Life insurance dividends are generally not taxable, as they are considered a return of premium. However, there are exceptions. If the amount of dividends you receive is greater than the total premiums you have paid into the policy, the excess may be taxable. Similarly, if you are earning interest on your dividends, the interest gain is taxable. Prudential dividends are also not guaranteed, but the company has a good track record of making regular dividend payments.

| Characteristics | Values |

|---|---|

| Are Prudential life insurance dividends taxable? | No, Prudential life insurance dividends are not taxable. They are treated as tax-free returns of premiums. |

| When are life insurance dividends taxable? | Life insurance dividends may be taxable if they exceed the total premiums paid or if you earn interest on dividends. |

| Dividend options | - Dividend payment in cash |

- Reduce future premium payments

- Leave the dividends with the insurance company and collect interest

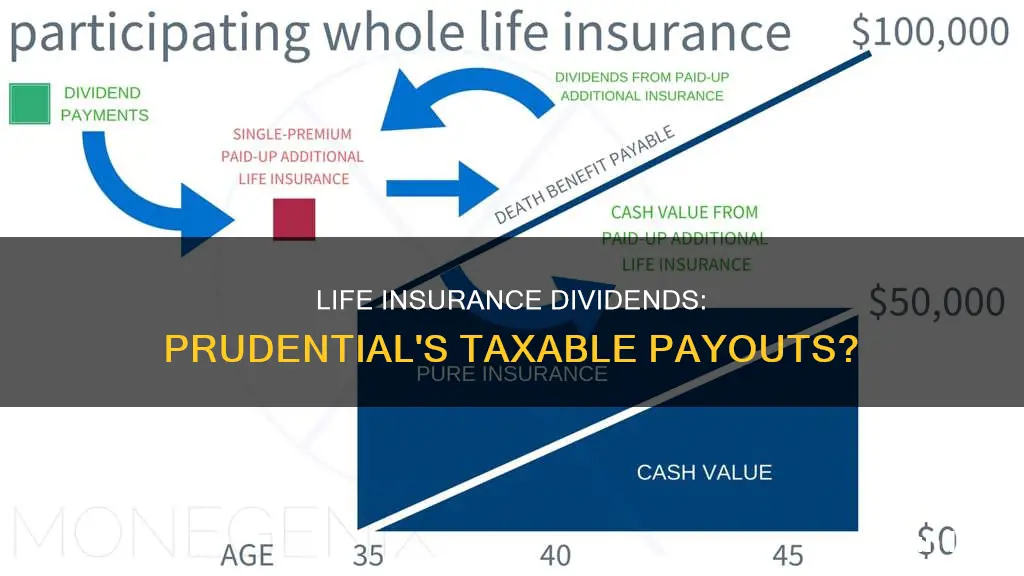

- Buy paid-up additional life insurance

- Buy one-year term life insurance

- Repay loan interest and/or principal |

What You'll Learn

- Prudential life insurance dividends are taxable if they exceed the total premium paid

- Interest on dividends is taxable

- Dividends are not guaranteed

- Dividends are considered a return of premium

- Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero

Prudential life insurance dividends are taxable if they exceed the total premium paid

For example, if you pay $1,000 in annual premiums and receive a dividend of $1,250, you may owe taxes on the $250 excess. It's important to note that this only applies if your policy is not classified as a Modified Endowment Contract (MEC). If your policy is a MEC, dividends are generally taxable when earned, to the extent of the gain in the contract.

Prudential life insurance dividends can be used in several ways. You can choose to receive them as a cash payment, use them to reduce future premium payments, leave them with the company to collect interest, or purchase additional paid-up insurance. It's important to carefully review the details of your policy to understand how dividends are calculated and guaranteed, as well as how you plan to handle the dividend income.

While life insurance dividends are generally not subject to income tax, it's always a good idea to consult with a tax professional to determine your specific tax obligations. Additionally, keep in mind that there may be state-specific regulations regarding abandoned or lost accounts, so it's important to keep your account information up to date.

Best Canadian Life Insurance: Top-Rated Companies and Plans

You may want to see also

Interest on dividends is taxable

If you choose to leave your dividends in your policy to earn interest, this interest income may be taxable if it exceeds the amount of premiums you have paid. This is because any dividends over the amount you have paid are considered income, not a return of premium. For example, if you pay $1,000 in life insurance premiums in a year and receive a dividend of $1,250, you may owe taxes on the excess $250.

