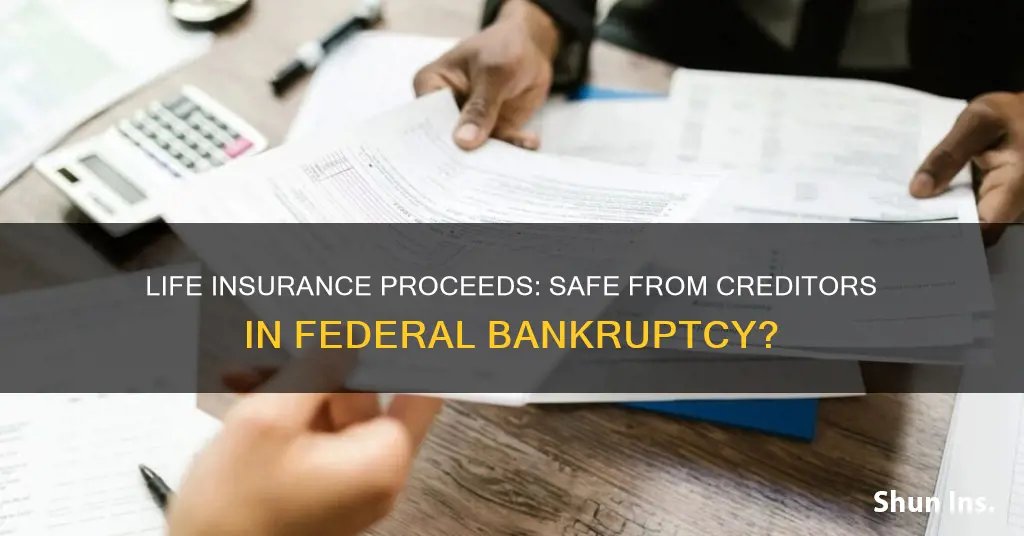

Life insurance is a valuable asset that can provide financial security for individuals and their families. However, in the event of bankruptcy, it is unclear whether the proceeds from life insurance will be protected from creditors. The treatment of life insurance proceeds during bankruptcy depends on various factors, including the type of bankruptcy, state laws, and the specifics of the life insurance policy. Understanding these factors is crucial for individuals seeking to safeguard their financial assets during difficult times.

| Characteristics | Values |

|---|---|

| Life insurance proceeds are protected in bankruptcy | Depends on the state and type of policy |

| Bankruptcy exemptions | State and federal exemptions exist |

| Bankruptcy estate | All of a debtor's possessions, including real and personal property, cash, and other assets with a monetary value |

| Exempt items | Enjoy partial to full protection from creditors, depending on location and chosen exemptions |

| Non-exempt items | Can be pursued by creditors to satisfy debt obligations |

| State exemptions | Vary dramatically; some don't exist in other states |

| Federal exemptions | Life insurance proceeds can be exempted if they haven't matured, except for credit life insurance |

| 180-day rule | If you inherit life insurance within 180 days of filing for bankruptcy, it will be included in the bankruptcy estate |

| Term life insurance | No financial value, but must still be listed as an asset |

| Whole life insurance | Has a cash value and is considered an asset with monetary value |

| Cash surrender value (CSV) | Must be listed in bankruptcy forms, or it may be taken and distributed by the trustee |

| Bankruptcy fraud | Attempting to conceal assets can result in case dismissal and fraud charges |

What You'll Learn

Life insurance proceeds and bankruptcy exemptions

Life Insurance Proceeds in Bankruptcy:

When an individual files for bankruptcy, their assets, including life insurance policies, become part of the "bankruptcy estate." This means that the court-appointed trustee can liquidate these assets to pay off creditors. However, certain assets, such as life insurance proceeds, may be exempt from liquidation under specific conditions.

Exemptions for Life Insurance Proceeds:

Both federal and state laws provide exemptions for life insurance proceeds in bankruptcy. Here are some key points to consider:

- Federal Exemptions: Under federal law, life insurance proceeds are generally exempt from creditors if they have not matured, with the exception of credit life insurance. The federal personal property exemptions also allow an exemption of up to $12,625 in the loan value of a life insurance policy.

- State Exemptions: Each state has its own set of exemption laws, which can vary significantly. Some states offer complete exemptions for life insurance proceeds, while others cap the exemption amount. For example, Pennsylvania exempts life insurance proceeds if the beneficiary is the decedent's child, spouse, or dependent relative. In contrast, New Jersey exempts proceeds if the policy expressly prohibits them from being used to satisfy the beneficiary's creditors.

- Timing of Receipt: The timing of receiving life insurance proceeds also plays a role in bankruptcy. If you receive proceeds within 180 days of filing for bankruptcy, they may be included in the bankruptcy estate. However, if you receive proceeds after this period, they are typically not part of the bankruptcy estate.

