When considering when to get rid of whole life insurance, it's important to evaluate your financial situation and long-term goals. Whole life insurance provides lifelong coverage and a guaranteed death benefit, making it a valuable asset for many. However, there are instances where it may no longer be necessary or beneficial. For example, if you've paid off your mortgage or have sufficient savings to cover final expenses, you might decide to terminate the policy. Additionally, if your financial needs have changed, such as a reduced dependency on the insurance proceeds, it could be a sign to reassess your coverage. Understanding the reasons for keeping or removing whole life insurance can help you make an informed decision about your financial security.

What You'll Learn

- Premiums: High costs may outweigh benefits if policy is no longer needed

- Financial Goals: Achieved goals may make whole life insurance redundant

- Health Changes: Improved health could lead to better alternatives

- Alternative Investments: Diversifying with other assets might be more profitable

- Tax Implications: Tax benefits may no longer apply, making it less attractive

Premiums: High costs may outweigh benefits if policy is no longer needed

When considering whether to keep or terminate a whole life insurance policy, the financial aspect, particularly the premiums, is a critical factor. Whole life insurance is a long-term commitment, and the associated costs can be substantial. As time passes, the initial reasons for taking out the policy might change, and the premiums could become a significant financial burden. If the insured individual's life is no longer at risk due to improved health, age, or other mitigating factors, the need for the policy may diminish. In such cases, the high premiums might outweigh the benefits, making it financially prudent to reconsider the insurance arrangement.

The decision to discontinue the policy should be based on a comprehensive assessment of the current circumstances. For instance, if the insured person has reached an age where the risk of death is statistically lower, or if their health has improved significantly, the rationale for maintaining the insurance may no longer hold. Additionally, if the insured individual has accumulated sufficient savings or assets to provide financial security in the event of their passing, the need for the insurance's payout might be reduced.

Another aspect to consider is the potential for long-term savings. Whole life insurance policies often have an investment component, allowing the policyholder to build a cash value over time. However, if the policy is no longer needed, the focus should shift to utilizing the accumulated cash value for other financial goals. This could involve taking out loans against the policy's value or using the funds to invest in other assets that provide more immediate benefits.

Furthermore, the changing financial landscape of the insured individual should be taken into account. If their financial situation has improved, and they now have a more substantial emergency fund or a robust investment portfolio, the need for the insurance's financial safety net may decrease. In this scenario, the premiums could be redirected to more productive investments or savings vehicles.

In summary, the high premiums associated with whole life insurance can be a significant consideration when deciding whether to keep or terminate the policy. If the insured person's life is no longer at risk due to various factors, and if the policy's benefits are no longer essential, the financial costs might outweigh the advantages. Regularly reviewing the policy and its relevance to one's current circumstances is essential to making informed decisions about insurance coverage.

Life Insurance Annuity: What Happens When It Matures?

You may want to see also

Financial Goals: Achieved goals may make whole life insurance redundant

When you've achieved your financial goals, the need for whole life insurance may diminish. This type of insurance is typically designed to provide long-term financial security, often serving as a cornerstone of a comprehensive financial plan. However, once your financial objectives are met, the rationale behind maintaining this insurance could become less compelling. Here's a breakdown of why and how this might occur:

Debt Elimination: One of the primary purposes of whole life insurance is to ensure that your loved ones are financially protected in the event of your passing. If you've successfully paid off your debts, including any outstanding loans or mortgages, the financial burden on your beneficiaries is reduced. In this scenario, the insurance's primary function of providing financial security to cover debts is no longer necessary.

Investment Portfolios: Achieving financial goals often involves building a robust investment portfolio. This portfolio can generate income, accumulate wealth, and provide a safety net for your family. As your investments mature and generate returns, you may have alternative sources of financial support that can replace the role of whole life insurance. For instance, a well-diversified investment portfolio can offer a steady income stream, ensuring your family's financial stability without relying solely on insurance proceeds.

Retirement Planning: Whole life insurance can be a valuable tool for retirement planning, providing a guaranteed income stream during your golden years. However, if you've reached your retirement goals and have sufficient savings or pension plans, the need for this insurance may diminish. A comprehensive retirement strategy, including a mix of savings, investments, and pension benefits, can offer a more secure and sustainable financial future without the need for insurance proceeds.

