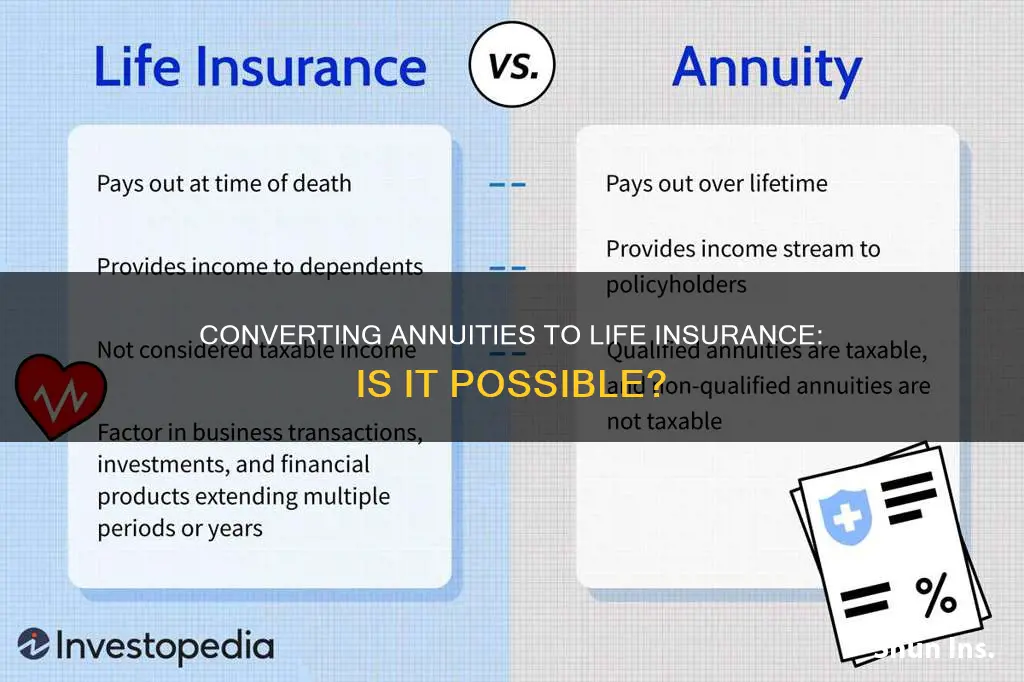

Life insurance and annuities are financial tools that can provide valuable benefits and financial protection for individuals and their families. While they share some similarities, they serve different purposes and have distinct features. Life insurance is designed to provide financial protection for loved ones in the event of the policyholder's death, whereas annuities offer a reliable income stream during retirement. Converting life insurance into an annuity involves surrendering the policy, receiving a lump sum payout, and using that amount to purchase an annuity. This can provide a guaranteed income stream for retirement but comes with considerations such as costs, tax implications, and the loss of the death benefit. Understanding these factors is crucial before making any decisions.

| Characteristics | Values |

|---|---|

| Purpose | Financial strategy to transform the death benefit of a life insurance policy into a stream of income through an annuity contract. |

| Process | Surrender the life insurance policy, receive a lump sum payout, and use that amount to purchase an annuity |

| Benefits | Provides a reliable income source, helps meet retirement goals, and offers financial security. |

| Considerations | Policy value, policyholder's age and health, surrender charges, financial goals, impact on beneficiaries, costs, and tax implications. |

| Role of Insurance Companies and Brokers | Insurance companies facilitate the conversion and provide guidance. Insurance brokers act as intermediaries, helping policyholders explore options and find the most suitable annuity. |

| Steps to Convert | Evaluate financial situation, consult professionals, understand the process and its implications, and execute the conversion. |

| Drawbacks | Loss of death benefit, costs and tax implications, impact on liquidity, and potential lack of flexibility. |

What You'll Learn

Understanding the conversion process

The process of converting a life insurance policy into an annuity involves several steps, and it is important to understand the potential costs and the permanency of the decision. Here is what you need to know:

- Surrendering the life insurance policy: Converting a life insurance policy to an annuity typically involves surrendering the life insurance policy and receiving a lump sum payout. This means giving up the death benefit offered by the life insurance policy. It is important to consider if your survivors will have other resources to cover funeral and burial costs without the life insurance payout.

- Tax implications: While the conversion itself is usually tax-free, there are tax implications for the annuity payments. Taxes will be due on a portion of each withdrawal, whereas life insurance proceeds are generally tax-free.