The taxation of dividends depends on whether your policy is classified as a Modified Endowment Contract (MEC). If your policy is not a MEC, dividends are generally considered a return of premium and are not taxable. However, if your policy is a MEC, dividends (except those used to purchase paid-up additional insurance or to pay premiums on the same policy) are taxable when earned to the extent of the gain in the contract.

It is important to note that dividend payments received from participating life insurance policies are generally not subject to taxes by the Internal Revenue Service (IRS) since the insurance companies generated the gains from their policyholders. Dividends received from a life insurance policy are treated as a distribution from the contract and are taxed similarly to other types of distributions.

Teamsters Life Insurance: Interest Included or Excluded?

You may want to see also

Dividends are not guaranteed

The dividends policyholders receive are based on the performance of Prudential's Closed Block, which includes investment returns and mortality rates specific to similar life insurance policies. Since these factors are subject to change, the dividends paid out may be higher or lower than in previous years. Consequently, policyholders cannot rely on a fixed dividend amount.

While Prudential has a track record of making regular dividend payments, future dividends are not guaranteed. Policyholders should be aware that there is no assurance of receiving dividends consistently or reaching a point where non-guaranteed policy values are sufficient to cover premiums. Even if policy values temporarily cover premiums, policyholders may need to resume out-of-pocket premium payments due to dividend changes or if they take out loans or withdrawals against the policy.

It is important to note that dividend payments are separate from cash value earnings. The total cash value of a policy includes guaranteed cash values, cash value of paid-up additional insurance, dividend accumulations, and, in some cases, termination dividends. Guaranteed values, such as the death benefit and cash value, are not affected by dividend fluctuations as long as premiums are paid on time and no policy loans are taken out. On the other hand, total cash values and total death benefits are non-guaranteed values that can be influenced by changes in the dividend scale.

Haven Life: Insurance Without the Medical Exam Hassle

You may want to see also

Dividends are considered a return of premium

If your life insurance policy is not a Modified Endowment Contract (MEC), dividends are considered a return of premium. In this case, amounts received over the life of the policy become taxable when they exceed the premiums paid for the policy. For example, if you pay $1,000 in premiums and receive a $1,250 dividend, you may owe taxes on the excess $250. This is because any dividends over the amount you paid are considered income, not a return of premium.

Dividends from life insurance policies are generally treated as tax-free returns of premiums. However, if you are earning interest on your dividends, the interest gain is taxable. The interest you earn on dividends is fully taxable as soon as you have the right to withdraw it, regardless of whether or not you actually withdraw it.

Additionally, if your life insurance policy is a MEC, dividends (except those used to purchase paid-up additional insurance or to pay premiums on the same policy) are taxable when earned to the extent of the gain in the contract. The gain is calculated as the difference between the cash value of your policy and the cost basis of the policy (premiums paid less amounts previously received tax-free).

Tax Liens: Life Insurance and Federal Law

You may want to see also

Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero

Dividends from life insurance policies are generally not subject to income tax. The Internal Revenue Service (IRS) treats them as a distribution from the contract, and they are taxed similarly to other types of distributions. Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero. This means that the dividends are essentially treated as refunds for overpayment of the premium.

The taxation of dividends depends on whether the policy is classified as a Modified Endowment Contract (MEC). If the policy is not a MEC, dividends are considered a return of premium. Amounts received over the life of the policy become taxable when they exceed the premiums paid for the policy. If the policy is a MEC, dividends (except those used to purchase additional insurance or to pay premiums on the same policy) are taxable when earned to the extent of gain in the contract.

It's important to note that if you earn interest on your dividends, this interest income may be taxable if it exceeds the amount you have paid in premiums.

Rop Life Insurance: Understanding the Unique Benefits

You may want to see also

Frequently asked questions

Yes, if you choose to have your dividends accumulate interest with the insurance company, the interest will be taxable.

No, Prudential life insurance dividends are not taxable if you choose to receive them as cash. They are treated as tax-free returns of premiums.

No, Prudential life insurance dividends are not taxable if they are used to buy paid-up additional insurance.

No, Prudential life insurance dividends are not taxable if they are used to pay off a loan.