Review and Adjustment: Achieving financial goals is a significant milestone, and it's an opportune moment to review your entire financial plan, including insurance policies. It's essential to periodically assess your insurance needs and make adjustments as your life circumstances change. This review process can help you identify areas where insurance might be redundant and allow you to optimize your financial strategy.

In summary, achieving financial goals can significantly impact your insurance needs, particularly with whole life insurance. As your financial situation evolves, it's crucial to regularly evaluate your insurance policies and make informed decisions to ensure your financial plan remains aligned with your goals and objectives. This proactive approach can help you make the most of your financial resources and provide the best possible security for your loved ones.

Life Insurance Dividends: Prudential's Taxable Payouts?

You may want to see also

Health Changes: Improved health could lead to better alternatives

Improved health can significantly impact your decision to keep or remove whole life insurance. When you experience health changes, it's essential to reassess your insurance needs and make informed choices. Here's how improved health can lead to better alternatives regarding whole life insurance:

Reduced Risk Assessment: As your health improves, you may find yourself in a lower-risk category for insurance companies. When you take positive steps towards a healthier lifestyle, such as regular exercise, a balanced diet, or successful management of pre-existing conditions, insurance providers often view you more favorably. This improved health status can result in lower insurance premiums or even the possibility of canceling certain coverage types, as you become less likely to require frequent medical interventions.

