Life insurance is a crucial aspect of financial planning that often sparks curiosity and debate. Many people wonder why they should invest in life insurance, despite the common misconception that it's only for the elderly or those with families. The appeal of life insurance lies in its ability to provide financial security and peace of mind. It offers a safety net for loved ones, ensuring they are protected in the event of the insured's untimely death. This financial protection can cover various expenses, such as mortgage payments, children's education, and daily living costs, allowing beneficiaries to maintain their standard of living and achieve their financial goals. Moreover, life insurance can be a valuable tool for wealth accumulation, as certain types of policies offer investment components that can grow over time. Understanding the benefits and importance of life insurance can help individuals make informed decisions about their future and the well-being of their loved ones.

What You'll Learn

- Financial Security: Life insurance provides a safety net for loved ones in the event of death

- Peace of Mind: Knowing you're protected offers reassurance and reduces stress

- Legacy Planning: It allows individuals to leave a financial legacy for their family

- Debt Management: Insurance can help pay off debts, ensuring financial stability

- Medical Expenses: Coverage can cover unexpected medical costs, preventing financial strain

Financial Security: Life insurance provides a safety net for loved ones in the event of death

Life insurance is a powerful tool that offers financial security and peace of mind to individuals and their families. It is a way to ensure that your loved ones are protected and provided for, even in the worst-case scenario of your passing. When you purchase life insurance, you are essentially creating a safety net for your family, which can be a crucial aspect of financial planning. This safety net provides a sense of security, knowing that your family will have the necessary financial support to maintain their standard of living and cover essential expenses.

The primary purpose of life insurance is to financially protect your beneficiaries, who are typically your spouse, children, or other dependents. In the event of your death, the insurance company pays out a death benefit, which can be a lump sum or regular payments, to the designated beneficiaries. This financial support can cover various expenses, such as mortgage payments, rent, utility bills, education costs, and daily living expenses, ensuring that your family can continue to live comfortably and securely. For example, if you have a young family and a substantial mortgage, life insurance can provide the funds needed to keep the roof over their heads and maintain their lifestyle.

Financial security is a significant benefit of life insurance, especially for those with a large financial responsibility or a family to support. It allows individuals to leave a lasting legacy and provide for their loved ones' long-term needs. With life insurance, you can ensure that your family's financial future is protected, even if you are no longer around. This peace of mind is invaluable, knowing that your family's financial well-being is secure and that you have taken the necessary steps to safeguard their future.

Moreover, life insurance can also help cover funeral and burial expenses, which can be a significant financial burden on a family during an already difficult time. It provides an additional layer of support, ensuring that your loved ones do not have to worry about the financial aspects of your passing. By having life insurance, you are not only securing your family's financial future but also providing them with the emotional comfort of knowing they are protected.

In summary, life insurance is a vital tool for anyone who wants to provide financial security for their loved ones. It offers a safety net that can cover essential expenses, maintain a family's lifestyle, and even contribute to long-term financial goals. With life insurance, individuals can rest assured that their family's financial future is in good hands, allowing them to focus on the present and create lasting memories. This aspect of financial security is a primary reason why many people choose to love and rely on life insurance.

Affordable Term Life Insurance: Finding the Cheapest Option

You may want to see also

Peace of Mind: Knowing you're protected offers reassurance and reduces stress

The concept of life insurance often evokes a sense of security and peace of mind for many individuals. One of the primary reasons people love life insurance is the profound sense of reassurance it provides. When you purchase a life insurance policy, you are essentially creating a safety net for yourself and your loved ones. This financial protection ensures that your family can maintain their standard of living and cover essential expenses, such as mortgage payments, education costs, or daily living expenses, even if the worst happens. Knowing that you have this financial safeguard in place allows you to face life's uncertainties with a reduced sense of anxiety and stress.

In today's uncertain world, having life insurance can be a powerful tool to combat financial worries. It provides a sense of control and stability, knowing that your family's well-being is protected. This peace of mind is invaluable, as it enables individuals to focus on their daily lives, careers, and personal goals without constantly worrying about potential financial hardships. With life insurance, you can make decisions and take risks knowing that your loved ones are financially secure, which can boost your confidence and overall happiness.

