Life insurance is an asset used in long-term financial planning, providing financial support to loved ones after the policyholder's death. It is a contract between the policyholder and the insurance company, which pays out a death benefit to the named beneficiaries. There are several types of life insurance, including term and permanent plans, with varying premium costs depending on factors such as the policy type, the insured's health, and age. Policyholders can choose from different payment options, including recurring payments, one-time payments, and pre-authorized payment plans. However, it is essential to understand the conditions and restrictions associated with each payment method, as some insurers may not accept certain payment methods beyond the first premium payment.

What You'll Learn

Payment methods

Regular Premium Payment

This is the most common and preferred mode of payment, where premiums are paid periodically (yearly, monthly, quarterly, or half-yearly) based on the policyholder's preference. This method is popular as it makes premiums more affordable and avoids placing a heavy financial strain on the policyholder at any one time. It also offers flexibility, allowing policyholders to discontinue the policy at any time due to changing circumstances or reduced liabilities.

Single Premium Payment

This is a less frequently chosen option where the policyholder makes a one-time upfront payment of premiums, regardless of the policy duration. While it may seem tempting, financial advisors caution that when adjusted for inflation, single premium payments can often be more costly compared to other payment methods. However, an advantage of this method is that there is no risk of policy lapse due to non-payment of premiums. This option is suitable for those who can afford the upfront financial burden and want protection against policy lapse.

Limited Premium Payment

With this option, policyholders can pay the premiums for their entire policy within a limited period, such as 5 or 10 years, while continuing to enjoy the insurance benefits for a longer duration. The downside is that the premium amounts for this method are generally higher than regular payments. It is ideal for those who wish to retire before the end of the policy term and want to reduce the financial burden of premiums during their post-retirement years.

Electronic Bank Transfer

Most insurance companies accept premium payments via electronic bank transfer, which is often set up as a recurring payment to avoid policy lapses due to missed payments. This method is convenient and ensures timely payment of premiums.

Check or Cashier's Check

Some insurance companies may accept personal checks or cashier's checks, especially for the first premium payment. However, checks are usually only allowed for annual, bi-annual, or quarterly payments. Cash is never accepted as a form of payment for life insurance premiums.

Credit Card

Some insurance companies may allow credit card payments, but this is typically limited to the first premium payment and may incur additional processing fees. Most companies do not accept credit card payments for temporary coverage or after the initial premium.

Lincoln National Life Insurance: Size and Scope Explored

You may want to see also

Discounts for annual payments

Many insurance companies offer discounts if you pay your annual premium in full, rather than in monthly payments. This is because it removes the risk of non-payment and ensures the insurance company gets compensated, regardless of what happens during the coverage term.

The amount of the discount varies depending on the insurance company and your policy. Here are some examples of insurance companies that offer discounts for annual payments:

- Corebridge Financial

- Legal & General America

- Brighthouse Financial

In addition to these companies, most of the top life insurance companies offer a small discount for paying annually.

Other Ways to Get Discounted Life Insurance

There are several other ways to get discounted life insurance, including:

- Bundling your policies: Many insurance companies offer bundling discounts, or multi-line discounts, for policyholders with multiple coverage lines.

- Taking safety precautions: Improving your health and taking steps to stay healthy can qualify you for a discount. This could include losing weight, committing to a regular workout routine, or avoiding risky hobbies like skydiving.

- Taking advantage of group discounts: Being a member of certain organizations or working in specific professions can sometimes make you eligible for a life insurance discount. For example, teachers and military members are often eligible for small discounts.

- Loyalty discounts: Many insurance companies offer loyalty discounts for policyholders who renew their policies year after year.

- Setting up automatic payments: Some insurance companies offer an additional discount if you set up automatic payments or opt for e-statements.

- Getting insurance when you're younger: The younger and healthier you are, the cheaper your premiums will be.

Credit Score Impact on Life Insurance: What's the Link?

You may want to see also

Accepted payment methods

Some insurers accept credit cards, but only for the first premium payment, and there may be an added fee. These companies include HDFC Life, which also accepts debit cards, UPI, wallets, and bill pay. John Hancock is one insurer that does not accept credit or debit cards.

Recurring payments using electronic bank transfer are the most common way to pay for life insurance.

Best Whole Life Insurance: Comprehensive Coverage for Peace of Mind

You may want to see also

Temporary coverage

Temporary life insurance is short-term coverage that you can buy during the life insurance application process before your official policy goes into effect. It is a stopgap measure to protect your beneficiaries while you wait for your insurer to approve your application.

