Life insurance is a crucial step in financial planning, especially if you have people depending on your income. While it is a topic that many people avoid, it is essential to have a policy in place to protect your loved ones in case something happens to you. The cost of life insurance is determined by various factors, including age, health, gender, lifestyle choices, and the type of policy chosen. So, can you get life insurance at 35, and is it a good idea?

| Characteristics | Values |

|---|---|

| Age | 35 |

| Affordability | Affordable, but more expensive than in 20s |

| Dependents | Likely to have financial dependents |

| Health | Likely to be in good health |

| Income | Likely to be earning more than in 20s |

| Debt | Likely to have mortgage, student loan, and consumer debt |

| Family situation | Likely to be buying a house, getting married, or starting a family |

| Life insurance type | Term life insurance is a good option for this age group |

| Life insurance amount | Should be 5-10 times annual salary |

| Life insurance term | 10, 20, or 30 years |

What You'll Learn

Life insurance at age 35: what are the benefits?

Life insurance at 35: what are the benefits?

Life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies. The older you get, the more expensive life insurance becomes, which is why it's beneficial to buy life insurance at 35. Here are some advantages of buying life insurance at this age:

Protect your loved ones

If you have a family, you likely have people who depend on your income. Life insurance can help replace your income if something happens to you. The proceeds from a life insurance policy can be used by your beneficiaries to pay for regular expenses, such as utilities and transportation, and other insurance policy premiums.

Save money

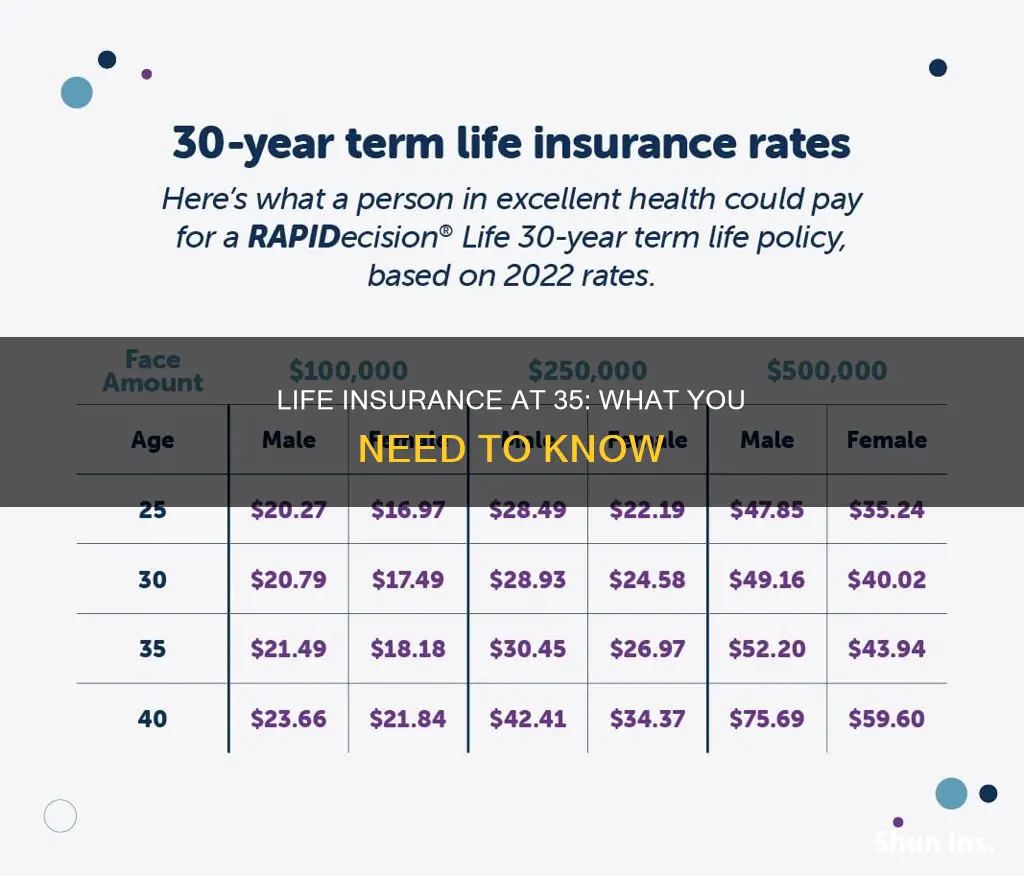

The cost of life insurance is determined by several factors, including your age and health. By purchasing life insurance at 35, you can lock in a lower insurance premium while you're still young and healthy. For example, a 35-year-old woman in excellent health can purchase a 30-year term life insurance policy with a $500,000 death benefit for $34 per month. If she waits until she's 40, the same coverage would cost $53 per month.

