Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future. However, there are some exceptions to this rule. For instance, if your loved ones choose to receive the life insurance payout in instalments instead of a lump sum, any interest that builds up on those payments could be taxed.

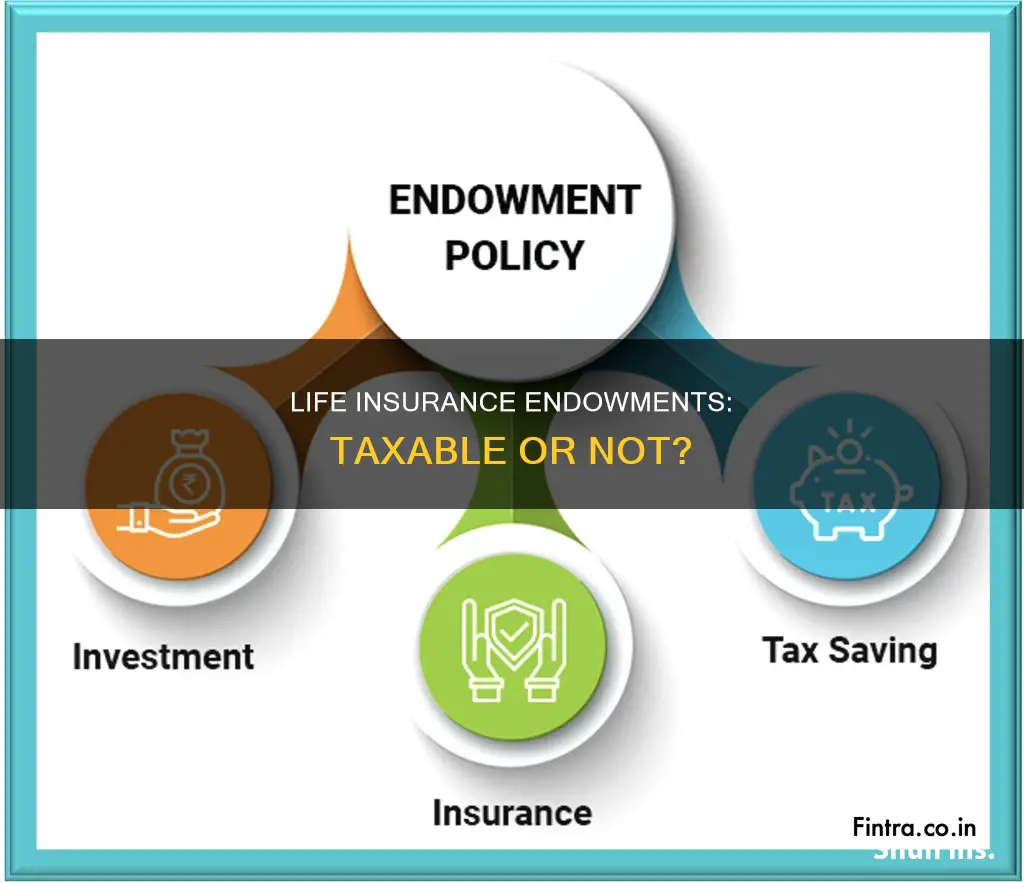

Endowment life insurance combines life insurance with a savings plan. You can choose how long you want the endowment life insurance protection to last. If you pass away before the maturity date, your heirs receive the insurance death benefit. If you live past the maturity date, you get a large payout from the insurer.

In the case of endowment life insurance, the payout could be helpful for college savings or retirement. However, the return is not as high as other accounts provide. When you receive the final payout, you owe income tax on any amount you receive in excess of what you paid in premiums.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | No, life insurance proceeds are not considered taxable income. |

| Are there exceptions to the rule? | Yes, there are some exceptions. For example, if the beneficiary chooses to receive the life insurance payout in installments, any interest that builds up on those payments is considered taxable income. |

| Are life insurance premiums tax-deductible? | No, life insurance premiums are not tax-deductible. |

| Are there exceptions to the rule? | Yes, there are some exceptions. For example, if you gift a life insurance policy to a charity and continue to pay the premiums, those payments are generally considered charitable donations and may be tax-deductible. |

| Are there any tax implications for endowment life insurance? | Yes, endowment life insurance policies are generally more expensive than permanent life insurance. The returns are guaranteed but are lower than what you could get by investing. |

What You'll Learn

Taxation on death benefit payouts

Death benefit payouts from life insurance are typically not taxable. However, there are some exceptions to this rule.

Firstly, if the payout has accumulated interest, taxes are usually due. In this case, only the amount that earned interest will be taxed, not the entire death benefit.

Secondly, if the policyholder names their estate as the beneficiary, taxes may apply depending on the estate's value.