The emotional benefit of life insurance is often overlooked but is a significant factor in its appeal. It allows individuals to feel more prepared and confident about the future. When you have a life insurance policy, you can make long-term plans with a clear conscience, knowing that your family's financial future is secure. This sense of security can lead to improved mental well-being and a more positive outlook on life. Moreover, it provides a sense of comfort during difficult times, knowing that your loved ones will be taken care of according to your wishes.

Life insurance offers a unique form of protection that is both practical and emotionally fulfilling. It empowers individuals to take charge of their financial future and that of their family. By providing a financial safety net, life insurance ensures that your loved ones can maintain their lifestyle and cover essential costs, even in your absence. This financial security can lead to a more relaxed and stress-free life, allowing you to focus on the things that matter most.

In summary, the peace of mind that comes with life insurance is a powerful motivator for many. It allows individuals to face life's challenges with confidence, knowing that their loved ones are protected. This sense of security and reassurance is a valuable aspect of life insurance, making it an essential consideration for anyone looking to safeguard their family's financial future. With life insurance, you can achieve a sense of control and stability, ensuring that your loved ones' well-being is always a priority.

Switching Billing Methods for Your Whole Life Insurance

You may want to see also

Legacy Planning: It allows individuals to leave a financial legacy for their family

Legacy planning is an essential aspect of financial strategy that enables individuals to secure their family's future and ensure their long-term financial well-being. It is a thoughtful and proactive approach to wealth management, allowing you to leave a lasting impact on your loved ones. By implementing a legacy plan, you can provide financial security and peace of mind, knowing that your family will be taken care of even in your absence.

The primary goal of legacy planning is to create a financial legacy that can support and benefit your family members. This involves making strategic decisions about how your assets will be distributed and managed after your passing. One of the most effective ways to achieve this is through life insurance. Life insurance policies can be structured to provide a substantial financial payout upon your death, which can then be used to cover various expenses and leave a lasting inheritance.

When considering legacy planning, it's crucial to evaluate your family's unique needs and circumstances. This includes assessing their current financial situation, future goals, and any specific requirements they may have. For instance, if your spouse relies on your income for daily expenses, or if you have children who require financial support for education, life insurance can be tailored to meet these obligations. The proceeds from the policy can be designated to cover these essential costs, ensuring that your family's standard of living is maintained.

Moreover, life insurance can be a powerful tool for intergenerational wealth transfer. By utilizing various policy structures, such as whole life or universal life insurance, you can build a substantial cash value over time. This cash value can be borrowed against or withdrawn, providing funds for various purposes, including education expenses for grandchildren or even starting a business venture. This aspect of legacy planning allows you to not only secure your family's present but also contribute to their future success.

In summary, legacy planning is a vital component of financial strategy, offering individuals the opportunity to create a lasting financial impact on their families. Through life insurance, you can provide financial security, cover essential expenses, and even facilitate intergenerational wealth transfer. By carefully considering your family's needs and utilizing appropriate insurance products, you can ensure that your legacy extends beyond your lifetime, leaving a positive and lasting impression on your loved ones.

Oral Swab Testing: Life Insurance Simplified

You may want to see also

Debt Management: Insurance can help pay off debts, ensuring financial stability

Life insurance is a powerful tool that can provide financial security and peace of mind, especially when it comes to managing and paying off debts. Here's how insurance can be a valuable asset in your debt management strategy:

Debt Relief and Financial Security: One of the primary reasons people purchase life insurance is to protect their loved ones financially. When an individual passes away, a life insurance policy pays out a death benefit to the designated beneficiaries. This financial cushion can be a significant source of debt relief for the family. For example, if a breadwinner's death leaves a family with outstanding mortgage payments, car loans, or credit card debts, the life insurance payout can directly address these financial obligations. By ensuring that debts are settled, the insurance proceeds help maintain financial stability and prevent the loved ones from falling into further financial hardship.

Long-Term Debt Management: Insurance can also be a strategic tool for managing long-term debts. For instance, if an individual has a substantial amount of debt, such as a large student loan or a business loan, life insurance can provide a safety net. In the event of an unexpected death, the insurance policy can cover the remaining debt, ensuring that the borrower's family is not burdened with the financial responsibility of repaying the loan. This is particularly beneficial for families who rely on the primary income earner and may struggle to maintain financial stability without that support.