- Disclosure Requirements: It is essential to disclose any life insurance policies and proceeds during bankruptcy. Failure to do so can result in sanctions, including dismissal of the bankruptcy case or denial of discharge.

- Wildcard Exemptions: In addition to specific life insurance exemptions, some states offer wildcard exemptions that allow debtors to protect any property of their choosing, which may include life insurance proceeds.

- Conditions and Exclusions: Exemptions often come with conditions, such as requiring the beneficiary to be a third party and not the policyowner. There are also exclusions, such as cases where the policy was purchased to defraud creditors or if the claim involves domestic support obligations.

Whole Life vs. Term Life Insurance in Bankruptcy:

The treatment of life insurance policies in bankruptcy also depends on the type of policy:

- Whole Life Insurance: Whole life insurance policies have an investment component that accumulates cash value over time. This cash value is considered an asset in bankruptcy and may be exempt up to a certain amount, depending on the applicable exemptions.

- Term Life Insurance: Term life insurance policies, on the other hand, do not have a cash value and are typically not worth anything until they pay out. Therefore, they usually have no financial value in bankruptcy but must still be disclosed as an asset.

In conclusion, the treatment of life insurance proceeds in bankruptcy depends on a variety of factors, including the type of policy, federal and state exemption laws, and the timing of receiving the proceeds. It is important to consult with a bankruptcy attorney to understand how these factors apply to your specific situation.

Term Life Insurance: Benefits and Peace of Mind

You may want to see also

Creditor protection for life insurance proceeds

When an individual files for bankruptcy, a court-appointed trustee takes control of their assets, which are collectively referred to as the "bankruptcy estate." The trustee's role is to liquidate these assets to settle creditor claims. However, certain assets, such as the cash value of life insurance policies, are classified as exempt. This means they are kept outside the reach of the bankruptcy estate and are not available for attachment or liquidation by the insured's creditors or the trustee.

The extent to which life insurance policies are protected from creditors varies from state to state. Some states offer full protection, meaning the total cash value of the policy is exempt from creditors, regardless of its worth. Other states impose caps on the amount of exemption, protecting only a portion of the cash value up to a specified limit.

In most states, the exemptions applicable to bankruptcy are the same as those for creditor protection. However, a few states use different standards in bankruptcy cases. Notably, around twenty states, including New York, Pennsylvania, and Texas, allow debtors to choose between state or federal exemptions. Debtors must select one set of exemptions and cannot mix and match.

The federal exemptions, outlined in 11 U.S.C. 522, protect up to $15,000 of the cash value in whole life and universal life insurance policies. This federal protection can be crucial in preserving a debtor's assets in bankruptcy, depending on the chosen exemptions.

State exemption laws play a pivotal role in determining which assets are protected from creditors. These laws designate specific types of assets as either completely immune or partially immune to attachment. A well-known example is the "homestead exemption," which safeguards a debtor's primary residence.

Similarly, the cash value and death benefits of life insurance policies are often exempt from creditors, either fully or partially, in almost every state. This exemption makes life insurance policies valuable tools for financial planning, security, and asset protection.

The protection offered by life insurance policies against creditors is nuanced and influenced by state-specific laws. These exemption laws do not extend to obligations to the IRS. They provide a shield for the cash value of permanent life insurance policies, protecting this value from creditor claims up to the state-specified exemption limit.

The application of life insurance exemptions is often subject to conditions. A common stipulation is that the policy's primary beneficiary must be a third party, not the policy owner, for the cash value to qualify for exemption. This condition aims to prevent the misuse of life insurance as a shield for assets while ensuring its intended purpose of providing for beneficiaries.

It is important to note that there are exceptions to these exemptions. Circumstances that may disqualify a policy from protection include:

- Fraudulent Intent: Exemptions will not apply if a life insurance policy was purchased with the intent to defraud creditors.

- Domestic Support Obligations: Claims related to alimony or child support typically override exemption protections.

- Collateral Pledges: If a policy's cash value has been pledged as collateral for a loan, that value is not exempt from claims by that specific creditor.

Understanding these nuances is crucial for policyholders who aim to utilize life insurance as a tool for asset protection. Consulting with a legal or financial advisor can help navigate the specific exemptions and conditions applicable in an individual's jurisdiction.

Life Insurance Stacking: MetLife's Benefits and Drawbacks

You may want to see also

Bankruptcy estate and life insurance

When an individual files for bankruptcy, all their assets are included in their bankruptcy estate. This includes any life insurance policies they own and their cash value. The bankruptcy trustee oversees the estate and ensures that all assets are correctly listed, valued, and owned by the debtor.