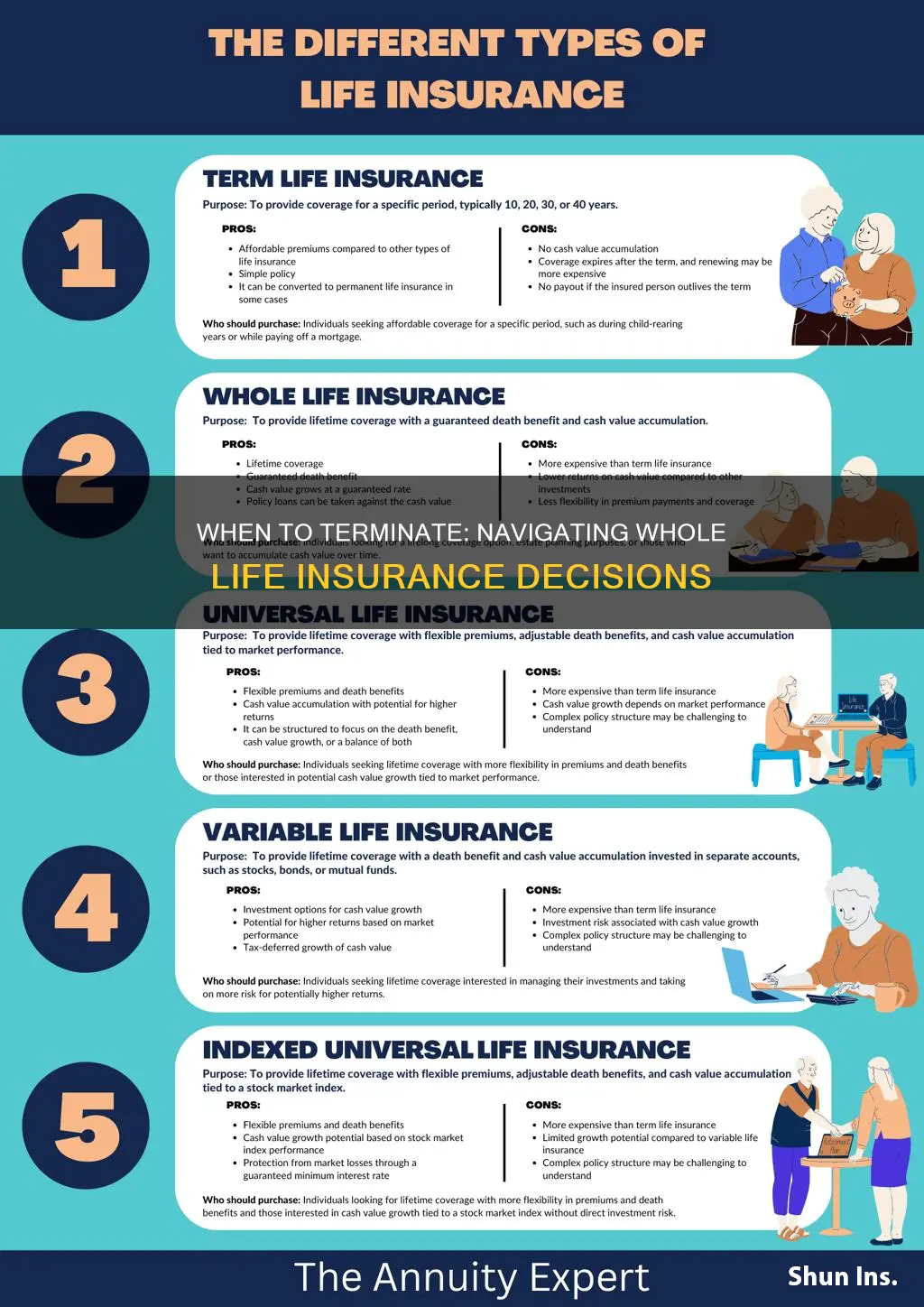

Alternative Coverage Options: With better health, you might discover that you no longer need the extensive coverage provided by whole life insurance. For instance, term life insurance, which offers coverage for a specific period, could be a more suitable and cost-effective option. Improved health may also allow you to explore other insurance alternatives, such as term life insurance with a convertible feature, which lets you switch to a permanent policy later if needed. This flexibility can be advantageous if your health continues to improve and you no longer require the long-term financial security of whole life insurance.

Regular Health Check-ups: Regular health check-ups and monitoring can help you stay informed about your well-being. These check-ups can identify any health improvements or changes, allowing you to make timely decisions about your insurance. If you notice a consistent improvement in your health, you can discuss these changes with your insurance provider to explore potential adjustments to your policy. This proactive approach ensures that your insurance remains aligned with your current health status and needs.

Long-Term Financial Planning: Improved health can also influence your long-term financial planning. As your health stabilizes and improves, you may have more control over your finances, allowing you to make informed decisions about insurance. You might consider reviewing your overall financial strategy and determining if the current level of whole life insurance is still necessary. This evaluation can lead to better financial management and potentially reduce unnecessary expenses associated with insurance premiums.

In summary, improved health opens up opportunities to reassess your insurance needs and explore better alternatives. It empowers you to make informed decisions, potentially saving money and finding more suitable coverage options. Regular health monitoring and check-ups play a vital role in this process, ensuring that your insurance remains relevant and beneficial as your health evolves.

Understanding Family Unit Life Insurance: A Comprehensive Guide

You may want to see also

Alternative Investments: Diversifying with other assets might be more profitable

When considering alternative investments to diversify your portfolio, it's important to explore various options beyond traditional stocks and bonds. Diversification is a key strategy to manage risk and potentially increase returns. Here are some alternative investments to consider and how they can contribute to a well-rounded financial plan:

Real Estate: Investing in real estate can be a powerful way to diversify. This asset class offers both tangible and intangible benefits. You can invest in physical properties, such as purchasing a rental home or flipping houses, which provides a steady income stream and potential for long-term wealth accumulation. Alternatively, consider real estate investment trusts (REITs), which are companies that own and operate income-generating properties. REITs offer the advantage of diversification across multiple properties without the need for direct management. This investment strategy can provide a hedge against market volatility and offer a steady return through dividends.

Commodities: Diversifying into commodities can be an effective strategy to protect against inflation and market fluctuations. This category includes precious metals like gold and silver, as well as agricultural products, energy resources, and industrial metals. Investing in commodities can be done through physical purchases, futures contracts, or exchange-traded funds (ETFs) that track commodity prices. For instance, gold is often seen as a safe-haven asset, providing a store of value during economic downturns. Diversifying with commodities can reduce the overall risk of your portfolio, especially when combined with other asset classes.