- Costs and penalties: There may be costs and penalties associated with the conversion process, including surrender charges for cancelling your life insurance policy early. These fees can significantly impact the value available for conversion.

- Impact on beneficiaries: Converting a life insurance policy into an annuity will affect your beneficiaries as they will no longer receive the death benefit. This could impact their financial security, especially if they are still dependent on your income.

- Choosing an annuity: There are different types of annuities, such as variable or fixed annuities, and it is important to understand the terms, costs, and potential tax implications of each before making a decision.

- Working with professionals: The conversion process can be complex, so it is recommended to consult a financial advisor or insurance broker. They can help guide you through the process, assess the feasibility of conversion based on your specific situation, and select the right type of annuity for your needs.

- Permanency of the decision: It is important to understand that conversion is generally a permanent process. Once you surrender your life insurance policy and purchase an annuity, you may not revert to the original life insurance policy. Therefore, it is crucial to carefully consider the decision and how it will impact your financial future.

Life Insurance Proceeds: Can Creditors Garnish Your Money?

You may want to see also

Costs and penalties of conversion

There are several costs and penalties to consider when converting a life insurance policy to an annuity. Firstly, there may be surrender charges imposed by the insurance company when a policy is cancelled before its term ends. These fees can significantly reduce the cash value available for conversion. It's important to review the terms of your life insurance policy to understand any potential surrender charges.

Additionally, the acquisition costs for annuities can be high. The specific costs will depend on the type of annuity chosen and the insurance company's terms. It is recommended to shop around and compare different annuity products before making a decision.

Another important consideration is the tax implications of the conversion. While life insurance death benefits are generally tax-free, distributions from annuities are typically taxed as ordinary income. It is crucial to consult a tax professional to understand the specific tax consequences of converting your life insurance policy to an annuity.

Furthermore, converting a life insurance policy to an annuity results in the loss of the death benefit. This could impact your beneficiaries' financial security, especially if they are still dependent on your income. It is important to ensure that your survivors have other resources to cover funeral and burial costs and that they do not rely on the death benefit for financial support.

Overall, it is essential to carefully evaluate the costs and penalties associated with converting a life insurance policy to an annuity. By understanding the potential surrender charges, acquisition costs, tax implications, and the impact on beneficiaries, individuals can make informed decisions that align with their financial goals and needs.

Life Insurance Options for People with Kidney Failure

You may want to see also

Impact on beneficiaries

When considering converting a life insurance policy to an annuity, it is important to understand the potential impact on beneficiaries. Here are some key points to consider:

Loss of Death Benefit

The primary impact on beneficiaries is the loss of the death benefit provided by the life insurance policy. This benefit offers financial protection to beneficiaries upon the policyholder's death. Converting the policy to an annuity means giving up this benefit, which could affect the financial security of the policyholder's family, especially if they rely heavily on this prospective fund for expenses such as funeral and burial costs.

Tax Implications

While life insurance death benefits are generally tax-free, annuity payments are typically taxed as ordinary income. Therefore, it is crucial to understand the tax implications for beneficiaries before proceeding with the conversion. Distributions from annuities can be subject to tax, and beneficiaries may owe taxes on any gains above the premiums paid.

Financial Security

The conversion of a life insurance policy into an annuity can impact the financial security of beneficiaries, especially if they are still dependent on the policyholder's income. It is important to ensure that beneficiaries will have other resources to meet their financial needs and that the policyholder's current financial situation allows for this conversion without jeopardizing their beneficiaries' well-being.

Spousal Benefits

Some life insurance policies include spousal benefits, which ensure that the spouse continues to receive income if the policyholder passes away. However, when converting to an annuity, these benefits may be lost or reduced. It is important to carefully review the terms and conditions of the annuity contract to understand the impact on spousal benefits.

Estate Planning

Life insurance policies are often used as a tool for estate planning, providing a tax-free death benefit to beneficiaries. Converting to an annuity may impact the value of the estate and the ability to maximize benefits for beneficiaries. It is important to consider the overall estate plan and how the conversion might affect the distribution of assets.

Timing of Payments

Life insurance policies typically provide a lump-sum payout to beneficiaries upon the policyholder's death. In contrast, annuities provide a steady stream of income during the policyholder's retirement. This change in payment structure may impact how and when beneficiaries receive financial support.

In conclusion, when considering converting a life insurance policy to an annuity, it is crucial to carefully evaluate the potential impact on beneficiaries. The loss of the death benefit, tax implications, financial security, spousal benefits, estate planning, and timing of payments are all important factors to take into account. Seeking advice from financial professionals and tax experts is highly recommended to make an informed decision that aligns with the policyholder's unique circumstances and goals.