In Chapter 7 bankruptcy, the trustee can liquidate nonexempt assets to pay creditors. In Chapter 13 bankruptcy, the trustee does not liquidate assets but estimates how much creditors would receive if the debtor had filed for Chapter 7. The debtor then pays this amount to creditors through a court-ordered repayment plan.

Life insurance policies can be protected in bankruptcy through exemptions. These are specific and limited and vary depending on state law and federal law. In some states, debtors can choose between state and federal exemptions, while in other states, they must use state exemptions.

The federal bankruptcy exemptions and many state exemption laws treat unmatured (active) and matured (expired or paid out) life insurance policies differently. Term life insurance policies, which have no cash value, usually have no financial value in bankruptcy, although they must still be listed as an asset. Whole life insurance policies, which have an investment component that accrues cash value, are considered assets with monetary value.

The federal exemptions allow debtors to exempt up to $12,625 or $13,400 of the cash value of a whole life insurance policy, depending on the source. If there is any non-exempt equity in a whole life insurance policy, the trustee in a Chapter 7 bankruptcy will likely require the debtor to liquidate the policy and distribute the non-exempt amount to creditors. In a Chapter 13 bankruptcy, the debtor will have to allocate at least the non-exempt amount in their repayment plan to unsecured creditors.

Life insurance proceeds received within 180 days of filing for bankruptcy are also considered part of the bankruptcy estate and may be claimed by the trustee unless they can be claimed as exempt.

Life Insurance Proceeds: Nonprofit Reporting Requirements and Compliance

You may want to see also

State-specific life insurance exemptions

The treatment of life insurance proceeds in bankruptcy varies from state to state. While some states offer complete exemptions for life insurance proceeds, others cap the exemption amount, allowing creditors to attach the excess. Here is a state-by-state breakdown of the life insurance exemptions:

- Alabama: Proceeds are exempt if the beneficiary is the decedent's child, spouse, or dependent relative.

- Alaska: Proceeds are exempt if the beneficiary is the insured's spouse or dependent, up to $473 per week.

- Arizona: Proceeds are exempt if the beneficiary is a spouse, close relative, or dependent family member of the insured for an uninterrupted period of at least two years.

- Arkansas: Proceeds are exempt if the beneficiary is not the owner or insured individual.

- California: Proceeds are exempt up to $15,650 (or $31,300 if married).

- Colorado: Proceeds are exempt if the policy has been owned by the debtor for at least four years.

- Connecticut: Proceeds are exempt if the policy is owned by the debtor and insures the debtor or an individual upon whom the debtor is dependent.

- Delaware: Proceeds are completely exempt.

- District of Columbia: Proceeds are completely exempt, except for policies intended to pay off the debtor's debts.

- Florida: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Georgia: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Hawaii: Proceeds are completely exempt if the beneficiary is the insured's spouse, child, parent, or dependent.

- Idaho: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Illinois: Proceeds are exempt if the beneficiary is a spouse, child, parent, or dependent of the insured.

- Indiana: Proceeds are exempt if the beneficiary is the insured's spouse, child, parent, or dependent.

- Iowa: Proceeds are exempt if the beneficiary is the insured's spouse, child, or dependent.

- Kansas: Proceeds are exempt if the beneficiary has an insurable interest and is not the owner or insured individual.

- Kentucky: Proceeds are exempt if the beneficiary is not the insured or owner.

- Louisiana: Proceeds are exempt up to $35,000 if the policy has been issued for at least nine months.

- Maine: Proceeds are exempt if the beneficiary is the insured's spouse, child, or other dependent relative.

- Maryland: Proceeds are exempt if the beneficiary is the insured's spouse, child, or other dependent relative.

- Massachusetts: Proceeds are exempt if the beneficiary has an insurable interest.

- Michigan: Proceeds are exempt if the beneficiary has an insurable interest.

- Minnesota: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Mississippi: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Missouri: Proceeds are exempt up to $150,000.

- Montana: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Nebraska: Proceeds are exempt up to $100,000 if the beneficiary is not the insured or the insured's estate.

- Nevada: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- New Hampshire: Proceeds are exempt if the beneficiary is not the insured or the insured's estate and has an insurable interest.

- New Jersey: Proceeds are exempt if the beneficiary is not the insured, owner, or the insured's estate and has an insurable interest.

- New Mexico: Proceeds are exempt if the beneficiary is the insured or a citizen of New Mexico.

- New York: Proceeds are exempt if the beneficiary is not the insured or owner.

- North Carolina: Proceeds are exempt if the beneficiary is the insured's spouse and/or children.

- North Dakota: Proceeds are exempt if the beneficiary is the insured's spouse, children, or other dependent relative.

- Ohio: Proceeds are exempt if the beneficiary is the insured's spouse, children, dependent relative, charity, creditor, or trust for the benefit of the insured.

