It is possible to convert your 401(k) into a life insurance policy, but not directly. One way to do this is to first roll over your 401(k) into an IRA annuity, which provides more flexible and favourable financial planning options. You can then use the funds from the IRA annuity to choose a life insurance policy that suits your needs. You can also use 72(t) distributions to fund your life insurance premiums, allowing penalty-free withdrawals before the age of 59 1/2 under specific conditions.

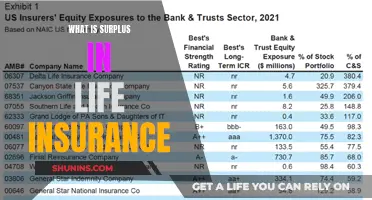

| Characteristics | Values |

|---|---|

| Is it possible? | Yes, but indirectly. |

| Tax consequences | You will have to pay taxes on the money you take out of your 401(k) before moving it into a life insurance policy. |

| Early withdrawal | If you are under 59 1/2, you will have to pay an additional 10% tax penalty on any money you withdraw from your 401(k). |

| Rollover options | You can roll over your 401(k) to an IRA annuity or a traditional IRA before moving it into a life insurance policy. |

| Life insurance options | Whole life, universal life, or indexed universal life insurance. |

| Distribution rules | You can use IRS rule 72(t) to make penalty-free withdrawals from your IRA annuity to pay for life insurance premiums. |

What You'll Learn

401(k) rollovers to another employer plan

If you're switching jobs or retiring, you might be wondering what to do with the money in your 401(k). It's important to meet with a financial professional to explore your options and determine the best course of action. Here's what you need to know about rolling over your 401(k) to another employer's plan:

Pros of Rolling Over to Another Employer's Plan

- You can avoid early withdrawal penalties.

- You may be able to get additional benefits, such as lower fees or greater matching contributions.

- You may be able to borrow from your 401(k) to pay for expenses like purchasing a home or paying for college (subject to limits).

Cons of Rolling Over to Another Employer's Plan

- You are limited to the investment options offered by the plan (unless it features a brokerage window that allows you to buy and sell investments through a built-in platform).

- Not all employers will accept a rollover from a previous employer's plan, so check with your new employer before making any decisions.

How to Roll Over Your 401(k) to Another Employer's Plan

- Find out if your new employer's plan accepts rollovers.

- Compare the fees and investment options of your current 401(k) with those of the new employer's plan to determine if rolling over makes sense for you.

- If you decide to roll over your 401(k) to the new employer's plan, contact the plan administrator at your old job and ask if you can do a direct rollover. Specify that you want a direct rollover so that you don't trigger a mandatory 20% withholding for taxes and a potential 10% early withdrawal penalty.

- Follow the instructions provided by the plan administrator to complete the rollover process.

Life Insurance: Can It Fail or Not?

You may want to see also

401(k) rollover to a traditional IRA

A 401(k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. If you are interested in having more control over your money, you may want to roll your assets into a traditional IRA.

Pros of Rolling Over to a Traditional IRA

- You can make additional contributions past the age of 70½ if you are still earning an income.

- You will have a wider range of investment options than most employer-sponsored 401(k) plans.

- You will have greater control of your investments.

- You can seek individualized investment advice from your financial professional.

Cons of Rolling Over to a Traditional IRA

- You must take required minimum distributions (RMDs) if you are still employed past the age of 73.

- You cannot borrow from this account.

- You may find that fees are higher than those for employer-sponsored 401(k) plans.

- You may not have the same level of protection against creditors as you would with an employer-sponsored 401(k) plan.

How to Roll Over to a Traditional IRA

There are two main ways to roll over your 401(k) into a traditional IRA:

- Direct Rollover: The financial institution that manages your 401(k) plan transfers your assets directly to the one that will be holding your IRA.

- Indirect Rollover: You receive a check for your 401(k) distribution and deposit it into an IRA within 60 days. This option is riskier because if you fail to meet the 60-day deadline, the distribution will be treated as a withdrawal, and you will be subject to income taxes and possibly penalties on the full amount.

Life Insurance Blood Tests: What Do They Uncover?

You may want to see also

401(k) rollover to a Roth IRA

While a 401(k) cannot be transferred directly into life insurance, there is a way to use the money from a 401(k) to buy a cash value life insurance policy. You can transfer any 401(k) balances to an IRA, allowing you to use IRS rule 72(t) to withdraw money from your retirement account and put it into a life insurance policy without incurring a penalty.

