Federal employees can now easily sign up for life insurance or make changes to their coverage using the PostalEASE module, which is similar to the platform's health insurance, tax, and banking modules. The new module allows current employees to reduce their current FEGLI elections, while new hires can use it to make their initial benefit elections. Previously, employees had to submit a form to the Human Resources Shared Service Center (HRSSC) to enroll in a FEGLI plan or make changes. Now, after validating their choices on the module, employees will receive a confirmation number and a summary of their selections with an effective date. Employees can still modify their FEGLI benefit if they experience a qualified life event, such as marriage or divorce, by contacting the HRSSC.

| Characteristics | Values |

|---|---|

| How to change federal life insurance | Use the PostalEASE module to sign up for life insurance or change coverage |

| Who can use it | Current employees and new hires |

| What it covers | Federal Employees Group Life Insurance (FEGLI) |

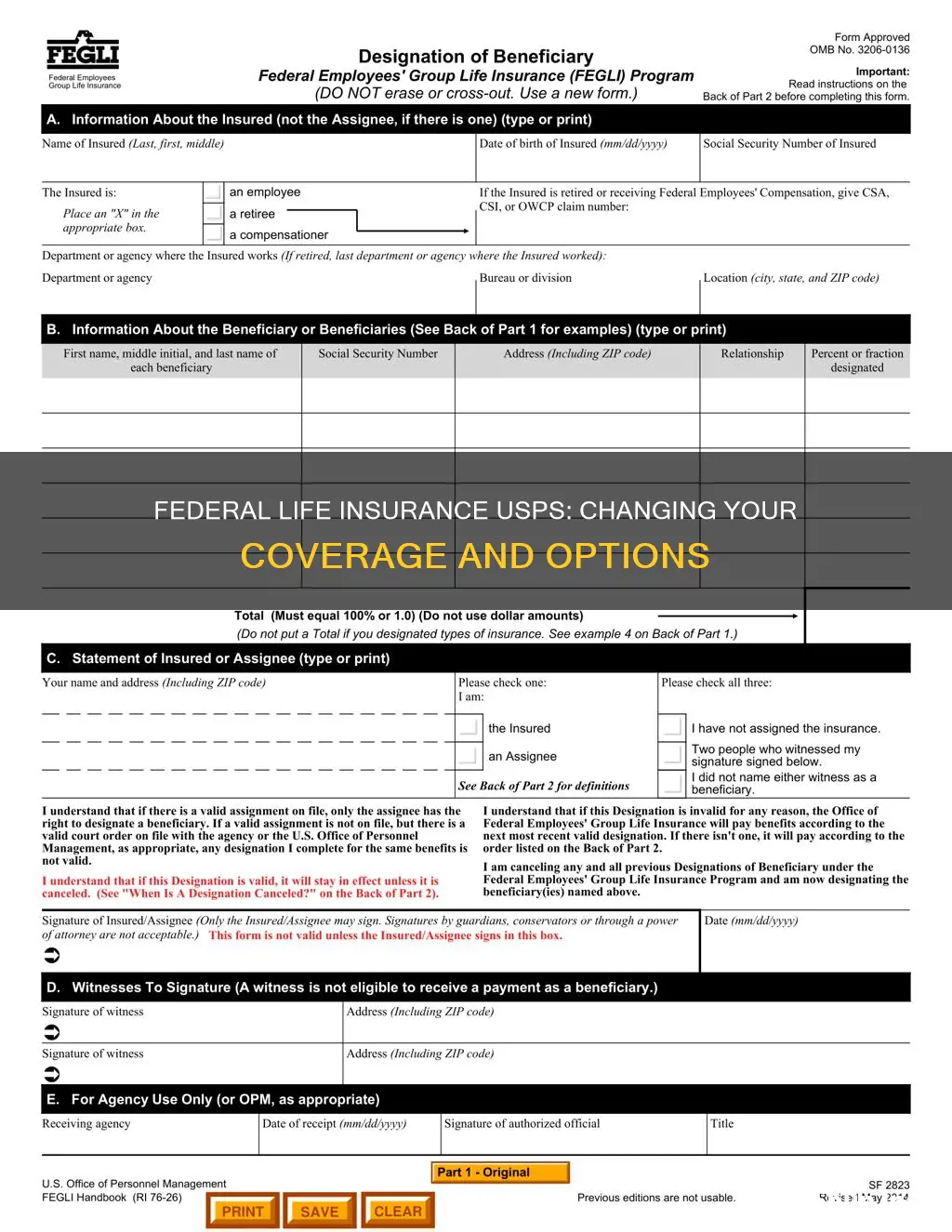

| Previous process | Submit form SF 2817, Life Insurance Election, to the Human Resources Shared Service Center (HRSSC) |

| New process | Validate choices on the module and receive a confirmation number and summary of selections with an effective date |

| Changes allowed | Current employees can reduce their current FEGLI elections |

| New hires | Enroll within 60 days from their appointment date |

| More information | Visit the FEGLI Blue page |

What You'll Learn

Enrolling in Federal Employees Group Life Insurance (FEGLI)

Federal Employees Group Life Insurance (FEGLI) is a program established by the Federal Government to provide group term life insurance to its employees and retirees. It is currently the largest group life insurance program in the world, covering over 4 million federal employees and their family members.

Most employees are eligible for FEGLI coverage, and in most cases, new federal employees are automatically covered by Basic life insurance. The cost of Basic insurance is shared between the employee and the government, with the employee paying 2/3 of the total cost and the government paying the remaining 1/3. Basic insurance is a prerequisite for any of the three Optional insurance plans available. Unlike Basic, enrollment in Optional insurance is not automatic, and employees must specifically elect the types of optional insurance they wish to carry within 31 days of becoming eligible.

USPS employees can use the PostalEASE module, similar to the platform's health insurance, tax, and banking modules, to sign up for life insurance or change their coverage. The new module allows current employees to reduce their current FEGLI elections, while new hires can use it to make their initial benefit elections. Employees still have the option to modify their FEGLI benefit if they experience a "qualified life event," such as marriage or divorce.

