Insurance adjusters are responsible for investigating insurance claims and preparing an estimate of the cost of repair or replacement of the insured's property loss. They interview witnesses and parties involved and review police or medical reports. For car accidents, they inspect property damage to determine the value of the claim. They are also responsible for verifying that the person filing a claim has an active insurance policy.

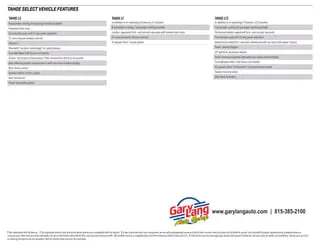

The process of calculating insurance claims varies depending on the type of claim being made. When calculating the value of a vehicle, insurance adjusters consider the vehicle's age, make, model, mileage, condition, prior damage, market value, and regional pricing trends. They may also take into account the additional features of the car, the estimated retail value, and comparable sales data of similar cars in the region.

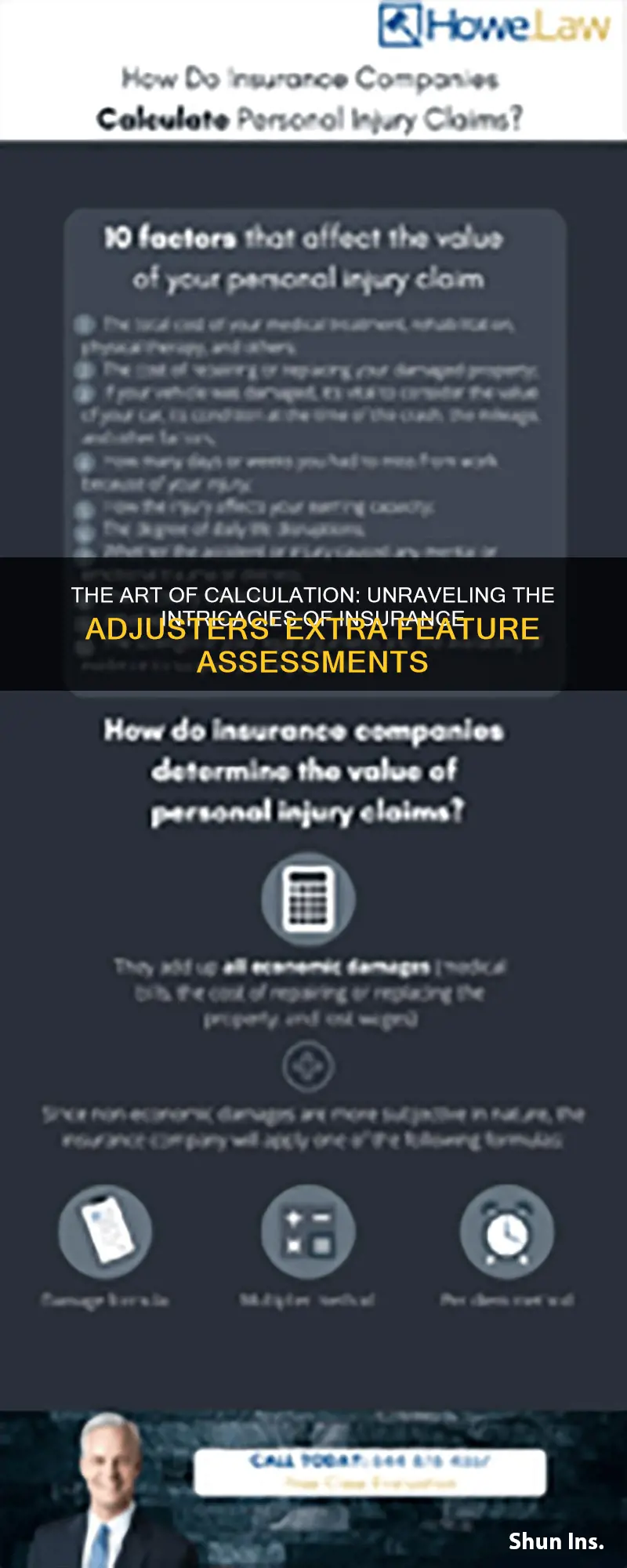

When determining compensation for pain and suffering, insurance companies multiply the sum of all medical bills by a certain number, depending on the severity of the injury. Minor injuries are usually multiplied by 1.5 to 3.