Life Insurance and Subrogation: What's the Verdict?

You may want to see also

Advantages of conversion

There are several advantages to converting a life insurance policy to an annuity. Here are some key benefits to consider:

Guaranteed Income Stream

Converting your life insurance policy to an annuity can provide a guaranteed stream of income for the rest of your life, which can be especially beneficial during retirement. This steady income is similar to Social Security benefits and can offer a sense of financial security and stability.

Tax Advantages

A significant advantage of converting a life insurance policy to an annuity is the potential tax benefit through a 1035 Exchange. This provision in the tax code allows for a tax-free exchange, enabling you to transfer funds from your insurance policy to an annuity without incurring income tax on the earnings. This can result in substantial tax savings, especially if you have accumulated significant cash value in your life insurance policy.

Spousal Benefits

Some annuity contracts offer the option to include benefits for your spouse. This ensures that they will continue to receive income in the event of your death. While these benefits might reduce the overall payout, it is a crucial consideration to provide financial security for your spouse.

Flexibility in Retirement Planning

Converting to an annuity can be a strategic move that aligns with your long-term financial goals. It offers income stability during retirement, providing a sense of reassurance. By assessing your options with a financial advisor, you can choose from different types of annuities, such as variable or fixed annuities, to find a contract that suits your specific needs.

Simplified Estate Planning

By converting your life insurance policy to an annuity, you may be able to simplify your estate planning. With an annuity, you can receive the funds directly during your lifetime, eliminating the need to leave money behind for heirs. This can reduce the complexity of your estate plan and provide you with immediate access to your money.

Before making the decision to convert your life insurance policy to an annuity, it is important to carefully consider your personal circumstances, financial goals, and the potential advantages and disadvantages of such a conversion. Consulting with a financial advisor or retirement specialist can help you make a well-informed decision that aligns with your retirement and estate planning objectives.

Custom Whole Life Insurance: Tax Documents Required?

You may want to see also

Drawbacks of conversion

While converting an annuity to life insurance can provide a guaranteed income stream for retirement, there are several drawbacks to consider.

Loss of Death Benefit

One significant disadvantage is the loss of the death benefit. This benefit provides financial protection to beneficiaries upon the policyholder's death. Giving up this benefit can impact your family's financial security, especially if they rely heavily on this prospective fund.

Costs and Tax Implications

The conversion process may involve costs such as surrender charges, which can reduce the cash value received from the life insurance policy. The tax implications of conversion can also be complex. While life insurance proceeds are generally tax-free, annuity payments are typically taxed as ordinary income. It is important to consult a tax professional to understand the specific tax consequences before proceeding.

Fixed Income and Inflation Risk

Annuities provide a fixed income, which can be comforting in terms of stability. However, the purchasing power of these fixed-income payments can decrease over time due to inflation. While some annuities offer inflation protection, they typically come at a higher cost.

Lack of Flexibility

Unlike life insurance policies that may allow for loans or withdrawals, annuities are less flexible. If you unexpectedly need a large sum of money, accessing funds from an annuity without incurring penalties can be challenging.

Impact on Beneficiaries

Converting a life insurance policy into an annuity can affect your beneficiaries. The death benefit provided by the life insurance policy will be lost upon conversion, which could impact your beneficiaries' financial security if they are still dependent on your income.

In conclusion, while converting an annuity to life insurance can provide a guaranteed income stream for retirement, there are several drawbacks to consider, including the loss of death benefits, costs and tax implications, inflation risk, lack of flexibility, and potential impact on beneficiaries. It is important to carefully weigh these considerations before making a decision.

Life Insurance: A Necessary Safety Net for Peace of Mind

You may want to see also

Frequently asked questions

The primary benefit is to provide financial protection for your loved ones in the event of your death. Life insurance ensures your beneficiaries receive a payout to cover debts, mortgage payments, and other financial obligations.

Yes, there are tax implications to consider. While life insurance death benefits are generally tax-free, annuity payments are typically taxed as ordinary income.

Converting your annuity to life insurance results in the loss of the annuity's regular income stream, which may impact your financial security during retirement. Additionally, there may be surrender charges and tax implications associated with the conversion.

While not mandatory, consulting a qualified financial advisor or insurance broker is highly recommended due to the complexity of the conversion process and the potential financial implications. They can provide personalised advice based on your unique circumstances and goals.