Thirdly, if the insured and the policy owner are different individuals, taxes may be involved.

To avoid paying taxes on a life insurance payout, there are several strategies that can be employed. One option is to use an ownership transfer, where the policy is transferred to another person or entity before the insured passes away. Another strategy is to set up an irrevocable life insurance trust (ILIT), which owns the policy instead of the individual. Additionally, ensuring that the policy's cash value does not exceed the gift tax exemption can help avoid a gift tax.

It is important to note that the taxation of life insurance proceeds can vary depending on the specific circumstances and it is always recommended to consult with a tax professional for personalized advice.

Protective Life Insurance: Is It Worth the Hype?

You may want to see also

Taxation on cash value withdrawals

The taxation of cash value withdrawals depends on the type of life insurance policy and whether it is classified as a Modified Endowment Contract (MEC). Withdrawals from a permanent life insurance policy are typically tax-free up to the total amount of premiums paid. However, if the policy is an MEC, withdrawals are treated as taxable income until they equal all interest earnings in the contract.

For non-MEC policies, withdrawals above the total premium payments made may be subject to income tax. Withdrawing more than the cost basis (the total amount of premiums paid) may result in income taxes. Additionally, cashing out or surrendering a policy may incur taxes on any gains or accrued interest.

Policy loans from a non-MEC policy are generally not taxable, but if the policy lapses with an outstanding loan, the unpaid loan balance that exceeds the cost basis will be treated as taxable income. On the other hand, policy loans from an MEC are treated as distributions and are taxable up to the amount of the policy's earnings.

It is important to note that withdrawals can lead to a reduction in the death benefit and may cause the policy to lapse if not managed carefully.

To summarise, the taxation of cash value withdrawals depends on the specific type of life insurance policy and whether it falls under the MEC classification. Withdrawals above the total premium payments may be taxed as income, and cashing out or surrendering a policy can also result in taxes on gains or accrued interest. Policy loans may be taxable, especially if the policy lapses with an outstanding loan balance.

Northwestern Mutual Life Insurance: Worth the Investment?

You may want to see also

Taxation on life insurance dividends

Dividends on Life Insurance:

Dividends in the context of life insurance are considered a return of a portion of the premiums paid for the policy. When you pay premiums, the insurance company invests those funds, and if their investments perform well and expenses are kept low, they may declare a dividend. This dividend essentially refunds a portion of the excess premiums charged. It's important to note that dividends are not guaranteed and the calculation methods may vary across insurance companies.

Types of Life Insurance with Dividends:

Whole life insurance policies, specifically participating policies, can offer dividends. Participating policies charge higher premiums but provide regular dividends to the policyholder. On the other hand, non-participating policies have lower premiums and do not pay any dividends.

Options for Utilizing Life Insurance Dividends:

There are several options available for using your life insurance dividends:

- Dividend payment in cash: You can opt to receive dividends as a cash payment, typically sent by check after each policy anniversary.

- Reduce future premium payments: You can use dividends to lower your future premium payments. As dividends increase, your required premium contributions decrease, and if dividends exceed premiums, you may not need to make any out-of-pocket payments.

- Leave dividends with the insurer to collect interest: You can choose to leave the dividends with the insurance company, allowing them to earn interest in a dividend accumulation account. The interest rate on this account is usually guaranteed to be at least a certain minimum but may be higher. You can withdraw cash from this account at any time. If the insured person passes away, the account balance is added to the face amount of the policy and paid to the beneficiaries. It's important to note that the interest earned on these dividends is fully taxable as soon as you have the right to withdraw it, regardless of whether you actually withdraw it.

- Buy paid-up additional life insurance: You can use dividends to purchase small amounts of fully paid-up additional life insurance, which will be the same type as your original policy. This option provides increased coverage without the need for additional medical exams or premium payments.

- Buy one-year term life insurance: Dividends can also be used to buy as much one-year term life insurance coverage as possible, based on your age and the amount of dividend money available. This can be useful for short-term additional coverage needs.

- Repay policy loans: If you have taken out a loan against your life insurance policy, you may use the dividends to pay off the loan's interest and/or principal.

The taxation of life insurance dividends depends on whether your policy is classified as a Modified Endowment Contract (MEC) or not:

- Non-MEC Policies: In most cases, dividends are considered a return of premium and are generally not taxable. However, if you receive dividends exceeding the total premiums paid for the policy over its lifetime, the excess amount is typically taxable. Additionally, if you surrender paid-up additional insurance purchased with dividends, the amount received may also be subject to taxes.

