Life insurance eligibility is largely based on an individual's current health and past medical history. While it may be more challenging for people with type 1 diabetes to obtain life insurance, it is not impossible. The likelihood of approval and the premium rates depend on how well the condition is managed, the applicant's overall health, age, and other factors.

| Characteristics | Values |

|---|---|

| Can a type 1 diabetic get life insurance? | Yes |

| Is it easy to get life insurance with type 1 diabetes? | No, it is more difficult than with type 2 diabetes |

| Why is it more difficult? | Type 1 diabetes is considered harder to control and therefore a higher risk |

| Are there ways to improve chances of getting life insurance with type 1 diabetes? | Yes, by demonstrating that the diabetes is well-managed, and by shopping around for insurers that view type 1 diabetes more favourably |

| Are there specific life insurance companies that are good for people with type 1 diabetes? | Yes, e.g. Legal & General America, John Hancock, Mutual of Omaha, Pacific Life Insurance |

What You'll Learn

- Type 1 diabetics may face higher premiums than those with Type 2 diabetes

- Life insurance companies consider your current health and medical history

- Timing your application is important—it's best to apply before developing diabetes

- The type of diabetes you have will determine the type of policy you can get

- You can get life insurance with diabetes, possibly at a competitive rate

Type 1 diabetics may face higher premiums than those with Type 2 diabetes

In addition, studies have shown that people with Type 1 diabetes typically have a shorter lifespan than those with Type 2 diabetes, which can make it more difficult to qualify for life insurance and result in higher premiums. The timing of the diabetes diagnosis also plays a role, as the longer one has had diabetes, the higher the insurance rate is likely to be. Thus, someone diagnosed with Type 1 diabetes at a young age may pay more than someone who was diagnosed with Type 2 diabetes later in life.

Furthermore, insurers view Type 1 diabetes as a higher risk than Type 2 due to the need for insulin therapy and the potential for more severe health complications. This perception of increased risk can lead to higher premiums for individuals with Type 1 diabetes. Insurers also consider the severity of diabetes when determining rates, and Type 1 diabetes is often seen as more challenging to control and manage. The management of diabetes is a critical factor in assessing insurance applications, and demonstrating good control of blood sugar levels can help secure better rates.

