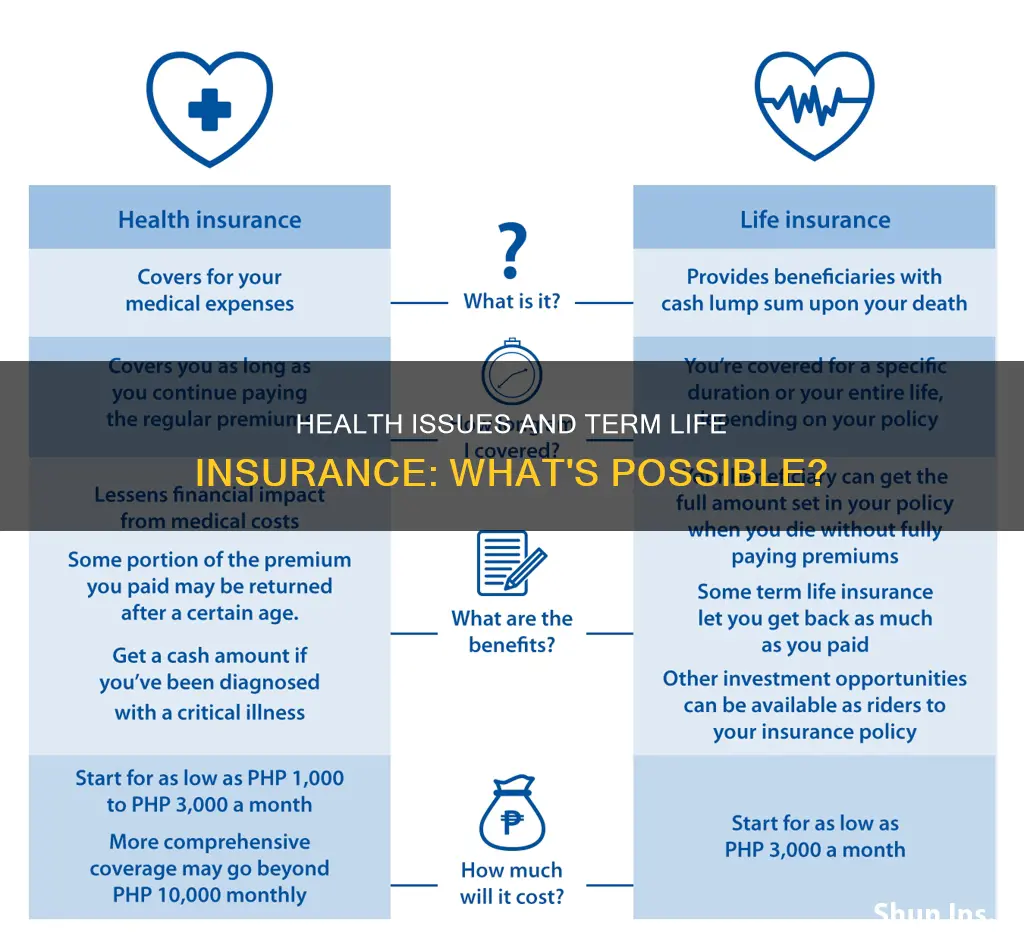

Life insurance is a financial product that provides peace of mind and security for individuals and their loved ones. However, for those with pre-existing health conditions, the process of obtaining life insurance can be challenging and often comes with higher costs. It is important to note that having a pre-existing condition does not automatically disqualify an individual from obtaining life insurance. The insurability and cost of coverage depend on various factors, including age, health, lifestyle choices, and gender.

The application process typically involves completing an application form, providing relevant documents, undergoing a medical examination, and waiting for the insurance company's evaluation and decision. The medical exam includes checking height, weight, blood pressure, and blood work, and it may include additional tests depending on the pre-existing condition.