- MEC Policies: For MEC policies, dividends (except those used to purchase paid-up additional insurance or pay premiums on the same policy) are taxable when earned, to the extent of the gain in the contract. The gain is calculated as the difference between the policy's cash value and the cost basis (total premiums paid less any amounts received tax-free). If you surrender a MEC policy's paid-up additional insurance, it is taxable at the time of surrender, based on the gain in the contract.

It's important to consult with a tax professional or advisor to fully understand the tax implications of your specific life insurance policy and dividend options. They can provide guidance tailored to your circumstances and help you navigate the complex world of life insurance taxation.

Life Insurance: Offset Taxes and Secure Your Future

You may want to see also

Taxation on policy surrender

Surrendering a life insurance policy means giving up the plan before the end of its tenure and receiving the accrued benefits at the time of surrender. The surrender value is the amount you get when you surrender your policy. The tax rules on surrendering a life insurance policy depend on the type of plan held.

If you hold traditional life insurance policies, such as an endowment plan or a money-back plan, the surrender value is tax-free only if you have regularly paid the premium for the first two years of the policy tenure. If you hold a single premium life insurance policy, the surrender value will be tax-free if you have held the policy for at least two years from the date of purchase.

For unit-linked insurance plans (ULIPs), the surrender value is tax-exempt only if the policy is surrendered after five years from the date of purchase. The date of policy issue also determines the taxability of the surrender value. If the life insurance policy was purchased before 31 March 2003, the full surrender value is tax-exempt.

If the policy was purchased between 1 April 2003 and 31 March 2012, the surrender value will be tax-exempt if the sum assured is at least five times the annual premium. For policies issued on or after 1 April 2012, there is no tax on the surrender value provided the sum assured is at least ten times the annual premium amount.

If the policy was issued on or after 1 April 2013, and the policyholder is categorised as disabled under Section 80U of the Indian Income Tax Act, 1961, or suffers from an ailment listed under Section 80DB, the surrender value is tax-exempt if the sum assured is at least 6.7 times the annual premium amount.

If none of the above criteria are met, the surrender value will be taxable. The tax exemption claimed for premium payment under Section 80C of the IT Act will be reversed, and an additional tax will be levied on the exemption previously claimed. The surrender value will be treated as 'income from other sources' and taxed according to the existing tax bracket.

In the case of pension plans, the surrender value will be taxable under the 'income from other sources' head. There are no tax provisions that make the surrender value from pension plans tax-free. Additionally, any tax exemptions claimed for premium payments will be reversed, and an additional tax will be levied on the exemptions previously availed.

When surrendering a life insurance policy, it is important to understand the tax implications to determine whether the surrender value qualifies for tax exemption. Failure to do so may result in incurring dual taxation.

Credit Score Impact on Life Insurance: What's the Link?

You may want to see also

Taxation on policy loans

Policy loans are generally not considered taxable income as long as the loan amount does not exceed the sum of the insurance premiums paid. However, interest is charged on the loan amount, and if the loan is not repaid, the interest can cause the policy to lapse. In the event of a lapse, any outstanding loan balance that exceeds the total premiums paid (also known as the cost basis) will be treated as taxable income.

If a policy is surrendered or lapses with an outstanding loan, the loan will be repaid from the proceeds, and the taxable gain will be calculated as if the loan did not exist. This means that even if all of the policy's cash value is used to repay the loan, taxes are still owed on any gains. This scenario is often referred to as a "tax bomb".

It's important to note that the tax consequences of a policy loan depend on whether the policy is a Modified Endowment Contract (MEC) or a non-MEC policy. MEC policies are generally taxed less favourably than non-MEC policies. For MEC policies, withdrawals and distributions are taxed as earnings first, followed by a return of the policy's cost basis. For non-MEC policies, distributions are treated first as a return of the cost basis, and only the amounts exceeding the cost basis are subject to income tax.

Additionally, if a policy loan is outstanding when the policyholder dies, the death benefit will be reduced by the amount of the loan and any accrued interest, but the benefit will likely not be taxed.

Free Life Insurance Leads: Strategies for Success

You may want to see also

Frequently asked questions

Life insurance death benefit payouts are usually not taxable. That means beneficiaries will receive the money without a tax burden hanging over their heads. However, there are certain situations where a life insurance death benefit may be taxable. For example, if the beneficiary chooses to delay the payout or take the payout in installments, interest may accrue. In that case, the interest paid to the beneficiary may be taxed.

Yes, if a beneficiary was not named, or is already deceased, the life insurance death benefit will go into the estate of the insured person and can be taxable along with the rest of the estate.

If you have a cash value life insurance policy, you can generally access the money through a withdrawal, a loan or by surrendering the policy and ending it. Money that’s withdrawn from cash value is generally made up of two parts: money that came from your premium payments, and money that came from interest or investment gains. The first part is not taxable, but the second part is subject to income taxes if you withdraw it.