Protecting Assets: Life insurance can also be used to protect and preserve assets. For high-net-worth individuals or those with valuable assets, life insurance can be structured to pay off debts while also providing a means to transfer wealth. For example, a policy can be set up to cover business debts, ensuring the business's continuity and protecting personal assets from being liquidated to settle those debts. This strategic use of insurance can help maintain financial stability and ensure that assets are passed on to beneficiaries according to the individual's wishes.

Peace of Mind: Beyond the financial benefits, having life insurance provides peace of mind. Knowing that your loved ones and financial obligations will be taken care of in the event of your passing can reduce stress and anxiety. This reassurance allows individuals to focus on their daily lives, careers, and personal goals without constantly worrying about potential financial losses.

In summary, life insurance is a versatile tool that goes beyond providing financial support to loved ones. It can actively contribute to debt management, ensuring that financial obligations are met and that families remain stable even in the face of unexpected circumstances. By incorporating insurance into a comprehensive financial plan, individuals can gain control over their financial future and the well-being of their families.

Haven Life Insurance: BBB Ratings and Reviews Explained

You may want to see also

Medical Expenses: Coverage can cover unexpected medical costs, preventing financial strain

Life insurance is a powerful tool that provides financial security and peace of mind, especially when it comes to covering unexpected medical expenses. Here's how it can be a game-changer:

Medical emergencies and unexpected illnesses can arise at any time, often without warning. These situations can lead to substantial medical bills, including hospital stays, surgeries, medications, and specialized treatments. Without adequate coverage, individuals and their families may find themselves facing financial ruin, especially if they have limited savings or no health insurance. This is where life insurance steps in as a crucial safety net.

When you purchase a life insurance policy, you're essentially investing in a financial safety net for yourself and your loved ones. The policy provides a death benefit, which is a lump sum payment made to the beneficiaries upon your passing. However, many life insurance plans also offer an additional layer of protection: critical illness coverage or income replacement benefits. These features can be invaluable when it comes to medical expenses.

Critical illness coverage is designed to provide financial assistance when you're diagnosed with a critical illness, such as cancer, heart attack, or stroke. This coverage can help cover the high costs associated with treatment, including medical procedures, medications, and follow-up care. By having this coverage, you can focus on your recovery without the added stress of financial burdens. For example, if you're diagnosed with a rare form of cancer, the critical illness benefit can cover the extensive treatment costs, ensuring you receive the best care without worrying about insurance limitations.

Moreover, some life insurance policies offer income replacement benefits, which can provide a regular income stream if you become unable to work due to a serious illness or injury. This is particularly important as it ensures that your family can maintain their standard of living and cover daily expenses even if you're unable to work. The income replacement benefit can bridge the gap between your current income and what you would have earned, providing financial stability during a challenging time.

In summary, life insurance goes beyond providing financial security in the event of your passing. It offers a comprehensive solution to manage unexpected medical costs. With critical illness coverage, you can tackle the financial aspects of serious illnesses, while income replacement benefits ensure your family's financial stability when you're unable to work. By having this coverage, you're taking a proactive approach to protect your loved ones from potential financial strain caused by unforeseen medical expenses.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers several advantages, including financial security, peace of mind, and the ability to plan for the future. With life insurance, beneficiaries receive a payout upon the insured person's death, which can help cover expenses like funeral costs, outstanding debts, mortgage payments, or daily living expenses. This financial support can ensure that loved ones are taken care of and that the insured individual's legacy is protected.

Life insurance plays a significant role in financial planning by offering a means to secure one's family's financial future. It allows individuals to plan for long-term goals and provide for their loved ones' well-being. For example, term life insurance can be used to cover large expenses like education costs or mortgage payments, ensuring that these financial obligations are met even if the primary breadwinner is no longer around. Additionally, life insurance can be a valuable asset in estate planning, helping to minimize taxes and provide liquidity to beneficiaries.