While term life insurance is generally the cheapest form of coverage, individuals with pre-existing conditions may find it challenging to pass the underwriting stage. In such cases, alternative options like no-medical-exam policies or guaranteed acceptance life insurance are available but tend to be more expensive. It is crucial to be honest during the application process, as misrepresenting one's health could lead to higher premiums or denial of coverage.

| Characteristics | Values |

|---|---|

| Can those with health issues get term life insurance? | Yes |

| What are some pre-existing conditions? | Asthma, diabetes, heart disease, HIV, high blood pressure, anxiety, depression, irritable bowel syndrome, rheumatoid arthritis, etc. |

| How does having a pre-existing condition affect the cost of life insurance? | It may increase rates or prevent you from applying for coverage. |

| What are the options for people with pre-existing conditions? | Term life insurance, no medical exam or guaranteed acceptance policies, group life insurance through work, accidental death and dismemberment insurance |

| How to get the lowest rates with a pre-existing condition? | Shop around across multiple insurers |

What You'll Learn

- What is a pre-existing condition?

- How does a pre-existing condition affect the cost of life insurance?

- What are the best life insurance companies for people with pre-existing conditions?

- What are the options for those with pre-existing conditions?

- How to buy life insurance with a pre-existing condition?

What is a pre-existing condition?

A pre-existing condition is a medical issue that you were diagnosed with or treated for before applying for life insurance. Each insurer has its own underwriting process, which is how they assess an applicant's risk profile. Insurers typically group applicants into rate classes based on their health, such as standard, preferred, or super preferred. The name given to each class can vary among insurers, but the goal is the same: to categorise the risk of insuring you based on your life expectancy.

Insurers may increase your premium or even disqualify you from certain types of life insurance due to the added risk that health problems create for them. A pre-existing condition might be any health problem that could affect your longevity, and each insurer qualifies them differently. For instance, high blood pressure, diabetes, cancer, and asthma are all common examples of pre-existing conditions. Previous injuries might also be considered pre-existing conditions, depending on their severity and any lasting effects.

It's important to note that your life insurance premium will be lower the younger you are, the better you maintain any conditions, and the less you participate in risky activities.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

How does a pre-existing condition affect the cost of life insurance?

A pre-existing condition can affect the cost of life insurance in several ways. Firstly, it can increase your rates or premiums. The younger and healthier you are, the cheaper your life insurance premium will likely be. Conversely, a pre-existing health condition can lead to higher costs. Insurers typically group applicants into rate classes based on their health, such as standard, preferred, or super preferred. If you have a serious health condition, you may only qualify for substandard rates, resulting in a more expensive policy.

Secondly, a pre-existing condition can limit your coverage options. Depending on the situation, a pre-existing health issue might cause an early or unexpected death, increasing the risk for the insurer. As a result, you may have fewer choices when selecting a policy, and some insurers may even deny coverage altogether if they deem the risk too high.

Thirdly, a pre-existing condition can affect the type of policy you are eligible for. If you are unable to secure a competitively priced term or permanent life insurance policy due to your health, you may need to consider alternative options such as guaranteed issue life insurance, which offers acceptance within a certain age range without a medical exam but often provides less coverage at a higher cost.

It's important to note that the impact of a pre-existing condition on the cost of life insurance varies depending on the specific health issue, how well it is managed, and the insurer's underwriting process. Some insurers are more flexible about certain health conditions than others, so it's advisable to shop around, compare quotes, and consult an independent insurance agent or broker familiar with underwriting standards for different conditions.

Contacting AIG Life Insurance: A Step-by-Step Guide

You may want to see also

What are the best life insurance companies for people with pre-existing conditions?

While having a pre-existing medical condition does not automatically disqualify you from buying life insurance, it may result in less choice, higher costs, and more complex application processes. Pre-existing conditions include a wide range of health problems, from asthma and diabetes to heart disease, HIV, and obesity.

Guardian Life

Guardian Life offers a whole life insurance product for people with HIV. Applicants 70 and younger may also qualify for standard rates with certain pre-existing conditions, such as anxiety, depression, Type 2 diabetes, cancer, coronary artery disease, hypertension, and obesity.