In the case of home insurance claims, insurance adjusters use a program called Xactimate to analyze damages and estimate the cost of repairs. They take into account factors such as room dimensions, waste factors, contractor overhead and profit, market conditions, and added costs.

Overall, insurance adjusters follow standard methods and guidelines to calculate extra features and determine the value of insurance claims.

What You'll Learn

- Insurance adjusters assess extra features when calculating total loss

- Extra features are customisations and equipment added to a vehicle

- These are considered when determining the actual cash value of a vehicle

- The make, model, year, kilometres, and condition are also factored in

- The current selling price for similar vehicles is also taken into account

Insurance adjusters assess extra features when calculating total loss

When a vehicle is declared a total loss, insurance adjusters will assess extra features when calculating its value. The process of determining a vehicle's value can vary among insurance companies and states, but there are some common factors that insurance adjusters take into account. These include the make, model, year, mileage, condition, and market value of the vehicle. Adjusters will also consider the cost of repairs and compare it to the vehicle's value to decide if it is a total loss.

When negotiating the value of a vehicle, it is important to provide as much information as possible to support your claim. This includes listing any additional features, such as leather interiors, airbags, or a sunroof, as these can increase the vehicle's value. Providing repair shop records, photographs, and documentation of new parts can also help drive up the value. It is recommended to gather evidence and consult with mechanics or auto body repair experts to ensure a fair valuation.

Insurance adjusters use specific guidelines and resources to determine a vehicle's value. They will inspect the vehicle, estimate the cost of repairs, and compare it to the vehicle's value to decide if it is a total loss. The value of the vehicle is often referred to as its actual cash value (ACV) or fair market value. The ACV is calculated by considering depreciation, mileage, condition, and market demand. If the cost of repairs exceeds a certain percentage of the vehicle's value, it is considered a total loss. This percentage can vary among states and insurance providers.

It is important to note that insurance companies are responsible for paying the value of the vehicle prior to the accident. The claim amount proposed by the insurer is negotiable, and vehicle owners can provide additional information to increase the valuation. Ultimately, the insurance adjuster will make the final call on the vehicle's value and whether it is a total loss.

Job Prospects for Insurance Adjusters in Florida: A Growing Market

You may want to see also

Extra features are customisations and equipment added to a vehicle

Dealer-installed options are added by the dealer after the vehicle arrives on the sales lot. They are not included in the manufacturer's warranty and the price of these options varies from dealer to dealer. Examples of dealer-installed options include rustproofing, extended warranties, fabric protection, and VIN etching.

Factory-installed and port-installed options, on the other hand, are approved by the auto manufacturer and are covered under warranty. The price of these options is set by the manufacturer. Examples of factory-installed options include advanced safety features, multi-zone climate control, heated seats, and smartphone integration.

When it comes to safety, some extra features that are worth considering include automatic emergency braking, forward collision warning, blind-spot warning, lane departure warning, and adaptive cruise control. These features can help to avoid accidents and improve overall safety on the road.

In addition to safety features, there are also convenience and comfort features that can enhance the driving experience. For example, a remote start system allows you to start your car and adjust the temperature before you get in. A backup camera can assist with parking and help to avoid obstacles. Smartphone integration and wireless charging can keep you connected and entertained during your drive.

Ultimately, the decision to include extra features depends on individual preferences and needs. While some features may be essential for some drivers, others may view them as unnecessary add-ons. It is important to research and evaluate which features are most important to you before purchasing a vehicle.

The Role of Independent Insurance Adjusters: Unraveling the Claims Process

You may want to see also

These are considered when determining the actual cash value of a vehicle

When determining the actual cash value of a vehicle, insurance adjusters consider the vehicle's depreciation, age, mileage, wear and tear, accident history, and any modifications made to the car. They compare the condition of the car to similar vehicles in the market to determine its fair market value. The year, make, and model of the vehicle also affect its depreciation, as some cars hold their value better than others.

Online tools like Kelley Blue Book, Edmunds, and National Auto Dealers Association (NADA) can provide estimates of a car's actual cash value. These tools consider factors such as location, accident history, year, make, model, and mileage to calculate depreciation and provide a more accurate estimate of the vehicle's worth.

It's important to note that the actual cash value of a vehicle is different from its replacement cost. The replacement cost is the amount needed to replace the vehicle with a new one, while the actual cash value takes into account the vehicle's depreciation. The replacement cost is typically higher than the actual cash value.