Avoid medical issues

The longer you wait to apply for life insurance, the higher the chances of developing health issues that will result in higher rates or difficulty getting coverage. At 35, you're more likely to be in good health, which can help you qualify for affordable coverage.

Provide for funeral expenses

A funeral, cremation, or burial can cost upwards of $8,000. Life insurance can help cover these expenses, so your family doesn't have to bear the financial burden during their time of grief.

Protect your business

If you have any business dealings, life insurance is important for succession planning. It can provide the necessary funds for your family to deal with your business holdings as you would have wanted.

Peace of mind

Buying life insurance at 35 gives you peace of mind, knowing that your loved ones will be financially protected if something happens to you.

In summary, purchasing life insurance at 35 can offer financial protection for your loved ones, save you money on premiums, and provide security for your family and business dealings. It's a practical decision that can make a significant impact on your life and the lives of those who depend on you.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Life insurance at age 35: what are the drawbacks?

While buying life insurance at 35 can be a practical, impactful, and affordable way to protect your loved ones, there are some drawbacks to consider. Here are some reasons why purchasing life insurance at this age may not be ideal in certain situations:

Higher Premiums:

Purchasing life insurance at 35 means you will likely pay higher premiums compared to someone who bought it at a younger age. Life insurance rates increase with age, as insurers consider the likelihood of a payout due to an increased risk of health issues. The older you get, the more expensive life insurance becomes. By waiting until 35 to buy life insurance, you may face higher premiums than if you had purchased it earlier.

Health Risks:

As people age, they become more susceptible to health problems. Waiting until 35 to buy life insurance means you may have developed health issues that could make insurance more expensive or even disqualify you from certain plans. Insurers consider your health when determining rates and coverage, and pre-existing medical conditions can result in higher premiums or limited options.

Limited Options:

At 35, you may find that the variety of life insurance options available to you has decreased. Insurers may offer fewer plans or place restrictions on certain types of coverage. For example, guaranteed life insurance policies, which do not require a medical exam, tend to be very expensive and have low policy limits. The older you get, the more limited your choices may become.

Impact on Family:

If you have a family that depends on your income, waiting until 35 to buy life insurance may leave them vulnerable. In the event of your untimely death, your loved ones could struggle financially without adequate coverage. The sooner you purchase life insurance, the better protection you can provide for your family.

Cost-Prohibitive for Seniors:

As you approach your senior years, life insurance can become increasingly cost-prohibitive. Many insurers stop issuing new policies to seniors over a certain age, typically around 80. If you wait too long to purchase life insurance, you may find that the available options are extremely expensive or that your application is declined due to age restrictions.

Impact on Retirement Planning:

Waiting until 35 to buy life insurance can impact your retirement planning. Permanent life insurance policies with a cash value component can be beneficial for retirement planning, as the cash value grows over time. By purchasing life insurance earlier, you give the cash value more time to accumulate, potentially supplementing your retirement income. Starting at 35, you may miss out on maximizing this benefit.

Canceling Life Insurance Payments: What You Need to Know

You may want to see also

How does life insurance at 35 compare to other ages?

Life insurance rates are largely determined by age, with older applicants facing higher premiums due to the increased risk of a payout. A 35-year-old will generally receive a lower premium than a 40-year-old, and this trend continues as age increases.

For example, a 35-year-old female can expect to pay around $25 per month for a $500,000 term life insurance policy, while a 35-year-old male will pay around $30 for the same coverage. As the age increases to 60, the rates more than double for both men and women.

The type of life insurance policy also affects the premium rates. Term life insurance policies, which cover a specific period, are typically more affordable than whole life insurance policies, which are permanent and include a cash value component. The younger the applicant, the more beneficial a whole life insurance policy can be due to the ability to accumulate value over time.

Additionally, health status, medical history, gender, and lifestyle choices can influence the cost of life insurance. Pre-existing medical conditions, family health history, tobacco use, and high-risk activities can result in higher premiums or even disqualification from certain policies.

In summary, life insurance at 35 is generally more affordable compared to older ages, as the likelihood of a payout is lower. However, individual circumstances, such as health and lifestyle, can also significantly impact the cost of life insurance, making it essential to consider various factors when comparing rates at different ages.

Understanding Life Insurance Cash Value and Net Worth

You may want to see also

What factors affect the cost of life insurance at age 35?

Yes, you can get life insurance at 35. In fact, 35 is a common age to purchase life insurance, as it is often the time when people start a family and have more financial responsibilities.

Now, let's explore the factors that affect the cost of life insurance at age 35 in detail:

Age

Age is a pivotal factor in determining life insurance premiums. As you get older, the likelihood of passing away increases, which means a higher risk to insurance providers. Consequently, insurance companies charge higher premiums to offset the increased risk of a payout. The closer you are to your life expectancy, the higher the premium will be.