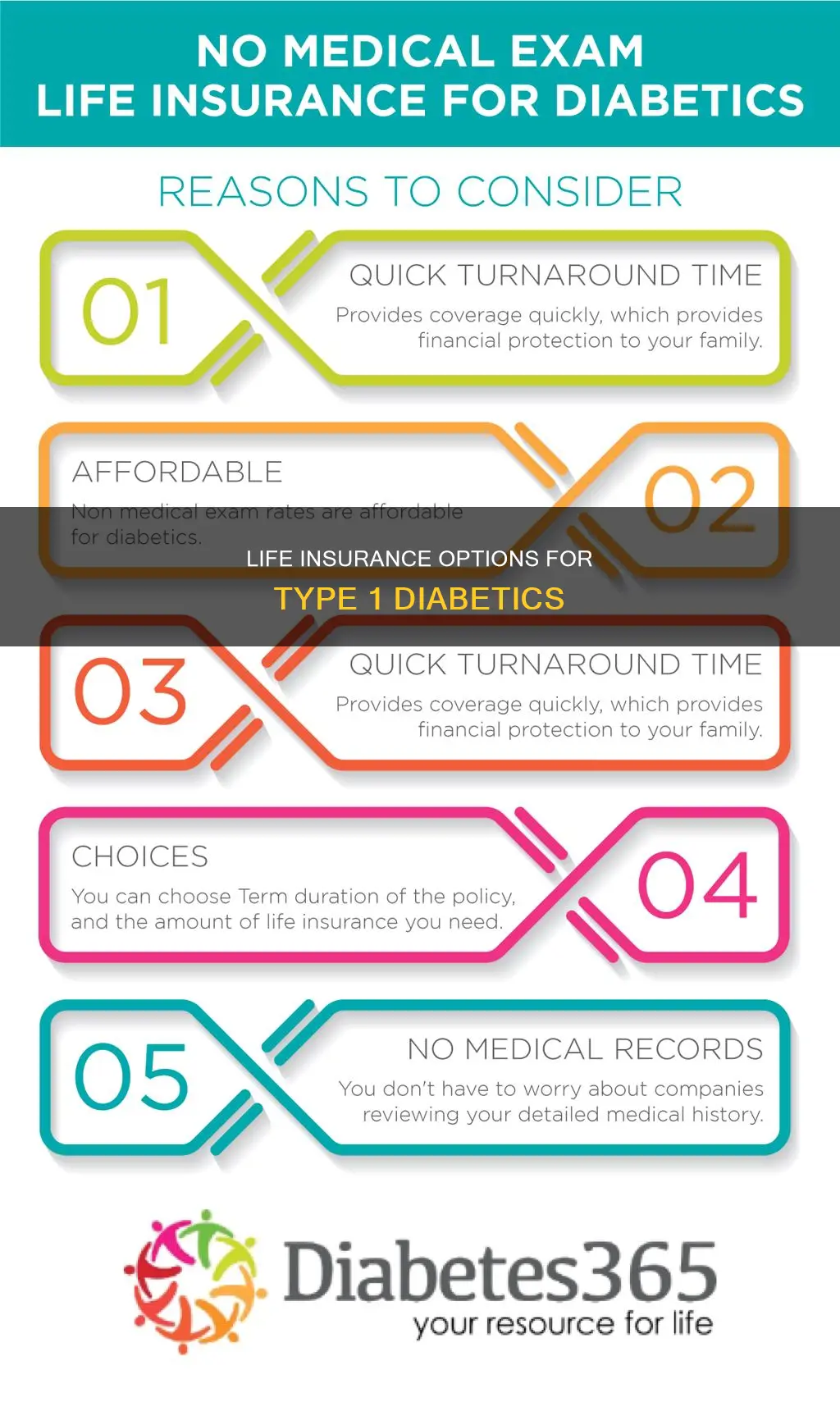

While it may be more challenging and expensive for individuals with Type 1 diabetes to obtain life insurance, it is not impossible. By shopping around, staying on top of diabetes management, and working with brokers or companies specializing in high-risk applicants, individuals with Type 1 diabetes can find suitable coverage options.

Chase Life Insurance: What You Need to Know

You may want to see also

Life insurance companies consider your current health and medical history

Life insurance companies consider several factors related to your current health and medical history when determining your eligibility and premium for coverage. Here are some key aspects they evaluate:

- Type of Diabetes: Insurers differentiate between Type 1 and Type 2 diabetes. Type 2 diabetes is often considered less risky by insurers because it is typically diagnosed later in life and can be managed through lifestyle changes and medication. On the other hand, Type 1 diabetes is viewed as harder to control and a higher risk, leading to potentially higher premiums or difficulties in obtaining coverage.

- Age of Diagnosis: The age at which you were diagnosed with diabetes also plays a role. If you were diagnosed at a younger age, your rates are likely to be higher because you've had the condition for a more extended period. Insurers tend to offer lower rates to those diagnosed with diabetes later in life.

- Duration of Diabetes: How long you've had diabetes is another factor. If you've recently developed diabetes, waiting until your condition is under control before applying for life insurance can result in more favourable rates. Demonstrating that you're managing your diabetes well over time can help you secure lower premiums.

- Management of Diabetes: Life insurance companies look favourably upon individuals who actively manage their diabetes. This includes maintaining a healthy diet, exercising, taking prescribed medications, and regularly seeing a doctor. By proving that your diabetes is well-controlled, you may qualify for better policies and rates.

- Blood Sugar Levels: Insurers assess your average blood sugar levels through tests like the A1C test or glucose tolerance test. The closer your levels are to the normal range, the more favourable the terms of your life insurance policy are likely to be. Poorly controlled blood sugar levels may lead to higher premiums or difficulties in obtaining coverage.

- Diabetes-related Complications: Insurers will inquire about any diabetes-related complications, such as neuropathy or retinopathy. While these conditions do not automatically lead to penalties, failing to manage them properly can result in higher premiums or challenges in obtaining traditional life insurance coverage.

