USAA is a financial services company that provides insurance and other financial products to U.S. military members, veterans, and their families. Its life insurance products are available to the general public, and it offers term, whole, and universal policies. USAA's life insurance rates are generally higher than those of its competitors, and it has fewer policy options overall. However, it offers several benefits tailored specifically for military personnel, such as coverage during wartime and a $25,000 payment for severe injuries sustained during military service. Its customer satisfaction ratings are above average, and it has a strong financial strength rating, indicating its ability to pay future claims.

| Characteristics | Values |

|---|---|

| Number of policies | 5 |

| Membership | Provides access to other financial products and advice |

| Policy types | Term, whole, and universal |

| Policy options | Few overall |

| Policy availability | Some policies aren't available in all states |

| Customer service | Phone support and a mobile app |

| Financial strength rating | A+ |

| NAIC complaint rating | Much better than expected for company size |

| AM Best rating | A++ (Superior) |

| Customer satisfaction | Above average |

| Application process | Online or over the phone |

What You'll Learn

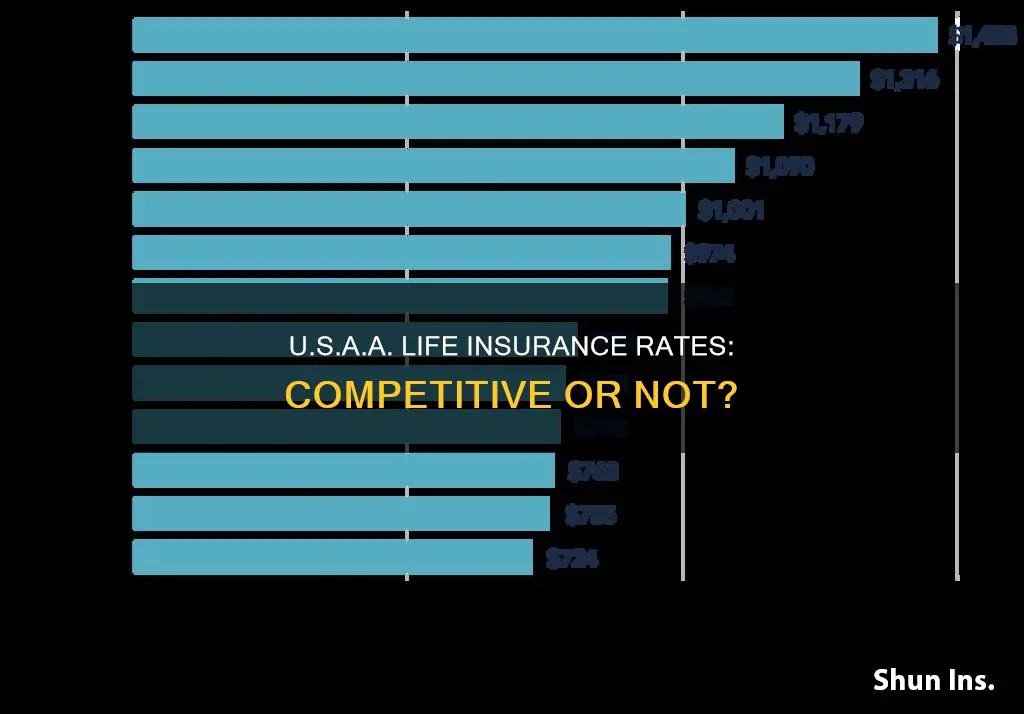

USAA's life insurance rates compared to competitors

USAA offers a range of life insurance policies, including term, whole, and universal, to U.S. military members, veterans, and their families. Its life insurance products are also available to the general public. The company provides coverage options ranging from $2,000 to $10 million, with flexible policies that can cater to various needs.

USAA's term life insurance rates are higher than most competitors, according to Forbes Advisor's analysis. However, USAA's life insurance policies include additional benefits for military personnel, such as coverage during wartime and a $25,000 payment for severe injuries sustained during active duty. These military-specific benefits make USAA life insurance a good choice for those on active duty or in the military.