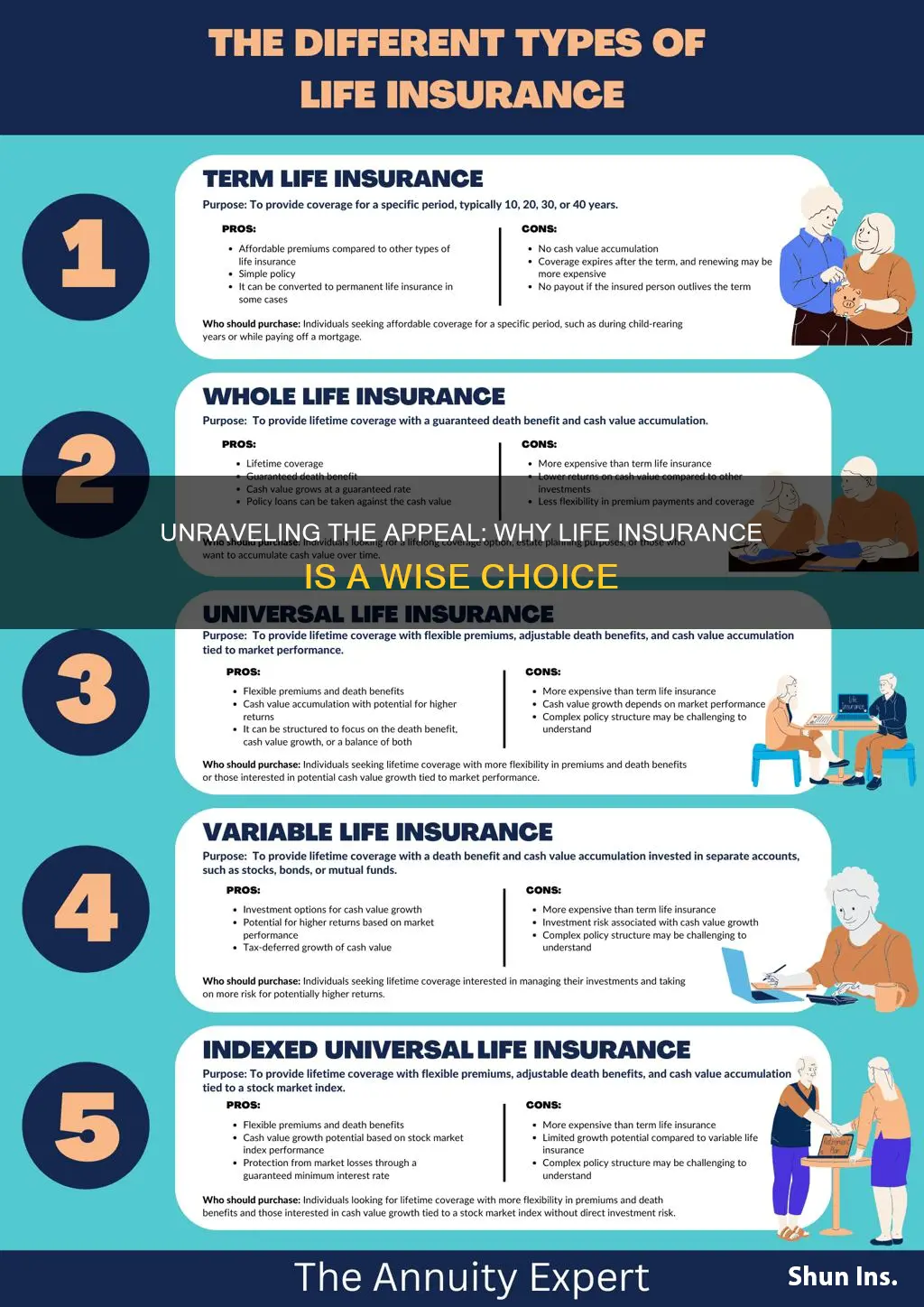

Term life insurance is a popular choice for many due to its affordability and simplicity. It provides coverage for a specific period, typically 10, 20, or 30 years, and is often more cost-effective than permanent life insurance. During the term, the policyholder pays a fixed premium, and if an insured event occurs (death), the beneficiaries receive the death benefit. This type of insurance is ideal for individuals who want to cover short-term financial responsibilities, such as raising children or paying off a mortgage, without the complexity of permanent insurance policies. It offers a straightforward solution to ensure financial security during specific life stages.