Annual renewable term life insurance is a type of short-term life insurance that offers coverage for a year and can be renewed at the end of each year at an increasing rate. This type of insurance is ideal for those who need short-term coverage or are working towards qualifying for lower rates for a level term policy.

If you have an annual renewable term life insurance policy and are considering cancelling it, it's important to understand the process and any potential consequences. Cancelling a life insurance policy is a significant decision that can arise due to various reasons, such as financial constraints or finding a better-suited policy. Before cancelling, it's recommended to explore alternatives, such as converting to a permanent policy or adjusting coverage amounts.

The process of cancelling an annual renewable term life insurance policy may vary depending on the insurance provider and the specific terms of your policy. It is advisable to carefully review your policy documents and contact your insurance company to understand the specific steps and implications of cancellation.

| Characteristics | Values |

|---|---|

| Renewal period | 1 year |

| Renewal age limit | Varies by state, e.g. 80 in New York |

| Premium | Starts low but rises annually |

| Face amount | Stays the same |

| Cancellation | Possible at any time |

What You'll Learn

What is annual renewable term life insurance?

Annual Renewable Term (ART) life insurance is a type of short-term life insurance that offers coverage for one year and can be renewed at the end of each year, with an increasing premium rate. This type of insurance is suitable for those with short-term life insurance needs or those who are working to qualify for lower rates for a level term policy.

ART life insurance is a form of term life insurance that provides a guarantee of future insurability for a set number of years. Policyholders can renew the policy each year up to a certain age, which varies by state—for example, the age limit is 80 in New York. The premiums for ART life insurance generally start low but increase with each passing year as the policyholder ages, and the insurance company re-evaluates the risk.

ART life insurance is best suited for individuals with short-term needs, such as those with temporary financial obligations, those who are in between jobs and planning to take group life insurance with their next employer, or those who need coverage for short-term loans. It can also be a good option for those who cannot afford regular term life insurance, as the initial premiums for ART life insurance are typically lower.

However, it's important to note that if you renew an ART policy for many years, you may end up paying more in premiums than you would have if you had purchased a term policy with level premiums. Therefore, ART life insurance is generally recommended only for those with short-term life insurance needs.

Understanding Life Insurance Rate Calculation Factors

You may want to see also

How does it work?

Annual Renewable Term (ART) life insurance is a type of short-term life insurance that offers coverage for a year at a time, with the option to renew at the end of each year. Here's how it works:

Annual Renewable Term life insurance is a type of life insurance that offers coverage for a fixed period, typically one year, with the option to renew at the end of each period. This means that you can choose to continue your coverage for another year by paying the renewal premium. The renewal premium is typically higher than the initial premium, as it is based on your new age and the increased risk of death.

When you purchase an Annual Renewable Term life insurance policy, you are locking in a period of insurability, which is the length of time you will be able to renew the policy without reapplying or undergoing additional medical exams. This period can vary by state, but it usually lasts until you reach a certain age, such as 80 or 85.

The premiums for Annual Renewable Term life insurance policies generally start low to attract customers. However, it is important to note that these premiums increase each year as you age and your risk of death rises. On the other hand, the face amount of the policy, which is the benefit paid to your beneficiaries in the event of your death, remains the same.

Unlike Annual Renewable Term life insurance, many term life insurance policies offer level premiums, which means the cost of coverage stays the same throughout the entire term of the policy. These level premium policies are more popular than Annual Renewable Term life insurance because they offer long-term stability in terms of cost.

When considering Annual Renewable Term life insurance, it is important to compare the initial low rates with the potential future rates. This type of insurance is generally recommended for those with short-term life insurance needs, as renewing the policy for many years can result in higher overall premiums compared to level term policies.

Pros and Cons of Annual Renewable Term Life Insurance

Annual Renewable Term life insurance can be beneficial in certain situations. Here are some pros of this type of policy:

- It is generally cheaper than other types of coverage during the first few years, making it a good option for those on a tight budget.

- It offers flexibility, as you can decide how many years you want to keep the policy active.

- It is suitable for those who only need temporary coverage, such as when covering a short-term loan.

- It can be a good option for those working to qualify for lower rates on a level term policy by improving their health or habits.

However, there are also some cons to consider:

- Over time, the increasing premiums can make this type of policy more expensive than a comparable level term life insurance policy.

- If you develop health issues, you may become ineligible for the policy or face significantly higher premiums.

- Cancelling a level term policy is often a better option if you find you no longer need coverage, as Annual Renewable Term policies can become costly.

Riders and Customizations

Similar to traditional term life insurance policies, Annual Renewable Term life insurance policies also offer additional coverage and customizations known as riders. Some common riders available include:

- Accelerated Death Benefit: This rider allows you to use a portion of your death benefit to pay for end-of-life care if you become terminally ill.

- Child Insurance: This rider provides coverage for your children at a lower cost than a standalone child life insurance policy.

- Spousal Insurance: This rider adds some coverage for your spouse, who may not qualify for an individual policy.

- Waiver of Premium: This rider waives your premiums if you become disabled and unable to work.