A 401(k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. If you are considering leaving a job and have a 401(k) plan, you need to be aware of the various rollover options for your workplace retirement account. One option is to roll over a traditional 401(k) into a Roth individual retirement account (Roth IRA). This can be particularly attractive if your future earnings will be high enough to exceed the ceiling placed on Roth account contributions by the Internal Revenue Service (IRS).

Pros and Cons of a 401(k) Rollover to a Roth IRA

Much like a traditional IRA, a Roth IRA offers greater control over your assets than is usually the case with a 401(k). With a Roth IRA, you pay ordinary income taxes on any money you roll over, but future earnings will be 100% tax-free (provided the account is at least five years old and you are at least 59 1/2 years old).

Pros

- You may be able to make additional contributions if you do not exceed income limits.

- You do not have to make mandatory withdrawals once you reach 73 years of age.

- You will have a wider range of investment choices.

- You will have greater control over your assets.

- You can seek individualized investment advice from your financial advisor.

Cons

- You cannot borrow from the account.

- You may face higher fees than those for employer-sponsored 401(k) plans.

- You may not have the same level of protection against creditors as an employer-sponsored 401(k) plan.

Life Insurance and MS: What Coverage is Offered?

You may want to see also

401(k) rollover to an annuity

A 401(k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. When you leave your job, you will have to decide what to do with your existing 401(k). While you may be able to leave it with your former employer, you will not be able to make additional contributions or receive any matching contributions. If you decide that a rollover makes sense, you can consider rolling over to another employer plan or a traditional IRA. Another option is to roll over your 401(k) into an annuity.

An annuity is a contract guaranteeing payments for a specified period of time. Insurance companies accept 401(k) rollovers to fund annuities. Annuities offer a steady income regardless of economic changes and stock market performance. For example, a $1 million annuity can provide about $70,000 in annual income until you pass away. On the other hand, $1 million in a 401(k) or IRA will last as long as the account produces investment income and your withdrawals don't deplete the fund.

Annuities also help to sidestep longevity complications. For instance, you might plan to live for 30 years after retiring at 62, but if you're still going strong at 90, your retirement account may not be able to keep up with the cost of living. With an annuity, you'll continue receiving payments year after year, no matter how long you live.

Additionally, annuities offer a longer deferral option. Current legislation mandates that you take required minimum distributions (RMDs) from 401(k)s, 403(b)s, and IRAs by age 72 (or 73 if you turned 72 in 2023). With annuities, you can delay RMDs until age 85.

However, there are some risks and drawbacks to consider before rolling over your 401(k) into an annuity. Annuities can come with high fees and charges that reduce your funds significantly. Some annuities also cannot be passed on to a beneficiary, which means any money left in them when you die goes to the insurance company. Additionally, annuities usually have lower growth rates than other investment accounts.

When considering a 401(k) rollover to an annuity, it is important to weigh the benefits against the risks and consult with a financial advisor to determine the best option for your unique situation.

Life Insurance Cancellation: Can You Get a Refund?

You may want to see also

401(k) to life insurance via an IRA annuity

A 401(k) can be rolled over into an IRA annuity without paying taxes. This is because annuities funded with an IRA or 401(k) rollover are considered "qualified" plans, allowing an insurance company to create an "IRA annuity". You can then deposit your retirement funds directly into this account.

There are several types of annuities that you can roll your 401(k) into:

- CD-type deferred annuity

- Equity-indexed annuity

- Immediate income annuity

Each of these options has its own benefits and drawbacks, so it's important to do your research and consult a financial advisor before making any decisions.

It's worth noting that annuities can come with a host of fees and charges that may reduce your funds significantly. Additionally, some annuities cannot be passed on to a beneficiary, which means the money left in them when you die goes to the insurance company. Therefore, it's crucial to carefully consider the pros and cons of rolling your 401(k) into an IRA annuity before making any decisions.

Basic Life Insurance: What Employers Provide and Why

You may want to see also

Frequently asked questions

Yes, you can convert your 401(k) into a life insurance policy, but not directly. You will need to transfer your 401(k) into an IRA annuity first.

Contact your 401(k) administrator and request a direct rollover form. Once you have filled out the form, open an IRA annuity with your broker or bank.

By transferring your 401(k) into a life insurance policy, you can avoid paying taxes on your withdrawals.

Before transferring your 401(k) into a life insurance policy, you should consider the potential costs and complexity of the process. Consult with a financial advisor or accountant to determine if this is the best option for you.