- Other Health Factors: Your overall health history is also taken into account. Factors such as high cholesterol, high blood pressure, or being overweight can contribute to higher rates. Your family medical history, alcohol consumption, and other lifestyle habits may also be considered.

In summary, while life insurance companies do consider your current health and medical history, the specific factors they evaluate vary. It's important to shop around and compare quotes from different insurers, as they may weigh these factors differently, resulting in more favourable rates and coverage options for individuals with diabetes.

Liberty Mutual: Life Insurance Options and Benefits

You may want to see also

Timing your application is important—it's best to apply before developing diabetes

Timing your application is key

If you're concerned about getting life insurance as a type 1 diabetic, it's best to apply for a policy before you develop diabetes. This is because your policy premiums will generally be cheaper than if you apply after you've been diagnosed.

However, it's important to note that you should never try to hide a diabetes diagnosis from your life insurance provider. Doing so could be considered life insurance fraud and could result in your policy being nullified without a refund.

If you're planning to start a family, it's a good idea to apply for life insurance before becoming pregnant or during the first trimester. If you develop gestational diabetes, your condition might resolve after giving birth, and you could score a better rate.

How to get the best rates

To get the best rates, it's important to prove that your diabetes is under control. This means demonstrating that you're taking action to treat your diabetes by eating a healthy diet, exercising, taking medication, and regularly seeing a doctor.

Insurers will also look at your average blood sugar levels using a blood test called A1C. The closer you are to a normal blood sugar level, the better it will be for your life insurance application.

Shop around

Different companies have different rules about life insurance for diabetics, so it's worth comparing quotes from a handful of providers to get the most competitive rates.

Work with a broker

Consider working with a life insurance broker, especially one who specialises in high-risk applicants. They can help you navigate your options and boost your chances of approval.

Life Insurance: Rising Costs and What to Expect

You may want to see also

The type of diabetes you have will determine the type of policy you can get

Life Insurance for Diabetics: What You Need to Know

If you have diabetes, you may be wondering if you can get life insurance and what type of policy you may qualify for. The good news is that people with diabetes can generally get life insurance, but the type of diabetes you have will be a significant factor in determining your options. Let's take a closer look.

Type 1 Diabetes and Life Insurance

Type 1 diabetes is considered a higher risk by insurance companies because it is typically diagnosed at a younger age, requires lifelong insulin therapy, and is harder to control. As a result, people with type 1 diabetes may have more limited options and higher costs for life insurance. Some carriers may not provide life insurance to people with type 1 diabetes at all. However, if you can demonstrate that your condition is well-managed, you may still be able to qualify for coverage, although your premiums will likely be higher compared to those with type 2 diabetes.

Type 2 Diabetes and Life Insurance

Type 2 diabetes accounts for the majority of diabetes cases and is often viewed more leniently by insurance companies. It is usually diagnosed in adulthood and can often be managed with lifestyle changes such as diet, exercise, and medication. People with type 2 diabetes typically qualify for standard life insurance policies and may even get competitive rates if their condition is well-controlled. However, it's important to note that complications or an A1C over 10% may result in denial of coverage.

Gestational Diabetes and Life Insurance

Gestational diabetes is a temporary condition that occurs during pregnancy. If you are considering life insurance and are diagnosed with gestational diabetes, it may be advisable to wait until after your pregnancy to apply. Once your diabetes resolves, you may have more options at lower prices.

Factors Affecting Life Insurance for Diabetics

Regardless of the type of diabetes you have, there are several factors that insurers will consider when evaluating your application:

- Age: The younger you are when you apply and when you were diagnosed with diabetes can impact your rates.

- Severity: Insurers will assess the severity of your diabetes through blood tests like A1C and glucose tolerance tests.

- Management: Demonstrating that you are actively managing your diabetes through a healthy lifestyle, medication, and regular doctor visits can improve your chances of getting a policy and lower rates.

- Other Health Factors: Your overall health history, family medical history, and lifestyle habits (such as alcohol consumption) can also influence your life insurance options and premiums.