John Hancock

John Hancock's Aspire™ with Vitality policy is designed for people living with Type 1 or Type 2 diabetes.

Prudential

Prudential offers coverage to HIV-positive applicants on a case-by-case basis.

Guaranteed issue life insurance

If your pre-existing condition prevents you from securing a competitively priced term or permanent life insurance policy, you might consider a no-exam policy such as guaranteed issue life insurance. These policies guarantee acceptance within a certain age range and without a medical exam or health questions. However, you often pay much more for less coverage.

Group life insurance through work

Basic group life insurance is often available through employers, and acceptance is typically automatic. Coverage may be limited to one or two times your annual salary, and you will likely lose the coverage if you leave the job.

Accidental death and dismemberment insurance

If you don't qualify for a term or permanent life insurance policy, accidental death and dismemberment insurance may be an option. The death benefit is paid out only in the event of an accidental death, so your medical history is not considered for eligibility. However, your death must be caused by a covered accident for your beneficiaries to receive the payout.

Term life insurance

Term life insurance is typically the cheapest form of coverage, even with a pre-existing medical condition. However, not everyone can pass the underwriting stage. Term life insurance offers coverage for a set period, usually five to 35 years, and your beneficiary will receive a payout if you pass away during this time.

No medical exam and simplified issue life insurance

Simplified issue and no medical exam policies are term or permanent life insurance plans with fewer requirements to qualify. There is usually no medical exam, and sometimes fewer health questions in the application. While these policies have lower maximum death benefits, you can still find coverage up to $250,000.

Stranger-Originated Life Insurance: Legal or Not?

You may want to see also

What are the options for those with pre-existing conditions?

Options for those with pre-existing conditions

Having a pre-existing condition doesn't disqualify you from getting term life insurance, but it may result in less choice and higher costs. The best way to get the lowest rates is to shop around across multiple insurers.

Guaranteed issue life insurance

If your pre-existing condition stops you from securing a competitively priced term or permanent life insurance policy, you might want to consider a no-exam policy such as guaranteed issue life insurance. These policies guarantee acceptance as long as you are within a certain age range. You're not required to take an exam or answer questions about your health to qualify. However, this means you often pay much more for less coverage.

Group life insurance through work

Basic group life insurance is available through many employers, including for those with health problems. Coverage is typically limited to one or two times your annual salary, and you won't have to take a health exam to qualify. However, you will likely lose the coverage if you leave the job.

Accidental death and dismemberment insurance

If you don't qualify for a term or permanent life insurance policy, you may want to consider accidental death and dismemberment insurance. The death benefit is paid out only if death is caused by an accident, so your medical history is not used to determine eligibility. However, your death must be caused by a covered accident for your beneficiaries to receive the payout.

Tips for buying life insurance with a pre-existing condition

- Be mindful of when you apply. An insurer will likely turn you down if you apply shortly after a cancer diagnosis or a heart attack, but you can always reapply if your treatment has been effective.

- Take advantage of improvements in your health. If you are accepted but are being charged a high rate, you can ask for a life insurance re-rating (and a lower premium) once your condition is under control and your prognosis is positive.

- Find the right agent. Look for an independent life insurance agent who works with an impaired risk specialist – a broker who will know which insurance companies are more likely to provide a good rate for your particular condition. Make sure your agent is submitting informal inquiries rather than formal applications that will be recorded.

- Get quotes from a handful of insurers. Insurance companies can be unique in how they review specific health conditions, so compare life insurance quotes to make sure you're getting the best possible coverage at the best possible price.

Life Insurance Seizure for Child Support: What's the Verdict?

You may want to see also

How to buy life insurance with a pre-existing condition

According to the Centers for Medicare and Medicaid Services (CMS), half of all adults under the age of 65 have some form of pre-existing medical condition. The good news is that it may still be possible to get life insurance with these and other pre-existing conditions, including HIV infection. However, the details of your specific health situation will matter.

