. The profession is considered to be in high demand, and it is expected to remain so for the foreseeable future. This is due to the crucial role insurance adjusters play in the settlement of insurance claims. Their responsibilities include inspecting property damage, determining liability, and negotiating settlements.

The career offers superb earning potential, with an average annual salary of $73,380, and the possibility of earning a six-figure salary with experience. The entry requirements are also relatively simple, making it an attractive career option. However, it is important to note that the job can be challenging and stressful due to the need to work outside regular office hours, handle multiple cases simultaneously, and make quick decisions.

Navigating the Aftermath of a House Fire: Strategies for Dealing with Insurance Adjusters

You may want to see also

The aging insurance workforce is causing an employment gap

The insurance industry is facing a looming worker shortage, with the combination of the pandemic, the Great Resignation, and an aging workforce creating a historic labor shortage. The insurance sector employs most individuals over 50, and within the next year, a quarter of insurance professionals will be looking to retire within the next decade. This is further exacerbated by the fact that the generation that came after the baby boomers is significantly smaller, resulting in a talent gap.

The aging insurance workforce is causing an inevitable employment gap in the industry. As experienced professionals retire, businesses risk losing valuable institutional knowledge and expertise. The departure of baby boomers from the workforce will create huge knowledge gaps, and few insurers have taken steps to address this issue. Critical information needs to be captured from these experienced professionals before they leave, to ensure a smooth transition of leadership roles and critical positions within organizations.

To address the aging workforce challenge, companies can implement various strategies such as:

- Harvesting critical information from experienced employees and making it accessible to newer workers.

- Using real-time collaboration tools to enable employees to interact and share knowledge with their colleagues.

- Utilizing advanced e-learning techniques, such as performance simulation, to help employees acquire new skills.

- Implementing succession planning and targeted knowledge retention initiatives to address the brain drain.

- Encouraging intergenerational workshops, mentorship programs, and team-building activities to facilitate knowledge transfer.

By proactively addressing the challenges posed by an aging workforce, insurance companies can ensure a smooth transition and maintain their competitive edge in the market.

The Integrity Tightrope: Examining the Honesty of Insurance Adjusters

You may want to see also

Natural disasters provide challenges and opportunities

Natural disasters present unique challenges and opportunities for insurance adjusters. On the one hand, they can be incredibly severe, resulting in devastating damage to properties and businesses. Additionally, disasters often affect multiple people simultaneously, which can overwhelm insurance companies with a high volume of claims. This, in turn, can lead to financial strain for insurance companies, especially if they have to access large amounts of capital to cover the claims. As a result, insurance companies may limit coverage or increase premiums to manage their risk.

However, natural disasters also create opportunities for insurance adjusters. Adjusters who specialize in natural disaster claims are often in high demand following a catastrophe, as hundreds or even thousands of people need to file claims. This can be lucrative for skilled adjusters, who can earn more during these spikes in demand than they would typically earn in an entire year. Adjusters who are willing to travel on short notice and work in demanding situations can take advantage of these opportunities.

Furthermore, natural disasters can provide a sense of purpose and fulfillment for insurance adjusters. Most of their clients will be going through some of the lowest points in their lives, with their homes and belongings destroyed. Adjusters are often among the first people to arrive at the scene, providing hands-on assistance and helping families recover their losses. Therefore, natural disasters present both challenges and opportunities for insurance adjusters in terms of financial gains, career development, and personal fulfillment.

Overall, the impact of natural disasters on the insurance industry and adjusters is complex. While they can strain the industry and present logistical challenges, they also highlight the importance of insurance coverage and the role of adjusters in helping communities recover from devastating events.