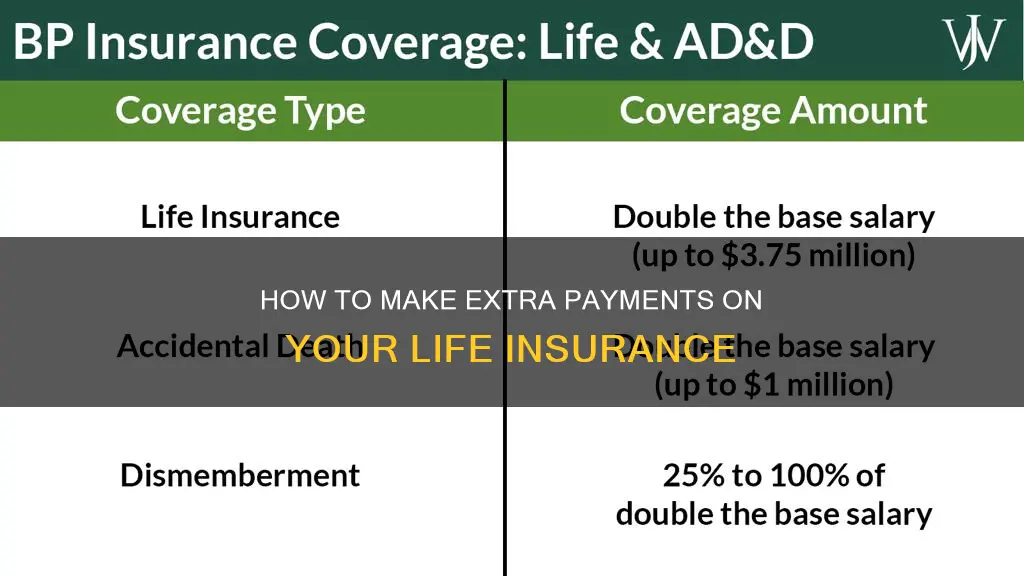

Temporary life insurance is only available if you buy a longer life insurance policy; you can't purchase this type of coverage on its own. The coverage can begin as soon as you sign your application and receive your temporary insurance receipt, but the exact timeline varies by insurer. The death benefit is typically equal to the amount of coverage for which you've applied, up to a limit (usually $1 million).

Temporary life insurance coverage ends when one of the following occurs:

- A set period of time passes after the application is filed (usually 60 to 90 days)

- You request a refund for the premium or terminate your proposed coverage

- You are declined for coverage

- Your policy becomes active

The cost of temporary life insurance is generally equivalent to the first month's premium for the policy coverage you are applying for. The premium paid towards temporary coverage is essentially a deposit. Once your policy is approved, the payment you made will be applied to your first month's premium. If your application is denied, you will receive the premium payment back.

Term Life Insurance: Understanding the Policy and its Penalties

You may want to see also

Cash value

Permanent life insurance policies often contain a cash value component that can be accessed during the policyholder's life. This cash value grows over time as you pay your premiums. If you have a permanent life insurance policy that has accumulated a significant amount of funds in its cash value, you can use that money while you're alive to pay premiums, take out a loan, or withdraw cash permanently. However, it's important to note that withdrawing money will leave less for your heirs after your death.

- Cover your policy premiums: The premiums on permanent life insurance policies can be expensive. Once your cash value reaches a certain point, some insurers and policies let you use it to pay for your coverage. This can be helpful if, for example, you need to reduce your monthly expenses but want to keep your policy in place.

- Take out a life insurance loan: Insurers often offer loans once policyholders have paid a certain amount into the policy. Life insurance loans can be a low-cost, flexible way to tap into your cash value while keeping your coverage in place. There are no credit or income checks required, and you can repay the loan while you're alive or with the policy death benefit. However, an outstanding loan could reduce your cash value growth, and if you die before paying off the loan, the outstanding balance will be deducted from the death benefit your beneficiary receives.

- Withdraw funds from your policy: You can withdraw up to the amount you've paid without paying any income taxes. However, if you withdraw more than you've paid in premiums, you will likely owe income tax on any earnings. Withdrawals will typically result in a reduction in your death benefit and may also set back the growth of your cash value account.

- Surrender your policy for cash: If you're willing to end your policy, you can cancel it and receive a surrender cash value payment, which may be a lump sum or paid over time. While this can allow you to access a large portion of your cash value, you'll no longer have life insurance coverage, so your beneficiary won't receive a death benefit. Surrender fees and taxes could also reduce the amount you receive.

- Sell your policy: You might be able to sell your policy through a life settlement or viatical settlement, receiving more than the cash surrender value but less than the death benefit. Once the sale is complete, the buyer becomes responsible for paying your insurance premiums and maintenance fees for the rest of your life, and they will receive the policy's death benefit when you pass away. Not all policies can be sold, and there may be requirements regarding the policy type, the age of the policyholder, and the policy's face value.

- Apply the cash value to your premium: You may be able to use the cash value of your policy to pay for part or all of your premiums, reducing your out-of-pocket costs for maintaining the policy.

It's important to carefully consider the consequences of accessing your cash value, as it will impact the amount available to you, your death benefit, and your account's growth. A financial advisor can help you understand the potential implications of accessing your cash value.

Understanding Life Insurance: Free Look Period Explained

You may want to see also