Life insurance death benefits are usually not taxable, but there are some situations in which they may be subject to tax. For example, if the beneficiary chooses to delay the payout or take it in installments, the interest accrued may be taxed. Additionally, if the death benefit is paid into a taxable estate, it may be subject to federal and state estate taxes. In some cases, the death benefit may also be considered a taxable gift if three different people are involved in the policy. Understanding the tax implications of life insurance is important for both the policyholder and the beneficiary to ensure that any taxes owed are properly paid and to avoid unexpected tax burdens.

What You'll Learn

Taxation on death benefits paid in installments

The taxation on death benefits paid in installments can be further understood by considering the following scenarios:

Scenario 1: Interest Accrual on Delayed Payout

When a beneficiary elects to delay the benefit payout, and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. This interest income is typically taxed at the beneficiary's marginal tax rate.

Scenario 2: Beneficiary Receives Installments with Interest

If the beneficiary receives the life insurance death benefit in a series of installments, the insurer will often pay interest on the outstanding death benefit amount. This is a common scenario when the beneficiary is a young child or someone dependent on the income of the deceased. In these cases, the beneficiary is taxed on the interest portion of each installment received. The principal amount, which is the original death benefit, is not taxable. Only the interest accrued is subject to taxation.

Scenario 3: Estate and Inheritance Taxes

Death benefits paid into an estate can also trigger taxation. When a death benefit is paid to an estate rather than directly to a named beneficiary, it may be subject to estate and inheritance taxes. The estate taxes depend on the value of the estate, including the death benefit, and can be levied at both the federal and state levels.

Scenario 4: Irrevocable Life Insurance Trust (ILIT)

By setting up an ILIT, it is possible to avoid taxation on death benefits. The ownership of the life insurance policy is transferred to the ILIT, effectively removing it from the taxable estate. However, there may be tax implications if the cash value of the policy exceeds the gift tax exemption when transferring ownership to the trust.

Life Insurance Agents: Filing Taxes Simplified

You may want to see also

Estate and inheritance taxes

Estate Tax

The estate tax is levied on the things the deceased owns or has certain interests in when they die. It is a tax on your right to transfer property at your death. The federal government levies this tax, but a dozen states and the District of Columbia do too. The federal estate tax returns are only required for estates with values exceeding $13.61 million in 2024 (up from $12.92 million in 2023). The federal tax rates range between 18% and 40%, depending on the amount above the threshold.

State estate tax rules differ from state to state, but exemption levels and the top tax rates are usually much lower than the federal government’s. For example, Oregon’s exemption is only $1 million. As of 2024, 12 states and one district still collected estate taxes: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Massachusetts, Maryland, New York, Oregon, Minnesota, Rhode Island, Vermont, and Washington.

Inheritance Tax

The inheritance tax is levied on someone who has inherited money, property, or other assets. It is paid by the heirs and only applies when the person who dies and passes on assets lived in one of the states that have an inheritance tax. It's not dependent on where the beneficiary lives. There is no federal inheritance tax.

The inheritance tax is not common in the U.S. In fact, just six states have an inheritance tax as of 2024: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. However, Iowa will phase out its inheritance tax by 2025.

Avoiding Estate and Inheritance Taxes

To avoid or limit the amount of inheritance tax beneficiaries might have to pay, you can:

- Give away some of your assets to potential beneficiaries before death. Each year, you can gift a certain amount to each person tax-free. In 2023, that annual gift exclusion was $17,000 and increased to $18,000 in 2024.

- Move to a state without an inheritance and estate tax. Federal estate tax may still be applicable though if your estate exceeds the exemption threshold.

- Set up an irrevocable trust. You give up some control over the assets because the trust becomes the official owner, and you can’t change or cancel it. But no trust assets transfer upon death, so no estate or inheritance taxes are charged.

Who Can Be a Secondary Life Insurance Beneficiary?

You may want to see also

Taxation on interest earned on death benefits

Taxation on Interest

The interest earned on death benefits is generally taxable and should be reported as such. When a beneficiary chooses to delay the payout or receive it in installments, the accrued interest becomes taxable income. This is an important consideration, especially if the beneficiary is dependent on the income. In such cases, proper financial planning is essential to ensure that taxes on the interest do not become a burden.

Estate and Inheritance Taxes

Estate taxes come into play when the beneficiary is not a specific individual but rather an estate. In such cases, the death benefit is added to the value of the estate, and if the total value exceeds federal and state exemptions, estate and inheritance taxes may apply. These taxes can be significant, depending on the size of the estate and the applicable tax rates. Therefore, careful estate planning is crucial to minimize the tax burden on heirs.

Strategies to Avoid Taxation

To avoid taxation on interest earned, it is essential to structure the policy carefully. One strategy is to ensure that the policy involves only two people: the policyholder, who is also the insured, and the beneficiary. This avoids the "Goodman triangle" or "Goodman rule," where the IRS considers the payout a taxable gift if it involves three different people (the policy owner, the insured, and the beneficiary). Additionally, setting up an irrevocable life insurance trust (ILIT) can help exclude the death benefit from the taxable estate, although there may be gift tax implications when transferring ownership.