- Oklahoma: Proceeds are exempt.

- Oregon: Proceeds are exempt if the beneficiary is not the policy owner.

- Pennsylvania: Proceeds are exempt if the beneficiary is the insured's spouse, child, or dependent relative.

- Rhode Island: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- South Carolina: Proceeds are exempt if the beneficiary is the insured's spouse, children, or dependents, and the policy was purchased more than two years before bankruptcy.

- South Dakota: Proceeds are exempt up to $20,000 if the beneficiary is the insured's spouse or children.

- Tennessee: Proceeds are exempt if the beneficiary is the insured's spouse, child, or dependent relative.

- Texas: Proceeds are exempt.

- Utah: Proceeds are exempt if the beneficiary is the spouse or child of the insured and the policy was purchased more than one year prior.

- Vermont: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Virginia: Proceeds are exempt.

- Washington: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- West Virginia: Proceeds are exempt if the beneficiary is not the insured or the insured's estate.

- Wisconsin: Proceeds are exempt if the beneficiary is the insured or a dependent of the insured.

- Wyoming: Proceeds are exempt if the beneficiary is not the policy owner.

Medicare Advantage: Life Insurance Coverage and Benefits Explained

You may want to see also

Federal life insurance exemptions

Understanding Federal Exemptions:

Federal exemptions are specific provisions that allow debtors to protect a portion of their property during bankruptcy proceedings. These exemptions are typically listed under "Schedule C" of a bankruptcy filing, and they vary from state to state. In some states, debtors can choose between state and federal exemptions, while other states have opted out of this option, requiring residents to use only their state exemptions. It's important to note that you must stick to one set of exemptions and cannot mix and match between state and federal options.

Life Insurance Exemption Amounts:

The exemption amounts for life insurance proceeds vary across states. Some states offer complete exemptions, meaning the entire cash value of the policy is exempt from creditors. Other states have capped exemption amounts, allowing only a portion of the cash value to be protected. It's essential to review the specific laws in your state to understand the exemption amount applicable to life insurance proceeds.

Conditions for Exemptions:

In many states, there are conditions that must be met for life insurance proceeds to be exempt from creditors. One common condition is that the beneficiary of the policy must be someone other than the policyowner or insured. Additionally, some states require that the beneficiary be a spouse, child, or dependent relative of the insured for the exemption to apply. It's important to review the specific conditions outlined in your state's exemption laws.

Timing of Exemptions:

The timing of life insurance proceeds can also impact their exemption status. In Chapter 7 bankruptcy cases, the 180-day rule applies. If you inherit life insurance proceeds within 180 days of filing for bankruptcy, those proceeds will be considered part of the bankruptcy estate, and any non-exempt portions may be vulnerable to creditors. However, if you inherit insurance proceeds after this 180-day period, they will not be included in the bankruptcy estate.

Types of Life Insurance Policies:

The type of life insurance policy you have also plays a role in federal exemptions. Term life insurance policies, which have a limited lifespan and pay out only upon the death of the insured, typically have no financial value in bankruptcy. On the other hand, whole life insurance policies, which have both an insurance component and an investment component, are considered assets with monetary value. The federal exemptions generally allow debtors to exempt a portion of the cash value of whole life insurance policies from creditors.

Protecting Your Interests:

To effectively protect your interests, it's crucial to understand the type of life insurance policy you have, its value, and whether it qualifies for any exemptions. Consulting with an experienced bankruptcy attorney is highly recommended, as they can guide you through the complex landscape of federal and state exemption laws and help you maximize the protection of your assets, including life insurance proceeds.

Life Insurance Cash: Withdrawing Money from Your Policy

You may want to see also

Frequently asked questions

No. Life insurance proceeds are considered part of the bankruptcy estate if the insured person dies before filing for bankruptcy or within a certain time frame after filing, known as the 180-day rule. This rule applies to Chapter 7 bankruptcy cases.

Yes. It is essential to disclose all your assets, including life insurance policies and proceeds, during bankruptcy. Failure to do so can result in sanctions, case dismissal, or even fraud charges.

Yes. Life insurance proceeds can be protected through exemptions. These exemptions vary by state, and there are also federal exemptions. Exemptions may depend on factors such as the relationship between the insured and the beneficiary, the purpose of the proceeds, and the type of policy.

A matured life insurance policy has paid out a death benefit or expired and is no longer in effect. An unmatured policy is still active and has not paid out any benefits. The treatment of these policies in bankruptcy differs, with unmatured policies often having no financial value.

The outcome depends on the type of policy and the exemptions available. Term life insurance policies, which have no cash value, are unlikely to be affected. Whole life insurance policies, which have a cash value component, may be partially or fully exempt, depending on the specific circumstances and the applicable exemptions.