Life insurance is a financial safety net for your loved ones in the event of your death. But what happens when you decide to surrender your policy? Are life insurance surrender proceeds taxable?

The short answer is: it depends. If you've been paying premiums on a life insurance policy and decide to cancel it, you may be entitled to a refund of some of the money you've paid in. This is known as the cash surrender value. Whether or not this amount is taxable depends on a few factors, including the type of policy you have and the reason for surrendering it.

Let's take a closer look at the tax implications of surrendering a life insurance policy.

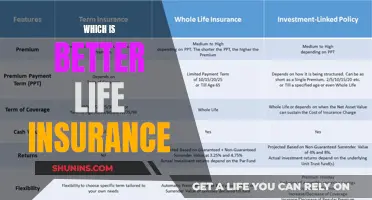

Types of Life Insurance Policies

There are two main types of life insurance policies: term life insurance and cash value life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the insured person dies during the term, the beneficiaries receive a death benefit. However, term life insurance does not build cash value, so there is no refund if you cancel the policy before the term ends.

On the other hand, cash value life insurance policies, such as whole life or universal life, include a cash accumulation account where excess premium payments and earnings are held. These policies offer the opportunity to access the accumulated cash through withdrawals, policy loans, or by surrendering the policy.

Tax Implications of Surrendering a Life Insurance Policy

When you surrender a life insurance policy, you are telling the insurance company that you no longer want coverage. In return, you may receive a portion of the cash value of the policy, known as the cash surrender value. This amount is usually slightly less than the total cash value due to surrender charges and administrative costs.

The taxability of the cash surrender value depends on whether it exceeds the total amount of premiums you have paid into the policy. If the cash surrender value is greater than the total premiums paid, the difference is typically considered taxable income. This is because the cash value has grown through interest or investment gains, and the IRS treats this as investment income.

However, if the cash surrender value is equal to or less than the total premiums paid, there is generally no tax liability. In this case, the cash surrender value is simply a return of the money you have already paid in taxes.

It's important to note that there may be alternative options to surrendering a life insurance policy, such as taking out a loan against the policy or performing a life settlement. It's always a good idea to consult a financial advisor or tax professional before making any decisions about your life insurance policy.

| Characteristics | Values |

|---|---|

| Are life insurance surrender proceeds taxable? | Yes, if the cash surrender value is larger than the total amount of premium paid into the policy. |

| No, if the cash surrender value is equal to or less than the total amount of premium paid into the policy. |

What You'll Learn

Surrendering a life insurance policy

Reasons to Surrender a Life Insurance Policy

- The coverage is no longer needed.

- To get the cash value.

- Less expensive coverage is available.

Understanding Cash Surrender Value

If you are cancelling something other than a term policy, you will probably have a small amount of money left after cancellation. The life insurance company will calculate this value, known as the cash surrender value or the non-forfeiture value.

The cash surrender value calculation is based on:

- The total amount of premium payments made into the policy.

- The performance of the investments that the cash value is held in.

- Any applicable surrender fees.

The cash surrender value is, therefore, the amount of money you will receive after all surrender charges and administrative costs are subtracted from the policy's cash value, and any outstanding loans are repaid.

Alternatives to Surrendering a Policy

There are several ways to access the cash value in your life insurance policy without surrendering it:

- Direct withdrawal: You take money out of your cash value but leave enough in the policy to keep it in force. You have to continue paying premiums, but you can keep the death benefit protection this way. The death benefit is reduced by the amount you withdraw.

- Policy loan: The most common way to access the cash value in your life insurance policy is to take out a loan using the policy as collateral. The interest on the loan is charged to the cash value in the policy, but the interest rate is usually less than you would pay to other traditional lenders.

- Life settlement: In a life settlement, a qualified buyer purchases your policy and assumes the responsibility of paying the premiums. The buyer will then receive the death benefit when you die, and you will walk away with a lump sum upfront at the time of purchase.

Tax Implications of Surrendering a Life Insurance Policy

The taxability of life insurance cash surrender value is a complex issue. As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value.