When negotiating with insurance adjusters, it is essential to provide evidence of the vehicle's value, including any additional features or upgrades. This can include research from online valuation sites, local dealership prices for similar vehicles, and documentation of the car's condition, mileage, and maintenance records.

The Fuzzy Line Between Employee and Contractor: Insurance Adjusters and Their Independence

You may want to see also

The make, model, year, kilometres, and condition are also factored in

When it comes to determining the value of a car, several factors come into play, including the make, model, year, kilometres driven, and overall condition of the vehicle. These elements are crucial in assessing the car's resale value and insurance costs.

The make of a car refers to its brand, such as Chevrolet, Lexus, or Lincoln. The model, on the other hand, is the specific name of the vehicle within that brand, like the Chevrolet Equinox, Lexus RX, or Lincoln Navigator. The year of the car is also important, as it indicates the vehicle's age and can impact its resale value.

The number of kilometres on a car is a significant factor. Generally, a car with fewer kilometres on the odometer is likely to have a higher value. Additionally, the overall condition of the vehicle matters. A car in excellent condition with no damage or only minor wear and tear can command a higher selling price.

These factors are not only relevant for resale value but also for insurance purposes. Overpricing or underpricing your car can lead to incorrect insurance premiums and claim payouts. Therefore, insurance adjusters consider these factors when calculating insurance costs. By taking into account the make, model, year, kilometres, and condition of a vehicle, insurance adjusters can provide a more accurate assessment of its value, ensuring that insurance coverage and claim payouts are appropriate.

The Path to Becoming an Insurance Adjuster: A Comprehensive Guide

You may want to see also

The current selling price for similar vehicles is also taken into account

When it comes to determining the value of a vehicle, several factors come into play. One crucial consideration is the current selling price for similar vehicles in the market. This involves examining the prices of comparable vehicles that are currently listed for sale or have been recently sold. By taking into account the selling price of similar vehicles, we can gain valuable insights into the prevailing market conditions and make more informed decisions about the value of a specific car.

The selling price of similar vehicles is an essential factor that helps buyers, sellers, and appraisers establish a fair and competitive value for a particular car. It serves as a reference point to ensure that the price aligns with the current market trends and demand. This information is especially useful for buyers, as it empowers them to make more informed decisions and negotiate confidently. By knowing the selling prices of comparable vehicles, buyers can identify whether a particular car is priced reasonably or if it deviates significantly from the market norm.

Various resources are available to help determine the selling price of similar vehicles. Online platforms, such as Kelley Blue Book, Edmunds, and Statista, provide valuable insights into vehicle values and market trends. These platforms often utilise data from a large number of dealerships and transactions to estimate the average selling price for specific makes and models. By considering factors such as location, vehicle specifications, and recent sales data, these resources offer a more accurate understanding of the current market value for similar vehicles.

It is worth noting that the selling price of similar vehicles is just one aspect of determining a car's value. Other factors, such as the vehicle's condition, mileage, and additional features, also play a significant role. By considering all these factors collectively, a more comprehensive and accurate valuation can be achieved. Nonetheless, the selling price of similar vehicles remains a crucial component in the process, providing a foundation for understanding the market and making well-informed decisions about a vehicle's value.

When it comes to buying, selling, or appraising a vehicle, it is essential to have a clear understanding of its value. By taking into account the selling price of similar vehicles, along with other relevant factors, one can navigate the process with greater confidence and ensure a more accurate valuation. This information empowers individuals to make well-informed decisions, whether they are looking to purchase a car that fits their budget or sell their vehicle for a fair price.

Negotiating a Fair Settlement: Strategies When Disagreeing with an Insurance Adjuster

You may want to see also

Frequently asked questions

Insurance adjusters consider the vehicle's age, make, model, mileage, condition, prior damage, market value, and regional pricing trends. They also take into account the cost of repairs and replacement parts to determine if the vehicle is a total loss.

Insurance adjusters use a "damages formula" to calculate pain and suffering. They multiply the victim's total medical expenses by a number between 1.5 and 5 to account for non-economic damages.

Insurance adjusters consider the cost of parts and labour rates in the local area. They may use software to search for parts based on the vehicle's make and model and the location of repairs.

The ACV is calculated based on the fair market value of the vehicle, taking into account its make, model, year, pre-loss condition, mileage, and sales value of similar cars in the region.

Insurance adjusters interview the policyholder to determine the scope of loss, which includes all the damages covered by the recent claim. They may also review documentation, such as photographs and repair estimates, to assess the condition of the property.