New hires interested in FEGLI benefits should enroll within 60 days from their appointment date. Employees can visit the FEGLI Blue page for more information.

Eerie's Life Insurance: What You Need to Know

You may want to see also

Using the PostalEASE module to change coverage

The PostalEASE website and telephone system provide a convenient, confidential, and secure way for U.S. Postal Service employees to make changes to their Federal Employees Group Life Insurance (FEGLI) coverage.

The PostalEASE FEGLI module is similar to the platform's health insurance, tax, and banking modules. After validating their choices on the module, employees will receive a confirmation number and a summary of their selections with an effective date.

- Access the PostalEASE website: You can access the PostalEASE website through the Internet, the Intranet (from the Blue page), or at an Employee Self-Service Kiosk (available in some facilities).

- Log in to your account: Use your USPS login credentials to access your PostalEASE account. If you don't have an account, you may need to create one.

- Navigate to the FEGLI module: Once you are logged in, look for the FEGLI module. It may be located under the "Insurance" or "Benefits" section.

- Review your current coverage: Before making any changes, review your current FEGLI coverage. This will help you understand your current benefits and make informed decisions about any necessary adjustments.

- Make your desired changes: The FEGLI module will allow you to reduce your current FEGLI elections or make initial benefit elections if you are a new hire. You can update your coverage amounts, add or remove beneficiaries, and make other necessary changes.

- Validate your choices: Before finalizing your changes, carefully review and validate your selections. Pay attention to the effective dates of any changes you make.

- Receive confirmation: After validating your choices, you will receive a confirmation number and a summary of your updated selections, along with the effective date of the changes. Keep this information for your records.

- Contact HRSSC for further assistance: If you need further assistance or have questions about your FEGLI coverage, you can contact the Human Resources Shared Service Center (HRSSC). They can provide support and guidance on more complex situations or qualifying life events that may impact your coverage.

Remember that making informed decisions about your life insurance coverage is important. Review your options carefully and consider seeking additional financial or insurance advice if needed.