Health Status and Medical History

Your overall health and medical history play a significant role in calculating life insurance premiums. Pre-existing medical conditions, such as diabetes, heart disease, or obesity, may result in higher rates as they can impact your life expectancy. Insurance companies use health categories, such as "Preferred Plus," "Preferred," and "Standard," to assess your health risks and determine your premium.

Gender

Actuarial data shows that women have a longer life expectancy than men, and insurance companies use this information to set premiums. On average, women pay lower life insurance rates than men of the same age and health.

Lifestyle Choices

Your lifestyle choices, including your hobbies and occupation, can also impact your life insurance premiums. High-risk activities, such as skydiving, rock climbing, or racing, may lead to higher rates or even affect your eligibility for coverage. Similarly, certain occupations deemed more hazardous or accident-prone may result in higher premiums.

Type of Coverage

The type of life insurance policy you choose will significantly impact your premium. Term life insurance, which offers coverage for a specific term, is generally the most affordable option. On the other hand, permanent life insurance, which lasts a lifetime and includes a cash value component, is significantly more expensive.

Amount of Coverage

The amount of coverage you need will also affect your premium. The higher the coverage amount, the higher the premium will be. This is because higher coverage limits present a greater financial risk to the insurance company.

Smoking Status

Smoking status is another critical factor in determining life insurance rates. Smokers are considered high-risk due to the increased likelihood of developing health issues, and therefore, they typically pay higher premiums for life insurance.

In conclusion, while age 35 is a common time to purchase life insurance, the cost will vary depending on a combination of these factors, including age, health, gender, lifestyle choices, type of coverage, amount of coverage, and smoking status. It is recommended to compare quotes from multiple insurance providers to find the best rate that suits your needs.

Life Insurance and Lung Cancer: What Coverage is Offered?

You may want to see also

What types of life insurance are available at age 35?

Life insurance is a contract between an insurer and an insured person, where the insurer guarantees payment to the insured's beneficiaries in the event of the insured's death. The cost of life insurance is influenced by various factors, including age, health, gender, lifestyle, and the type of policy chosen. While it is available at any age, the younger you are when you purchase life insurance, the more affordable it tends to be. Here are some types of life insurance available to 35-year-olds:

Term Life Insurance

Term life insurance provides coverage for a specified period, often 10, 20, or 30 years. It guarantees a death benefit to the insured's beneficiaries if the insured person dies during the term. Term life insurance is generally the most affordable option, as it does not have a cash value component like permanent insurance. The premiums are based on the insured's age, health, and life expectancy, and they increase with age. For example, a 35-year-old male in good health can expect to pay around $30 per month for a $500,000 term policy.

Permanent Life Insurance

Permanent life insurance, including whole life and universal life insurance, offers coverage for the insured's entire life, up to a maximum age. It has a cash value component that grows over time, which can be accessed by the insured or used to pay premiums. Permanent life insurance premiums are typically 10-15 times higher than term life insurance premiums due to the longer coverage period and the potential for cash value accumulation.

Convertible Term Life Insurance

This type of policy is a term life insurance plan with a conversion rider. It allows the insured to convert an existing term policy to a permanent plan without undergoing additional underwriting or proving insurability. While the conversion rider guarantees approval, the premiums will increase significantly as whole life insurance is more expensive.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a type of permanent life insurance specifically designed to cover end-of-life expenses such as funeral costs. It does not require a medical exam, but the premiums tend to be high compared to other forms of life insurance.

Guaranteed Life Insurance

Guaranteed life insurance is an option for older adults who may have difficulty obtaining coverage due to health issues. It does not require a medical exam or health questionnaire, and approval is guaranteed. However, these policies are expensive and usually have a low death benefit cap, typically around $25,000.

Haven Life: Insuring Innovation for the Reporter's Life

You may want to see also

Frequently asked questions

No, it is not too old. In fact, buying life insurance in your 30s is often one of the most practical and impactful times to financially protect your loved ones.

At 35, you might have more financial responsibilities and people who depend on you financially. A life insurance policy can help replace your income if something happens to you.

The cost of life insurance depends on various factors, including age, gender, health status, and lifestyle choices. For example, the average monthly rate for a 35-year-old female with a $500,000 term policy is $25, while for a 35-year-old male, it is $30.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, usually 10, 15, 20, or 30 years, and is more affordable. Permanent life insurance, on the other hand, provides coverage for a lifetime and includes a cash value component but is more expensive.

The amount of coverage you need depends on factors such as your income, debts, family situation, and future expenses. A common recommendation is to get a policy with a death benefit equal to five to ten times your annual salary.