- Conversion Rider: This rider allows you to convert your term life policy into a permanent policy at the end of the term without requiring a medical exam.

Alternatives to Cancellation

Before cancelling your Annual Renewable Term life insurance policy, it is worth considering some alternatives that can help you adjust your premiums or coverage without losing your policy entirely:

- Switch to Paid-up Status: If you have a whole life insurance policy, you may be able to use your accumulated cash value to pay all your future premiums, although this will result in a decrease in your death benefit.

- Lower Your Death Benefit: You can request to reduce the face value of your term or permanent policy, which will lower your premiums.

- Pay with Dividends: If your policy is with a mutual company, you may be able to use any dividends earned based on the company's financial performance to pay your premiums.

- Use the Cash Value: If you have a permanent life insurance policy, you can use the accumulated cash value to pay your premiums, as long as it remains above the minimum required amount.

Depression's Impact on Life Insurance: A Historical Concern?

You may want to see also

What are the pros and cons?

Annual Renewable Term (ART) life insurance is a type of short-term life insurance that offers an option to renew at the end of each year, albeit at an increasing rate. While it may be a good option for those with specific circumstances, there are pros and cons to ART life insurance that should be considered before purchasing a policy.

Pros

- ART life insurance is generally cheaper than other types of coverage during the first few years the policy is active.

- You get to decide how many years you keep your policy active.

- If a traditional policy is out of your budget, the initial premiums of a renewable policy may be more affordable for a short period.

- If you only need temporary coverage, an annual renewable policy may be more cost-effective.

- If you're improving your health or habits, a renewable policy may save you money until you can qualify for a long-term policy that fits your budget.

Cons

- Over time, you'll pay more for an annually renewable policy than you would for a level term policy with the same coverage.

- If you get sick, you might become ineligible for the policy, or your premiums could become too costly.

- With a traditional policy, your coverage can't become more expensive or be cancelled due to health changes as long as it remains active.

- You can also cancel your level term policy if you find you no longer need coverage, whereas with ART life insurance, you are locked in for a year at a time.

Term Life Insurance: Auto-Renewal and You

You may want to see also

When is it a good fit?

Annual Renewable Term (ART) life insurance is a good fit for those who need to cover short-term debts or are between jobs and plan to buy group life insurance through a future employer. ART is also a good option for those who need temporary coverage, such as when taking out a short-term loan. It is also a good option for those who are working to qualify for lower rates for a level term policy.

ART policies are generally cheaper than other types of coverage during the first few years the policy is active. This makes them a good option for those who cannot afford regular term life insurance. ART policies allow you to decide how many years you keep your policy.

ART policies are also a good option for those who are improving their health or habits. If your health improves or you quit a habit like smoking, life insurance companies may lower your premiums. However, you need to show improvement for a year or more. A renewable policy may save you some money until you can qualify for a long-term policy that fits your budget.

Dependent Life Insurance: Worth the Cost?

You may want to see also

What are the alternatives?

If you're considering cancelling your annual renewable term life insurance, there are several alternatives to explore. Here are some options to consider:

- Switch to a different type of life insurance policy: Depending on your needs, you could switch to a different type of life insurance policy, such as a term life insurance policy with level premiums or a permanent life insurance policy. Level term life insurance policies have fixed premiums for the entire duration of the term, which is typically 10, 20, or 30 years. Permanent life insurance policies, such as whole life or universal life, offer lifelong coverage and often include a cash value component.

- Shop around for a more affordable policy: Compare life insurance quotes from different companies to find a policy that better suits your budget. You may be able to find a similar level of coverage at a lower price by switching to a different insurance provider.

- Explore options to reduce your current premium: Contact your current insurance company to discuss ways to reduce your premium. They may be able to help you reduce the face amount of the policy, which can result in lower premium payments while still providing some level of coverage.

- Consider a conversion rider: If you need lifelong coverage but want to avoid the increasing premiums of an annual renewable term policy, look into adding a conversion rider to your current policy. This allows you to switch to a permanent life insurance policy without undergoing an additional medical exam.

- Improve your health and lifestyle: Life insurance premiums are often based on your age, gender, health, and lifestyle factors. If you can improve your health or make positive changes to your lifestyle, you may be able to qualify for lower premiums in the future.

- Review your coverage needs: Reevaluate your coverage needs to determine if you still require the same level of insurance. If your circumstances have changed, you may be able to reduce your coverage and, consequently, your premium payments.

- Consider other financial strategies: Instead of relying solely on life insurance, explore other financial strategies such as investing in savings or retirement accounts. This can help you build a more diverse financial portfolio that better aligns with your long-term goals.