Types of Life Insurance Policies for Diabetics

The type of diabetes you have will also determine the specific type of life insurance policy you can get:

- Term Life Insurance: If your diabetes is well-managed, you may qualify for traditional term life insurance policies, which offer coverage for a set number of years.

- Permanent Life Insurance: Whole life insurance and universal life insurance provide coverage for your entire life but are generally more expensive and may not be an option for those with uncontrolled diabetes.

- Final Expense Life Insurance: Also known as burial insurance, these policies help cover end-of-life expenses and are an option for those with well-managed diabetes, especially individuals over 50.

- Simplified Issue Life Insurance: This type of policy allows you to apply by completing a health survey without a medical exam, making it an option for diabetics in good overall health.

- Guaranteed Issue Life Insurance: Guaranteed issue policies do not require a medical exam or health questionnaire, but they are more expensive and have lower coverage options. They are suitable for older individuals or those with uncontrolled diabetes who have difficulty qualifying for other types of insurance.

- Group Life Insurance: You may also consider getting life insurance through your workplace, especially if your employer offers group coverage as part of your benefits package.

MetLife Insurance Agencies: Are They Franchises or Not?

You may want to see also

You can get life insurance with diabetes, possibly at a competitive rate

Yes, it is possible to get life insurance with diabetes, even at a competitive rate. While diabetes is a pre-existing condition, it does not make you ineligible for life insurance. The type of diabetes you have, how long you have had it, and how well you are managing it will play a key role in determining the cost of your policy and your eligibility.

If you have type 2 diabetes, you can typically qualify for standard life insurance. Type 2 diabetes is often considered less risky by insurers because it is usually diagnosed in adulthood and can be managed with lifestyle changes such as weight loss, diet, exercise, and medication. As a result, people with type 2 diabetes may be able to pay less expensive life insurance rates and have greater approval odds.

On the other hand, if you have type 1 diabetes, it may be more challenging to qualify for life insurance, and your life insurance costs will likely be higher than those with type 2 diabetes. Type 1 diabetes is considered harder to control and, therefore, a higher risk. It is usually diagnosed at a younger age, and people often need insulin therapy to keep the condition under control.

However, if you can prove that your diabetes is well-managed, you may qualify for better policies and rates. This means demonstrating that you are taking action to treat your diabetes by eating a healthy diet, exercising, taking medication, and regularly seeing a doctor.

The timing of applying for life insurance with diabetes is also important. If you already have a life insurance policy before you develop diabetes, your policy premiums will generally be cheaper. Additionally, waiting until your diabetes is under control can help you get lower rates.

When choosing a life insurance policy, you can consider term life insurance, whole life insurance, simplified issue life insurance, guaranteed issue life insurance, or group life insurance. Term life insurance is the most affordable option and provides coverage for a set number of years. Whole life insurance is more expensive and offers lifelong coverage with a cash value component. Simplified issue life insurance does not require a medical exam, while guaranteed issue life insurance skips both the medical exam and the health questionnaire but has lower coverage options and higher costs. Group life insurance is offered through your workplace and does not require a medical exam.

In conclusion, while having diabetes may impact your life insurance options and costs, it is still possible to obtain life insurance, possibly even at competitive rates, by managing your diabetes, shopping around for the right insurer, and choosing the most suitable policy type for your needs.

How Life Insurance and Medicare Benefits Intertwine

You may want to see also

Frequently asked questions

Yes, people with Type 1 diabetes can get life insurance, but they may have to pay higher premiums due to the condition being considered harder to control and, therefore, a higher risk.

Life insurance pays out a sum, known as a death benefit, to your beneficiaries if you pass away during the policy's term. You pay monthly or annual premiums to maintain coverage.

People with Type 1 diabetes can consider term life insurance, whole life insurance, universal life insurance, and final expense insurance.

Aside from diabetes, insurers will consider age, lifestyle, occupation, and other health conditions. The management of Type 1 diabetes is also crucial, with those requiring insulin likely to pay higher premiums.

No, a diagnosis of Type 1 diabetes after purchasing a permanent life insurance policy will not lead to a termination of coverage. However, you may have to pay higher premiums.