How medical conditions can affect the cost of life insurance

Age and health are the two most important factors that life insurance companies use to determine whether a person is insurable and at what cost. The younger and healthier you are, the cheaper your life insurance premium will probably be. As such, a pre-existing health condition can adversely affect your coverage options. While having a medical issue doesn’t automatically disqualify you from buying life insurance, it may result in less choice and higher costs.

Insurers typically group applicants into rate classes based on their health, such as standard, preferred or super preferred. The name given to each class can vary among insurers, but the goal is the same: to categorize the risk of insuring you based on your life expectancy.

Most people qualify for preferred or standard rates, but if you have a serious health condition, you may qualify only for substandard rates. Depending on the situation, a pre-existing health condition might cause an early or unexpected death, which increases the risk for the insurer. As a result, the cost of the policy is higher. If the risk is too high, the insurer may deny coverage altogether.

Life insurance options for people with pre-existing conditions

Don’t assume you’ll be turned down for life insurance just because of a chronic health condition. Insurers may quote a higher premium, but coverage is still accessible. Here are some options:

- No-exam policies: If your pre-existing condition stops you from securing a competitively priced term or permanent life insurance policy, you might want to consider a no-exam policy such as guaranteed issue life insurance. These policies guarantee acceptance as long as you are within a certain age range. You’re not required to take an exam or answer questions about your health to qualify. However, this means you often pay much more for less coverage.

- Group life insurance through work: Many people, including those with health problems, can get basic group life insurance through their employers. Basic coverage is typically limited to one or two times your annual salary, but you won’t have to take a health exam to qualify. Note that you will most likely lose the coverage if you leave the job.

- Accidental death and dismemberment insurance: If you don’t qualify for a term or permanent life insurance policy, you may want to consider accidental death and dismemberment insurance. The death benefit is paid out only in the event of an accidental death, which means your medical history is not used to determine eligibility. However, your death must be caused by a covered accident for your beneficiaries to receive the payout.

Tips for buying life insurance with a pre-existing condition

- Be mindful of when you apply: An insurer will likely turn you down if you apply shortly after a cancer diagnosis or a heart attack, but you can always reapply, especially if your medical records demonstrate that your treatment has been effective. In some cases, companies will have a specific timeline for when you can apply, such as two years after a final treatment for breast cancer.

- Take advantage of improvements in your health: If you are accepted but are being charged a high rate, you can ask for a life insurance re-rating (and a lower premium) once your condition is under control and your prognosis is positive.

- Find the right agent: Look for an independent life insurance agent who works with an impaired risk specialist — a broker who’ll know which insurance companies are more likely to provide a good rate for your particular condition. Make sure your agent is submitting informal inquiries rather than formal applications that will be recorded by the MIB Group. This could save you a lot of denied applications.

- Get quotes from a handful of insurers: Insurance companies can be unique in how they review specific health conditions. Compare life insurance quotes to make sure you're getting the best possible coverage at the best possible price.

- Don't conceal your condition: The worst strategy is to conceal your condition from your insurer. Life insurance companies use many methods to identify fraud. Misrepresenting your health on your application could cause the insurer to reject a life insurance claim, jeopardizing the benefit for your beneficiaries. If the insurer discovers fraudulent information, it typically records the incident in the MIB Group insurance database, which is shared with other insurers. This might hurt your chances of buying coverage from another company.

Whole Life Insurance Cash Values: Are They Flexible?

You may want to see also

Frequently asked questions

Yes, it is possible to get term life insurance with a pre-existing condition, but the options available and the premium payable will depend on your specific health situation.

A pre-existing condition is a medical issue that has been diagnosed or treated prior to applying for life insurance.

Insurance companies will ask questions about your health and may require a medical exam and/or access to your medical records to evaluate your application.

If you are unable to qualify for traditional term life insurance, you may want to consider alternative options such as guaranteed issue life insurance, group life insurance through your employer, or accidental death and dismemberment insurance.