Navigating the Path to Becoming an Insurance Adjuster in California: A Comprehensive Guide

You may want to see also

Demand is expected to increase by 0.94% annually

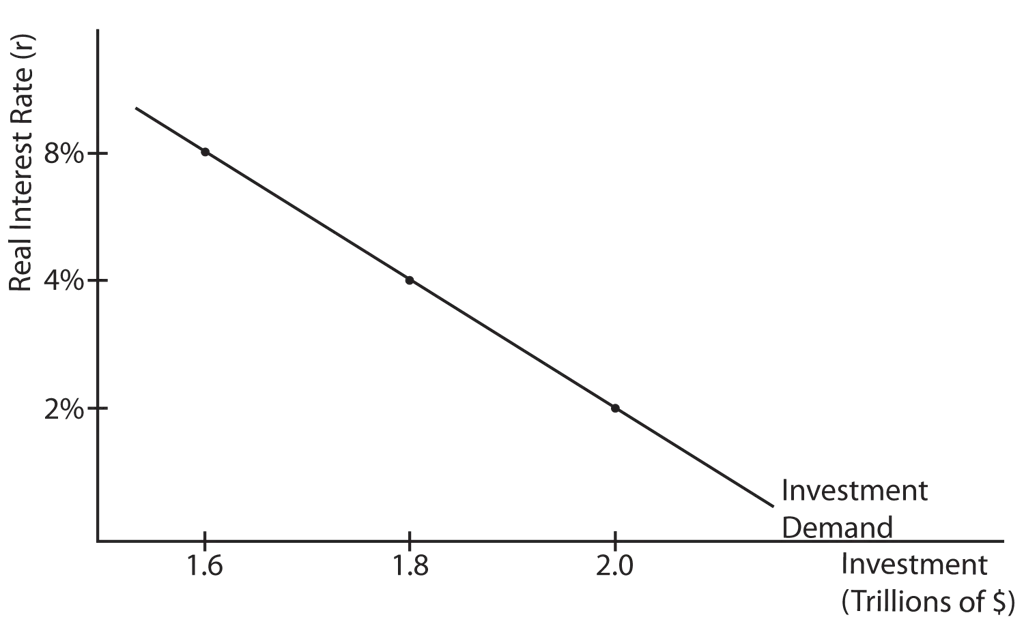

Demand for insurance adjusters is expected to increase by 0.94% annually. This is a positive outlook for the profession, with vacancies increasing by 22.22% nationwide since 2004, representing an average growth of 1.39% per year.

The insurance industry is facing an employment gap due to the retirement of the baby boomer generation, with a quarter of insurance professionals expected to retire within the next year. This, combined with the impact of the pandemic and the so-called "Great Resignation", has created a historic labour shortage.

The high demand for insurance adjusters is also driven by the ever-growing number of insurance claims. Adjusters play a crucial role in the settlement of claims, and their expertise is sought after by various industries, including personal injury law. Natural disasters, such as hurricanes and floods, also contribute to spikes in demand, providing both challenges and opportunities for skilled adjusters.

The career offers superb earning potential, with salaries ranging from $45k to $80k through direct employment and the possibility of earning over $100k as an independent claims adjuster. The job also provides personal fulfilment, as adjusters help insured individuals recover from devastating losses.

However, it is important to note that the number of claims adjusters is expected to decline by 6% from 2021 to 2031, according to data from the US Bureau of Labor Statistics. Despite this projected decline, the overall demand for insurance adjusters is still expected to increase in the coming years.

Providing a Recorded Statement to the Insurance Adjuster: What You Need to Know

You may want to see also

Frequently asked questions

Yes, insurance adjusters are in demand. Vacancies for this career have increased by 22.22% nationwide since 2004, with an average growth of 1.39% per year. Demand for insurance adjusters is expected to increase by 0.94% annually, with 24,340 new jobs predicted to be filled by 2029.

The insurance industry is facing an inevitable employment gap due to the retirement of the baby boomer generation. In addition, insurance adjusters are in demand due to the ever-growing number of insurance claims. Natural disasters, such as hurricanes and floods, also contribute to spikes in demand for skilled adjusters.

Insurance adjusters earn an average annual salary of $73,380 or an hourly rate of $35.28. Entry-level salaries can be significantly lower, while experienced adjusters with established reputations can earn six-figure salaries.

Insurance adjusting offers superb earning potential, a rewarding feeling of helping others, and excellent job security due to the constant demand for their skills. It also has relatively simple educational and training requirements, making it an attractive career option.

Working as an insurance adjuster can be stressful due to tight deadlines, unpredictable hours, and the need to work outside of regular office hours, including holidays. Adjusters may also have to deal with dangerous and unnerving situations when inspecting accident scenes.