Life Insurance: Haven Life's Agency LLC Guide

You may want to see also

Contacting the Human Resources Shared Service Center (HRSSC)

To contact the Human Resources Shared Service Center (HRSSC), you can call the Employee Service Line at 1-877-477-3273. When prompted, select 5 for the HRSSC, and then select Benefits to speak with a representative. Alternatively, you can use the PostalEASE website or telephone system to manage your Federal Employees Health Benefits (FEHB) enrollment. This is a convenient, confidential, and secure way for U.S. Postal Service employees to enroll, change, or cancel their FEHB Program.

If you are experiencing issues with your Federal Employees Group Life Insurance (FEGLI), you can also contact the HRSSC. Previously, employees had to submit form SF 2817, Life Insurance Election, to the HRSSC to enroll in or make changes to their FEGLI plan. Now, a new online module simplifies the process, and current employees can use it to reduce their current FEGLI elections. However, if you experience a "qualified life event," such as a marriage or divorce, you must contact the HRSSC to modify your FEGLI benefit.

The HRSSC is also responsible for determining an employee's eligibility to enroll or change enrollment under the FEHB Program. Employees are required to provide the HRSSC with sufficient evidence to justify their request. The HRSSC will also report any name changes for employees with Self Only enrollment to the health benefits plan.

In addition, the HRSSC plays a crucial role in dual enrollment situations. If there is dual enrollment, arrangements are made to terminate one of the enrollments as soon as possible. If the employees involved cannot agree on which enrollment to continue, the HRSSC will make the decision based on specific principles, prioritizing coverage for any children who are eligible family members and giving precedence to family enrollment over Self Only enrollment.

The HRSSC is also responsible for correcting erroneous enrollments. If an employee is erroneously enrolled due to the nature of their employment, the HRSSC will terminate or void the enrollment and ensure that the employee understands the action taken and its reasons and effects.

Colonial Life: Health Insurance Options and Benefits

You may want to see also

Qualifying life events

A "qualifying life event" is a term used by the United States Postal Service (USPS) to refer to certain events that allow employees to change their Federal Employees Health Benefits (FEHB) Program and Federal Employees' Group Life Insurance (FEGLI) plans outside of the annual Federal Benefit Open Season.

The following is a list of qualifying life events for the FEHB Program:

- New appointment: A new employee eligible for coverage may enroll within 60 days after the date of appointment in any available plan, option, and type of enrollment.

- Change in employment status: Employees who were previously employed under conditions excluding them from coverage but whose employment status changes so that they are no longer excluded may enroll in a plan of their choice within 60 days after the change.

- FEHB Open Season: During this season, eligible employees who are not enrolled may do so, and enrolled employees may change enrollment from one plan or option to another, or from Self Only to Self and Family, or both.

- Reemployment after a break in service of more than 3 days: An eligible employee who is reemployed after a break in service of more than 3 days may enroll or decline to enroll within 60 days after the date of the new appointment as though they are a new employee.

- Return to duty after 365 days in non-pay status: An employee whose enrollment is terminated because they have been in a non-pay status for 365 days may enroll within 60 days after returning to pay status. The employee may enroll in any plan, option, and type of enrollment as though they are a new employee.

- Return from military service: A non-enrolled employee who entered the military for service not limited to 30 days or less may enroll in either option of any available plan within 60 days after returning to civilian duty. An enrolled employee whose enrollment ended upon entering military service will have their enrollment reinstated upon restoration to duty in a civilian position.

- Loss of coverage under federal programs: An employee who loses coverage under any federally-sponsored health benefits program or under the Retired Federal Employees Health Benefits Program may enroll under the FEHB within 60 days after termination of coverage for any reason.

- Eligible for Medicare: An employee may change enrollment from one option to another of any available plan at any time beginning on the 30th day before they become eligible for Medicare.

- Change to Self Only: The option to change from Self and Family to Self Only at any time during the year is available only to employees whose health premiums are paid on an after-tax basis. For employees with health benefit premiums paid on a pre-tax basis, a change to Self Only may only be processed during FEHB Open Season or following a qualifying life event. Requests due to qualifying life events must be received by the Human Resources Shared Service Center (HRSSC) from the employee within 60 days of the qualifying event.