Peer-to-Peer Lending: This innovative investment approach allows you to act as a lender, connecting directly with borrowers through online platforms. Peer-to-peer lending platforms facilitate loans between individuals, offering higher interest rates compared to traditional savings accounts. However, it's crucial to carefully evaluate the creditworthiness of borrowers to minimize default risk. Diversifying your peer-to-peer lending portfolio across various borrowers can help manage this risk. This investment strategy provides an opportunity to earn competitive returns while potentially contributing to the financial well-being of others.

Collectibles and Art: For those with a penchant for unique assets, investing in collectibles and art can be an exciting diversification strategy. This category includes rare coins, vintage cars, fine wines, and, of course, artwork. These assets often have limited supply and can appreciate in value over time. Investing in collectibles and art requires expertise and research to ensure authenticity and market demand. Consider consulting with specialists to build a well-curated collection that aligns with your investment goals.

By incorporating these alternative investments into your portfolio, you can achieve a more balanced and resilient financial strategy. Diversification is a powerful tool to navigate market volatility and potentially enhance long-term returns. It's essential to carefully research and understand each investment before committing capital, ensuring that your decisions align with your risk tolerance and financial objectives.

Trans America Life Insurance: Marijuana Testing Policy Explained

You may want to see also

Tax Implications: Tax benefits may no longer apply, making it less attractive

When considering whether to keep or terminate your whole life insurance policy, it's crucial to understand the potential tax implications. One significant aspect to consider is the loss of tax benefits, which can make whole life insurance less appealing over time.

Whole life insurance policies offer tax advantages, primarily in the form of tax-deductible premiums and tax-deferred growth of cash value. However, these benefits can diminish or disappear entirely as you age and the policy's value grows. As you near retirement or when your financial situation changes, the tax benefits of whole life insurance may no longer be advantageous. For instance, if you have other sources of income or investments that provide tax benefits, the additional tax savings from whole life insurance might not be as valuable.

The tax implications become more apparent when you consider the death benefit. Typically, the proceeds from a whole life insurance policy are tax-free, but this is only true if the policy is owned by the insured and the beneficiary is not a spouse or a charity. If the policy is owned by an entity other than the insured, or if the beneficiary is a non-spouse, the death benefit may be subject to income tax. This can be a significant consideration, especially if you are no longer dependent on the insurance proceeds for financial support.

Additionally, the tax treatment of withdrawals or loans taken from the cash value of the policy can impact your overall tax liability. These withdrawals may be taxable as ordinary income, and the interest on loans can also be subject to taxes. As your financial needs evolve, you might find that these tax implications make whole life insurance less appealing, especially if you prefer to keep your financial affairs as tax-efficient as possible.

In summary, the tax benefits of whole life insurance can be a powerful incentive during the early years of the policy. However, as time passes and your financial circumstances change, these benefits may diminish. It is essential to regularly review your insurance policies and consider the evolving tax landscape to make informed decisions about keeping or terminating your whole life insurance coverage.

Whole Life Insurance: Accruing Cash Value Over Time

You may want to see also

Frequently asked questions

Whole life insurance is a long-term financial commitment, and there are several reasons why you might want to consider getting rid of it. Firstly, if your financial needs have changed significantly, such as having fewer dependents or a reduced financial burden, you may no longer require the same level of coverage. Secondly, if you've accumulated substantial savings or investments that can act as a financial safety net, the need for whole life insurance might diminish. Additionally, if the policy's costs, including premiums and fees, are becoming a financial burden, it may be time to reevaluate and consider alternative options.

Yes, there are certain situations where canceling your policy could be beneficial. For instance, if you've experienced a significant improvement in your health, leading to a lower risk profile, you might be able to secure more affordable coverage elsewhere. If you've found a better investment opportunity that offers higher returns, and you no longer need the guaranteed death benefit, it could be a valid reason to terminate the policy. Additionally, if you've taken out a loan against your policy's cash value and are struggling to make payments, it might be worth considering other options to avoid potential financial strain.

A A: Canceling whole life insurance early can have financial implications. You may have already paid significant premiums, and canceling the policy means losing out on the accumulated cash value. Additionally, you might face penalties or fees for early termination, which can further reduce the overall return on your investment. It's essential to carefully consider the reasons for cancellation and explore alternative solutions, such as adjusting the policy's coverage or seeking financial advice, to ensure you make an informed decision that aligns with your long-term financial goals.