Compared to State Farm, USAA tends to be more expensive and offers fewer policy options. State Farm has ten policies, while USAA has five. However, both insurers offer at least one term, whole, and universal policy. USAA also offers online applications for specific policies, whereas State Farm products must be purchased through an agent.

NerdWallet's analysis found that USAA's term life insurance rates for a 20-year, $500,000 policy are higher than average for both men and women in the 30 to 40-year-old age range.

USAA's life insurance rates are generally higher than competitors, but the company's military-specific benefits, flexible policies, and wide range of coverage options make it a competitive choice for those seeking life insurance, particularly those with military affiliations.

Pacific Life: Diabetic Life Insurance Options

You may want to see also

USAA's term life insurance

USAA offers term life insurance policies with flexible coverage and age restrictions. The Level Term V insurance policy is available until the age of 70 and offers coverage ranging from $100,000 to $10 million. This policy includes additional benefits for military personnel, such as coverage during wartime and a $25,000 payment for severe injuries sustained during active duty. The Essential Term insurance policy, on the other hand, does not require a medical exam but is only available for those aged 21 to 35 and expires at 39, with a coverage cap of $100,000.

In addition to term life insurance, USAA also offers whole and universal life insurance policies, providing a range of options for individuals to choose from based on their specific needs and preferences. The whole life insurance policies provide permanent coverage and the opportunity to build cash value, while the universal life insurance policy offers more flexibility in terms of payment options and death benefits.

When considering USAA's term life insurance policies, it is important to note that some policies may not be available in certain states, such as New York and Montana. Additionally, the cost of coverage will depend on various factors, including age, health, and lifestyle, so it is recommended to get a personalised quote from the company.

Creating Generational Wealth: Life Insurance as a Foundation

You may want to see also

USAA's whole life insurance

USAA offers two types of whole life insurance: simplified whole life and guaranteed whole life.

Simplified Whole Life

You can apply for this policy up to the age of 85. Payments don't increase and the policy value doesn't change. Coverage is available from $25,000 to $10 million. To apply, you must answer a health questionnaire and undergo a free medical exam.

Guaranteed Whole Life

No underwriting is needed for this guaranteed-issue policy, which is available to those aged 45 to 85 (50 to 75 in New York). This policy generally pays within 24 hours of death. Payments never increase and coverage ($2,000 to $25,000) never decreases.

Finding Lost Life Insurance: A Comprehensive Guide

You may want to see also

USAA's universal life insurance

The Universal Life Accumulator policy is more flexible than USAA's whole life policies as you can change things such as the premium payment schedule or the death benefit. It also has a guaranteed interest rate of 1%.

USAA also offers an indexed universal life insurance policy, which ties the cash value growth to a market index like the S&P 500.

Esurance Life Insurance: What You Need to Know

You may want to see also

USAA's customer satisfaction

USAA has received high ratings for customer satisfaction. It was ranked #1 in Customer Satisfaction and Most Trusted in the 2024 J.D. Power Individual Annuity Study. The company has also received high ratings from Investopedia, which gave it a spot on its list of the top life insurance companies for children, citing its financial stability and high maximum coverage for children's whole life insurance.

NerdWallet gave USAA 4.5 stars out of 5 for overall performance, taking into account consumer experience, complaint data, and financial strength ratings. Over three years, USAA has had fewer complaints than expected for a company of its size, according to the National Association of Insurance Commissioners.

USAA's website provides detailed information about its policies, and it offers online quotes without requiring personal contact information. It also has a survivors relations team to assist families of deceased members.

Life Insurance Rates: The 35-Year Spike Explained

You may want to see also

Frequently asked questions

The pros of USAA life insurance are that it has a high financial strength rating, high maximum coverage for children's whole life insurance, and extra perks for military personnel. The cons are that there are few options for no-medical exam policies, and a same-day decision is not available.

USAA offers term, whole, and universal life insurance policies.

The cost of a USAA life insurance policy depends on a host of factors, including age, sex, and location.

USAA's term life insurance rates are higher than most of the best term life insurance companies.

You can get up to $10 million worth of coverage from USAA's Level Term V or Simplified Whole Life policies.