Taxation on Interest for Different Types of Policies

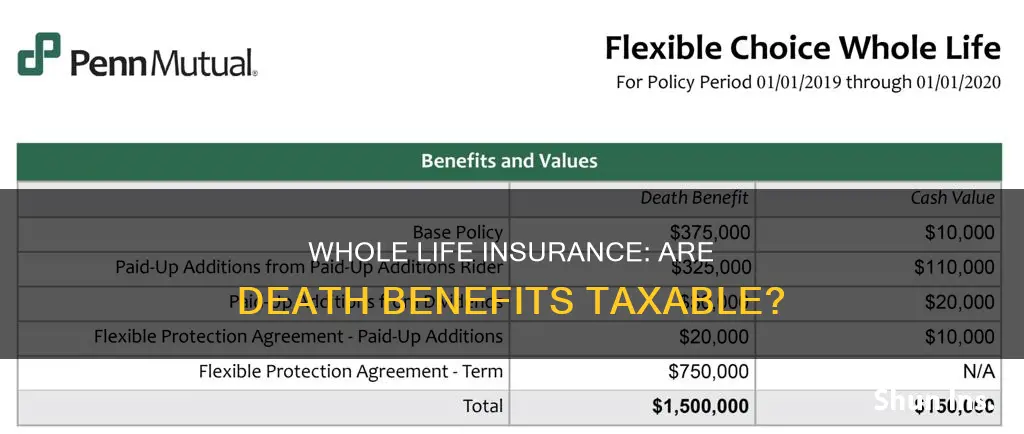

It's important to distinguish between whole life insurance policies and other types of policies, such as term life insurance. Whole life insurance policies have a cash value component that grows over time, and the interest accrued on this cash value is generally tax-deferred. On the other hand, term life insurance does not have a cash value component, and there are no taxes associated with surrendering the policy. However, if you decide to cancel or withdraw from a whole life insurance policy, the cash value may be subject to taxation if it exceeds the amount you have already paid in premiums.

In conclusion, while whole life insurance death benefits are typically not taxable, the interest earned on these benefits may be subject to taxation. Beneficiaries should be aware of this and plan accordingly. Additionally, careful structuring of the policy and consideration of estate planning can help minimize the tax burden on heirs. Proper financial advice should be sought to navigate the complexities of taxation on whole life insurance policies.

Life Insurance Tax: What Employees Need to Know

You may want to see also

Taxation on cash value of life insurance

Taxation on the cash value of life insurance is an important consideration when purchasing a policy. While the cash value of life insurance generally grows tax-free, taxes may apply when you access the cash value. Here are some key points to consider:

Withdrawals

You can typically withdraw an amount up to your total premium payments without owing taxes. However, withdrawals above this amount may be subject to income tax. Withdrawals may also cause your policy to lapse, resulting in a loss of coverage, and should be carefully considered.

Policy Loans

You can borrow money from the cash value of your life insurance policy. These loans are generally not taxable as long as the policy remains in force. However, if the policy terminates before the loan is repaid, the outstanding loan balance may become taxable. Policy loans can reduce your death benefit and should be evaluated carefully.

Surrendering or Cashing Out

Surrendering or cashing out your life insurance policy may incur taxes on any amount above your total premium payments. This is calculated as the cash value minus any surrender fees and unpaid premiums. Surrendering your policy means giving up your coverage, so it should be considered carefully.

Modified Endowment Contracts

If your life insurance policy is classified as a Modified Endowment Contract (MEC), different tax rules may apply. Withdrawals and policy loans from an MEC may be taxed according to the rules for annuities, including potential early withdrawal penalties.

Estate and Inheritance Taxes

While life insurance death benefits are typically not taxable, they can become part of your taxable estate if the beneficiary is not named or is deceased. This can result in significant estate and inheritance taxes for your heirs.

Tax and Financial Planning

It is important to understand the tax implications of any financial decisions, especially those related to life insurance. Consulting a tax advisor or financial professional can help you navigate the complexities of taxation on the cash value of life insurance and make informed choices.

Life Insurance: Who Needs It and Why?

You may want to see also

Taxation on life insurance dividends

However, if the sum of dividends paid on a policy exceeds the sum of premiums paid, the dividends become taxable as ordinary income to the policy owner. This occurs when the insurance company has refunded all the premiums through dividend payments. At this point, any further dividends received as cash become taxable. It is important to note that this only happens when the policy owner chooses to receive the dividend as a cash payment, as this option reduces the cost basis in the policy. Other dividend options, such as purchasing additional coverage or reducing future premiums, do not have the same effect.

If you withdraw dividends from a whole life policy, the withdrawal will first deduct from your cost basis. If the withdrawal exceeds your cost basis, you will owe ordinary income taxes on the amount that surpasses it. Any cash value in a whole life policy that is withdrawn or received through a full policy surrender will be taxable, but you will not owe taxes on the portion representing your cost basis.

Additionally, if you use dividends from one life insurance policy to pay dividends on another, this could eventually make the dividend payment on the first policy taxable as ordinary income. The dividends used will count as cost basis for the second policy, and any withdrawal or dividend received as cash will be non-taxable unless you remove the full cost basis.

Dividends on life insurance policies are typically received when a company performs better than expected when setting policy guarantees. While dividends are not guaranteed, they can be a great benefit, as they may be used to grow your life insurance, pay premiums, or be taken as cash.

Dementia and Life Insurance: What Are Your Options?

You may want to see also

Frequently asked questions

If you receive the death benefit in installments, the insurer will typically pay interest on the outstanding death benefit. In this case, you would have to pay income tax on the interest.

If the payout is part of your estate, it can be taxable along with the rest of the estate.

If the policy involves three different people, the IRS considers the life insurance payout a gift from the policy owner to the beneficiary. This is referred to as the "Goodman triangle" or "Goodman rule". In this case, the policy owner may have to pay gift tax for the life insurance payout that exceeds federal gift tax exemption limits.

If you sell the policy, a portion of the life insurance settlement will be taxable as income, and the rest will be taxed as capital gains.

If you take out a loan against the cash value and the policy terminates before you've paid the loan back, you will get a tax bill.