Federal Life Insurance USPS: Changing Your Coverage and Options

You may want to see also

Frequently asked questions

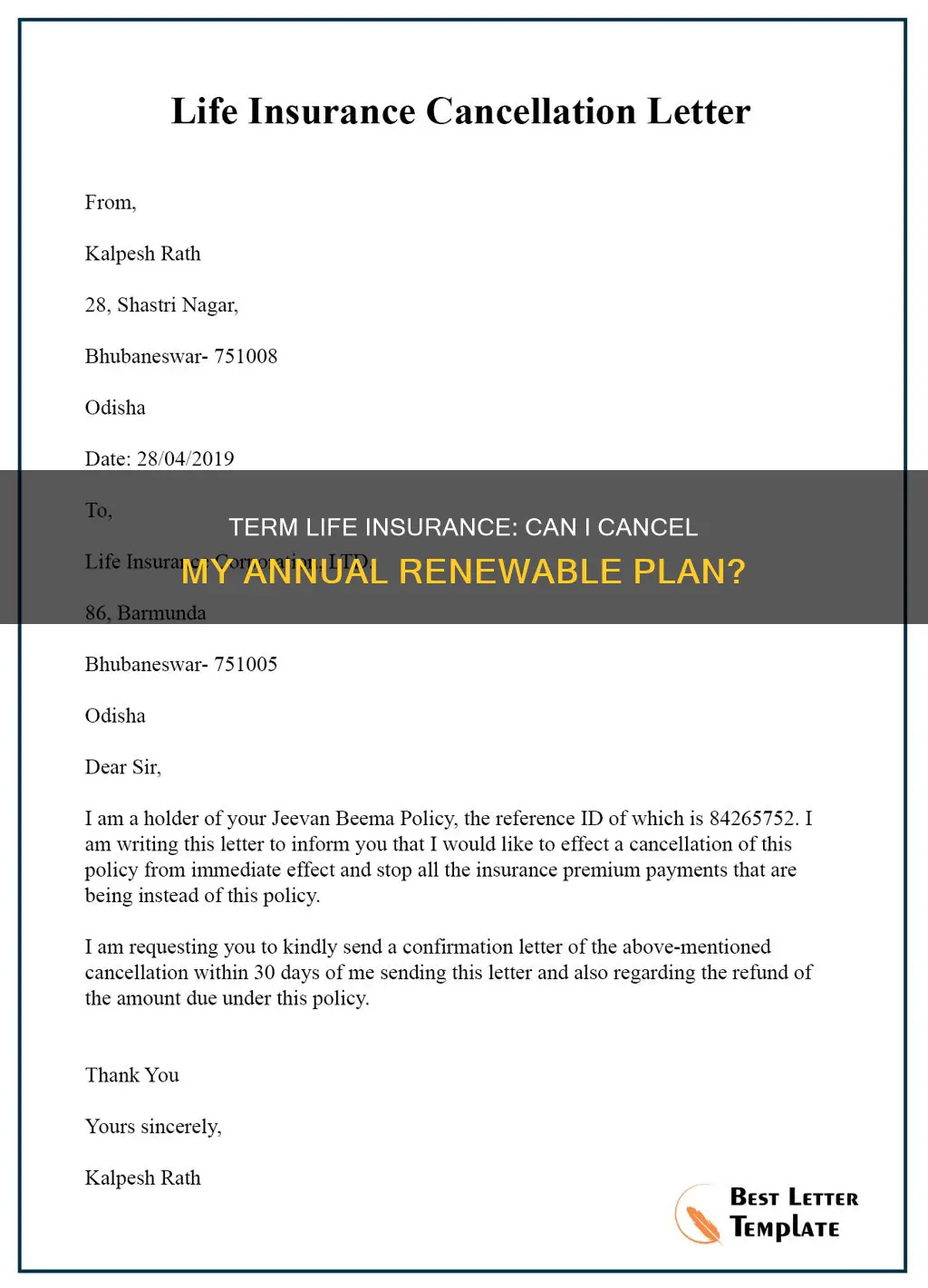

Yes, you can cancel your annual renewable term life insurance policy at any time. However, it's important to note that by cancelling, you will lose life insurance protection, and your beneficiaries will not receive a death benefit if you pass away.

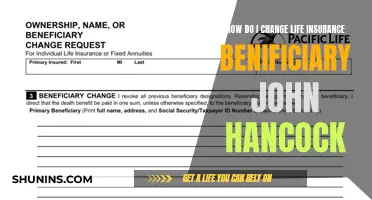

Cancelling your annual renewable term life insurance policy can be done in a few ways. One option is to simply stop paying the premiums, which will cause the policy to lapse and coverage to end. You can also contact your insurance company by phone or mail to express your intention to cancel.

Cancelling during the free look period, which typically lasts 10 to 30 days from receiving the policy, allows you to receive a full refund of any premiums paid. This period gives you the flexibility to reconsider your decision without financial penalty.

Yes, there are a few alternatives to consider before cancelling your policy. You can explore options like reducing your coverage amount, using the cash value of your policy to cover premiums, or retaking your medical exam to qualify for lower-risk premiums if your health has improved.

Annual renewable term life insurance is generally cheaper than other types of coverage during the first few years. It is suitable for those who need short-term coverage or are working towards qualifying for lower rates on a level term policy. However, over time, the premiums increase with each passing year, and it can become more expensive than a comparable level term life insurance policy.