- Change in marital status: As a result of a change in marital status, an employee may enroll or, if already enrolled, may change the enrollment from Self Only to Self and Family, or from one plan or option to another, or both, during the period beginning 31 days before a change in marital status and ending 60 days after the change.

- Change in family status: An enrolled employee who has a change in family status, including a change in marital status, may enroll, change enrollment from Self Only to Self and Family, or from one plan or option to another, or both, during the period beginning 31 days before a change in family status and ending 60 days after the change.

- Change in spouse's employment status: When both spouses are covered under the FEHB in Self Only enrollment and a change in enrollment status results in one of them losing eligibility for health benefits, the eligible employee may change enrollment from Self Only to Self and Family, or from one plan or option to another, or both, during the period beginning 31 days and ending 60 days after the date of loss of coverage.

- Employee loses coverage as a family member: An employee enrolled for Self and Family may change enrollment to Self Only or cancel coverage. This action may cause an employee listed as a family member of another employee to lose coverage. If this occurs, the affected employee may enroll for Self Only or Self and Family in either option of any plan during the period beginning 31 days before and ending 60 days after the change to Self Only or cancellation has been filed.

- Loss of coverage under a parent's non-federal plan: An employee who loses coverage under a parent's non-federal health plan may enroll under the FEHB Program within 31 days before and ending 60 days after losing coverage for any reason.

- Loss of dependent coverage under a spouse or other parent's non-federal plan: An employee whose children lose coverage under the other parent's non-federal health plan may change enrollment from Self Only to Self and Family, or from one plan or option to another, or both during the period beginning 31 days before and ending 60 days after the children's loss of coverage.

The following is a list of qualifying life events for the FEGLI:

Outside of the annual Federal Benefit Open Season, eligible employees can enroll or increase their FEGLI coverage by taking a physical exam or with a Qualifying Life Event.

Intestate Law vs Life Insurance: Who Wins?

You may want to see also

FEGLI benefit enrolment for new hires

The Federal Employees' Group Life Insurance (FEGLI) Program is the largest group life insurance program in the world, covering over 4 million federal employees and retirees, as well as many of their family members. Most federal employees, including both full-time and part-time employees, are eligible to enroll in the FEGLI program.

New hires are automatically enrolled in the FEGLI "basic" insurance, called the Basic Insurance Amount (BIA), unless they formally waive the BIA. The BIA is equal to the greater of the employee's salary rounded up to the next $1,000 plus $2,000, or $10,000. The federal government pays one-third of the premium cost of an employee's BIA, while employees pay the remaining two-thirds.

Newly hired employees must elect any optional coverage at their initial hire date using Form SF 2817. There are three types of optional insurance:

- Option A, Standard: a flat amount of $10,000.

- Option B, Additional: an amount equal to one to five times an adjusted salary, rounded up to the next $1,000 plus $1,000.

- Option C, Family: provides coverage for an employee's spouse and eligible dependent children.

Employees pay all the premiums for the optional coverages, with no federal government contribution.

New hires interested in FEGLI benefits should enroll within 60 days from their appointment date. They can use the PostalEASE module, similar to the platform's health insurance, tax, and banking modules, to make their initial benefit elections.

The FEGLI Calculator is a useful tool that allows employees to determine the cost and benefits of various levels of optional insurance coverage.

Equitable Life Insurance: Does It Cover Medicare in Florida?

You may want to see also

Frequently asked questions

You can change your federal life insurance by using the PostalEASE module, which is a similar platform to the health insurance, tax and banking modules.

You can access PostalEASE on the internet, at an Employee Self-Service Kiosk (available in some facilities), or on the Intranet (from the Blue page).

If you experience issues with the platform, you can call the Employee Service Line at 1-877-477-3273. When prompted, select 5 for the Human Resources Shared Service Center (HRSSC), then select Benefits to speak with a representative.

If you are a new employee, you should enroll in federal life insurance within 60 days from your appointment date.