However, when money leaves a life insurance policy, there may be tax implications. There are two ways to take money out of a life insurance policy while it remains in force: You may want to see also The cash surrender value of a life insurance policy is the amount of money you will receive if you decide to redeem your policy for cash prior to your death. As you continue to pay premiums on your policy, the cash-surrender value will increase steadily. To determine how much tax you will owe on your life insurance policy, you must determine the difference between the basis of the policy and its current cash-surrender value. This difference will be the profit you have earned, which will then be subject to taxation. The basis of a life insurance policy is the total sum of premiums that you have paid into the policy over its lifetime, less any prior withdrawals. For example, if you have paid $4,000 worth of premiums into the policy and taken two prior withdrawals worth a total of $375, the current amount of funds invested in the policy would be $3,625. This value is referred to as the "basis". To calculate the taxable income on your life insurance policy, you must first identify the current cash-surrender value. You can consult with your life insurance provider to determine the current cash-surrender value of your policy. With this sum in mind, you can subtract the basis you calculated earlier to identify the exact amount of profit you will earn in the event that you complete the cashing-out process. It is important to take into account any and all withdrawals or dividends received from the policy prior to cashing out, as this information can significantly affect the total amount of tax you will end up paying on the money you receive. As expected, the less profit you earn from your policy, the less tax you can expect to pay. If your basis is larger than the cash-surrender value of the policy, you will still receive the cash-out amount but will not be required to pay any tax on these funds, as you have technically earned no profit from cashing out the policy. The funds you receive from the cash surrender value are taxable as ordinary income rather than capital gains. This means that these funds will be subject to federal income tax regulations as well as any state-level income tax policies. When it comes time to report this income on your tax return, you will use the standard IRS Form 1040 and list the profit from your policy as "other income". Keep in mind that this profit must be reported on Form 1040 during tax filing; failure to do so can result in a variety of penalties and fines from the IRS. Once you have committed to cashing out your life insurance policy, your life insurance provider will provide you with a 1099-R that lists the gross payout from your policy following the cash-out. This information can act as an official point of reference once you begin filing your tax documentation. If you have any questions about your life insurance policy or the cashing-out process, it is best to discuss your concerns with a financial advisor or representative from your policy provider well in advance of tax time. Not only will this ensure that you have the information you need to complete your taxes accurately, but it will also help you create a strategic financial plan that incorporates the funds you stand to gain from your policy. Ultimately, preparation will allow you to maximize your benefits during this process. You may want to see also Non-Taxable Scenarios If you are the beneficiary of a life insurance policy, you will typically not owe any taxes on the death benefit. However, there are certain situations where a life insurance death benefit may be taxable. Here are some common scenarios where life insurance proceeds are not taxable: Taxable Scenarios There are some instances where taxes may be owed on life insurance proceeds. These include: You may want to see also Estate Tax An estate tax is a tax on your right to transfer property upon your death. Your life insurance proceeds may be taxable if your estate is worth more than the maximum threshold allowed. Inheritance Tax The inheritance tax is a tax placed on the recipient for any inherited cash payouts, properties, and other assets. Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania are currently the only states that enforce this tax. Income Tax An income tax is collected by the government for any money earned by citizens throughout the year. Typically, life insurance proceeds are not considered taxable income. Generation-Skipping Tax Similar to the estate tax, the generation-skipping tax is imposed on any assets that skip a generation. They are only enforced when they exceed the same threshold. Tax on Surrendered Policies When you surrender a life insurance policy, you may face surrender fees. You will have to pay taxes on the life insurance cash value because it now falls under the qualifications to be income taxed. Tax on Interest on Installments If the death benefit from a life insurance policy is paid out in installments rather than as a lump sum, any interest that accumulates on those payments will be taxed as regular income. Tax on Sale of Policy If you sell your policy for more than what you've paid in premiums, the gain on that amount could be taxed. Tax on Policy Loans If you take out a loan against the cash value, you can be subjected to interest payments. If the policy lapses, any outstanding loan balance that exceeds what you've paid into the policy will be treated as taxable income by the IRS. You may want to see also The cash surrender value is calculated by taking the total accumulated cash value, then subtracting any prior withdrawals, outstanding loans, and surrender charges. Surrender charges are fees that insurance companies charge when you claim the cash surrender value of your life insurance policy. These fees are usually more expensive for newer policies and decrease over time. If you surrender your policy during the early years of ownership, when the value is relatively low, the company will likely charge surrender fees, reducing your cash value. These charges vary depending on how long you've had the policy and, often, on the amount being surrendered. Some policies can levy surrender charges for many years after the policy is issued. Surrender fees typically range from 10% to 35% but can be as high as 35% to 40%. When you surrender your policy for cash, the gain on the policy is subject to income tax. You will only need to pay taxes on amounts that exceed the total amount of premiums paid into the policy. The rest of the cash value is the amount you paid in and will not be taxed at this point because it will have previously been part of your taxable income. Before surrendering your policy, it is important to understand the financial repercussions. You will not likely recoup the full amount that you spent on premiums over the years. Cash surrender value is not a refund—it is only the return of your investment while taking into account any gains or losses. If you have the means, consider other options before using your life insurance policy for cash, such as borrowing against your 401(k) plan or taking out a home equity loan. You may want to see also Yes, if the cash value of the policy is greater than the total amount of premiums paid, the difference is taxable as ordinary income. The cash surrender value of a life insurance policy is the amount of money the policyholder will receive after all surrender charges and administrative costs are subtracted from the policy's cash value, and any outstanding loans are repaid. The cash surrender value of a life insurance policy is calculated based on the total amount of premium payments made into the policy, the performance of the investments that the cash value is held in, and any applicable surrender fees. Yes, there are several alternatives to surrendering a life insurance policy, including direct withdrawals, policy loans, and life settlements.Life Insurance Proceeds: Regular Mail or Not?

Calculating taxable income

Life Insurance Dividends: Taxable or Not?

Taxable and non-taxable scenarios

Life Insurance Options: Minnesota Life's Whole Life Insurance

Life insurance tax types

Credit Life Insurance: What You Need to Know

Cash surrender value

Success Keys in Life Insurance: Unlocking the Secrets

Frequently asked questions